Last Updated: 10/10/2025 | 17 min. read

From a purely technical standpoint, Solana is a decentralized computer network that processes transactions and records them sequentially into a blockchain. But this description is like saying that Manhattan is an island with roads and buildings. Solana is a vibrant community and on-chain economy: an invisible metropolis with millions of users, conducting thousands of transactions per second, and interacting with an almost overwhelming diversity of applications. Solana is crypto’s financial bazaar.

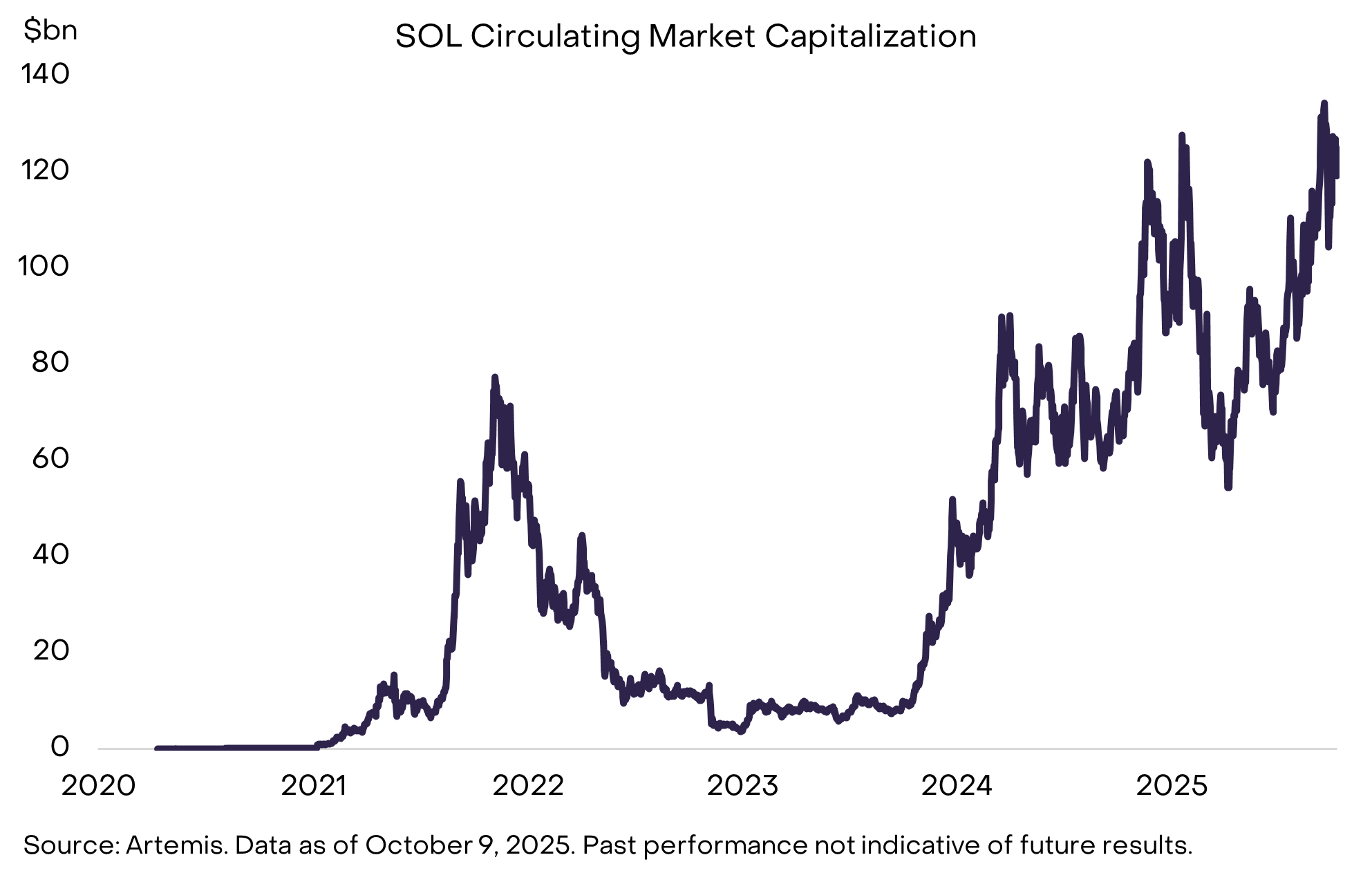

The SOL token is a digital commodity that helps operate the network and provides investment access to growth in the Solana ecosystem (Exhibit 1). Currently, SOL is the fifth-largest crypto asset by market capitalization (excluding stablecoins) and the third-most liquid (based on average daily trading volume).[2]

Exhibit 1: SOL is the fifth-largest crypto asset by market cap[3]

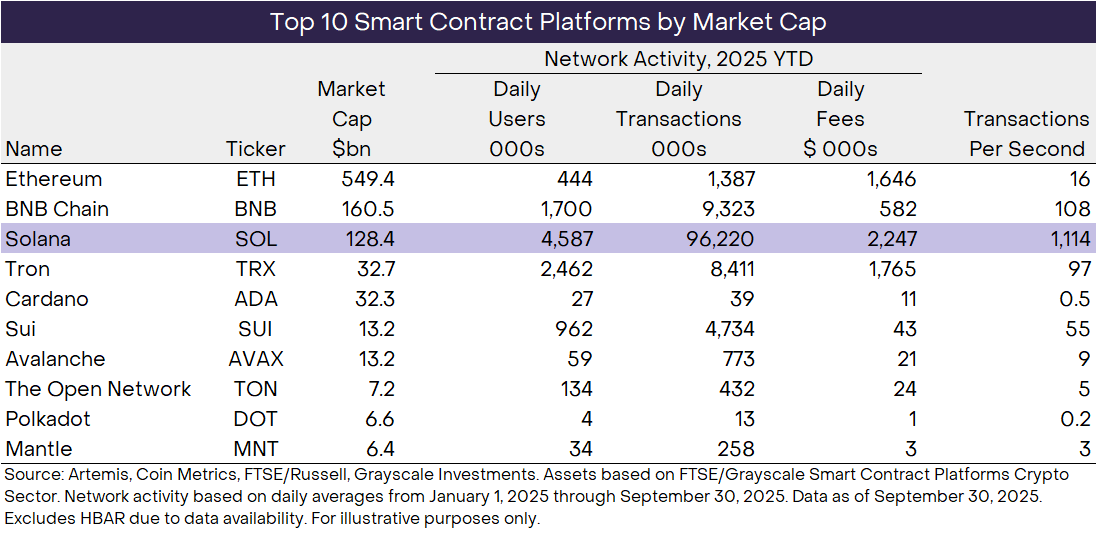

Solana is a component of the Smart Contract Platforms Crypto Sector, along with Ethereum, BNB Chain, Tron, Cardano, Sui, and other networks (Exhibit 2). Among this group, Solana stands out for the depth and diversity in its on-chain activity. Today it’s the category leader in terms of users, transaction volume, and transaction fees.[4] Blockchains are network technologies, which means that, in general, bigger is better: more users and more economic activity typically equates to higher network value. These aren’t the only considerations that matter, but on these core blockchain fundamentals, Solana stands apart from its peers.

Exhibit 2: Solana is the category leader in on-chain activity

Smart contract blockchains are networks that host applications, and Solana is home to industry-leading applications across an impressive range of functions. These include:

These examples represent a small subset of Solana’s more than 500 unique applications.[9] As a general-purpose blockchain with virtually all the functionality of other major networks, Solana ranks third in trading of non-fungible tokens (NFTs), fifth in stablecoin transaction volume, and seventh in tokenized assets.[10] Other use cases gaining recent transaction include trading of collectible Pokémon cards and on-chain issuance of tokenized equities.[11]

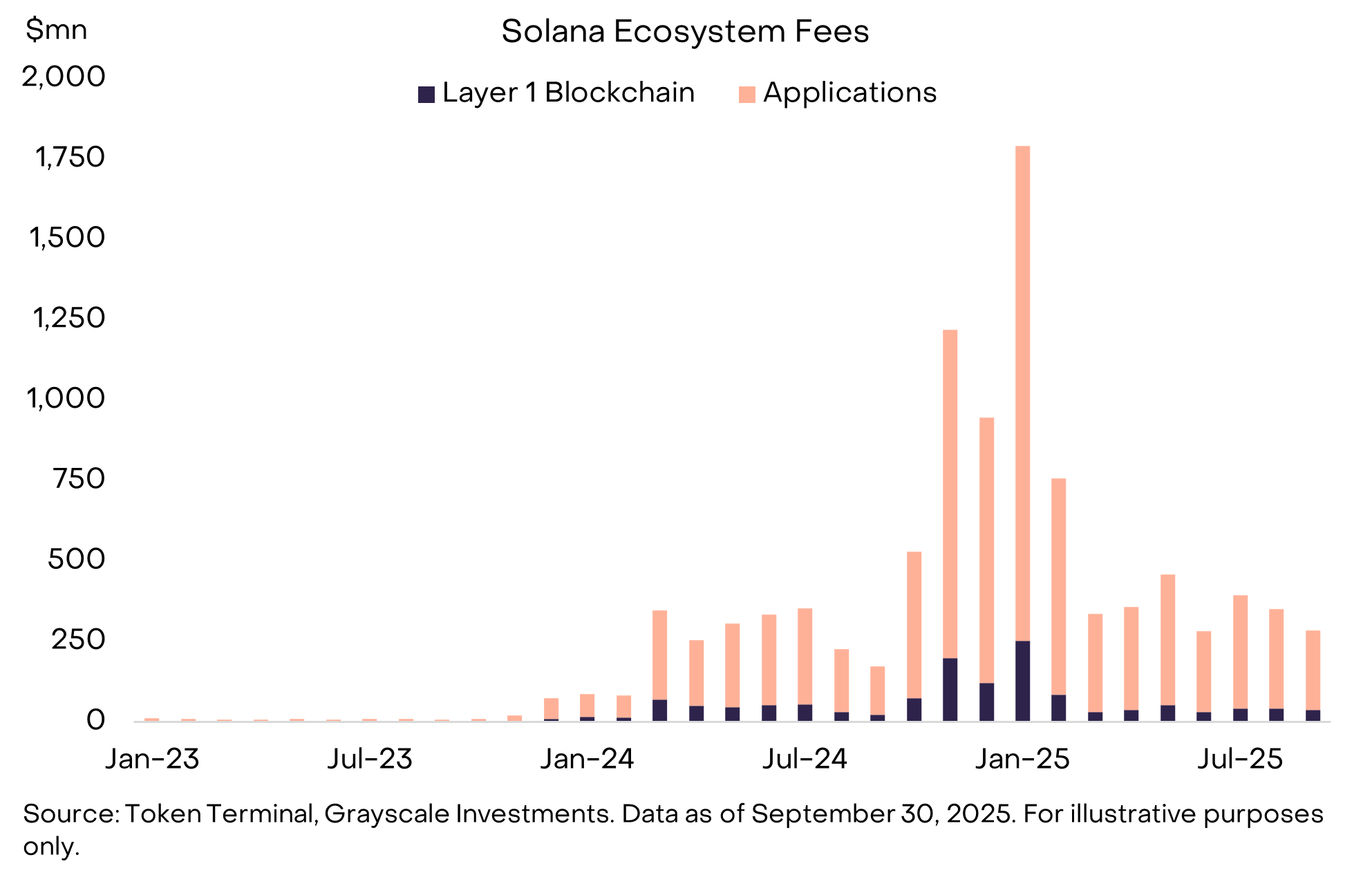

Measuring the Solana ecosystem should take into account transaction activity on both the blockchain itself and its hosted applications. Although there’s variation over time, the Solana ecosystem earns about $425 million in fees per month[12] — or more than $5 billion annualized (Exhibit 3). We believe that fees are the most direct measure of total demand for a blockchain and its applications, and the data indicate there’s significant demand for Solana.

Exhibit 3: Solana ecosystem now generates significant fees

Solana has managed to stand out in a competitive market by offering fast and cheap transactions, a compelling new-user experience and, in our view, partly by going its own way.

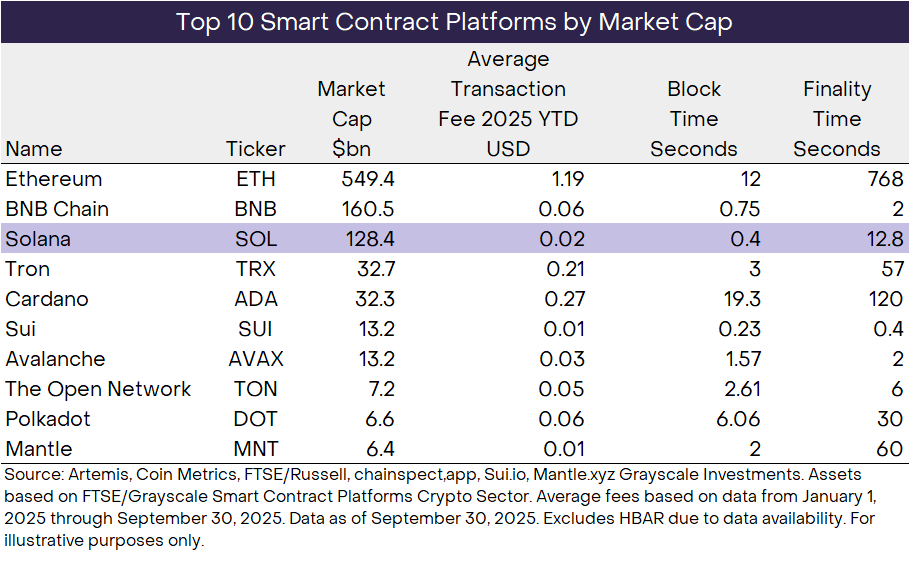

The network produces new blocks every 400 milliseconds, and transactions can be considered final in about 12–13 seconds.[13] In addition to high throughput, transaction costs have remained relatively low: users have paid an average transaction fee of just $0.02 year to date. Solana uses a technology called local fee markets, which limits fee competition to specific in-demand applications. Partly because of this feature, median daily transaction fees this year have averaged just $0.001 (i.e., one-tenth of one cent).[14] Solana’s speed and cost effectiveness compare favorably to other smart contract platforms, although a few are even faster and cheaper, including Sui (Exhibit 4). A forthcoming upgrade to Solana called Alpenglow is expected to reduce finality time to 100–150 milliseconds.[15]

Exhibit 4: Solana offers relatively fast and cheap transactions

Solana offers arguably one of the best new-user experiences in crypto. Partly this reflects its fast and cheap transactions and the diversity of its applications. But additional factors include its “monolithic” rather than layered design (which avoids the need to bridge assets between network components), as well as its excellent wallet infrastructure, led by Phantom. Solana has also had fewer network outages in recent years — a critical feature for every user.[16]

In addition, Solana has pursued a distinct development strategy that may contribute to competitive moats over time. Smart contract blockchains can be thought of as software-based computers[17], and today the dominant architecture for those “computers” is the Ethereum Virtual Machine (EVM) — the system used by Ethereum and many other smart contract platforms, including BNB Chain, Polygon, and Avalanche. EVM-based applications can be easily ported from one EVM chain to another. In contrast, Solana uses a distinct architecture called the Solana Virtual Machine (SVM). SVM-based applications can’t be easily transferred to non-SVM blockchains, potentially contributing to sticky demand.

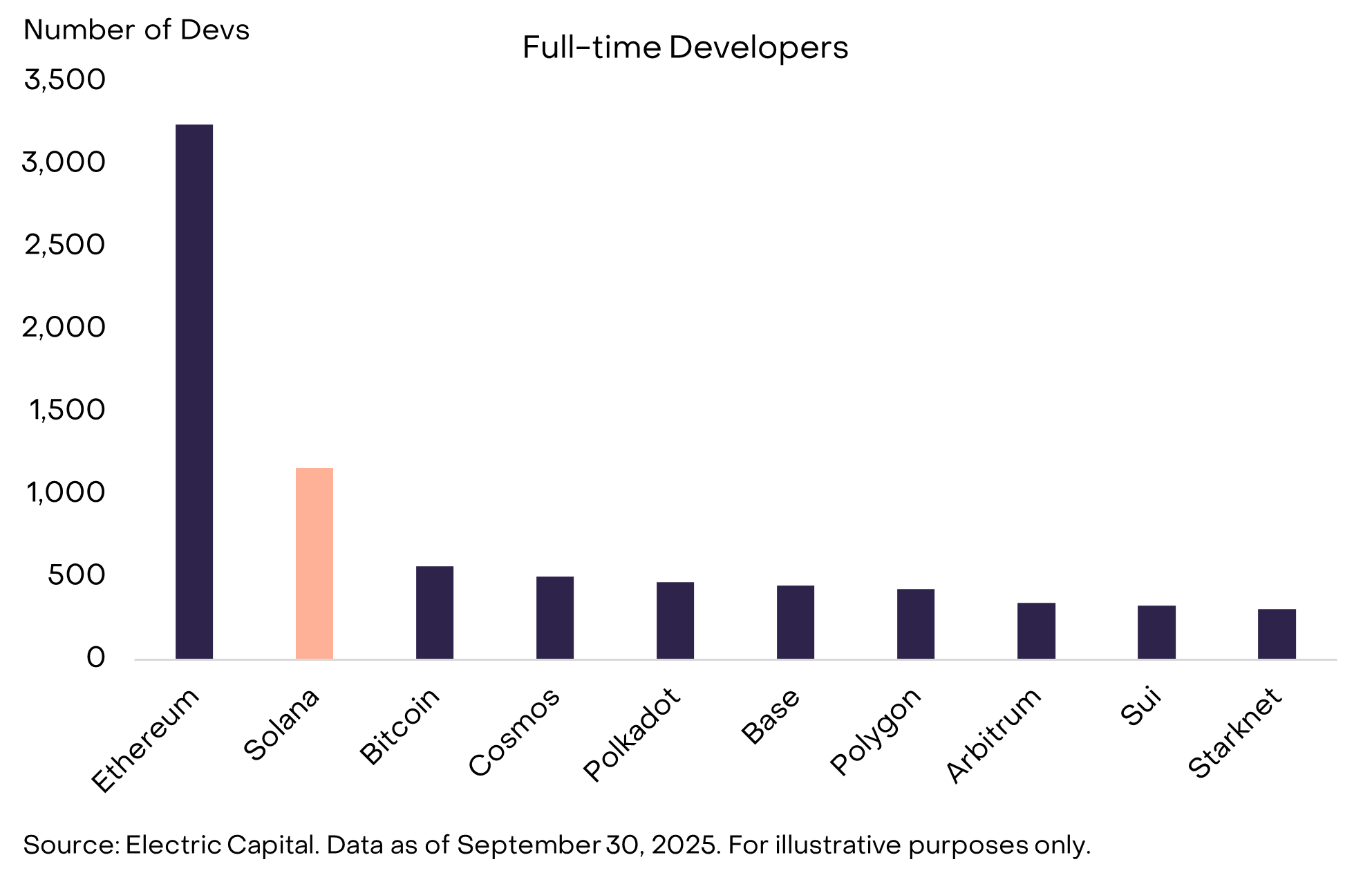

Today there are more than 1,000 full-time developers working on Solana and SVM-based applications, and the number of Solana-focused developers has grown faster than any other smart contract platform over the last two years (Exhibit 5).[18] This human capital could contribute to ongoing Solana-dedicated innovation over time.

Exhibit 5: Solana has second-largest developer ecosystem after Ethereum[19]

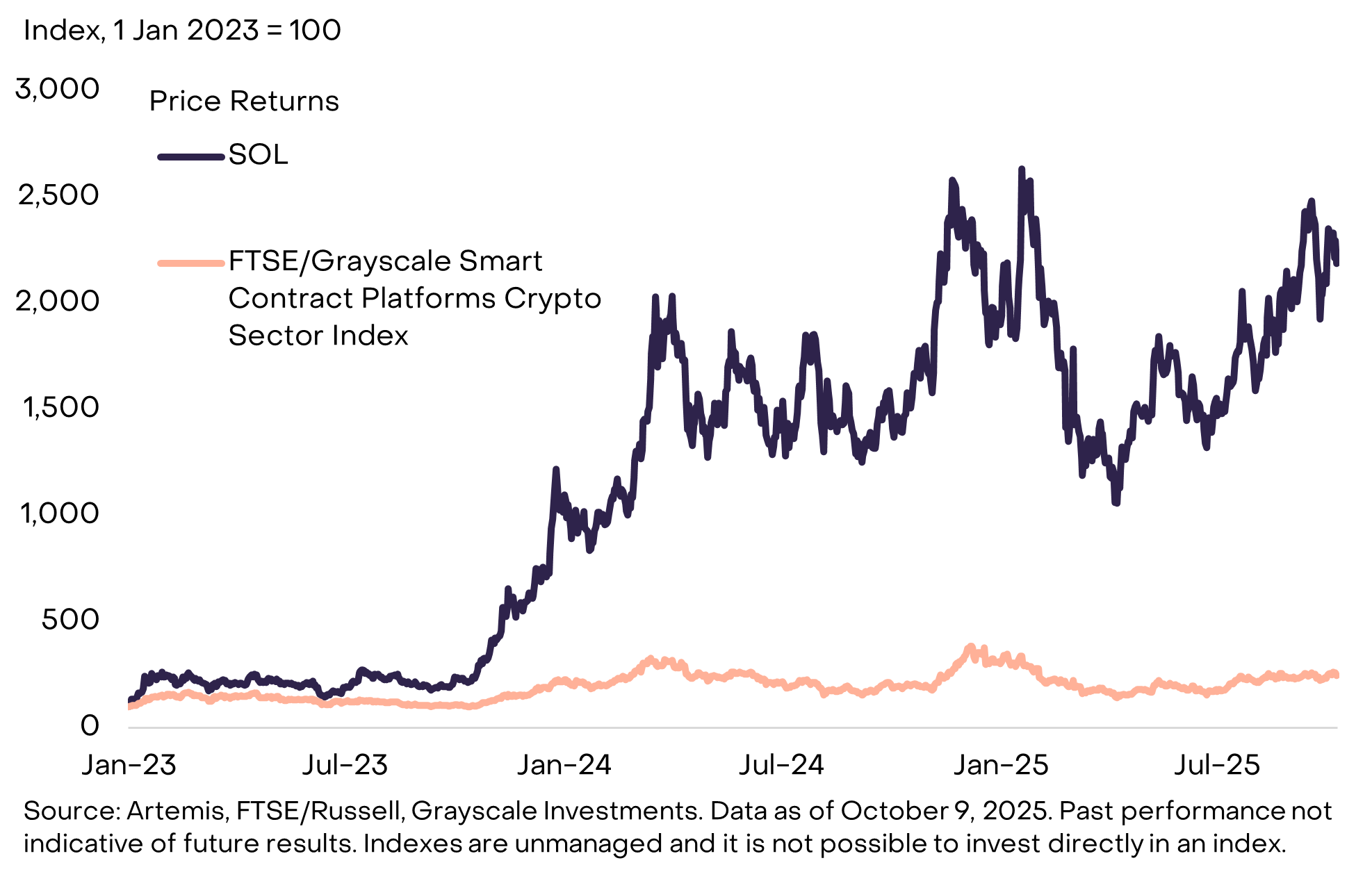

During the last crypto cycle, the price of the SOL token fell from a peak of almost $260 in November 2021 to just $2 in December 2022.[20] For a time, Solana was associated with failed crypto exchange FTX, which had invested capital and contributed some development resources. Perhaps not surprisingly, many casual observers were unsure about Solana’s future after the FTX bankruptcy, even as plenty of SVM developers stuck around. Starting in late 2023, though, the SOL token began to recover. Since that time, it has significantly outperformed the FTSE/Grayscale Smart Contact Platforms Crypto Sector Index (Exhibit 6).

Exhibit 6: SOL has outperformed its peer group since 2023

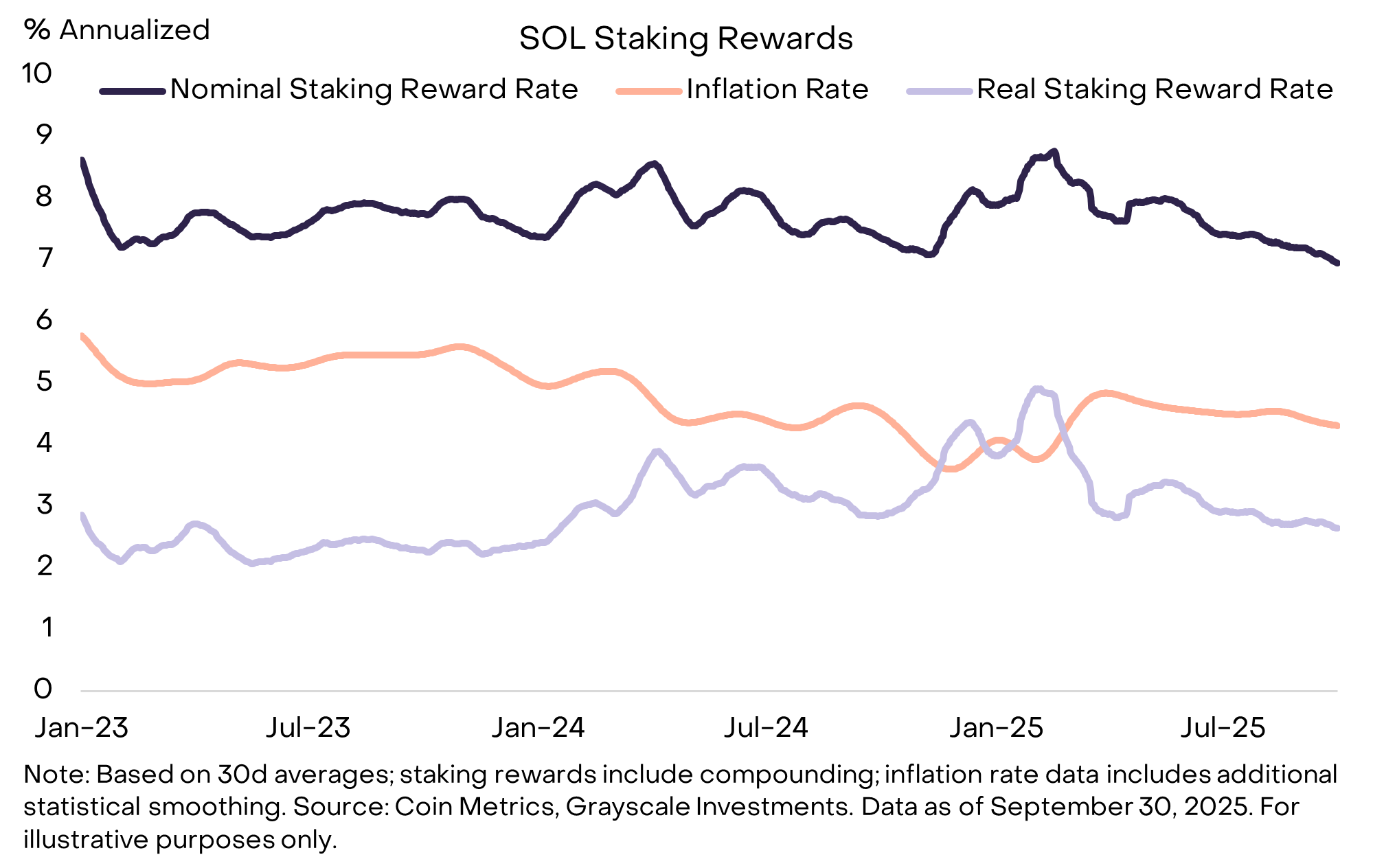

The supply of SOL tokens currently increases at a rate of about 4%–4.5% per year.[21] This can be considered a source of dilution for token holders, all else equal. However, SOL stakers can receive a nominal reward rate of around 7%, depending on network conditions.[22] Therefore, SOL stakers earn a “real” (inflation-adjusted) reward rate of roughly 2.5%–3% (Exhibit 7). Currently around two-thirds of outstanding SOL tokens are staked.[23]

Exhibit 7: SOL stakers can earn a nominal reward rate of about 7%

Smart contract platform tokens like SOL are digital commodities that offer utility in the context of their networks, plus the possibility of additional financial returns (e.g., staking rewards). Their values are correlated to measures of network size. Like other smart contract platform tokens, the investment thesis for the SOL token centers on potential growth in the size of the Solana network. Like any other asset, price does not always move one-for-one with changes in fundamentals. But, if the Solana network grows over time — if it hosts more users, processes more transactions, and earns more fees — investors can anticipate a rising SOL price, in our view.

Solana has executed well on its vision, which we interpret as a fast and cheap blockchain open to anyone. Nonetheless, its specific design choices leave space for competitors to capture or retain market share in certain use cases.

For example, other blockchains offer even faster and/or cheaper transactions, sometimes by operating a more centralized network (e.g., using only a small number of active network nodes). Users may favor this convenience even if centralization could introduce risks. Other blockchains may compete with Solana by keeping their networks permissioned — i.e., by only allowing approved users and/or approved activity. This can have advantages in certain contexts. Because Solana is a permissionless network — everyone is welcome — it’s home to both high-tech startups and speculative retail trading.

At the other end of the spectrum, the SOL token may be less suitable as a long-term “store of value” monetary asset compared to Bitcoin or Ether. Partly this reflects SOL’s higher nominal supply inflation: scarcity is a key feature of any long-term store of value. But an even more important factor may be network resilience from third-party interference. For a digital asset to serve as a long-term store of value, users need to have confidence that they can transact in the future under virtually all circumstances. One way to support this outcome is by keeping node requirements low so the network remains highly decentralized and easily reproducible. Solana’s efficiency comes at the cost of comparatively high hardware and bandwidth requirements, such that many of the network’s nodes operate in data centers.[24] Theoretically, this could become a source of centralization over time and a vector for third-party interference with the network.[25]

All that being said, these are complex and unsettled issues, and investor perceptions over which crypto assets can serve as long-term stores of value may change over time.

Blockchains are not businesses, and blockchain tokens are not stocks — they’re digital commodities with functional utility in the context of these decentralized networks. Nonetheless, it’s possible to analyze blockchain fundamentals and invest in tokens on the basis of fundamentals. The three most important measures of on-chain activity, in our view, are users, transactions, and transaction fees. And based on those indicators, Solana is the leading network for on-chain activity today. Other blockchain fundamentals can be important for token price, and the Solana network has formidable competitors. But the depth and diversity of Solana’s on-chain economy creates a strong foundation for SOL valuation and, in our view, the necessary conditions for further growth over time.

[1] Coin Metrics, Grayscale Investments. Data as of October 9, 2025.

[2] Source: Coin Metrics, Grayscale Investments. Data as of September 30, 2025. Volume ranking based on average daily spot volume for the 90 days ending September 30, 2025.

[3] Excluding stablecoins

[4] Note: Ranking by transactions excludes Internet Computer (ICP), which counts queries as transactions, and therefore reports artificially high transaction counts.

[5] Source: DeFi Llama. Data as of September 30, 2025.

[6] Source: DeFi Llama. Based on the 30 days ending October 7, 2025.

[7] Source: Token Terminal, Grayscale Investments. Data as of September 30, 2025. Estimates of users and revenue based on 90 day averages ending September 30, 2025.

[8] Source: World.helium.com, Helium Blog, and Helium Blog. Data as of October 1 2025.

[9] Source: DappRadar. Data as of September 30, 2025.

[10] Source: Allium, rwa.xyz, Artemis, Grayscale Investments. Data as of September 30, 2025. Stablecoin transaction volume based on the three months ending September. Tokenized assets based on level as of September 30, 2025. NFT volume based on 90 days ending September 30, 2025.

[12] Token Terminal. Based on median monthly ecosystem fees over the 12 months ending September 30, 2025.

[13] Source: Chainspect.app.

[14] Source: Coin Metrics, Grayscale Investments. Data as of September 30, 2025. For illustrative purposes only.

[15] Source: Helius. The Alpenglow upgrade will also reduce the network’s Byzantine fault tolerance threshold to ~20% from ~33% currently.

[17] For more background, see Ethereum: The OG Smart Contract Blockchain.

[18] According to Electric Capital, the number of Bitcoin developers has grown at a faster rate over the last two years. Grayscale categorizes Bitcoin in the Currencies Crypto Sector rather than the Smart Contract Platforms Crypto Sector.

[19] Largest ecosystems by number of developers

[20] Source: Artemis. Data as of September 30, 2025.

[21] Source: Tokenomist.ai. Half of SOL paid in base transaction fees is burned and permanently removed from circulating supply.

[22] The staking reward rate equates to the inflation rate divided by the share of SOL supply that is staked, plus any transacted-related rewards that are shared by validators to delegated stake.

[23] Source: Coin Metrics, Grayscale Investments. For the 90 days ending September 30, 2025, the share of SOL staked averaged 68%.

[24] Solana’s validator docs recommend 12 cores/24 threads, 256 GB RAM, and 1 TB. Ethereum docs recommend 8 cores/16 threads, 64 GB RAM, and 4 TB. In other words, Solana requires higher ~50% more CPU, ~4x more RAM, and less disk than Ethereum’s validator guidance. Ethereum requires 100 Mbps of download bandwidth and 50Mbps of upload bandwidth; Solana requires 1Gbps for both, but 10Gbps is preferred. EIP-7870, proposed in early 2025, recommends that validators increase hardware specs from 32GB to 64Gb, signaling a push for higher performance hardware. Source: Solana Labs, Ethereum.org. According to validators.app, ~99% of staked SOL represents validators in data centers, and ~45% in the top two hosting providers. According to ethernodes.org, Ethereum has 43% of nodes in data centers (“hosting”) versus 51% in residential settings. The Dollar cost of any specific hardware and bandwidth requirement should be expected to decline over time.

[25] There is no one measure of decentralization, and what users ultimately value is network resilience and the ability to transact peer-to-peer without fear of censorship. This is a byproduct of decentralization, as well as other network design choices. For details on Solana’s current node distribution see Helius.

Investments in digital assets are speculative investments that involve high degrees of risk, including a partial or total loss of invested funds. Investments in digital assets are not suitable for any investor that cannot afford loss of the entire investment.

All content is original and has been researched and produced by Grayscale Investments Sponsors, LLC (“Grayscale”) unless otherwise stated herein. No part of this content may be reproduced in any form, or referred to in any other publication, without the express consent of Grayscale.

This information should not be relied upon as research, legal, tax or investment advice, or a recommendation regarding any products, strategies, or any investment in particular. This material is strictly for illustrative, educational, or informational purposes and is subject to change. This content does not constitute an offer to sell or the solicitation of an offer to sell or buy any security in any jurisdiction where such an offer or solicitation would be illegal. There is not enough information contained in this content to make an investment decision and any information contained herein should not be used as a basis for this purpose.

This content does not constitute a recommendation or take into account the particular investment objectives, financial situations, or needs of investors. Grayscale Operating, LLC and its affiliates, directors, officers, and employees may have interests, financial or otherwise, in the digital assets and/or securities discussed.

The price and value of assets referred to in this content and the income from them may fluctuate. Past performance is not indicative of the future performance of any assets referred to herein. Fluctuations in exchange rates could have adverse effects on the value or price of, or income derived from, certain investments.

Certain of the statements contained herein may be statements of future expectations and other forward-looking statements that are based on Grayscale’s views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements. In addition to statements that are forward-looking by reason of context, the words “may, will, should, could, can, expects, plans, intends, anticipates, believes, estimates, predicts, potential, projected, or continue” and similar expressions identify forward-looking statements. Grayscale assumes no obligation to update any forward-looking statements contained herein and you should not place undue reliance on such statements, which speak only as of the date hereof. Although Grayscale has taken reasonable care to ensure that the information contained herein is accurate, no representation or warranty (including liability towards third parties), expressed or implied, is made by Grayscale as to its accuracy, reliability, or completeness. You should not make any investment decisions based on these estimates and forward-looking statements.

There is no guarantee that the market conditions during the past period will be present in the future. Rather, it is most likely that the future market conditions will differ significantly from those of this past period, which could have a materially adverse impact on future returns. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. We selected the timeframe for our analysis because we believe it broadly constitutes the most complete historical dataset for the digital assets that we have chosen to analyze.

© 2025 Grayscale. All trademarks, service marks and/or trade names (e.g., DROP GOLD®, G™, GRAYSCALE®, GRAYSCALE CRYPTO SECTORS™ and GRAYSCALE INVESTMENTS®) are owned and/or registered by Grayscale.