Last Updated: 11/19/2025 | 18 min. read

Public blockchain technology promises to transform digital money and digital finance by reducing the role of centralized intermediaries. But to make this vision a reality, blockchains must be connected to the real world. Almost all financial assets are issued off-chain and, at least over the short and medium term, will need to be bridged to blockchains through the process of tokenization. Moreover, there are aspects of mainstream finance that are not going away, including regulatory compliance, dispute resolution, and customer service, so there will be a lasting role for certain types of intermediaries. That’s where Chainlink comes in.

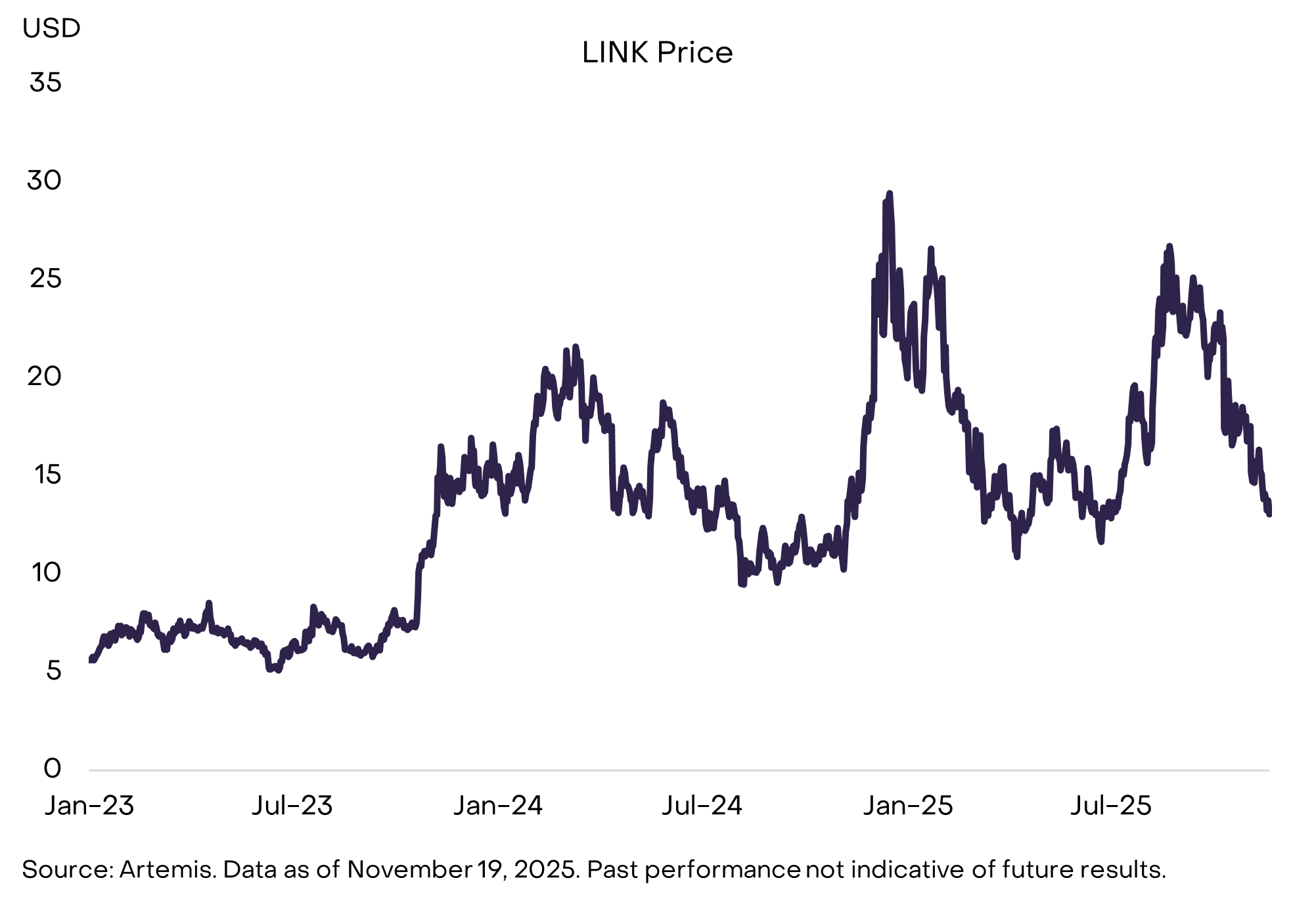

Chainlink is the critical connective tissue between crypto and traditional finance. It can already be considered essential infrastructure in blockchain-based finance, in our view, and it’s difficult to imagine how crypto can go mainstream without applying Chainlink’s suite of software technologies. Chainlink’s broad and likely increasing adoption, the token’s straightforward approach to value accrual, and its distinct features compared to other large crypto assets make LINK a compelling addition to diversified crypto portfolios, in our view (Exhibit 1).

Exhibit 1: LINK is largest asset in Utilities & Services Crypto Sector by market cap

To understand Chainlink’s technology and its potential future growth, consider its role in the process of tokenization. At some point, when blockchains are more widely adopted, securities may be issued and tracked entirely on-chain. But today, the beneficial ownership of securities — as well as real assets like real estate, physical commodities, and collectibles — is recorded on traditional off-chain ledgers (typically electronic book-entry accounts). Tokenization refers to the process of registering asset ownership on blockchain infrastructure, so that market participants can benefit from a blockchain’s functionality. These benefits may include more efficient settlement, the ability to interact with smart contracts, and potentially lower cost (for more background, see Public Blockchains and the Tokenization Revolution). We expect Chainlink to play a central role orchestrating the process of tokenization, and it has announced a variety of partnerships, including with S&P Global and FTSE/Russel, that should help it do so.[1]

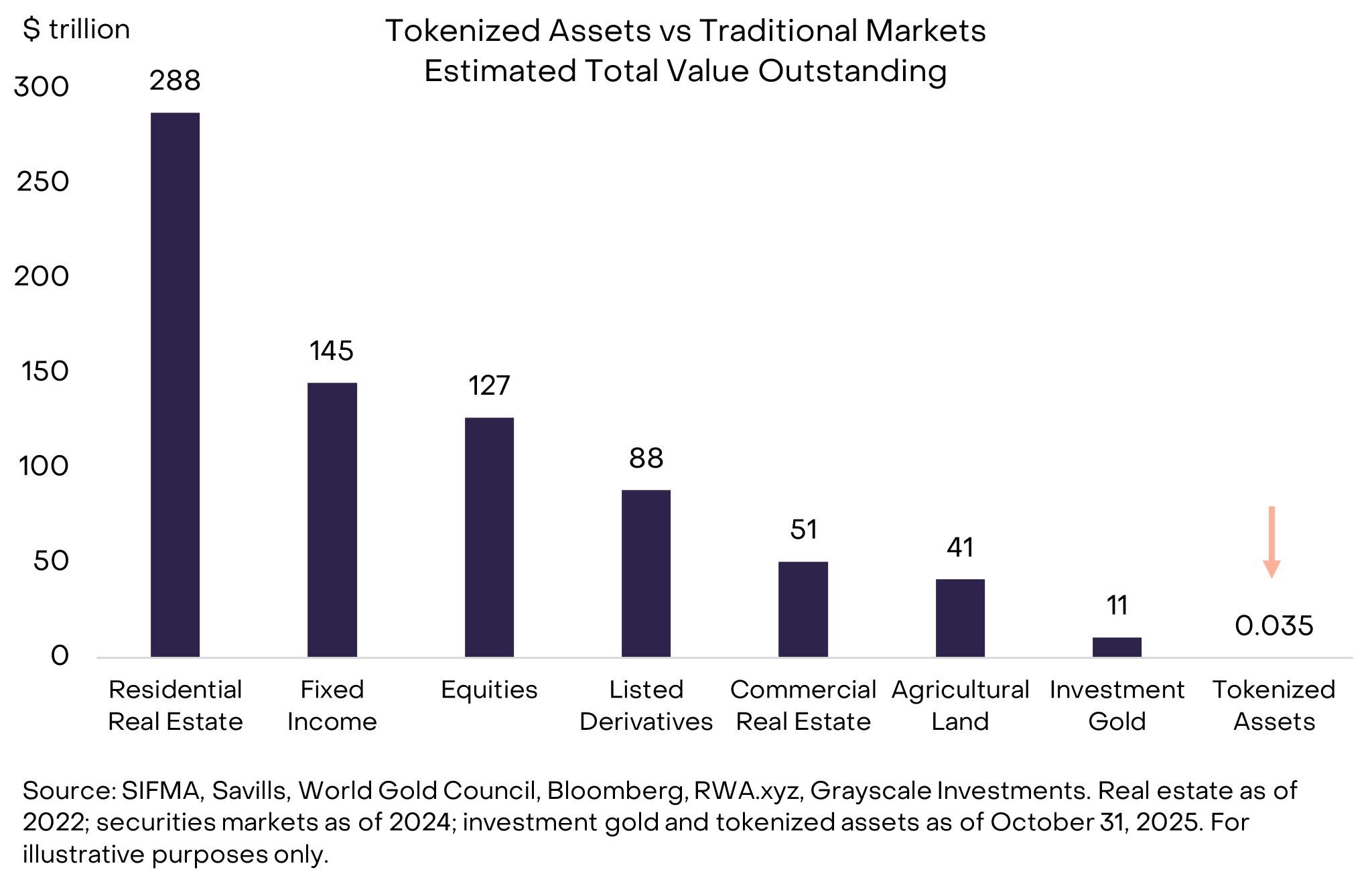

The market for tokenized assets is growing: estimates suggest that it now totals around $35 billion (excluding stablecoins), up from just $5 billion at the start of 2023.[2] But compared to traditional asset markets, these values are still extremely small. For example, the total market for tokenized assets today amounts to just 0.01% (i.e., 1 basis point) of the total value of global fixed income and equity securities, and equities and bonds represent only part of the global asset base that may eventually be tokenized (Exhibit 2). Continued growth in this market may imply growth in demand for Chainlink’s unique software solutions.

Exhibit 2: Tokenized assets are extremely small compared to tokenizable assets

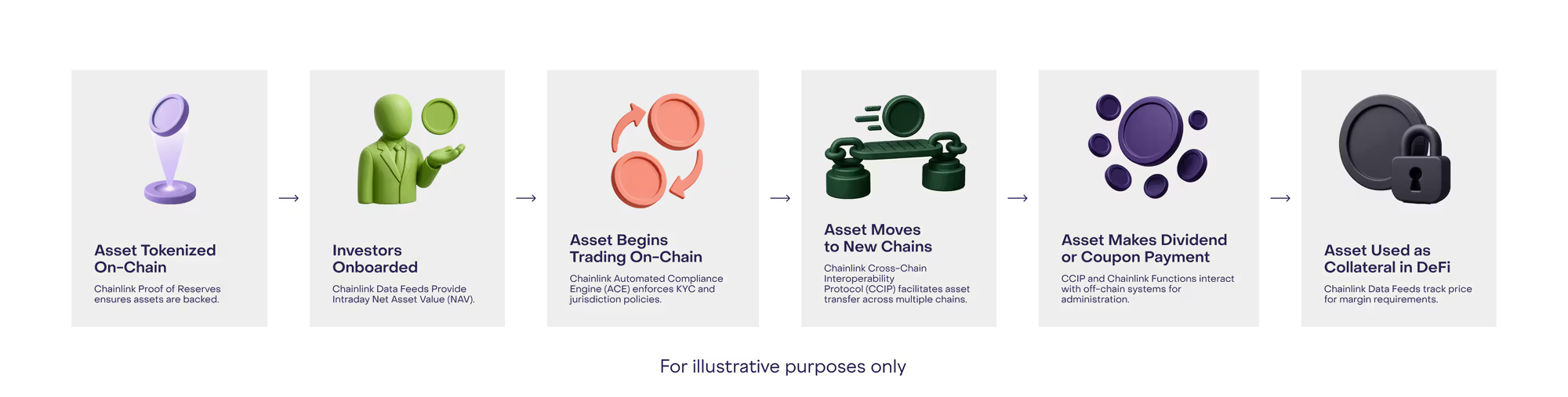

Chainlink’s technology will touch many parts of the tokenization life cycle (Exhibit 3).

Tokenization could eventually reach enormous scale and change the way we hold and trade assets, but there are many practical issues that need to be overcome before that happens. In our view, Chainlink is the crypto project offering the most compelling solutions to those challenges today.

Exhibit 3: Chainlink powers many parts of the tokenization lifecycle

Chainlink is often described as a crypto “oracle,” meaning a source of price data and other information that comes from outside the blockchain itself (e.g., the price of Bitcoin on an exchange). This is where the Chainlink project began; today, it’s much broader. A more accurate description of Chainlink today would be modular middleware that lets on-chain applications safely use off-chain data, interact across blockchains, and meet enterprise-grade compliance needs — without stitching together solutions from many different providers.

For simplicity, Chainlink’s many modular elements can be grouped into three main categories: oracles/data feeds, CCIP, and other solutions. These services are packaged together into a toolkit known as the Chainlink Runtime Environment.

1. Speaking to the Oracle: Chainlink Data Feeds

Chainlink’s original product is its price and data feeds — known in crypto jargon as an “oracle.” Data feeds are how smart contract-based applications incorporate off-chain information. In Chainlink’s structure, independent node operators (organized into decentralized oracle networks, or DONs) pull data from multiple high-quality sources, agree on a single answer off-chain via Offchain Reporting[3] (OCR), and post that result on-chain for contracts to read. Importantly, the feeds are run by independent operators — Chainlink itself does not run any nodes. Because DONs are geographically diverse and use different infrastructure, the feeds are designed to continue operating even if any single cloud server region has interruptions.

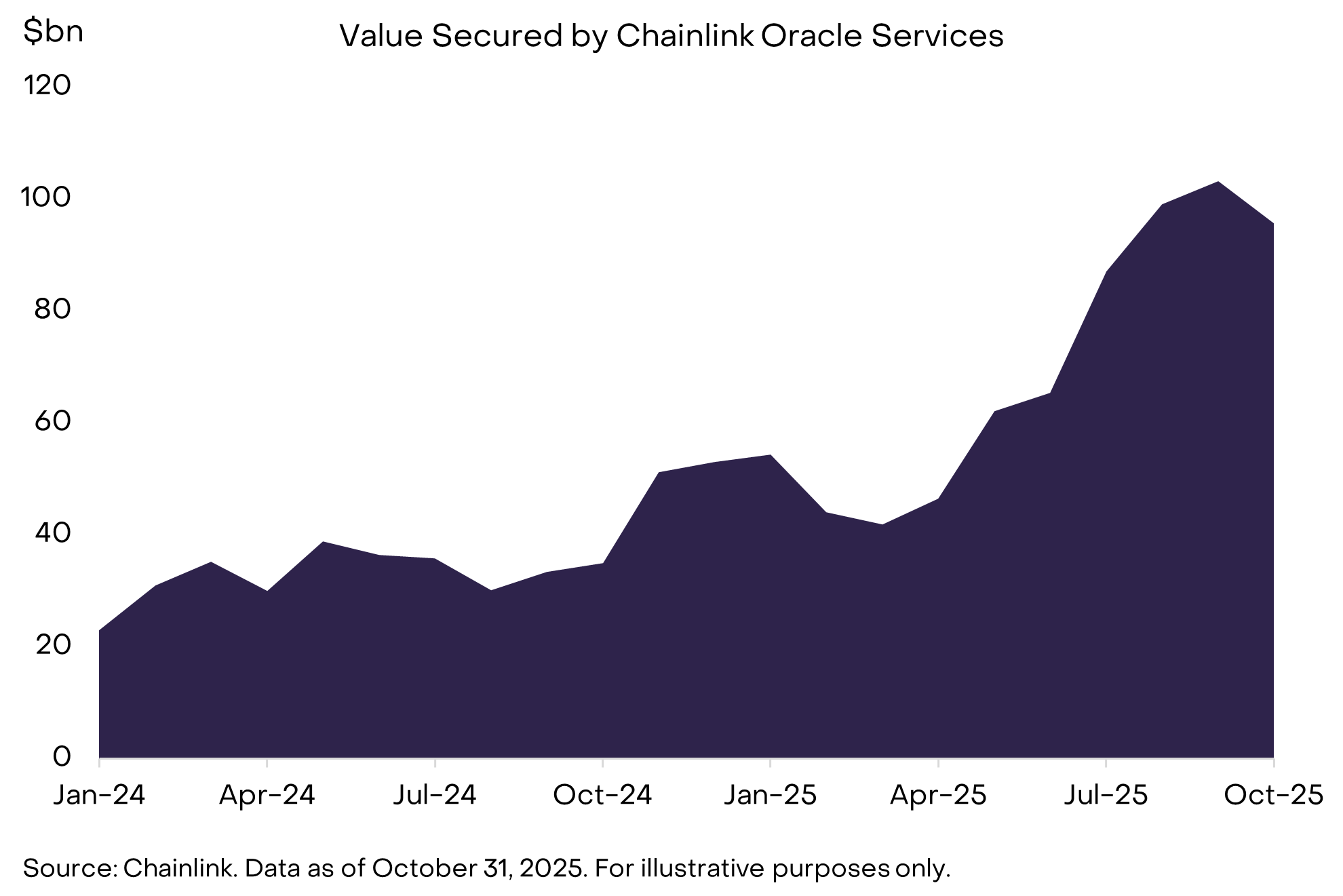

Chainlink is widely regarded as the default oracle for decentralization finance (DeFi), securing major money markets, derivatives, and stablecoins across many chains (Exhibit 4).[4] Aave, the largest DeFi protocol by Total Value Locked (TVL), is also Chainlink’s largest customer.[5]

Exhibit 4: Chainlink oracles secure the largest DeFi applications

2. Reaching Across Blockchains: Chainlink CCIP

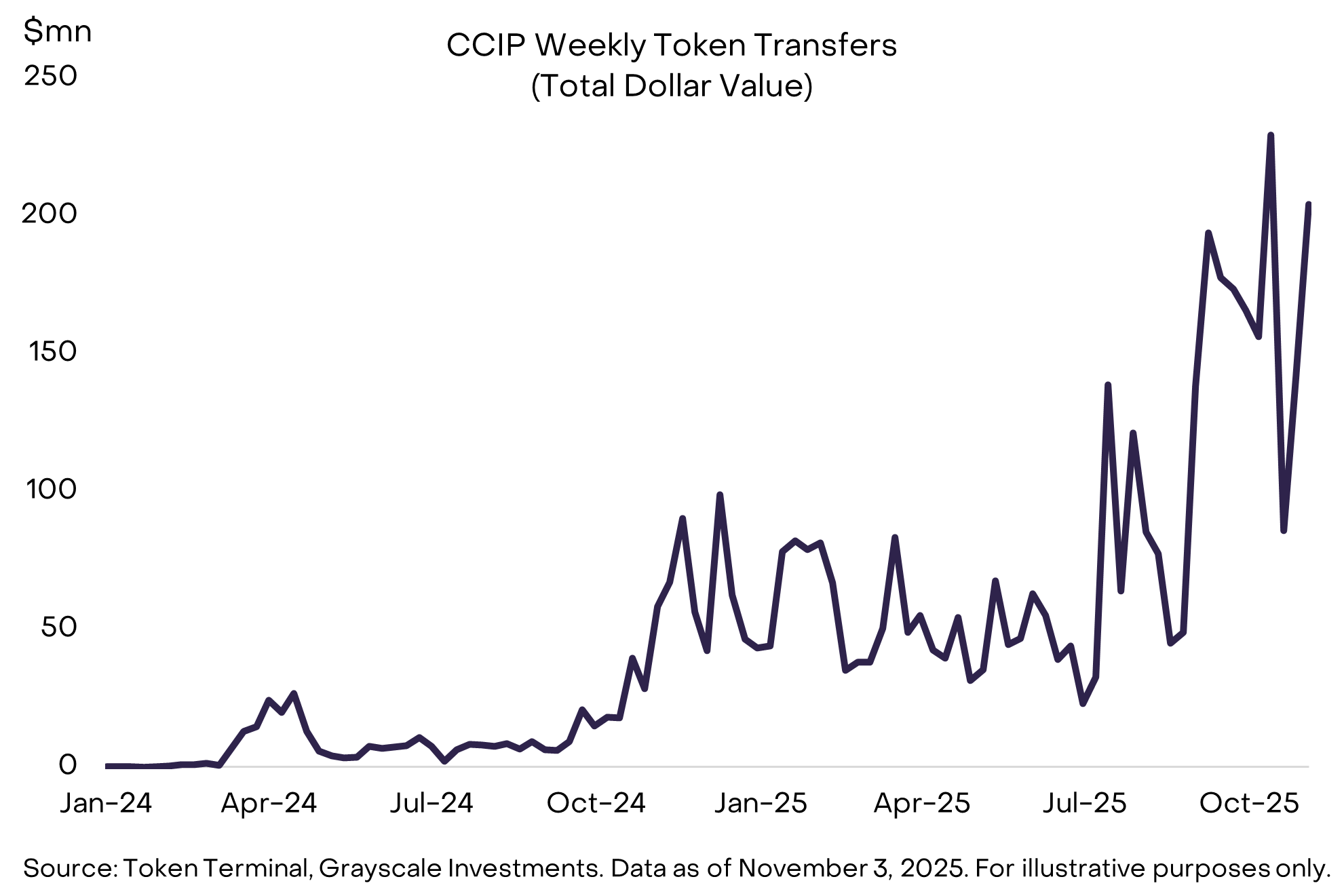

Chainlink Cross-Chain Interoperability Protocol (CCIP) is a programmable bridge-plus-messaging layer: it can send data, tokens, or both (tokens plus instructions) between supported blockchains. Under the hood, Chainlink’s “TokenPools” standard handles how assets move across chains, while security comes from an execution oracle network plus an independent risk-management network. CCIP now supports dozens of blockchains and ~200 tokens, powers assets like Aave’s GHO stablecoin and Lido’s wrapped staked ETH, and has been used in high-profile integration experiments with traditional financial institutions, including SWIFT.[6] Over the last six months, CCIP has transferred tokens valued at an average of about $90 million per week (Exhibit 5).

Exhibit 5: Chainlink’s interoperability solution is growing

3. Solving Practical Challenges: Chainlink’s Other Services

Beyond price feeds and CCIP, Chainlink ships a set of modular services that cover data, compute, and operations.

Chainlink packages its many services together in the Chainlink Runtime Environment (CRE). CRE can be thought of as the orchestration process that connects these modules into end-to-end, auditable workflows. The result is a modular, enterprise-style software technology stack where consumers can start with one service, add others as needs grow, and maintain compliance and auditability from day one.

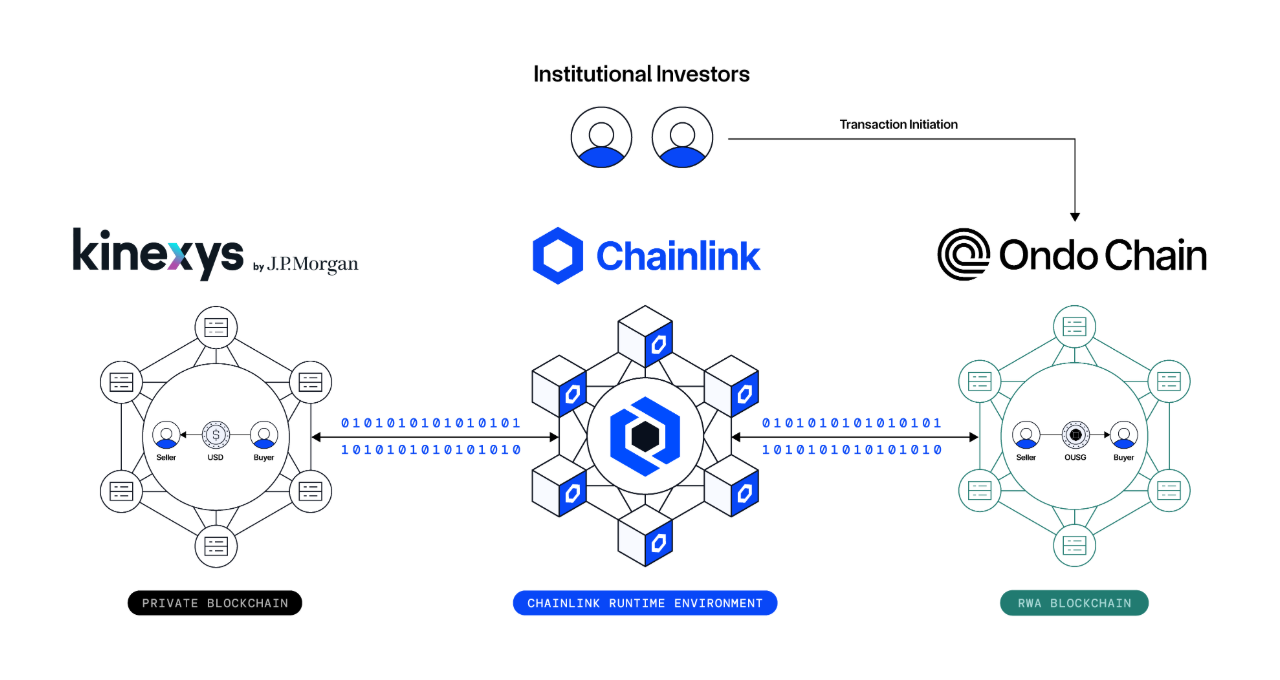

In May–June 2025, Chainlink, J.P. Morgan’s Kinexys, and Ondo Finance ran a cross-chain delivery-vs-payment (DvP) test. DvP means the asset and the cash settle at the same time, so neither party ends up delivering without getting paid. The asset leg used Ondo’s tokenized treasury product OUSG on the Ondo Chain testnet, and the payment leg ran on Kinexys Digital Payments — a permissioned blockchain network — with both sides settling automatically. Chainlink’s CRE handled the choreography: it maintained the OUSG escrow, confirmed events off-chain, turned them into payment instructions for Kinexys, authenticated via API, processed the payment callback, and then released the OUSG. The assets never left their home networks — only the settlement instructions moved — showcasing CRE coordinating public-chain assets with private-chain infrastructure (Exhibit 6). The test demonstrated how Chainlink can enable secure simultaneous settlement across chains.

Exhibit 6: Kinexys/Ondo experiment showcased Chainlink Runtime Environment

Source: Chainlink. For illustrative purposes only.

While Chainlink has competitors, most compete in just one part of the project’s many elements. Within oracles, Pyth targets ultra-low-latency, first-party prices: exchanges and market makers publish signed updates to Pythnet, and apps pull fresh data. Pyth has become a compelling oracle for trading use cases and dominates in Solana-based applications. RedStone, another oracle, offers a modular, cost-efficient model with pull/push delivery and on-demand verification, well-suited to long-tail assets and newer blockchains. Both projects are competitive in their market subsegments, but don’t include Proof of Reserve, automation, or an enterprise compliance layer.

In cross-chain interoperability, most of Chainlink’s competitors specialize, too. Wormhole relays messages through a permissioned guardian set, which is fast and widely integrated but anchored to that relay model. LayerZero provides lightweight endpoints with configurable security, giving apps flexibility over how to validate messages. If a protocol needs bridging plus data, compliance, and ops in one place, Chainlink stands apart.

The main risk to Chainlink’s dominance is that applications using other oracles and/or competing integration software gain traction. To monitor this risk, investors should track growth in non-EVM[9] blockchains, where Chainlink has lower adoption than other protocols.

Chainlink’s LINK token powers payments and incentives across the project’s many services.[10] LINK is the largest asset by market capitalization in the Utilities & Services Crypto Sector — the “picks and shovels” of on-chain finance.[11]LINK is also the largest asset in crypto that is not a Layer 1 token (excluding stablecoins).[12] The supply of LINK is capped at 1 billion tokens, of which nearly 700 million are already circulating.[13] The non-circulating supply is controlled by Chainlink, which releases new circulating supply at a rate of 7% per year.

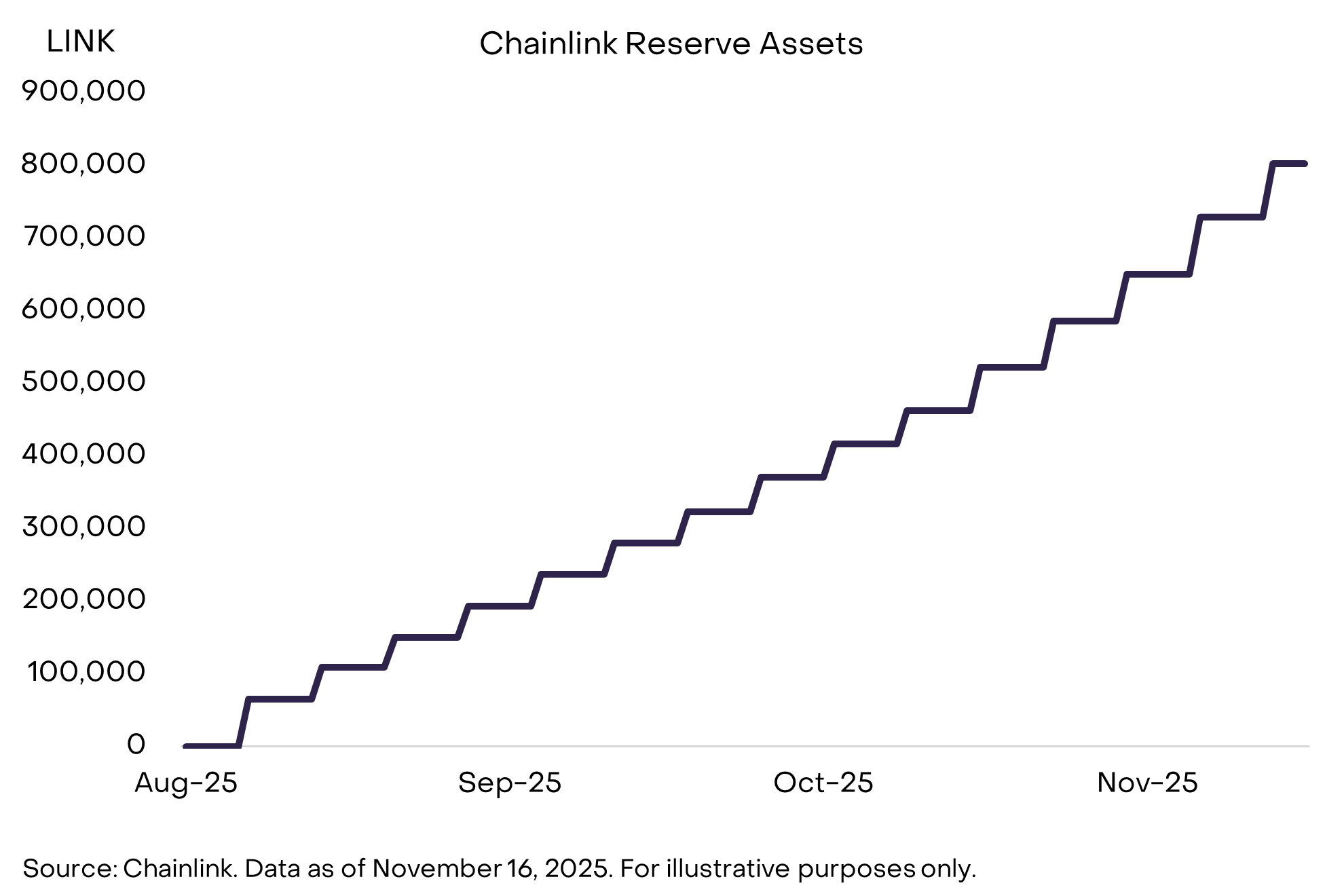

Chainlink earns both on-chain revenue, like CCIP network fees, and off-chain revenue, like payments for enterprise contracts (e.g., with banks, data vendors, etc.).[14] The LINK token accrues value through a buyback-like mechanism. In August 2025, Chainlink launched the LINK Reserve, which programmatically converts service revenue into LINK, removing it from circulating supply. Recent figures show about 800,000 in the Reserve, worth ~$11 million at current prices (Exhibit 7).[15] Although a meaningful Dollar amount, the current size of the LINK Reserve is still relatively small compared to circulating supply.[16]

Exhibit 7: LINK Reserve removes token supply from market

An investment in LINK centers on potential future growth of demand for Chainlink services and therefore demand for the token. If adoption grows over time, Chainlink may increase the rate of growth of the LINK Reserve, resulting in supply scarcity and higher prices. The LINK token can also be staked[17] to earn additional rewards, which currently amount to 4%-5% annualized.[18]Higher demand for LINK for its functional uses within the Chainlink ecosystem could also result in higher prices. Lower-than-expected growth in demand for Chainlink services should be considered the key downside risk to an investment in LINK.

In our view, Chainlink is poised for significant further growth. If major financial institutions will someday trade trillions of dollars of tokenized assets on decentralized platforms, Chainlink seems likely to be one of the projects standing at the center, orchestrating it all. Chainlink has already become foundational infrastructure for blockchain-based finance and is especially well positioned for a future where smart contracts interact seamlessly with real-world assets, data, and institutions. By serving as the connective layer across multiple blockchains, LINK isn’t just tied to one network’s success — it provides broad exposure to growth of the crypto economy. Therefore, in our view, LINK is one of the most important assets to consider when constructing a diversified crypto portfolio.

[1] Source: S&P Global, FTSE/Russell.

[2] RWA.xyz as of 11/18/2025.

[3] Chainlink OCR is a protocol that allows nodes to aggregate their observations into a single report off-chain using a secure P2P network.https://docs.chain.link/architecture-overview/off-chain-reporting#what-is-ocr

[4] Chainlink is the largest oracle service by TVS, source: DeFi Llama. Data as of 11/19/25. "Total value secured" (TVS) is a term primarily used in decentralized finance (DeFi) to represent the aggregate value of all crypto assets locked in smart contracts that depend on a specific oracle network.

[5] DeFi Llama, as of 11/19/25

[6] Source: SWIFT, Chainlink Docs as of 11/19/25

[7] Examples of compliance needs that could potentially be addressed with ACE include enforcing local KYC/AML policies while maintaining investor privacy through digital identity solutions, and maintaining identifying information as assets move across blockchains. Source: Chainlink.

[8] https://www.prnewswire.com/news-releases/chainlink-kinexys-by-jp-morgan-and-ondo-finance-team-up-to-bring-bank-payment-rails-to-tokenized-asset-markets-302455268.html

[9] Non-EVM refers to any blockchain that does not use the Ethereum Virtual Machine for executing smart contracts, meaning it relies on a different runtime, programming language, and execution architecture.

[10] The LINK token was issued in an initial coin offering (ICO) and the project has not raised equity capital.

[11] FTSE, Grayscale. Data as of 11/19/2025.

[12] FTSE, Grayscale. Data as of 11/19/2025.

[13] Chainlink Docs

[14] Payments can be made in multipole crypto assets as well as fiat currencies, and are often converted into LINK via payment abstraction.

[15] Source: https://metrics.chain.link/reserve, data as of 11/19/25

[16] https://metrics.chain.link/reserve

[17] Chainlink staking lets LINK holders lock up their tokens to help secure the oracle network. Staked LINK acts as collateral that aligns node operators and participants with network reliability — if a node misreports data or fails its duties, it can lose a portion of its stake. Because LINK is an ERC-20 token, staking occurs through smart contracts on Ethereum, where participants deposit and later withdraw LINK directly on-chain while earning rewards tied to oracle performance and network usage.

[18] Source: Stakingrewards.com.