Last Updated: 10/1/2025 | 14 min. read

In the last crypto market cycle, prices peaked in November 2021, then troughed in November 2022. Now, almost three years later, some crypto market participants are warning about an end to the current cycle and “top” in valuations.[1]

Cycles are a feature of financial markets, and an important factor for investors to consider in their risk management process. But there is no reason to think valuations will begin to decline simply because the bull market has lasted for three years. The economist Rudi Dornbusch famously said that economic expansions don’t die of old age—they are murdered by the Fed.[2] In other words, a shift in fundamentals—usually a tightening of monetary policy designed to control inflation—is what could tip the economy into recession.

Like every bull market, the latest expansion in crypto valuations will end at some point. But for now, fundamentals are still pointing in a positive direction: macro imbalances are creating demand for scarce digital assets and regulatory clarity is driving institutional investment in blockchain technology. Until those factors change, market pullbacks are likely to be temporary, and crypto markets could be on a path to new highs, in our view. Bitcoin supply will always follow a four-year cycle, but crypto valuations may not.

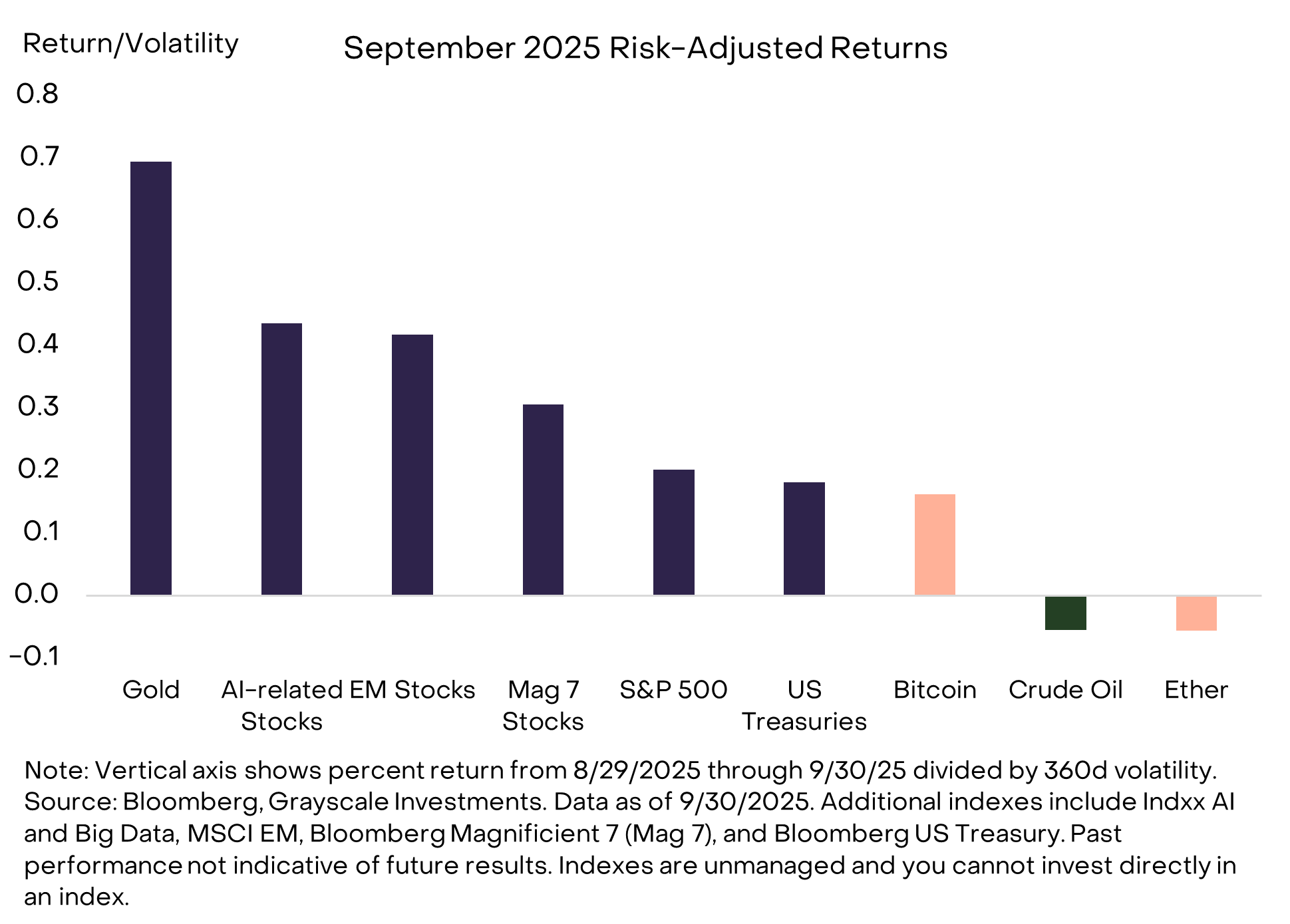

In September, Bitcoin and other digital assets were outshined by other market segments, especially precious metals and equities closely associated with artificial intelligence (AI) (Exhibit 1). Both categories, as well as traditional capital markets overall, may have benefited from the Fed’s rate cut as well as strong inflows into exchange traded products (ETPs).[3]

Exhibit 1: Crypto trailed other asset classes in September

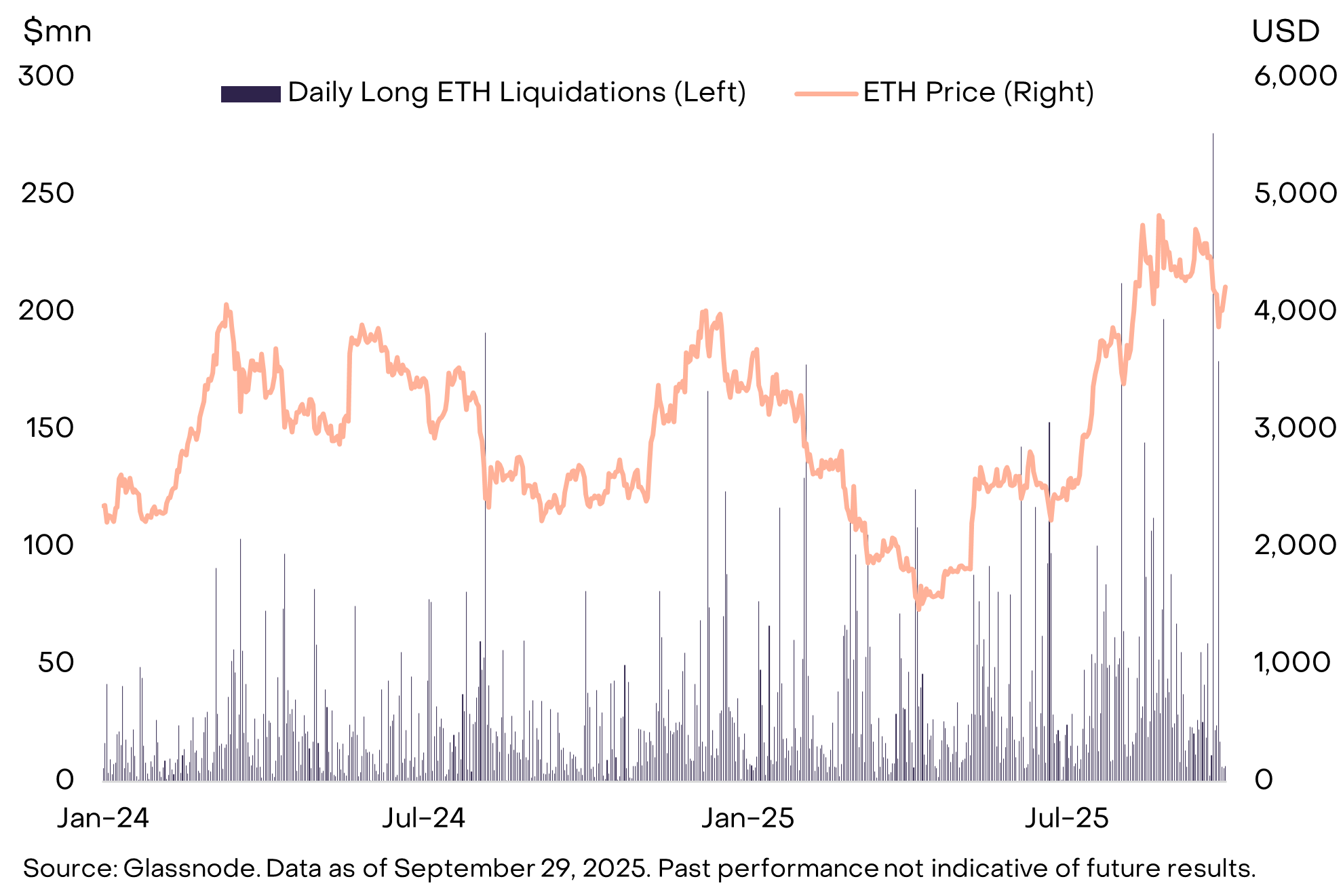

Crypto assets appreciated at the start of September but declined sharply later in the month. The sudden drawdown can be tied to the liquidation of long positions in perpetual futures contracts—a unique feature of crypto’s market structure. According to Glassnode, liquidations of ETH perpetual futures contracts, for example, totaled $277 million on September 25, the largest one-day liquidation since April 2021 (Exhibit 2). Following the liquidations, funding rates (i.e. the cost of holding leveraged long positions) declined and prices stabilized, likely indicating more balanced positioning among speculative traders.

Exhibit 2: Leveraged positions in perpetual futures were liquidated

Aside from price performance, the most important development last month was arguably the approval by the Securities and Exchange Commission (SEC) of generic listing standards for crypto ETPs.[4] This decision provides a streamlined approval process for exchanges to list crypto ETPs, provided the underlying tokens meet certain technical criteria related to trading on qualified venues.[5] Grayscale expects that several additional crypto assets will qualify under these criteria, and that investors can expect a significant increase in the number of single-asset crypto ETPs available on US exchanges. Alongside the approval of generic listing standards, the SEC also approved listing and trading of certain Bitcoin option products.

There was also further progress in the US Senate on crypto market structure legislation—the next big effort in Congress after the Genius Act covering stablecoins (see June 2025: Stablecoin Summer). The Senate Banking Committee released new draft text of the market structure bill. It included better protections for decentralized finance (DeFi) applications and developers which were generally welcomed by crypto industry. Separately, a group of 12 Senate Democrats released a framework for crypto market structure legislation. The framework also received a positive reception from key stakeholders, suggesting there is room for the bipartisan process to continue.[6] A House version of the market structure bill, known as the CLARITY Act, passed that chamber on a bipartisan vote in July.

Regulatory clarity for the digital assets industry continued to drive institutional activity during the month. More crypto businesses went public, including Figure Technologies (FIGR), which uses blockchains to help drive efficiency gains in home equity lending, and Gemini (GEMI), an exchange. In addition, a variety of traditional financial institutions announced plans related to tokenized assets, including BlackRock and Nasdaq.[7] There were also efforts to introduce new regulated financial products, including “continuous” (i.e. perpetual) futures and stablecoins compliant with the GENIUS Act.[8]

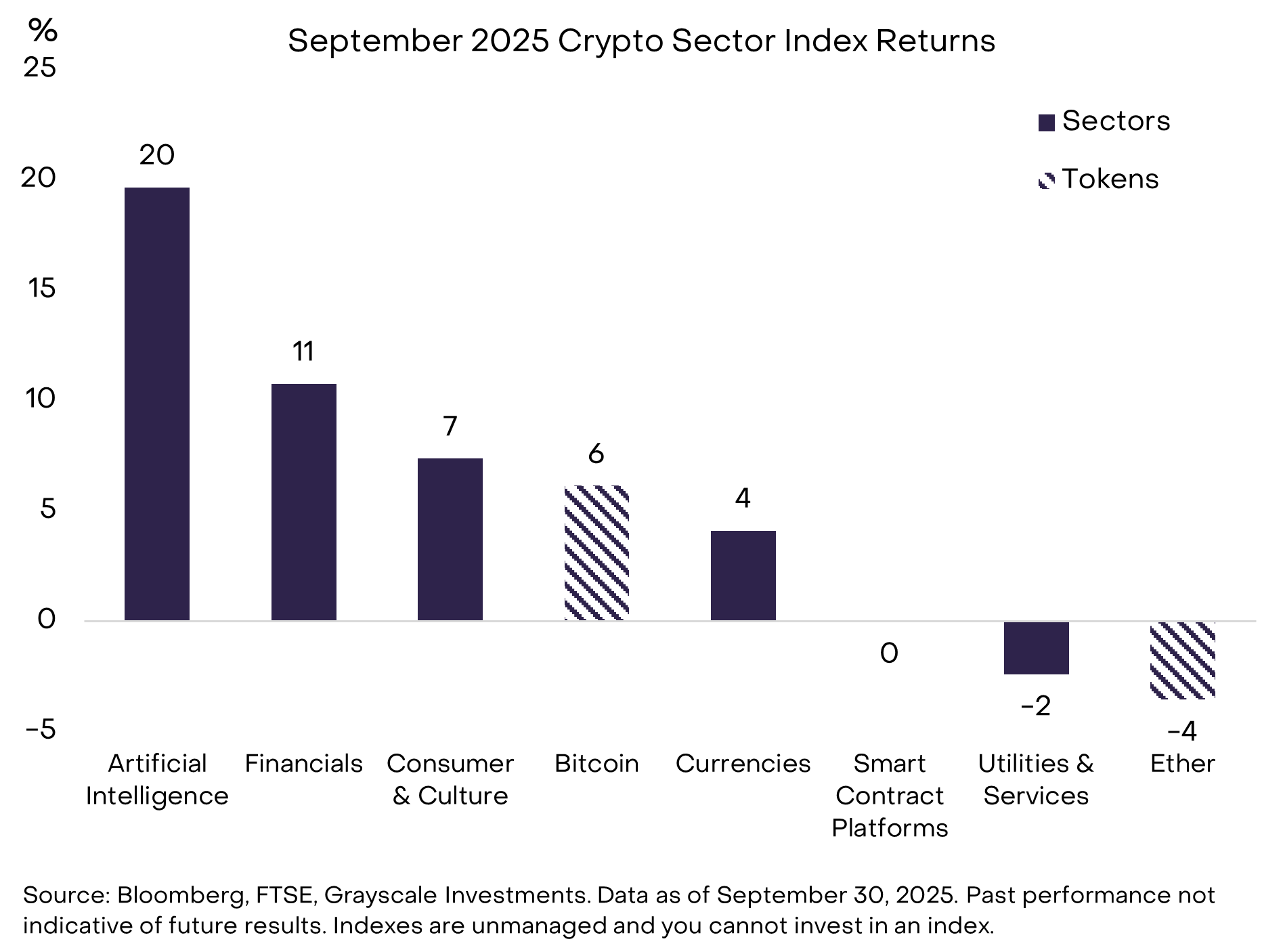

From a Crypto Sectors perspective, Artificial Intelligence (AI) was the top performing market segment, driven by several standout projects (Exhibit 3). The strong returns were primarily attributable to Near (NEAR), Worldcoin (WLD), and Aethir (ATH). Founded by one of the AI industry’s leaders, NEAR is a blockchain platform tailored for AI use cases which has seen rising adoption of its NEAR intents product.[9] Worldcoin, founded by Sam Altman, aims to provide digital identity solutions. The gain in the WLD token’s price was likely partly related to a new digital asset treasury (DAT), Eightco Holdings (ORBS). Aethir, a GPU marketplace, benefited from a new partnership with Chainlink as well as a new DAT.[10]

Exhibit 3: The AI Crypto Sector outperformed

Story Protocol (IP), a blockchain focused on intellectual property, was another top performer in the AI Crypto Sector, albeit with significant intra-month volatility.[11] Much of the focus centered on announcements at the project’s Origin Summit during Korea blockchain week. Story partnered with Solo Levelling, an award-winning Korean webtoon brand. The partnership will allow Solo Levelling to explore on-chain intellectual property models and potentially launch a memecoin.[12] Story also integrated with gaming company Verse8 to bring web3 brands Moonbirds and Azuki into AI-generated games, enabling creators to remix and monetize these brands with licensing and royalties enforced on-chain.

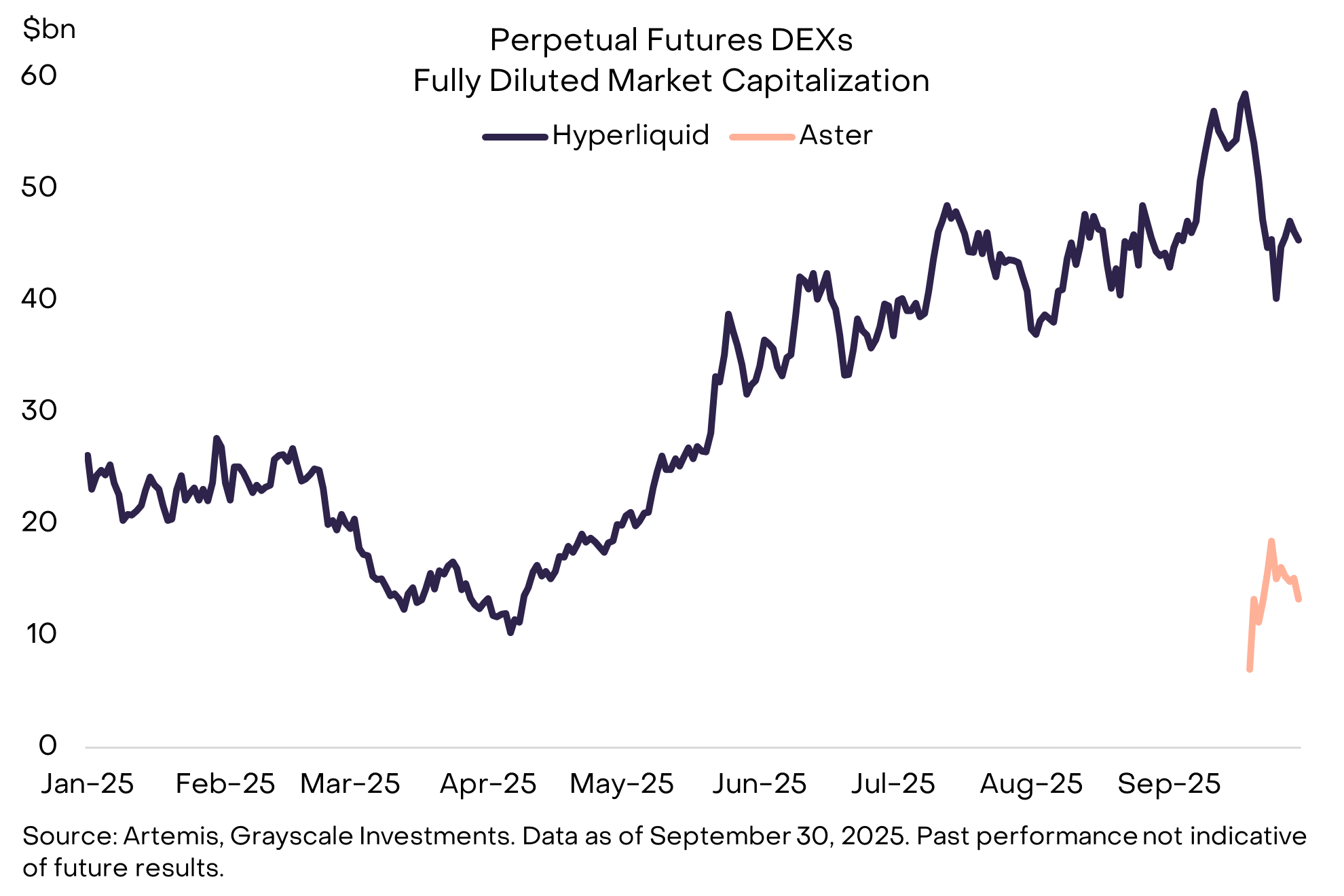

Aside from AI-related applications, the category with the most industry focus has arguably been decentralized exchanges (DEXs) for perpetual futures (for background see DEX Appeal: The Rise of Decentralized Exchanges). Leading the category is Hyperliquid, which has risen to become one of the top three revenue-generating applications in crypto.[13] However, Hyperliquid faces new competition from Aster, a perpetual futures DEX supported by Binance founder Changpeng Zhao (Exhibit 4). Whatever the outcome, it is encouraging to see DEXs capture volume from centralized alternatives—decentralization is the core premise of blockchain technology and DeFi.

Exhibit 4: A new perpetual futures DEX has emerged

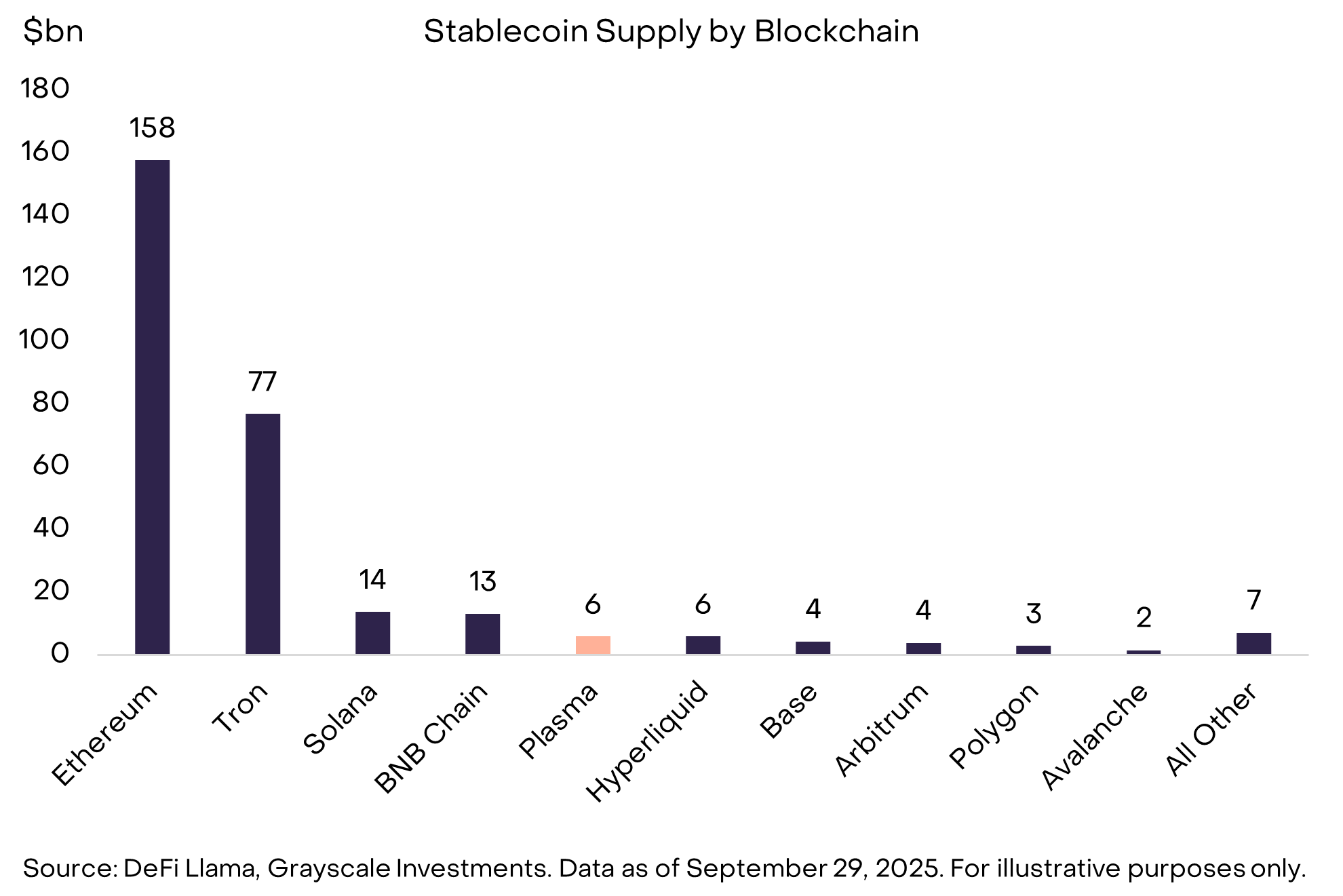

Lastly, there were continued developments related to stablecoins (for background see Stablecoins and the Future of Payments). For example, Plasma, a stablecoin-focused Layer 1, launched its mainnet and XPL network token in late September. It quickly grew to $6 billion in stablecoin supply within a week, making it the fifth largest chain by stablecoin supply and placing it ahead of Coinbase’s Layer 2, BASE (Exhibit 5).[14] Meanwhile, Tether, the largest stablecoin issuer, announced plans to raise between $15 billion and $20 billion at an estimated $500 billion valuation, which would rank it amongst the most valuable private companies in the world alongside OpenAI and SpaceX.[15]

Exhibit 5: Plasma, a new payments blockchain, now ranks 5th in stablecoin supply

As noted above, the crypto bull market has been driven by a combination of macro demand for scarce digital assets and regulatory clarity supporting adoption. Both factors will likely again be the focus for investors in Q4 2025.

The Federal Reserve resumed cutting rates in September and signaled it may cut once or twice more before the end of the year.[16] All else equal, lower rates should be considered positive for the crypto asset class (because they reduce the opportunity cost of holding non-interest-bearing commodities like Bitcoin and may support investor risk appetite). At the same time, there are a variety of macro factors that could weigh on crypto valuations, including a possible slowdown in GDP growth and/or geopolitical tail risks. Of course, an unexpected pivot by the Fed from rate cuts to rate hikes should also be considered a risk scenario for crypto valuations.

From a regulatory perspective, positive market catalysts may include the potential introduction of staking to crypto ETPs, the listing of more altcoin[17] ETPs, and passage of the market structure bill in the Senate. That being said, each of these developments is at least partially priced in, so any roadblocks could be considered a downside risk to valuations.

Some links are for articles which may sit behind a paywall and may require a subscription to access them in full.

Index Definitions:

The Indxx Big Data index typically refers to the Indxx Artificial Intelligence & Big Data Index, which tracks companies positioned to benefit from the development and use of Artificial Intelligence (AI) for Big Data analysis. The MSCI Emerging Markets Index is designed to measure the financial performance of companies in fast-growing economies around the world and tracks mid-cap and large-cap stocks in 25 countries.Bloomberg Magnificent 7 Total Return Index is an equal-dollar weighted equity benchmark consisting of a fixed basket of 7 widely-traded companies classified in the United States and representing the Communications, Consumer Discretionary and Technology sectors as defined by Bloomberg Industry Classification System (BICS). The Bloomberg-Barclays US Treasury Index measures the total returns of nominal US government notes and bonds with greater than one year remaining maturity. The S&P 500 Index is a market-capitalization-weighted index that measures the performance of 500 of the largest publicly traded companies in the United States. FTSE/Grayscale Crypto Sectors Total Market Index measures the price return of digital assets listed on major global exchanges. The FTSE Grayscale Smart Contract Platforms Crypto Sector Index was developed to measure the performance of crypto assets that serve as the baseline platforms, upon which self-executing contracts are developed and deployed. The FTSE Grayscale Utilities and Services Crypto Sector Index was developed to measure the performance of crypto assets that aim to deliver practical and enterprise-level applications and functionalities. The FTSE Grayscale Consumer and Culture Crypto Sector Index was developed to measure the performance of crypto assets that support consumption-centric activities across a variety of goods and services. The FTSE Grayscale Currencies Crypto Sector Index was developed to measure the performance of crypto assets that serve at least one of three fundamental roles: store of value, medium of exchange, and unit of account. The FTSE Grayscale Financials Crypto Sector Index was developed to measure the performance of crypto assets that seek to deliver financial transactions and services.

[1] See for example, Cointelegraph, The Defiant, The Daily Hodl.

[3] According to Bloomberg data, US-listed ETPs/ETFs experienced net inflows of $XXbn in September, the highest monthly total since December 2024.

[4] Technically “commodity-based trust shares”. Source: SEC.

[5] For more detail see SEC, pages 5-6.

[6] Source: Crypto in America.

[7] Source: Bloomberg, Reuters.

[8] Source: Blockworks, Reuters.

[9] Near Intents is an off-chain coordination layer that uses APIs to abstract away cross-chain complexity for developers and users. This technology enables seamless interactions across ecosystems like Ethereum, Solana, and Sui, and was recently extended to support Tron.

[11] Story was not yet incorporated into our AI Crypto Sector Index until the Q4 rebalance.

[13] Source: Artemis, Grayscale Investments

[14] Defi Llama, data as of 9/30/2025

[17] Altcoins are crypto assets with a lower market cap than Bitcoin.