Last Updated: 2/25/2025 | 20 min. read

Solana recently gained mainstream media attention when President Trump and first lady Melania Trump both launched memecoins on the chain in January. Although Solana is the dominant blockchain today for memecoin trading,[3] it also plays host to one of the key non-speculative use cases in crypto: Decentralized Physical Infrastructure Networks (DePINs).

What Is DePIN?

DePIN represents a unique emerging space: connecting blockchain to the real world. Serving needs like internet connectivity and computing resources, these physical systems include hotspot devices, wireless routers, physical Internet of Things (IoT) sensors, car dashcams, and GPUs. These devices provide value across a network in exchange for crypto token rewards. Unlike traditional models, which rely on corporations like telecom providers and data centers, DePINs are decentralized, distributing ownership and management across a diverse set of independent participants. In the Grayscale Research framework, DePIN assets belong to the Utilities & Services Crypto Sector as application-layer protocols that operate on smart contract blockchains like Ethereum or Solana.

DePIN Investment Outlook

Because DePIN distributes physical nodes across different participants, this helps eliminate single points of failure and enhances the resilience, efficiency, and sustainability of the infrastructure. In doing so, DePIN fosters innovation, promotes equity, and offers greater flexibility, while reducing operational costs. In sum, DePIN may offer several key advantages over traditional centralized models:

Because of these benefits, DePIN is particularly relevant to industries with high capital requirements, a large barrier to entry, monopolistic dynamics, and underutilized resources. The DePIN model is particularly relevant toward sectors like internet connectivity, data storage, and computational hardware for AI development. These industries are worth trillions of dollars and include some of the largest companies in the world, from AT&T to Amazon (AWS) and Nvidia.

As a result, we feel the opportunity is significant; if DePINs capture even a small share of these markets, the potential impact could be substantial. Grayscale Research believes this outcome is feasible because 1) DePINs offer a more efficient business model than traditional alternatives, and 2) there are already examples of DePINs successfully leveraging crypto incentives to massively bootstrap network supply.

Today, we believe Solana is the best way to gain investment exposure to this early and growing theme, as the go-to blockchain for DePIN (more on this later). However, we also believe several DePIN projects have demonstrated impressive levels of adoption and are emerging as potential category winners.

The State of DePIN Today

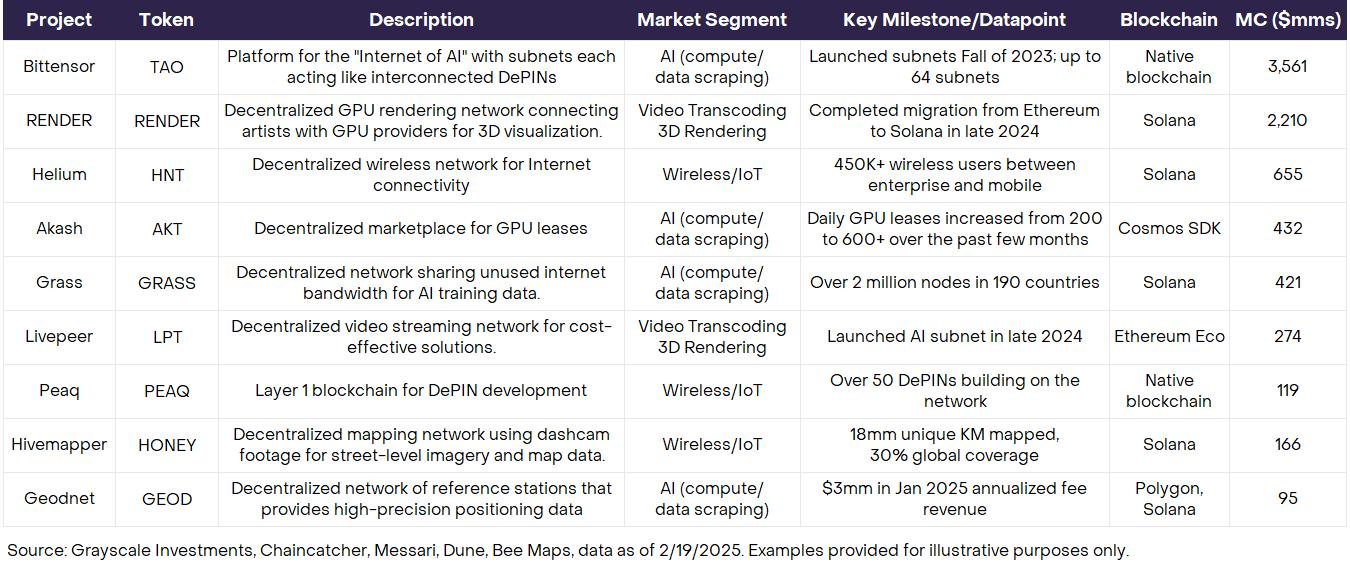

DePIN assets range in use cases, including wireless connectivity and IoT (Helium), geospatial data collection (Hivemapper), decentralized video rendering (Render), and AI-related use cases like computing networks (Akash). Today, AI-related DePIN projects dominate by market cap (Exhibit 1). In the following sections, we will highlight some of these emerging use cases and projects.

Exhibit 1: AI-related DePIN projects dominate by market cap

Helium — Wireless Connectivity & IoT

Solana-based Helium was one of the early pioneers of DePIN and is a prime example of real-world crypto usage. Helium enables individuals to monetize their unused network capacity in exchange for token rewards (HNT), creating a decentralized network of hotspots. Users access internet connectivity through this network of hotspots at a rate that is significantly cheaper than traditional alternatives. Helium mobile currently has over 129,000 mobile subscribers, offering its $30 monthly unlimited plan — well below the U.S. average of $144 per month.[4] Significantly, Helium recently announced its free mobile plan with limited data, texts, and minutes.[5]

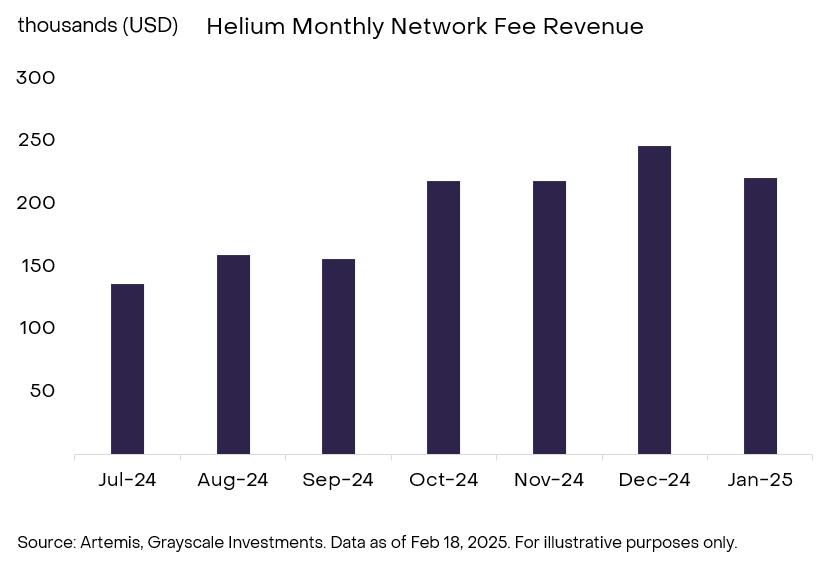

Helium also partners with telecom providers like T-Mobile. This partnership allows T-Mobile users to seamlessly access Helium’s wireless connectivity in high-traffic areas, reducing congestion and lowering costs. T-Mobile pays the Helium network based on usage, creating a deflationary impact on the supply of HNT. In large part due to their enterprise efforts, Helium has provided wireless internet access to around 450K people and saw increased overall network usage through the second half of 2025 (Exhibit 2).[6]

Beyond mobile connectivity, Helium supports IoT devices, allowing sensors to transmit data via its decentralized network at lower costs than traditional Wi-Fi solutions. Similar DePIN projects that focus on IoT solutions include Geodnet, Hivemapper, and NATIX, which use IoT sensors on cars or at home to collect real-time geospatial data. This data is valuable for navigation services today and could be used to enhance precision accuracy for AI systems such as autonomous vehicles and robotics. Geodnet in particular has shown impressive growth to $3 million in January 2025 annualized network fee revenue (up around 518% YoY).[7]

Grayscale Research believes that if Helium can 1) continue to grow its usage and geographical coverage within current partnerships like T-Mobile and Telefonica and 2) gain broader consumer adoption with its new free mobile plan, its opportunity may be meaningful.

Exhibit 2: Helium network usage increased through the latter half of 2024

Data scraping — Grass

DePIN has a significant overlap with AI use cases; one example of this is in data acquisition. Large Language Models (LLMs) require massive amounts of high-quality data. Incumbent AI services like OpenAI and Gemini have a substantial advantage over competitors due to their continuous access to real-time and multimodal data through Bing and Google, respectively. Grass aims to level the playing field by enabling new data acquisition models driven by token incentives.

Through a simple desktop app, Grass allows anyone to share their unused internet bandwidth in exchange for GRASS tokens. This bandwidth is used to scrape online data, which is then sold to AI companies and developers for model training. As a result, individuals on the Grass network can monetize their bandwidth, while AI companies can access data that otherwise would be stuck in siloes.

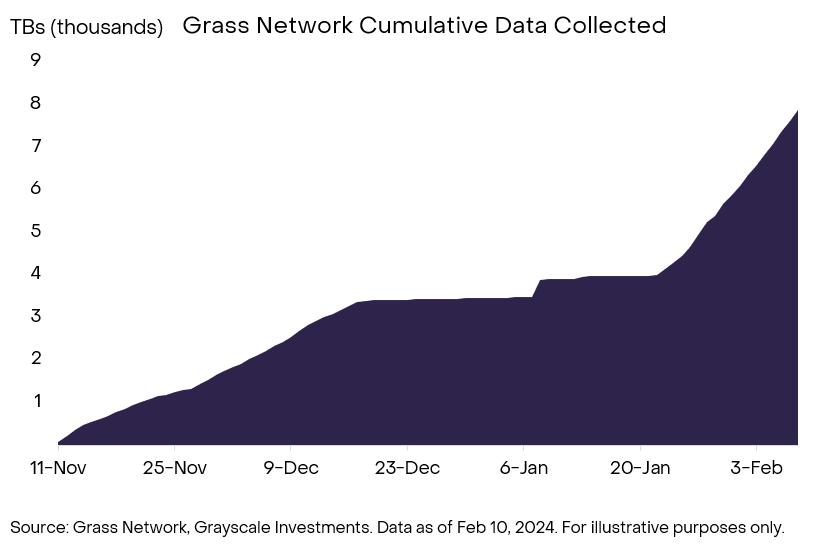

Grass stands out as a DePIN success story in leveraging token incentives to bootstrap supply, growing its contributor base to 2.5 million nodes across 190 countries, more than any other DePIN project.[8] As a result of all this bandwidth, Grass has scraped 20% of YouTube’s data and over 7 thousand TBs of data in total (Exhibit 3). The Grass network currently provides data to AI labs such as Laion and Ontocord and potentially has substantial upside if it can partner with some of the larger AI labs.

Competitors in this theme include Masa, which provides a similar decentralized data scraping service to the Bittensor ecosystem.

Exhibit 3: Grass has grown total data scraped since last November

AI Model Training — Prime Intellect & Others

After an AI company has access to high-quality data, it can use that data to train an LLM (large language model). One of the earliest use cases of DePIN — but perhaps still one of the most promising — is decentralized training.

AI model training requires immense computational power, typically concentrated in centralized data centers. DePIN is changing that. By distributing workloads across global GPU networks, these projects unlock decentralized training. This past November, Prime Intellect successfully trained a 10 billion parameter language model over 1 trillion tokens across five countries and three continents.[9] Prime intellect was able to do this using their DiLoCo framework, which enables efficient training across loosely connected devices by significantly reducing communication requirements.[10] Competitors include Nous Research, which built the Hermes open-source model and recently selected Solana as its blockchain. Another emerging player is Flock.io (FLOCK), which enables financial companies like Animoca Brands and GSR as well as medical companies to train AI models in a privacy-preserving manner. While Prime Intellect and Nous Research have not yet launched tokens, Grayscale Research believes some of these decentralized training protocols could reduce costs and improve access for AI developers.

AI Model Inference — Akash

Once an LLM has been trained, it can be queried by consumer applications like chatbots (e.g., ChatGPT). Every time a user asks ChatGPT a question, there is an inference cost associated with producing the output. This process of inference involves sophisticated GPU hardware like NVIDIA H100s to perform the necessary computation. These in-demand resources are often sold at high prices and long-term contracts, making it difficult for startups, researchers, or organizations without significant capital to afford them. At the same time, many data centers that possess these GPUs have up to 30% underutilized capacity.[11]

Akash is a decentralized cloud computing marketplace for GPU leasing. It enables GPU suppliers to monetize the idle supply and consumers to access high-performance GPUs at flexible time periods and often lower costs than alternatives.

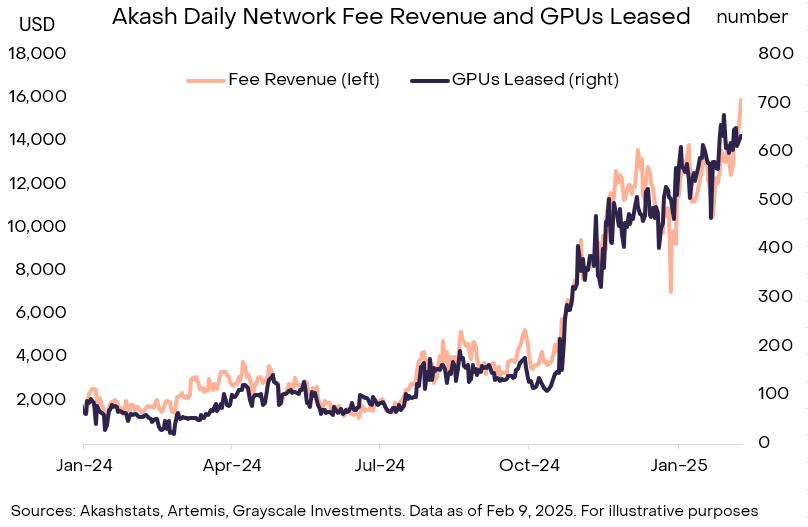

Akash has grown GPU leases from less than 200 before November 2024 to over 600 in January 2025, including 398 NVIDIA H100s.[12] As a result, Akash was able to grow network fee revenue to an annualized $4.6mm this January (Exhibit 4).[13] Akash GPUs are used by brev.dev (acquired by Nvidia), Venice.ai, ElizaOS (formerly ai16z), and UT Austin.[14] Though Akash and similar decentralized inference platforms may not compete directly with major cloud providers, they have an opportunity to carve out market share as they serve startups, decentralized AI projects, independent researchers, and universities. Competitors to Akash offering similar services include io.net, Nosana, and Hyperbolic.

Exhibit 4: Growth of network fee revenue and GPU leases on Akash accelerated in November 2024

The largest DePIN asset by market cap today is Bittensor (Exhibit 5), an AI-related platform that we’ve written about in depth before. Acting as a platform for the “Internet of AI,” it hosts subnets specializing in tasks like data scraping and compute for model inference (two of the use cases previously mentioned). Each subnet functions as an independent entity within the broader Bittensor ecosystem, which operates like a network of interconnected DePINs. Bittensor is experiencing a major upgrade called “dynamic TAO” on February 13th, which made individual subnets investible for the first time.

Exhibit 5: Example DePINs by Category and Market Cap

Solana as the Leading DePIN Blockchain

While many DePIN projects have opted to build their own standalone Layer 1 blockchain (an “app-chain”), Solana has emerged the primary blockchain for DePIN applications. Solana is the leading DePIN blockchain by market cap and the chosen blockchain of many of the top DePIN projects (Exhibit 6). A notable example is Helium, which was originally built on its own Layer 1 and then moved to Solana. Similarly, Render, a video rendering network and one of the larger DePIN assets by market cap, migrated from Ethereum to Solana in 2024. Other DePIN projects built on Solana include Grass, Hivemapper, io.net, Nosana, and others.

Grayscale Research believes Solana is the DePIN chain of choice for a few reasons. First, Solana is a fast and low-cost chain, allowing DePIN projects to transfer value and operate efficiently for suppliers and consumers alike. Second, among high throughput and low-cost chains like BASE and SUI, Solana offers the greatest amount of network security, liquidity, and history. Finally, by building on Solana rather than a standalone Layer 1 app-chain, DePIN project developers can focus on their core competency at the application layer, eliminating the need to allocate resources towards scaling as well as infrastructure-level tooling and maintenance.

Exhibit 6: Solana is the leading blockchain for DePIN by market cap

Conclusion

DePIN potentially represents a promising frontier in blockchain technology, offering innovative solutions for global resource allocation. While some may claim that the crypto industry is limited to speculative or financial use cases, many DePIN projects provide compelling evidence to the contrary.

Most DePIN projects are less than five years old, but some have shown promising signs of adoption, including partnering with and serving some of the largest organizations in the world (e.g., T-Mobile and Nvidia via brev.dev). As a result, we are particularly excited about certain use cases, including internet connectivity, decentralized training, and networks that collect either social data or real-world physical video data for AI training. In addition, the potential future growth of DePIN may create incremental tailwinds for Solana. As the leading DePIN blockchain, Solana provides the speed, cost-effectiveness, and security necessary for these projects to flourish.

Ultimately, we believe that DePIN may represent a compelling investment opportunity. Investors interested in earlier-stage, higher-beta DePIN exposure may consider Helium or Bittensor for wireless/IoT and AI exposure, respectively. For those more inclined to hold larger-cap options, Solana represents the premier investment choice alongside the growth of DePIN in our opinion.

Glossary

Internet of Things (IoT):The Internet of Things (IoT) refers to the network of interconnected physical devices, vehicles, appliances, and other objects embedded with sensors, software, and connectivity features, enabling them to collect and exchange data over the internet.

DePIN: Decentralized Physical Infrastructure Networks that use blockchain and token rewards to incentivize individuals to contribute physical infrastructure resources.

Blockchain: A distributed digital ledger that securely stores records across a network of computers in a transparent and tamper-resistant manner.

Helium: A blockchain network designed to facilitate wireless communication for IoT devices across the globe, using a unique Proof of Coverage consensus mechanism.

Render: A utility token native to the Render Network, which allows users to share GPU power for rendering visual projects.

Grass: A protocol on the Solana blockchain that allows users to share unused internet bandwidth for web data collection, supporting AI development.

Solana: A crypto computing platform designed to achieve high transaction speeds without sacrificing decentralization, using innovative approaches like the "proof of history" mechanism.

Decentralized AI: The integration of artificial intelligence algorithms and processes within a decentralized network, typically utilizing blockchain technology to promote transparency, security, and collaboration

Data scraping: A technique where a computer program extracts data from human-readable output coming from another program.

Bittensor: A platform that bridges artificial intelligence and blockchain, allowing users to create or participate in competition-based markets called subnets

Memecoin: A cryptocurrency created for fun or comedic purposes, frequently based on memes or humor, rather than serious technological development.

Ethereum: A decentralized blockchain platform with smart contract functionality, using Ether (ETH) as its native cryptocurrency.

Data storage: In the context of decentralized networks, a system where data is encrypted and stored across multiple locations or nodes run by individuals or organizations sharing extra disk space.

Computational hardware: The physical components and devices that make up a computer system, enabling it to perform various tasks and run software.

Geospatial data collection: The physical components and devices that make up a computer system, enabling it to perform various tasks and run software.

Decentralized video streaming: Video platforms that use blockchain technology to distribute content storage and streaming across multiple nodes in a peer-to-peer network, reducing censorship risks and enhancing privacy.

Akash: A decentralized cloud computing marketplace that pools and reallocates idle computing processing power to customers who need it, using AKT as its native utility and governance token.

Market cap: The total value of a cryptocurrency, calculated by multiplying the total number of coins in circulation by the current price of a single coin.

LLM: Large Language Model, an advanced AI system trained on vast amounts of text data to understand and generate human-like text.

Token rewards: Incentives given in the form of cryptocurrency tokens to participants in a blockchain network for their contributions or activities.

[1] Artemis, Grayscale Investments, data as of Feb 18, 2025.

[2] Artemis, Grayscale Investments, data as of Feb 18, 2025.

[3] Artemis, as of Feb 18, 2025

[6] Messari

[7] Artemis, data as of Feb 18, 2025.

[13] Artemis

Important Information

Risk Disclosures

Extreme volatility of trading prices that many digital assets have experienced in recent periods and may continue to experience could have a material adverse effect on the value of the Product and the shares of each Product could lose all or substantially all of their value.

Digital assets represent a new and rapidly evolving industry. The value of the Product shares depends on the acceptance of the digital assets, the capabilities and development of blockchain technologies and the fundamental investment characteristics of the digital asset.

Digital asset networks are developed by a diverse set of contributors and the perception that certain high-profile contributors will no longer contribute to the network could have an adverse effect on the market price of the related digital asset.

Digital assets may have concentrated ownership and large sales or distributions by holders of such digital assets could have an adverse effect on the market price of such digital assets.

The value of the Product shares relates directly to the value of the underlying digital asset, the value(s) of which may be highly volatile and subject to fluctuations due to a number of factors.

A substantial direct investment in digital assets may require expensive and sometimes complicated arrangements in connection with the acquisition, security and safekeeping of the digital asset and may involve the payment of substantial acquisition fees from third party facilitators through cash payments of U.S. dollars.

Because the value of the Shares is correlated with the value of digital asset(s) held by the Product, it is important to understand the investment attributes of, and the market for, the underlying digital asset. Please consult with your financial professional.

This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This material is strictly for illustrative, educational, or informational purposes and is subject to change.

© 2025 Grayscale Investments Sponsors, LLC. All rights reserved. The GRAYSCALE and GRAYSCALE INVESTMENTS logos, graphics, icons, trademarks, service marks, and headers are registered and unregistered trademarks of Grayscale Investments Sponsors, LLC in the United States.