Last Updated: 6/25/2025 | 21 min. read

Public blockchains provide a way to conduct digital commerce without centralized intermediaries. However, to attract users, decentralized technologies need to offer features that are at least as compelling as centralized alternatives. If decentralized applications are slower and more expensive than centralized alternatives, blockchain-based activity will likely remain a relatively small part of online commerce.

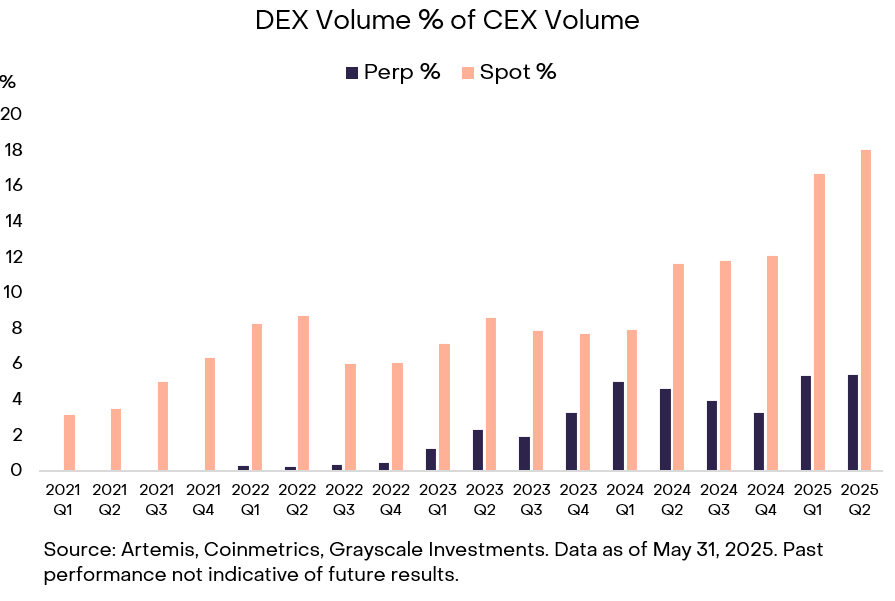

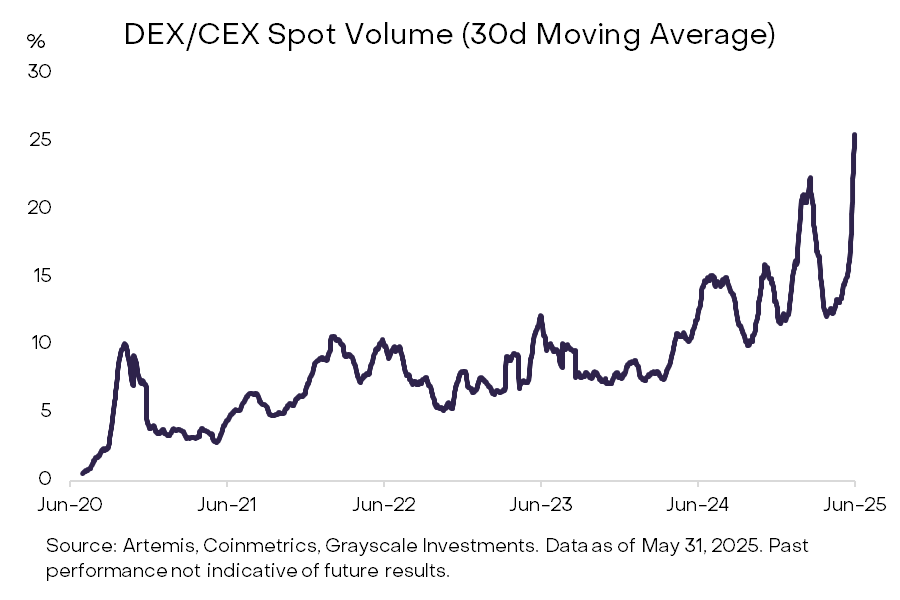

Fortunately, after several years of experimentation, we are now seeing decentralized applications compete head-to-head with traditional firms in a core part of crypto: token trading. Grayscale Research estimates that decentralized exchanges (DEXs) account for 7.6% of total global crypto trading volume, up from just 3% in 2023 and account for a larger percentage of CEX volume (Exhibit 1). DEXs are now price competitive with centralized exchanges (CEXs) on average, may provide higher transparency, and frequently host higher volume for new assets issued on-chain.

Exhibit 1: DEX volume has more than doubled relative to CEX volume since 2021

This year may in fact prove to be the industry’s tipping point, with technological advancements and potential regulatory clarity supporting user adoption of DEXs and other decentralized finance (DeFi) applications. This report provides a comprehensive overview of DEXs, including the industry structure, competitive dynamics, and growth prospects. Grayscale Research believes that market leadership will ultimately consolidate into a small cohort of dominant venues — likely one or two exchanges in each segment (CEX vs. DEX, spot vs. perpetual futures) — that pair deep liquidity with capital-efficient infrastructure and compelling token or equity economics.

In traditional finance (TradFi), trades are executed when counterparties agree on a price via exchanges or over-the-counter (OTC) markets. These trades are matched through central limit order books (CLOBs) or broker networks. Following execution, a clearinghouse such as Depository Trust Company (DTC) confirms the trade details, nets exposure among participants, and settles the trade one day later (transfers the funds and the electronic record of securities ownership). For equity securities, T+1 settlement was introduced in May 2024; previously securities settled T+2.

Crypto trading has an entirely different market structure, which can be categorized into trading venues, exchange architecture, and traded products.

Crypto venues primarily fall into two categories:

DEXs primarily use two types of trading architectures:

Both CEXs and DEXs trade two types of products:

Exchanges earn revenue by charging transactions fees. In crypto, CEXs collect these fees directly, while DEXs typically distribute fees among liquidity providers, token holders, and/or protocol treasuries via smart-contract mechanisms or governance decisions.

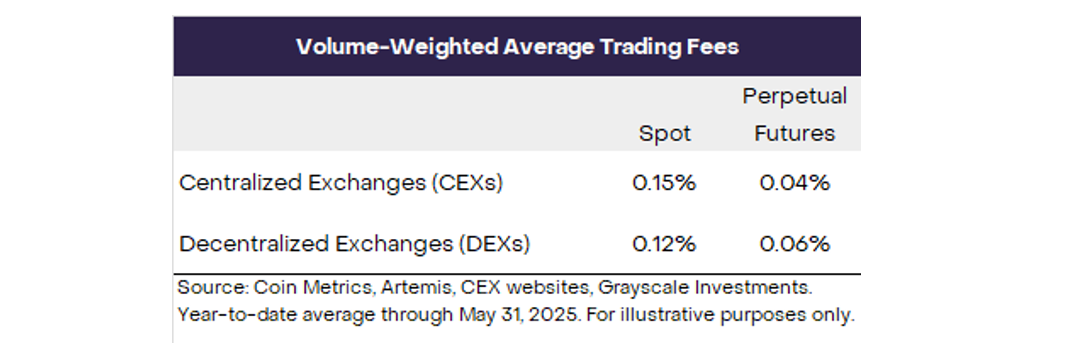

DEXs are now broadly price competitive with CEXs. Based on data from the first five months of 2025, Grayscale Research estimates a volume-weighted average spot fee of about 15 basis points (bps) for CEXs and 12 bps for DEXs, and a volume-weighted average perp fee of about 4 bps for CEXs and 6 bps for DEXs (Exhibit 2). These numbers mask a wide range of fees across venues and tokens but indicate that on average fees are comparable across venue types.

Exhibit 2: DEXs are now price competitive with CEXs[4]

As the crypto industry grows, all exchanges will likely benefit from volume growth but suffer from fee compression. Although CEX and DEX fees are now comparable, crypto trading fees are high compared to the most efficient markets in traditional finance. For example, academic research finds that U.S. equity exchanges charge an average fee of just 0.0001% (i.e., just one-hundredth of a basis point).[5] It will be a long time before crypto trading is that inexpensive, but the highly competitive prices on traditional exchanges do suggest crypto fees will need to come down as market competition increases.

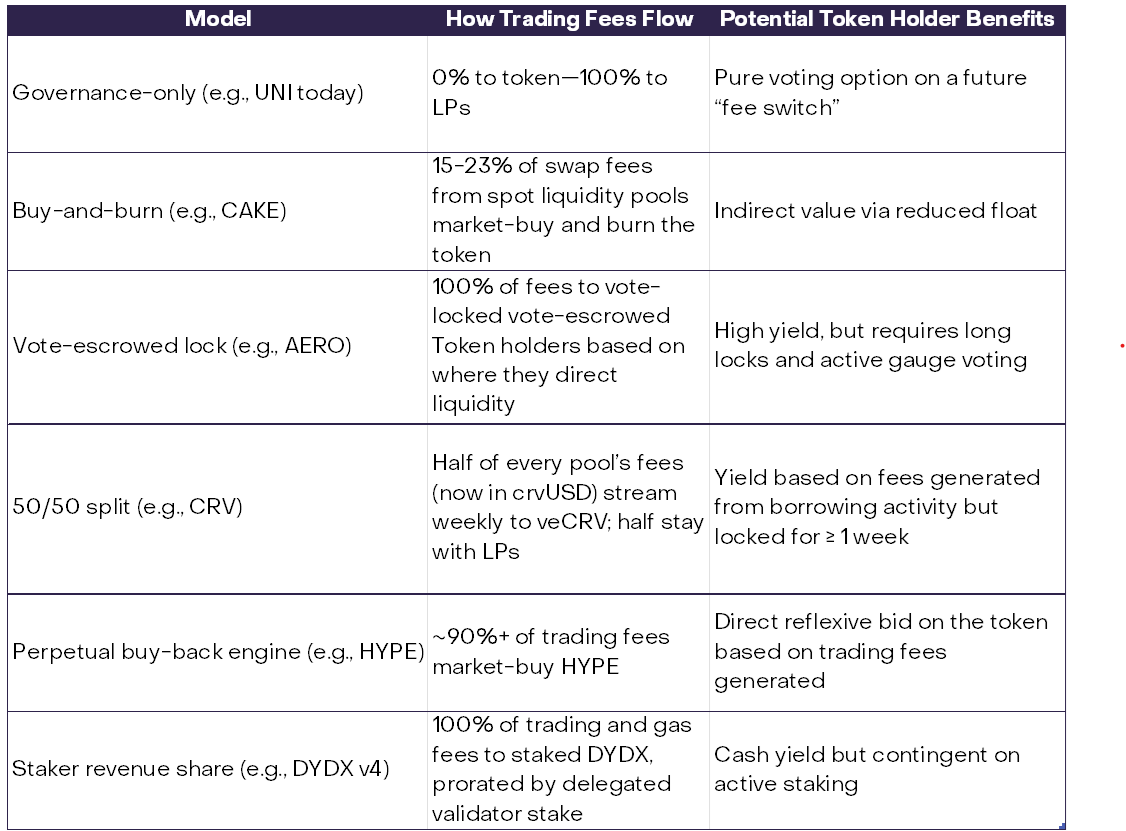

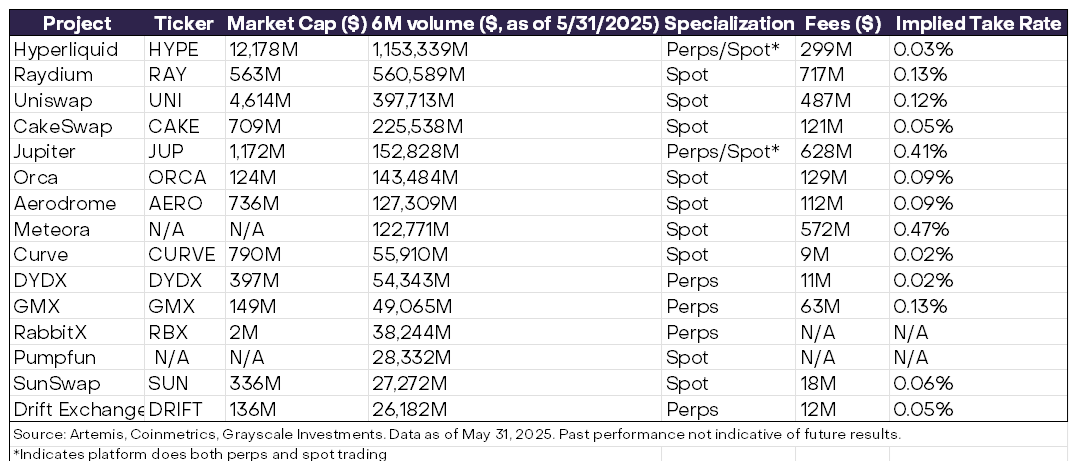

Over time, we also expect to see more consistency in capital structure for crypto exchanges. As traditional businesses, CEXs are typically equity-funded (e.g., Coinbase) but may also have associated tokens (e.g., BNB). DEXs are smart contracts based on open-source software and operate without any controlling party. However, their supporting developer teams may be funded by equity, tokens, or a combination of the two. Tokens may provide benefits to holders, but there is no common model across projects: DEX tokens may capture cash flows, provide governance rights, or simply offer marketing and brand value (Exhibit 3). It’s important to note that tokens models can and do shift through governance; some like Uniswap’s UNI token have explored proposals such as turning on a fee switch (governance controlled toggle to allocate fees) for staked holders, which could reshape the token’s value proposition overnight. Therefore, investing in DEX tokens requires understanding the project’s economics and governance proposals, as well as token supply and value accrual.

Exhibit 3: DEX tokens operate on very different economic models

Source: UNI, CAKE, AERO, CRV, HYPE, DYDX documentation, Grayscale Investments. For illustrative purposes only. As of 5/31/2025.

Decentralized exchanges emerged in distinct waves, each overcoming earlier limitations. Early attempts (2017-2018) — such as EtherDelta’s order book, the 0x protocol’s off-chain relayers, and Bancor’s initial AMM pools — demonstrated decentralized trading but faced significant user-experience and liquidity challenges. Uniswap’s 2018 launch was a turning point. Its streamlined AMM model and intuitive interface greatly improved accessibility, paving the way for growth in volume and total value locked during “DeFi Summer[6]” in 2020.

Further refinements from 2021 to 2023, notably Uniswap v3’s concentrated liquidity and the perpetual-futures innovations of Perpetual Protocol and GMX, enhanced capital efficiency and enabled slightly more sophisticated on-chain derivatives trading. Most recently, from 2023 to 2025, on-chain CLOBs like dYdX’s Cosmos-based Layer 1[7] and Hyperliquid’s ultra-fast custom blockchain have emerged[8], combining the speed and precision of centralized exchanges with the transparency and decentralization of DeFi.

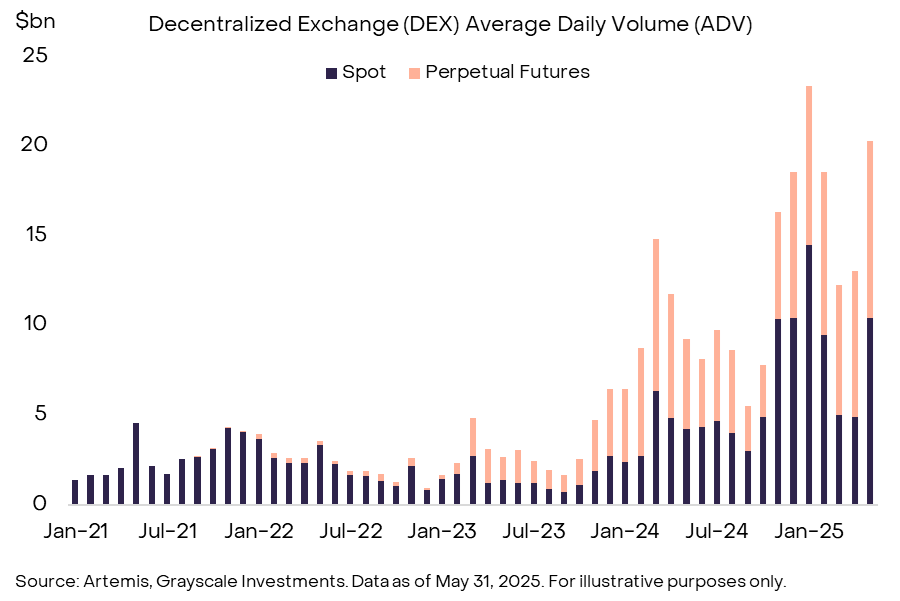

Today crypto DEXs process nearly $10bn in average daily volume (ADV) in both spot crypto assets and perpetual futures (Exhibit 4). For comparison, the NYSE family of exchanges hosts about $150bn in ADV.[9] Much of the growth in DEX perp volume reflects the growth of Hyperliquid, which accounts for ~80% of total perp ADV[10].

Exhibit 4: Nearly $10bn in DEX ADV for both spot and perps

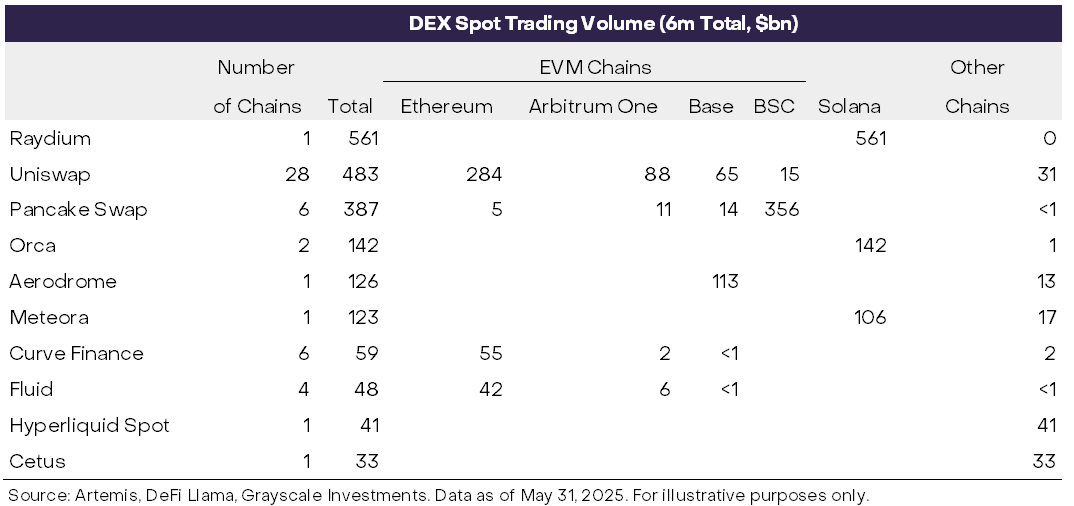

One unique feature of crypto trading is that some spot DEXs are tied to specific blockchain ecosystems like Ethereum or Solana. For example, Exhibit 5 shows DEX spot trading volume over the last six months by blockchain. Industry leader Raydium is only deployed on Solana, while trading on Uniswap AMMs occurs across 28 distinct chains[11]. As a result, for crypto spot DEXs, changes in volume are often closely related to changes in economic activity within their specific blockchain ecosystem.

Exhibit 5: Spot DEXs can operate on multiple protocols

DEXs now capture about 25% of crypto spot market volume[12]. Decentralized exchanges have been capturing market share in large part due to their rapid innovation in product offerings. DEXs frequently list new tokens first, attracting early liquidity and speculative volume. For instance, during the "onchain season[13]" in late 2024, many prominent crypto narratives — such as AI agent-themed tokens on Solana and Base and viral memecoins like the TRUMP memecoin on Meteora — originated exclusively from decentralized liquidity pools on chains like Solana and Base. These new tokens weren't initially available on centralized exchanges, prompting traders to engage directly with decentralized platforms.[14]

Exhibit 6: DEX spot volume to CEX spot volume ratio has been increasing

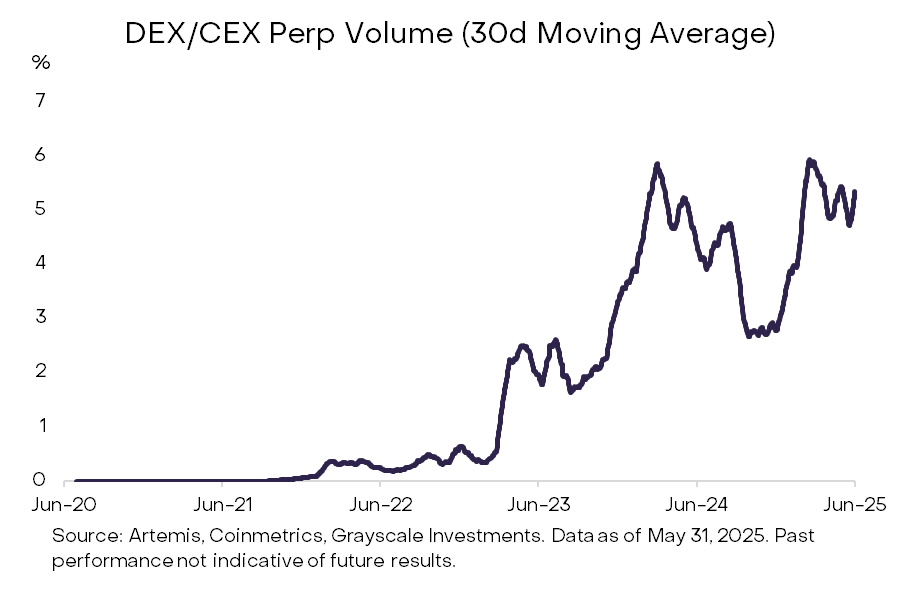

DEXs have also gained ground in trading of perpetual futures contracts — largely due to the breakout success of Hyperliquid, a decentralized perp exchange. Grayscale Research estimates that DEX perp volume was about 5.4% of CEX perp volume over the last 30 days ending 5/31/2025 (Exhibit 7). Even so, centralized perp exchanges maintain a variety of advantages[15], including (1) deep liquidity and network effects, (2) high execution speeds, and (3) an integrated user experience

Exhibit 7: DEX perp volume is a small but growing portion of CEX perp volume

Despite these advantages that CEXs have, why has Hyperliquid captured so much volume? In our view, traders are increasingly drawn to decentralized perps for several reasons, including:

Ultimately, while centralized venues currently retain significant advantages — particularly in risk management, user interface, and institutional-level liquidity — the rapid progress and increasing sophistication of decentralized exchanges suggest that the competitive landscape may shift substantially in coming years.

The top ten DEXs by market cap in crypto account for 6.7% of total trading volume[17] and have a combined market capitalization of $22bn, with the top five capturing roughly 80% of that volume (Exhibit 8). These platforms may benefit from strong network effects: on the spot side, concentrated-liquidity AMMs minimize slippage, while on perpetuals, ultra-competitive fee tiers draw in high-volume traders. In both cases, deeper pools attract more order flow—traders naturally gravitate toward venues with tighter spreads, lower execution risk, and large, active communities.

Exhibit 8: Despite the number of DEXs, only a few tend to dominate in volume

In our view, no single exchange will dominate every corner of the crypto market. Rather, there will likely be one or two dominant exchanges for each venue type (CEX and DEX) and product type (spot and perps).

In spot products, the trading of large-cap assets (e.g., Bitcoin, Ether, the largest stablecoins) still tilts toward CEXs. CEXs, with their integrated fiat on-ramps, deep market-maker inventories, and sub-10 bps VIP trading fee tiers generally allow users to trade more cheaply than even the most efficient AMM pools for more popular tokens. However, lower-cap and newly launched tokens will still see the earliest activity on DEXs. Because DEXs allow for permissionless listings, as soon as a narrative rallies behind a newly created, niche coin—traders chasing day-one exposure tend to follow the liquidity to where it first appears.

The same pattern is emerging in perpetual futures. CEXs retain >90% of the notional in Bitcoin and Ether perps[18] because they offer millisecond latency, maker rebates, and mature liquidation engines. However, once you leave the top 10 contracts, market share begins to flip: on several mid-cap trading pairs, Hyperliquid offers the majority of global volume and open interest[19]. For traders chasing newer assets, the combo of self-custody, borderless access, and governance-driven contract creation may outweigh the convenience of centralized exchanges.

Decentralized exchanges have progressed from experimental curiosities to essential rails for an expanding universe of on-chain assets. As stablecoins scale, tokenized real-world assets migrate to public blockchains, and block space becomes cheaper, DEXs will likely capture a growing share of everyday trading — especially in newly minted or niche markets that never touch a centralized order book. CEXs will remain formidable for high-notional, latency-sensitive flow. But the long-term battleground is broader: crypto venues, generally, are poised to challenge traditional exchanges for custody, liquidity, and price discovery in tokenized equities, bonds, and beyond. In short, the question is no longer whether DEXs will matter, but how quickly their transparent, programmable infrastructure will redefine what “an exchange” means in the next decade.

[1] Source: Artemis, Coinmetrics, Grayscale Research. As of 5/31/2025. The analysis incorporates exchange-level volume and fee data from three cohorts: top 15 centralized exchanges (spot + perpetual) tracked by CoinMetrics, top 12 perpetual-futures DEXs ranked by volume on Artemis, top 11 spot DEXs ranked by volume on Artemis. Exchanges outside these groups were excluded because their volumes were de minimis or data were unavailable on Artemis. Covered exchanges: Binance, Bitfinex, BitFlyer, Bithumb, Bitstamp, Bybit, Coinbase, Crypto.com, Gate.io, Huobi, Kraken, KuCoin, MEXC, OKX, Upbit, Hyperliquid, dYdX, Vertex, RabbitX, GMX, Synthetix, Drift, MUX Protocol, Gains, Jupiter, Perpetual Protocol, Uniswap, PancakeSwap, SushiSwap, Aerodrome, Raydium, Orca, Pump.fun, Meteora, Curve, Balancer, SunSwap.

[2] A concentrated-liquidity model (e.g., Uniswap v3) lets liquidity providers deposit funds only within custom price ranges, creating deeper liquidity and higher capital efficiency where trades are most likely to occur instead of spreading reserves across the entire price curve.

[3] Jensen, Johannes Rude, Mohsen Pourpouneh, Kurt Nielsen, and Omri Ross. 2021. “The Homogenous Properties of Automated Market Makers.” https://arxiv.org/abs/2105.02782.

[4] See footnote 1 for additional information

[5] https://www.journals.uchicago.edu/doi/full/10.1086/727284

[6] Source: Artemis, Grayscale Investments. “DeFi Summer” refers to the mid-2020 surge in Ethereum-based decentralized-finance protocols, when liquidity-mining incentives and yield-farming programs (led by Compound, Uniswap, Yearn, and Curve) sent total value locked in DeFi from roughly $1 billion to over $10 billion in a matter of months. The frenzy brought millions of new users, pushed gas fees to record highs, and cemented AMMs and lending pools as foundational primitives of on-chain finance.

[7] https://docs.dydx.xyz/concepts/architecture/overview

[8] https://hyperliquid.gitbook.io/hyperliquid-docs

[9] Source: CBOE. Five day average ending June 16, 2025.

[10] Source: Artemis. Data as of May 31, 2025.

[11] Source: Artemis, DeFi Llama. Data as of May 31, 2025.

[12] Source: Artemis, Coinmetrics. Data as of May 31, 2025.

[13] “On-chain season” in late 2024 describes the surge of retail-led memecoin that sent on-chain volumes, validator/MEV revenues and alt-coin inflows to record high

[14] Additionally, aggregator tools like 1inch and CoW Swap have significantly lowered execution costs and complexity, drawing more retail traders and arbitrage bots into the decentralized trading ecosystem.

[15] Source: Coinmetrics. The largest CEXs such as Binance, Bybit, and OKX have higher volumes historically on the majors (BTC, ETH, SOL), centralized servers (faster than decentralized blockchains), additional investment products like options, and VIP tiers for high volume users.

[16] https://www.coindesk.com/business/2025/04/03/bybit-beefs-up-asset-security-following-usd1-45b-hack

[17] Source: Artemis, Coinmetrics. Data as of May 31, 2025.

[18] Source: Artemis, Coinmetrics. Data as of May 31, 2025

[19] https://hyperdash.info/marketshare