Last Updated: 12/15/2025 | 32 min. read

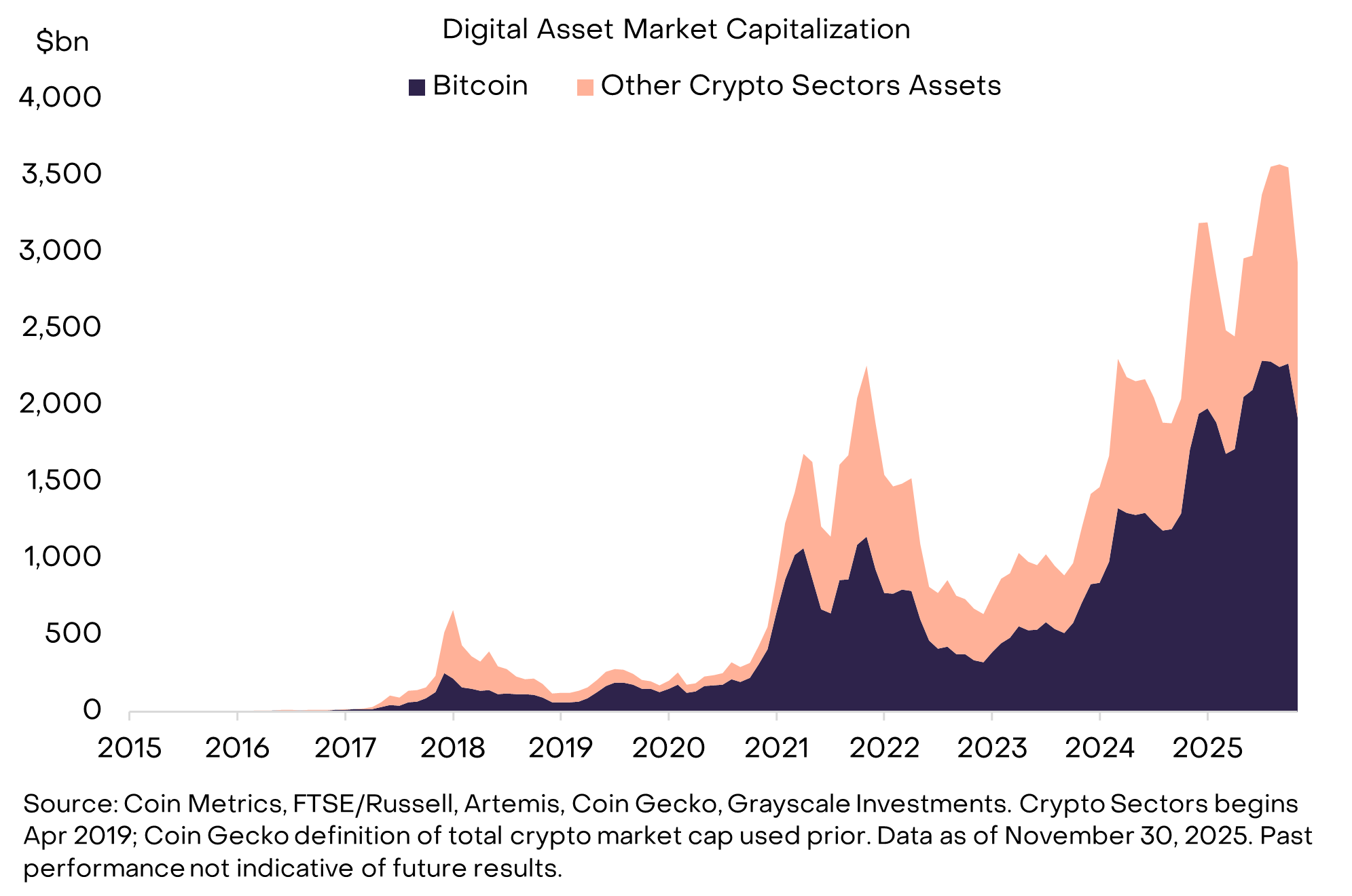

Fifteen years ago, crypto was an experiment: just one asset (Bitcoin) with a market capitalization of about $1 million. Today, crypto is an emerging industry and mid-sized alternative asset class, consisting of millions of individual tokens with a combined market capitalization of about $3 trillion (Exhibit 1). Now, a more complete regulatory architecture across major economies is deepening the integration of public blockchains with traditional finance and fueling long-term capital inflows into the marketplace.

Exhibit 1: Crypto now a mid-sized alternative asset class

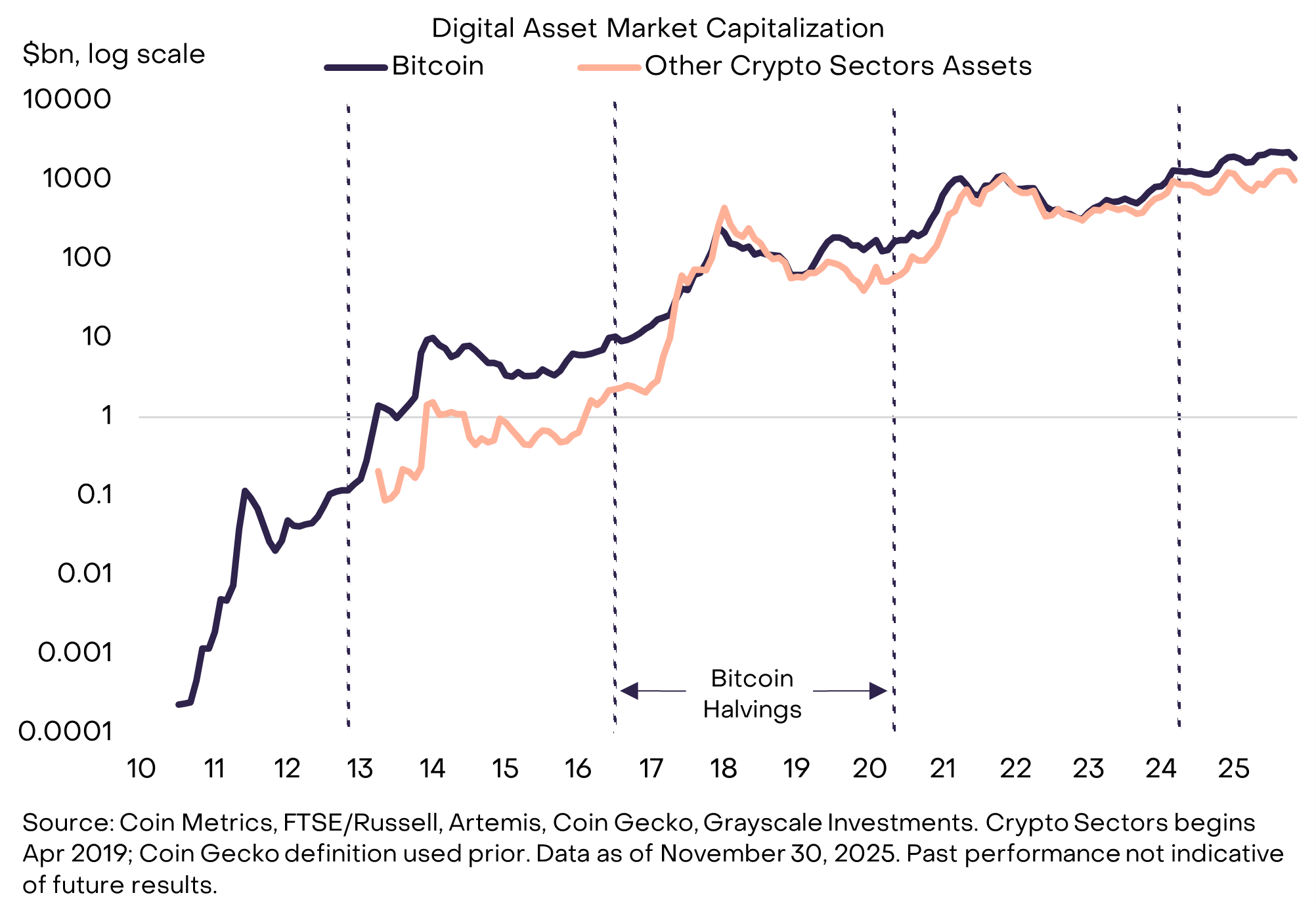

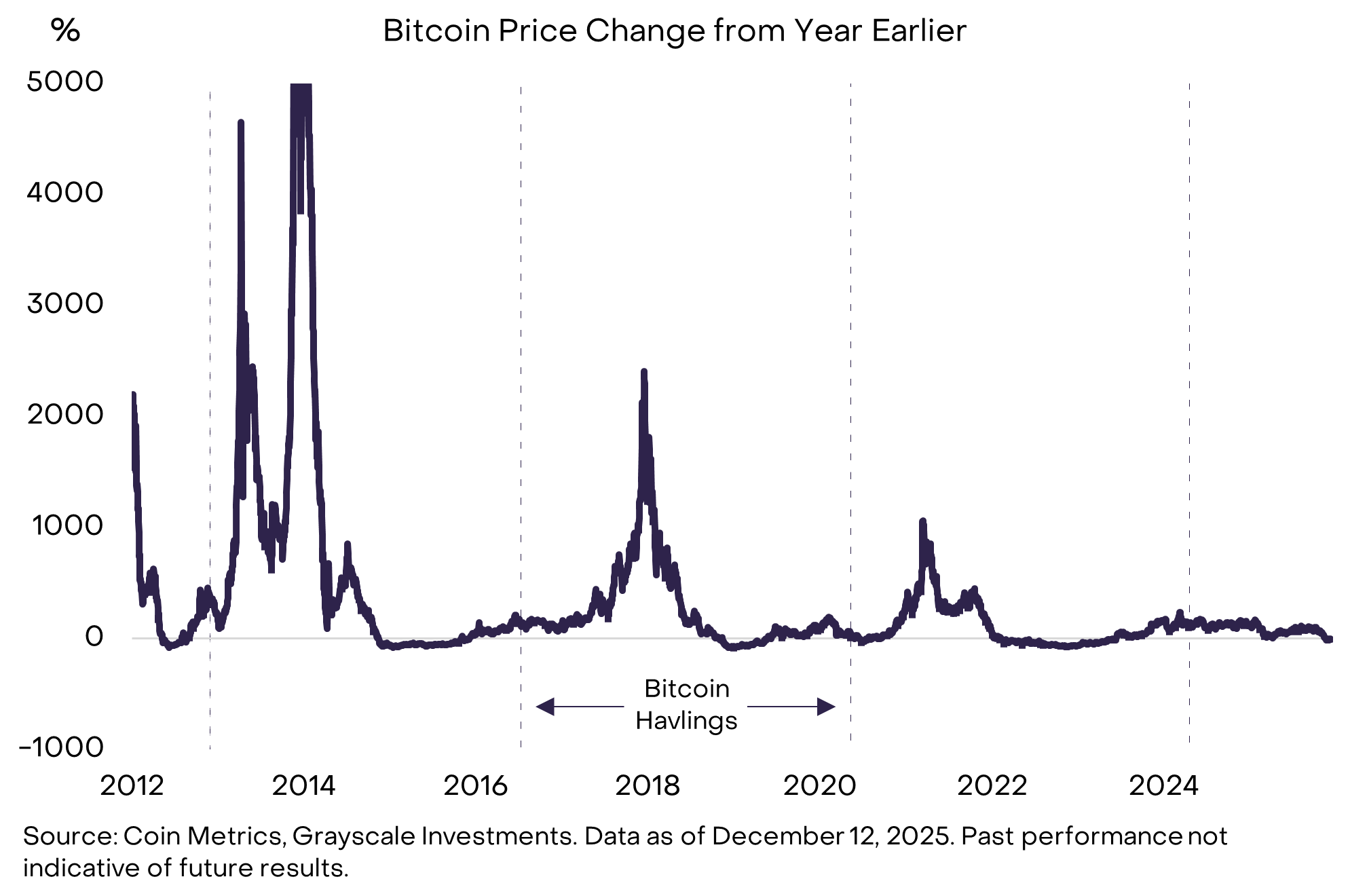

Along the journey from crypto’s early beginnings, token valuations have experienced four large cyclical drawdowns, or about one every four years (Exhibit 2). In three of these examples, the cyclical peak in valuations occurred 1 to 1.5 years after a Bitcoin halving event, which also happens once every four years. The current bull market has lasted more than three years, and the most recent Bitcoin halving was in April 2024, more than 1.5 years ago. Therefore, conventional wisdom among certain market participants says that Bitcoin’s price likely peaked in October, and 2026 will be a challenging year for crypto returns.

Exhibit 2: Rising valuations in 2026 will mark the end of the “four-year cycle” theory

Grayscale believes that the crypto asset class is in a sustained bull market, however, and that 2026 will mark the end of the apparent four-year cycle. We expect rising valuations across all six Crypto Sectors in 2026, and we think the price of Bitcoin could exceed its previous high in the first half of the year.

There are two main pillars to our optimistic outlook:

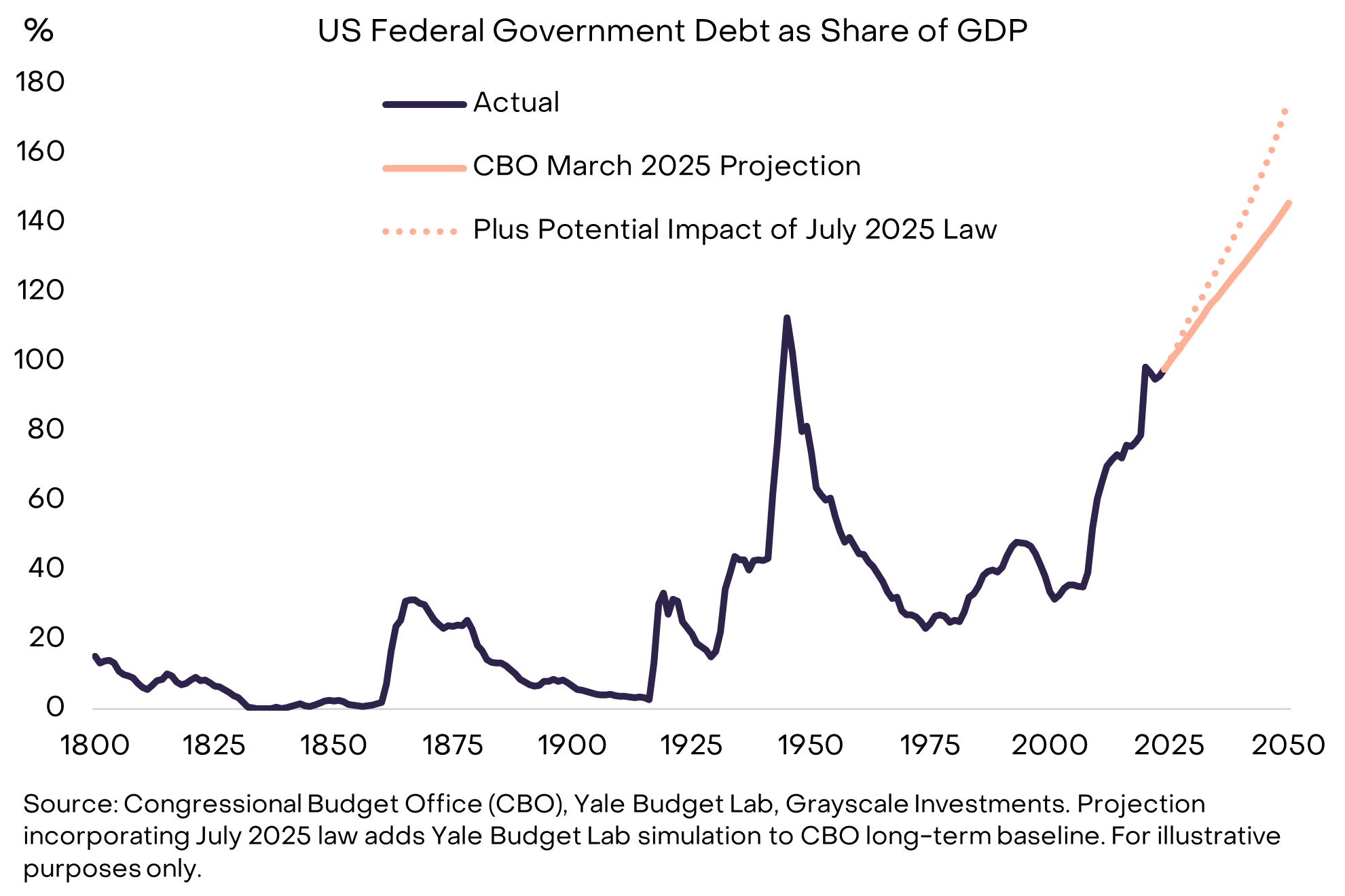

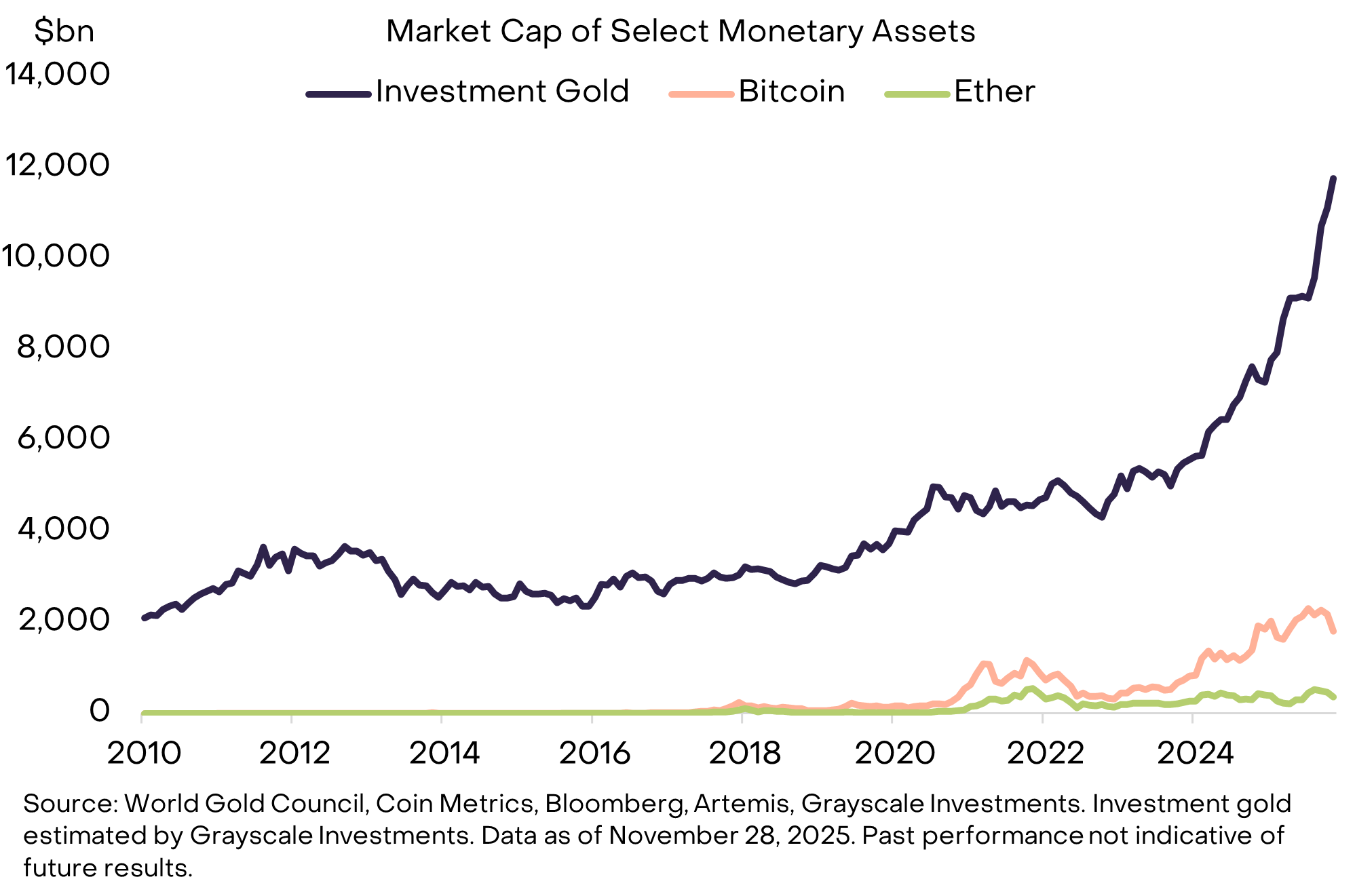

First, there will be ongoing macro demand for alternative stores of value. Bitcoin and Ether, the two largest cryptocurrencies by market cap[1], can be considered scarce digital commodities and alternative monetary assets. Fiat currencies (and assets denominated in fiat currencies) face additional risks due to high and rising public sector debt and its potential implications for inflation over time (Exhibit 3). Scarce commodities — whether physical gold and silver or digital Bitcoin and Ether — can potentially serve as a ballast in portfolios for fiat currency risks. As long as the risk of fiat currency debasement keeps rising, portfolio demand for Bitcoin and Ether will likely continue rising as well, in our view.

Exhibit 3: U.S. debt problem raises doubts about low inflation credibility

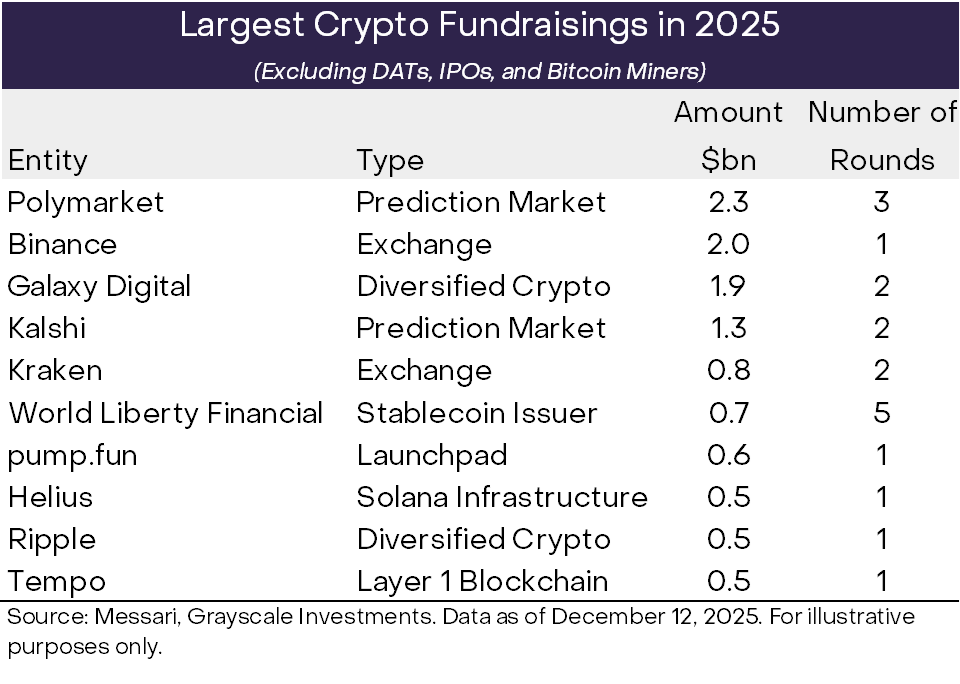

Second, regulatory clarity is driving institutional investment into public blockchain technology. It can be easy to forget, but until this year the U.S. government had outstanding investigations and/or lawsuits with many leading firms in the crypto industry, including Coinbase, Ripple, Binance, Robinhood, Consensys, Uniswap, and OpenSea. Even today, exchanges and other crypto intermediaries operate without clear spot-market guidelines.

This ship has slowly been turning. In 2023, Grayscale won its lawsuit against the SEC (Securities and Exchange Commission), which paved the way for spot crypto exchange-traded products (ETPs). In 2024, Bitcoin and Ether spot ETPs came to market. In 2025, Congress passed the GENIUS Act on stablecoins and regulators shifted their approach toward crypto, working with the industry to provide clear guidance while continuing to focus on consumer protection and financial stability. In 2026, Grayscale expects Congress to pass bipartisan crypto market structure legislation, which will likely cement blockchain-based finance in U.S. capital markets and facilitate continued institutional investment (Exhibit 4).

Exhibit 4: Higher fundraising potentially a sign of institutional confidence

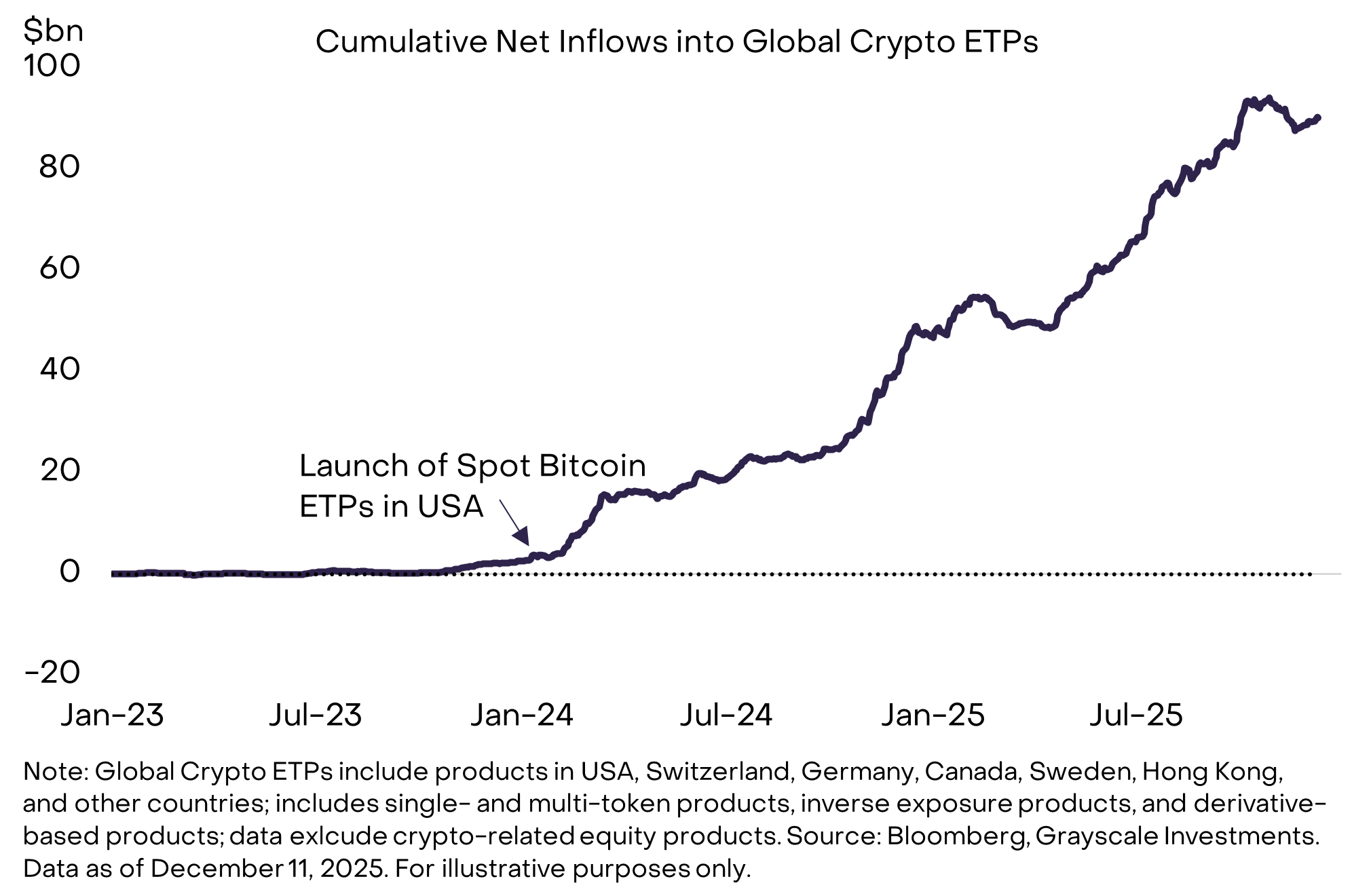

New capital entering the crypto ecosystem is likely to come primarily through spot ETPs, in our view. Since the Bitcoin ETPs launched in the U.S. in January 2024, global crypto ETPs have seen net inflows of $87 billion (Exhibit 5). Despite the early success of these products, the process of incorporating crypto into mainstream portfolios is still in early innings. Grayscale estimates that less than 0.5% of U.S. advised wealth is allocated to the crypto asset class.[2] This number should grow as more platforms complete their due diligence, build out capital market assumptions, and incorporate crypto into model portfolios. Beyond advised wealth, early movers have already adopted crypto ETPs in institutional portfolios, including Harvard Management Company and Mubadala (one of Abu Dhabi’s sovereign wealth funds).[3] We expect this list to grow significantly in 2026.

Exhibit 5: Persistent inflows into spot crypto ETPs

With crypto increasingly driven by institutional capital inflows, the nature of price performance has changed. In each prior bull market, Bitcoin’s price increased by at least 1,000% over a one-year period (Exhibit 6). This time around, the maximum year-over-year price increase was about 240% (in the year to March 2024). We think the difference reflects steadier institutional buying recently compared to retail momentum chasing in past cycles. Although crypto investing involves significant risks, we believe the probability of a deep and prolonged cyclical drawdown in prices is relatively low at the time of writing. Instead, a steadier advance in prices, driven by institutional capital inflows, is more likely next year, in our view.

Exhibit 6: No dramatic surge in Bitcoin price this cycle

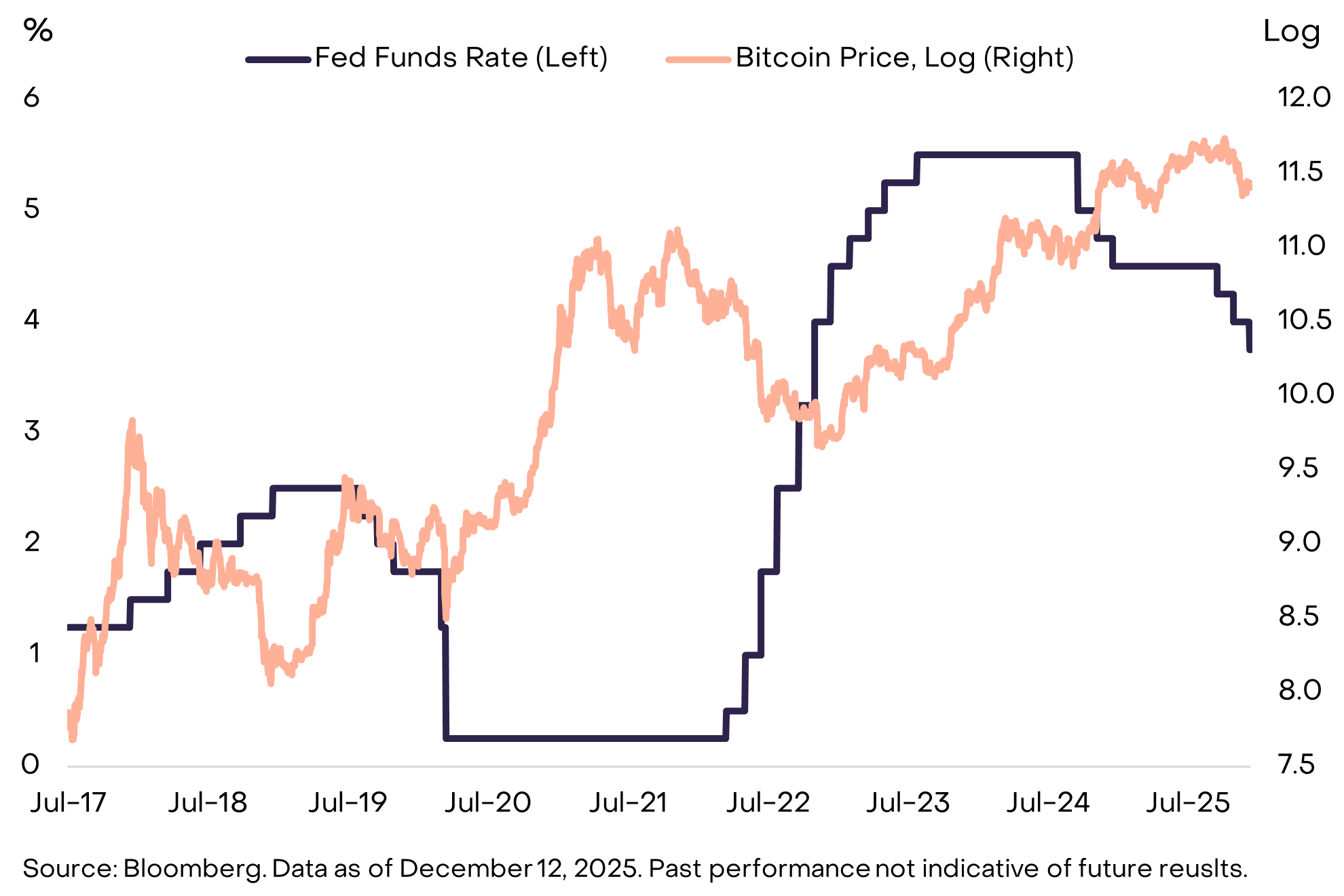

A supportive macro market backdrop may also limit some downside risks to token prices in 2026. The last two cyclical peaks occurred when the Fed was raising rates (Exhibit 7). In contrast, the Federal Reserve cut rates three times in 2025 and is expected to keep reducing rates next year. Kevin Hassett, who may replace Jerome Powell as Fed Chair, recently told Face the Nation: “The American people can expect President Trump to pick somebody who’s going to help them have cheaper car loans and easier access to mortgages at lower rates."[4] Generally speaking, a growing economy and broadly supportive Fed policy should be consistent with favorable investor risk appetite and potential gains in risky assets, including crypto.

Exhibit 7: Prior cyclical peaks have been associated with Fed rate hikes

Like every other asset class, crypto is driven by a combination of fundamentals and capital flows. Commodity markets are cyclical, and crypto may have prolonged cyclical drawdowns at certain points in the future. But we don’t see it for 2026. The fundamentals look solid: we expect ongoing macro demand for alternative stores of value, and regulatory clarity to drive institutional investment into public blockchain technology. Moreover, new capital is still coming to the market: crypto ETPs will likely be in many more portfolios by the end of next year. This cycle, there has not been one large wave of retail demand, but rather a steady bid for crypto ETPs from a wide range of portfolios. With a broadly supportive macro backdrop, we think these are the conditions for new highs for the crypto asset class in 2026.

Crypto is a diverse asset class, reflecting the many use cases of public blockchain technology. The following section outlines Grayscale’s view on the 10 most important crypto investing themes for 2026 — plus two “red herrings.” For each theme, we list the most relevant tokens from our perspective. For more background on the types of investable digital assets, see our Crypto Sectors framework.

Relevant crypto assets: BTC, ETH, ZEC

The U.S. economy has a debt problem (revisit Exhibit 3), which may ultimately put pressure on the Dollar’s role as a store of value. Other countries face similar issues, but the Dollar is the dominant international currency in the world today, so U.S. policy credibility matters more for potential capital flows. A small subset of digital assets can be considered viable stores of value, in our view, because of sufficiently broad adoption, a high degree of decentralization, and limited supply growth. This includes the two largest crypto assets by market capitalization, Bitcoin and Ether. Like physical gold, their utility derives partly from the fact that they are scarce and autonomous.

Bitcoin’s supply is capped at 21 million coins and is entirely programmatic. For example, we can confidently predict that the 20 millionth Bitcoin will be mined in March 2026. A digital money system with transparent, predictable, and ultimately scarce supply is a simple idea, but it has rising appeal in today’s economy due to fiat currency tail risks. As long as the macro imbalances creating fiat currency risk keep rising, portfolio demand for alternative stores of value may continue to rise as well (Exhibit 8). Zcash, a smaller decentralized digital currency with privacy features, may also be appropriate for portfolios positioning for Dollar debasement (see Theme #5).

Exhibit 8: Macro imbalances may drive demand to alternative stores of value

Relevant crypto assets: Almost all

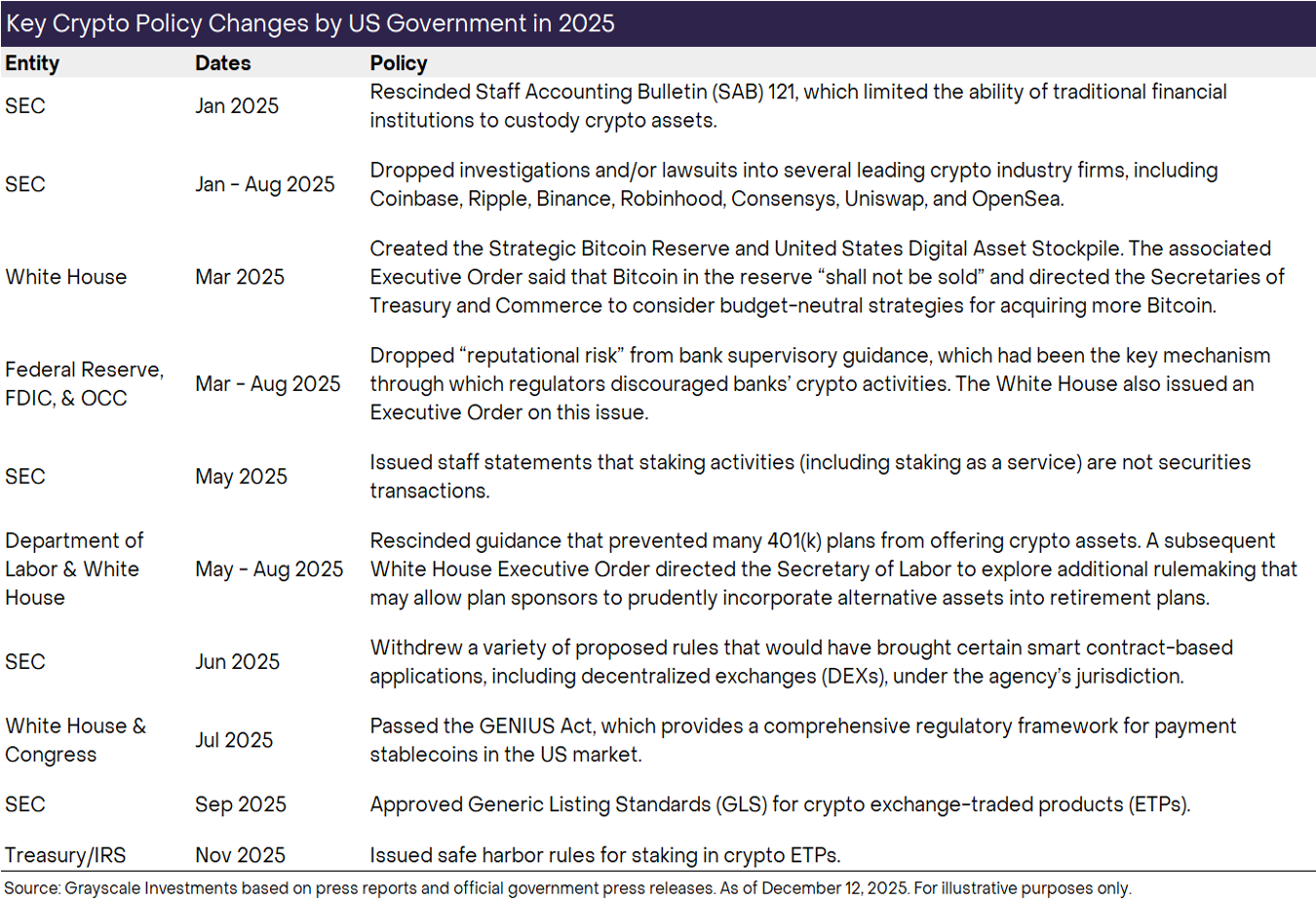

The U.S. made big strides toward crypto regulatory clarity in 2025, including passing the GENIUS Act (on stablecoins), rescinding SEC Staff Accounting Bulletin 121 (on custody), introducing Generic Listing Standards for crypto ETPs, and addressing traditional banking access for the crypto industry (Exhibit 9). Next year we expect another major step forward with the passing of bipartisan market structure legislation. The House passed its version of this legislation in July — known as the Clarity Act — and the Senate has since taken up its own process. While there are many details to be ironed out, broadly speaking the legislation provides a traditional finance rulebook for crypto capital markets, including registration and disclosure requirements, classifications of crypto assets, and rules for insiders.

In practice, a more complete regulatory framework for crypto assets across the U.S. and other major economies could mean that regulated financial services firms report digital assets on balance sheet and begin transacting on the blockchain. It may also allow for on-chain capital formation, with both startups and mature firms issuing regulated tokens. By further unlocking the full potential of blockchain technology, regulatory clarity should help lift the crypto asset class in general. Because of the potential importance of regulatory clarity in driving the crypto asset class in 2026, a breakdown of bipartisan process in legislation in Congress should be considered a downside risk, in our view.

Exhibit 9: U.S. made big strides toward regulatory clarity in 2025

Relevant crypto assets: ETH, TRX, BNB, SOL, XPL, LINK

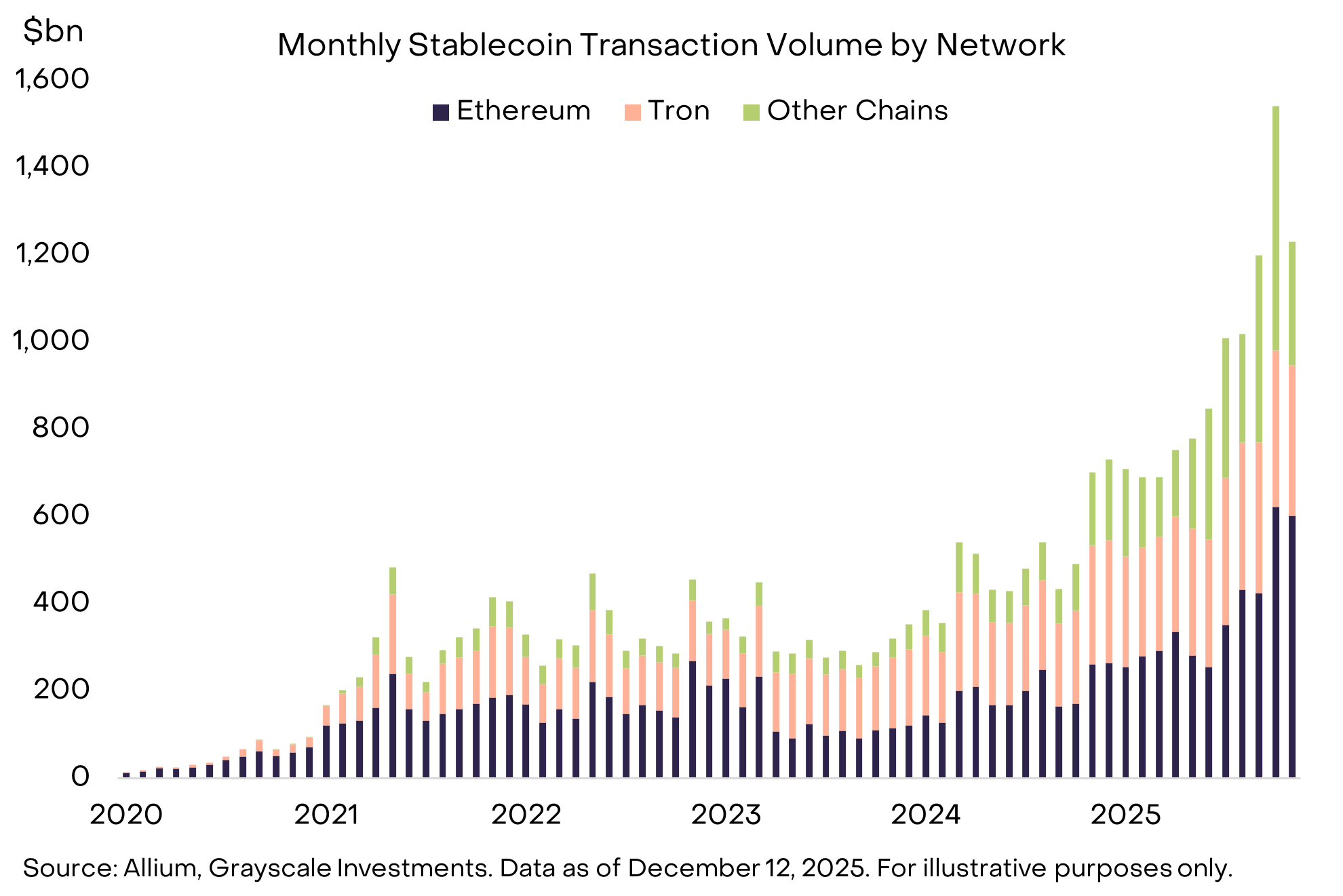

Stablecoins had their breakout moment in 2025: outstanding supply reached $300 billion and monthly transactions averaged $1.1 trillion per month over the six months ending in November[5], the U.S. Congress passed the GENIUS Act, and a wave of institutional capital poured into the industry (Exhibit 10). In 2026 we expect to see the practical results: stablecoins integrated into cross-border payments services, stablecoins as collateral on derivatives exchanges, stablecoins on corporate balance sheets, and stablecoins as an alternative to credit cards in online consumer payments. Continued growth in the popularity of prediction markets may also drive new demand for stablecoins. Higher stablecoin volumes should benefit the blockchains that record these transactions (e.g., ETH, TRX, BNB, and SOL, among many others), as well as a variety of supporting infrastructure (e.g., LINK) and decentralized finance (DeFi) applications (see Theme #7).

Exhibit 10: Stablecoins having a breakout moment

Relevant crypto assets: LINK, ETH, SOL, AVAX, BNB, CC

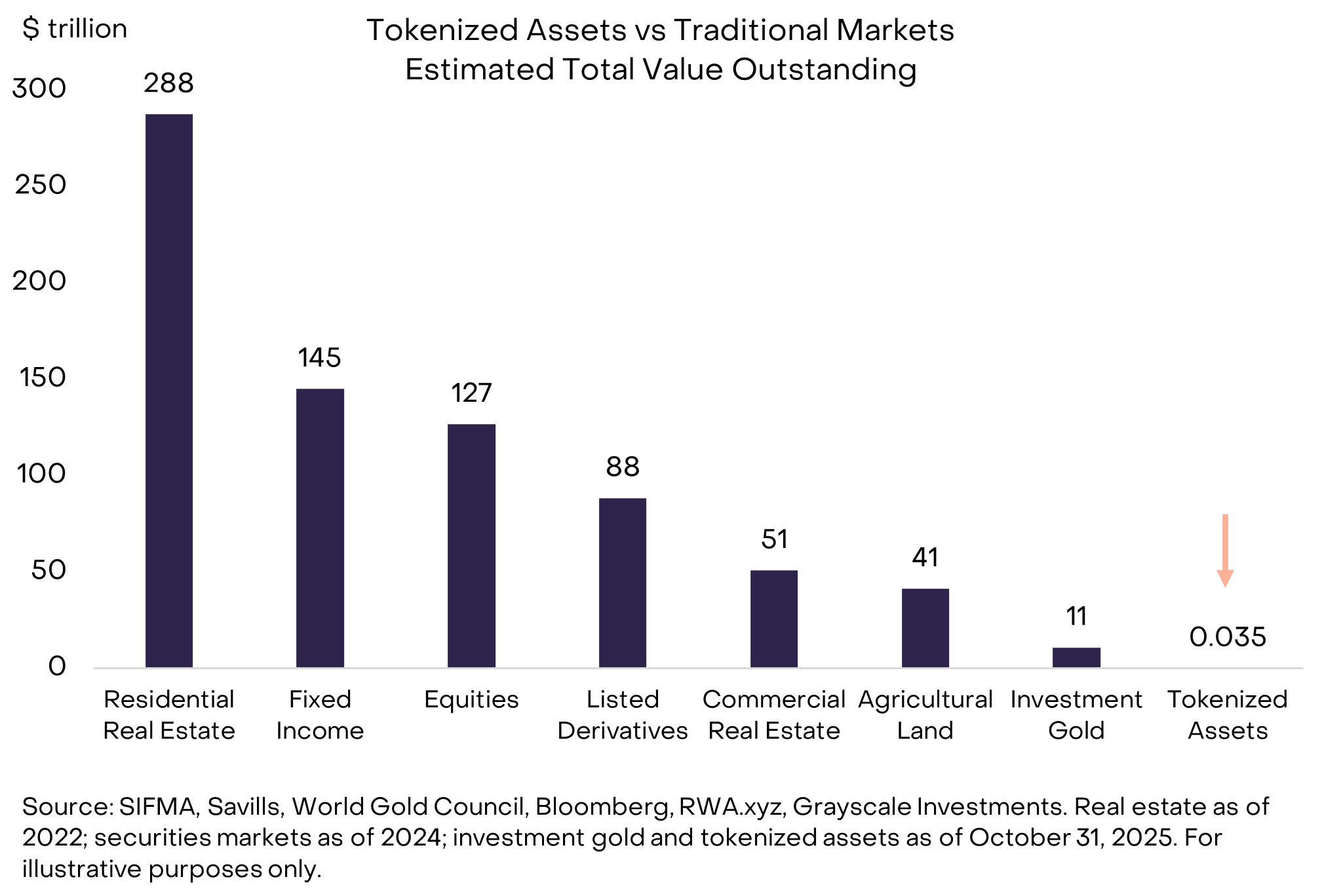

Tokenized assets are tiny today: just 0.01% of global equity and bond market capitalization (Exhibit 11). Grayscale expects rapid growth in asset tokenization over the coming years, facilitated by more mature blockchain technology and improved regulatory clarity. By 2030, it would not be surprising to see tokenized assets grow by ~1,000x, in our view. This growth will likely drive value to the blockchains that process transactions in tokenized assets, as well as a variety of supporting applications. The leading blockchains for tokenized assets today[6] are Ethereum (ETH), BNB Chain (BNB), and Solana (SOL), although this list will likely evolve over time. In terms of supporting applications, Chainlink (LINK) looks especially well placed, given its unique suite of software technologies.

Exhibit 11: Scope for enormous growth in tokenized assets

Relevant crypto assets: ZEC, AZTEC, RAIL

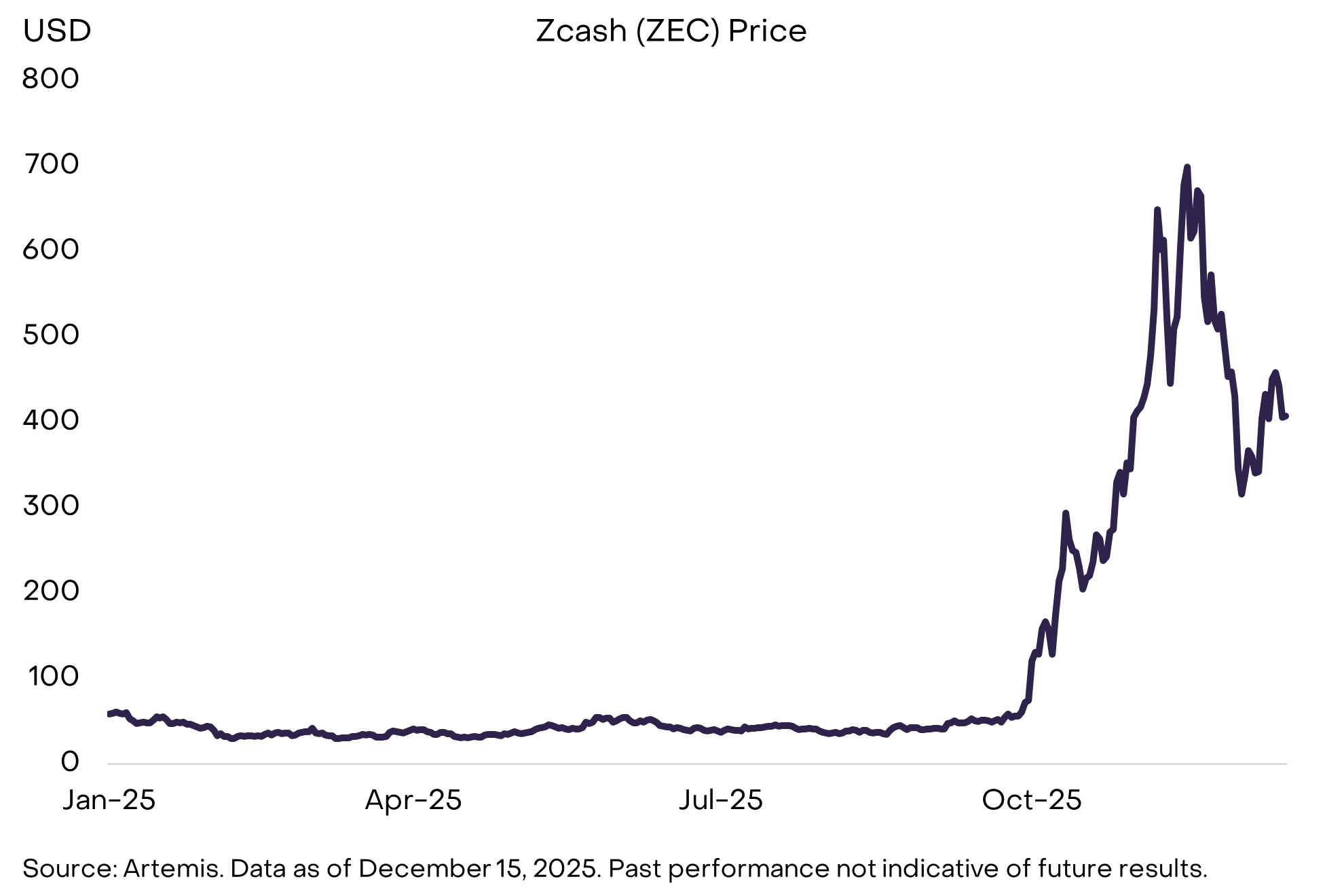

Privacy is a normal part of financial system: almost everyone has an expectation that their paychecks, taxes, net worth, and spending habits will not be visible on a public ledger. However, most blockchains are transparent by default. If public blockchains are going to be more deeply integrated into the financial system, they will need much more robust privacy infrastructure — and this is becoming obvious now that regulation is facilitating that integration. Potential beneficiaries from investor focus on privacy may include Zcash (ZEC), a decentralized digital currency akin to Bitcoin with privacy-preserving features; Zcash appreciated sharply in Q4 2025 (Exhibit 12). Other major projects include Aztec, a privacy-focused Ethereum Layer 2, and Railgun, privacy middleware for DeFi. We may also see rising adoption of confidential transactions on leading smart contract platforms like Ethereum (with ERC-7984) and Solana (with Confidential Transfers token extensions). Improved privacy tools may also require better identity and compliance infrastructure for DeFi.

Exhibit 12: Crypto investors focusing more on privacy features

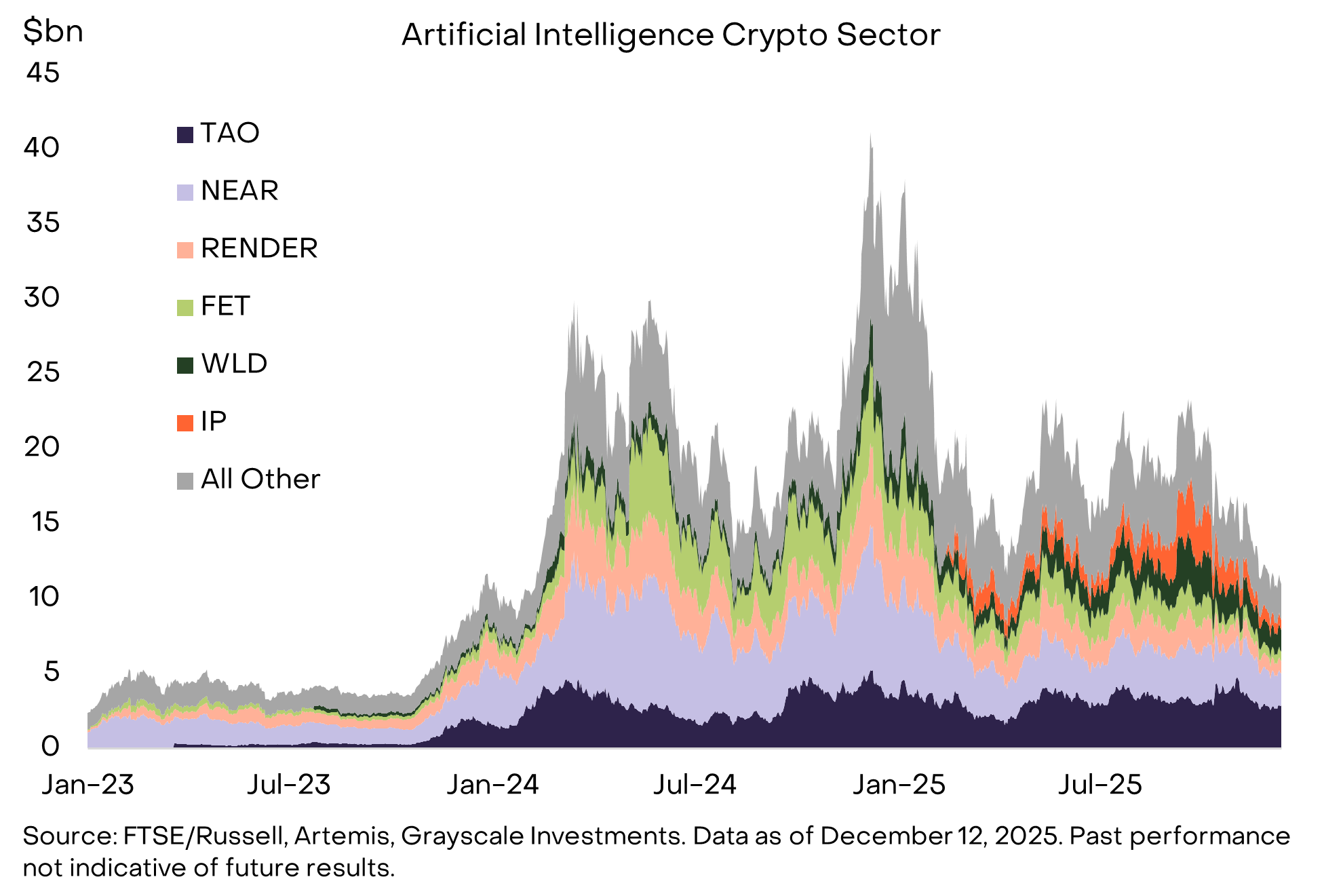

Relevant crypto assets: TAO, IP, NEAR, WORLD

The fundamental alignment between crypto and AI is stronger and clearer than ever. AI systems are centralizing around a few dominant firms, creating concerns about trust, bias, and ownership, and crypto offers primitives that directly address these risks. Decentralized AI development platforms like Bittensor aim to reduce reliance on centralized AI technologies; verifiable Proof of Personhood systems like World distinguish humans from agents in a world of synthetic activity; and networks such as Story Protocol provide transparent, traceable intellectual property at a time when identifying the origin of digital content is becoming increasingly difficult. Meanwhile, tools like X402 — an open, zero-fee payments layer for stablecoins across Base and Solana — enable the low-cost, instant micropayments required for agent-to-agent or machine-to-human economic interactions.

Together, these components form the early infrastructure of the “agent economy,” where identity, compute, data, and payments must all be verifiable, programmable, and censorship-resistant. Though early and uneven today, the intersection of crypto and AI continues to produce one of the most compelling long-term use cases in the space, and the protocols building real infrastructure stand to potentially benefit as AI becomes increasingly decentralized, autonomous, and economically active (Exhibit 13).

Exhibit 13: Blockchains offer solutions for some of the risks from AI

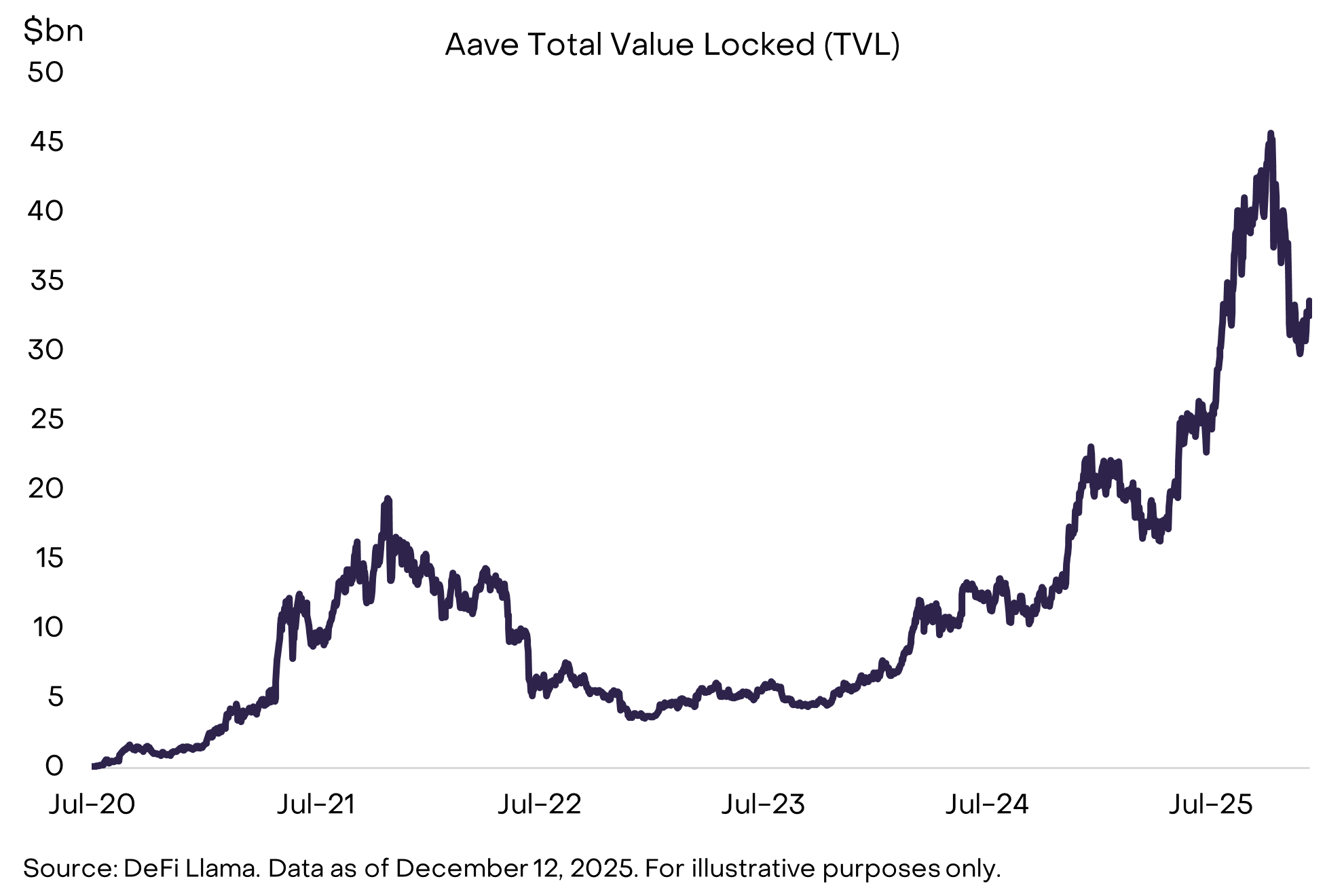

Relevant crypto assets: AAVE, MORPHO, MAPLE, KMNO, UNI, AERO, RAY, JUP, HYPE, LINK

DeFi applications saw significant momentum in 2025, driven by improved technology and regulatory tailwinds. Growth in stablecoins and tokenized assets were important success stories, but there was also meaningful growth in DeFi lending, led by Aave, Morpho, and Maple Finance (Exhibit 14).[7] Meanwhile, decentralized perpetual futures exchanges like Hyperliquid consistently see open interest and daily volumes that rival some of the largest centralized derivatives exchanges. Looking ahead, the growing liquidity, interoperability, and real-world price connections across these platforms position DeFi as a credible alternative for users who want to conduct finance directly on-chain. Look for more DeFi protocols to integrate with traditional fintechs to benefit from their infrastructure and installed consumer base. We expect core DeFi protocols to benefit — including lending platforms like AAVE, decentralized exchanges like UNI and HYPE, and related infrastructure like LINK — as well as the blockchains that support most DeFi activity (e.g., ETH, SOL, BASE).

Exhibit 14: DeFi growing in size and diversity

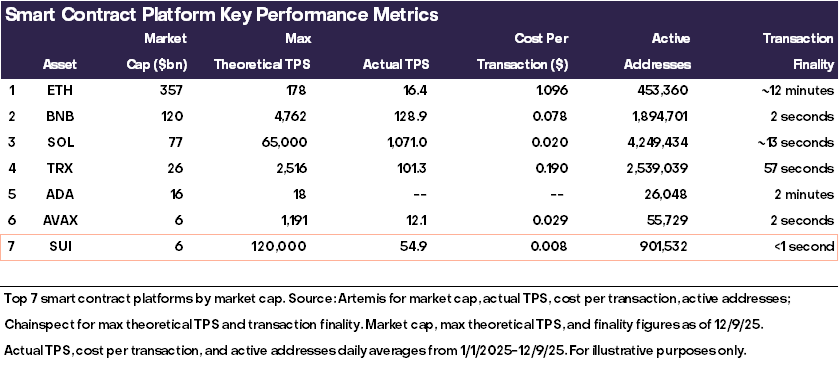

Relevant crypto assets: SUI, MON, NEAR, MEGA

New blockchains continue to push forward the technological frontier. However, some investors argue that more block space is not needed, because there is insufficient demand for existing chains. Solana itself was once the textbook example of this critique: a fast chain with little usage, dismissed as “excess block space,” before a wave of adoption made it one of the industry’s best success stories. Not all of today’s high-performance chains will follow a similar trajectory, but we expect that a few will. Superior technology doesn’t guarantee adoption, but the architectures of these next-gen networks make them uniquely suited for emerging categories such as AI micropayments, real-time gaming loops, high-frequency on-chain trading, and intent-based systems. Among the group, we expect Sui to stand out due to its technological edge and integrated development strategy (Exhibit 15). Other promising projects in Monad (parallelized EVM), MegaETH (ultra-fast ETH L2), and Near (AI-focused blockchain seeing success with its Intents product).

Exhibit 15: Next-generation blockchains like Sui offer faster and cheaper transactions

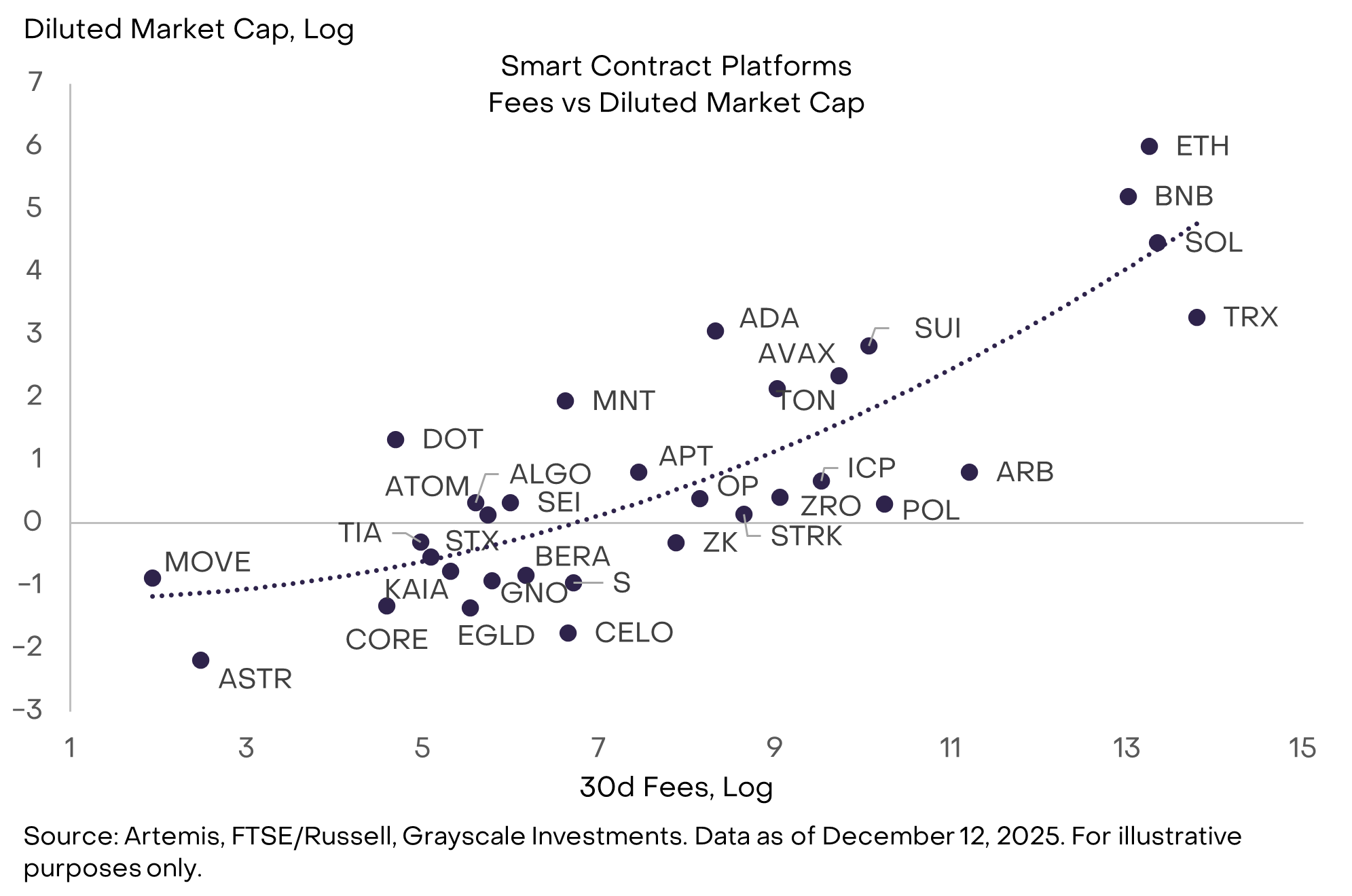

Relevant crypto assets: SOL, ETH, BNB, HYPE, PUMP, TRX

Blockchains are not businesses, but they do have measurable fundamentals, including users, transactions, fees, capital/TVL, developers, and applications. Of these indicators, Grayscale believes that transaction fees are the single most valuable fundamental indicator because they are hardest to manipulate and most comparable across blockchains (they also give the best empirical fit). Transaction fees are comparable to “revenue” in traditional corporate finance. For blockchain applications, it may also be important to distinguish between protocol fees/revenue and “supply side” fees/revenue.[8] As institutional investors begin to allocate capital to crypto, we expect them to focus on blockchains and applications with high and/or growing fee revenue (with the exception of Bitcoin). Smart contract platforms with relatively high revenue include TRX, SOL, ETH, and BNB (Exhibit 16). Application-layer assets with relatively high revenue include HYPE and PUMP, among others.

Exhibit 16: Institutional investors likely to scrutinize fundamentals

Relevant crypto assets: LDO, JTO

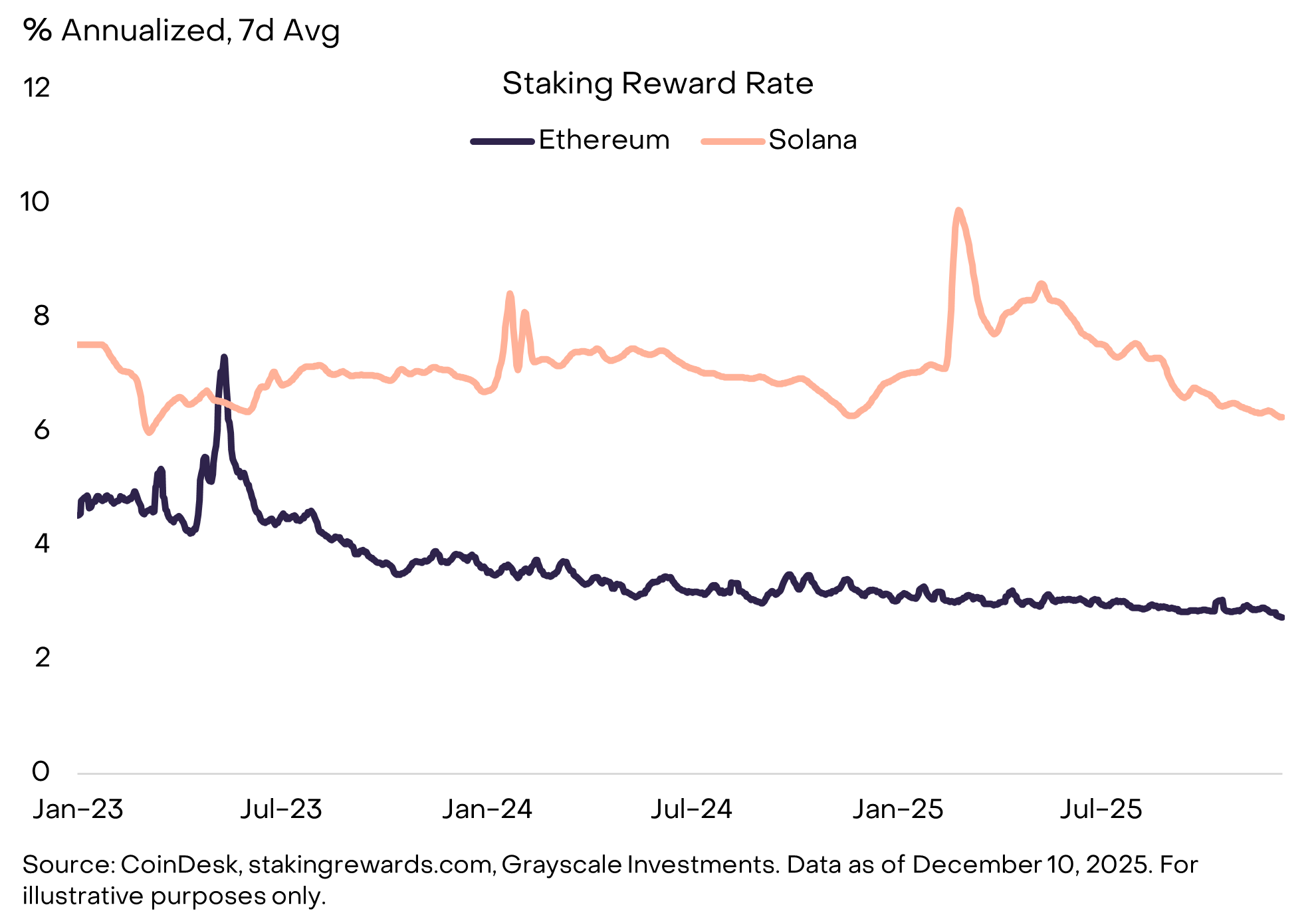

U.S. policymakers made two changes related to staking in 2025 that should allow more token holders to participate in this activity: (i) the SEC clarified that liquid staking activities do not constitute securities transactions[9], and (ii) the IRS and Treasury said that investment trusts/ETPs may stake digital assets.[10] The guidance around liquid staking services may benefit Lido and Jito, the leading liquid staking protocols by TVL on Ethereum and Solana, respectively.[11] More broadly, the fact that crypto ETPs are able to stake will likely make this the default structure for holding investment positions in Proof of Stake tokens, resulting in higher stake ratios and pressure on reward rates[12] (Exhibit 17). In an environment where staking is more broadly adopted, custodial staking through ETPs will offer a convenient structure to capture the rewards, while on-chain non-custodial liquid staking will have the advantages of composability within DeFi. We expect this dual structure to persist for some time.

Exhibit 17: Proof of Stake tokens offer native rewards

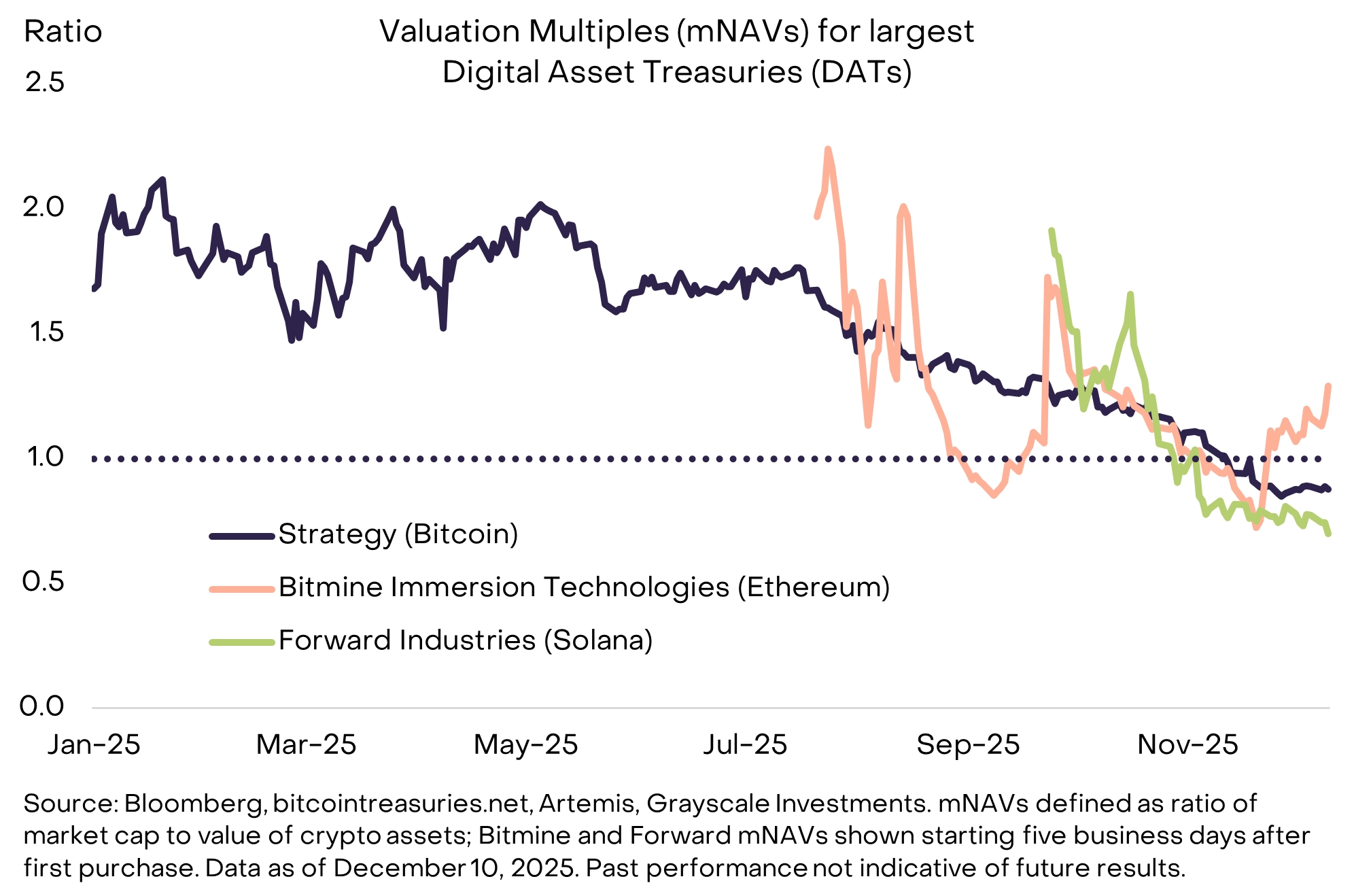

We expect each of the investment themes above to contribute to crypto market developments in 2026. There are two topical issues that we do not expect to meaningfully influence crypto markets next year: cryptographic vulnerability to quantum computing and the evolution of digital asset treasuries (DATs). Much ink will be spilled on these topics, but we do not think they are central to the market outlook.

If technical progress on quantum computing continues, most blockchains will eventually require updates to their cryptography. Theoretically, a sufficiently powerful quantum computer could derive private keys from public keys, which could then be used to create valid digital signatures to spend users’ coins.[13] Therefore, Bitcoin and most other blockchains — and virtually everything else in the economy that uses cryptography — will eventually need to be updated for post-quantum tools. However, expert estimates suggest a quantum computer powerful enough to break Bitcoin’s cryptography is unlikely before 2030 at the earliest.[14] Research on quantum risk and community preparedness efforts will likely accelerate in 2026, but this theme is unlikely to move prices, in our view.

The same goes for the DATs. The strategy pioneered by Michael Saylor of holding digital assets on a corporate balance sheet spawned dozens of copycats in 2025. By our estimate, DATs own 3.7% of the supply of BTC, 4.6% of ETH, and 2.5% of SOL[15]. Demand for these vehicles has waned from the peak in mid-2025: the largest DATs now trade at mNAVs[16] close to 1.0 (Exhibit 18). However, most DATs are not excessively levered (or are not levered at all), so they may not be forced to liquidate assets in a downturn. The largest DAT by market cap, Strategy, recently raised a U.S. Dollar reserve fund so that it can continue to pay dividends on preferred shares even if the price of Bitcoin were to fall.[17] We expect most DATs to behave like closed-end funds, trading at premiums and discounts to net asset value and infrequently liquidating assets. These vehicles are likely to be a permanent feature of the crypto investing landscape but are unlikely to be a major source of new demand for tokens or a major source of selling pressure in 2026, in our view.

Exhibit 18: DAT premiums have compressed, but asset sales are unlikely

We see a bright outlook for digital assets in 2026, underpinned by the dual forces of macro demand for alternative stores of value and improving regulatory clarity. Next year is likely to be about deepening the connectivity between blockchain-based finance and traditional finance, and about institutional capital inflows. The tokens seeing institutional adoption are likely to be those with a clear use case, sustainable revenue, and access to regulated trading venues and applications. Investors can expect to see an expansion of the range of crypto assets available through ETPs, with staking enabled whenever possible.

At the same time, regulatory clarity and institutional adoption are likely to raise barriers to entry to mainstream success. For example, crypto projects may be required to meet new registration and disclosure requirements to access regulated exchanges. Institutional investors are also likely to ignore crypto assets without a clear use case — even those with relatively high market caps. The GENIUS Act created a clear distinction between regulated payment stablecoins — which will have certain rights and responsibilities under U.S. law — and other stablecoins — which will not have the same rights. Similarly, we expect crypto’s institutional era to create sharper distinctions between assets with access to regulated venues and institutional capital, and those without the same access. Crypto is entering a new era, and not every token will make a successful transition from the old one.

Some links are for articles which may sit behind a paywall and may require a subscription to access them in full.

Index Definitions: FTSE/Grayscale Crypto Sectors Total Market Index measures the price return of digital assets listed on major global exchanges. The FTSE Grayscale Smart Contract Platforms Crypto Sector Index was developed to measure the performance of crypto assets that serve as the baseline platforms, upon which self-executing contracts are developed and deployed. The FTSE Grayscale Artificial Intelligence Crypto Sector includes crypto assets related to the development, production or application of artificial intelligence technology.

[1] Source: FTSE/Russell. Data as of December 15, 2025.

[2] Source: Bloomberg, Blockworks, Cerulli, Federal Reserve, Grayscale Investments. As of December 12, 2025. US-listed crypto ETPs and digital asset treasuries (DATs) hold approximately $220bn in assets (for DATs, estimate based on market cap of shares outstanding). According to 13F filings, approximately 50% of these assets are held by “investment advisors”, which we consider an upper bound on the share held by wealth management intermediaries (WMI). We estimate that total US WMI assets are around $40 trillion. Together these values suggest that crypto assets may be as much as 0.3% of total WMI assets.

[3] Source: The Crimson, Bloomberg.

[5] Source: Allium. Data as of December 12, 2025.

[6] Source: RWA.xyz. Data as of December 12, 2025. Ethereum, BNB Chain, and Solana are the leading chains by distributed tokenized assets. Data provider RWA.xyz distinguishes between tokenized assets that are “distributed” on-chain, defined as those “that can be moved to wallets outside the issuing platform and transferred between wallets, and tokenized assets that are “represented” on-chain, defined as those “that cannot be moved to wallets outside the issuing platform or transferred between wallets”. Here we use RWA’s definition of “distributed” tokenized assets.

[7] Source: DeFi Llama. Data as of December 15, 2025.

[8] In a DeFi application, capital is often provided by users, who capture “supply side” fees in exchange for the service they provide to the protocol.

[11] Source: DeFi Llama. TVL = Total Value Locked. Data as of December 15, 2025.

[12] Plus potentially changes by the protocols themselves to manage growth in stake ratios.

[13] For background see “Bitcoin and Quantum Computing: Current Status and Future Directions.” Dr. Anthony Milton and Dr. Clara Shikhelman. Chaincode Labs, May 2025.

[15] Source: Artemis.xyz. Data as of December 12, 2025.

[16] Multiples to net asset value (NAV).