Last Updated: 7/1/2025 | 15 min. read

Despite a drumbeat of negative news, markets posted strong returns in June 2025. The disconnect can be explained by two features of the current market backdrop. First, while markets are dealing with some challenges, the worst-case scenarios haven’t played out. The U.S. economy seems to be slowing, but global trade hasn’t come to a halt. Tariff threats persist, yet the White House has announced a trade agreement with China, and despite active military conflict in the Middle East, oil shipments have seen little disruption. Because financial markets price the full range of possible outcomes — not just the base case — merely avoiding tail risks can be enough to lift valuations.

Second, the macro policy mix is broadly favorable (other than the increases in tariffs). The U.S. federal government is running a large budget deficit despite a low unemployment rate, and the One Big Beautiful Bill Act (OBBBA), which recently passed the Senate, should keep most of this stimulus in place. In addition, the Federal Reserve will probably ease monetary policy later this year.[1] Supportive macro policy may help the economy and markets weather episodes of volatility from tariffs, geopolitical conflict, or other issues.

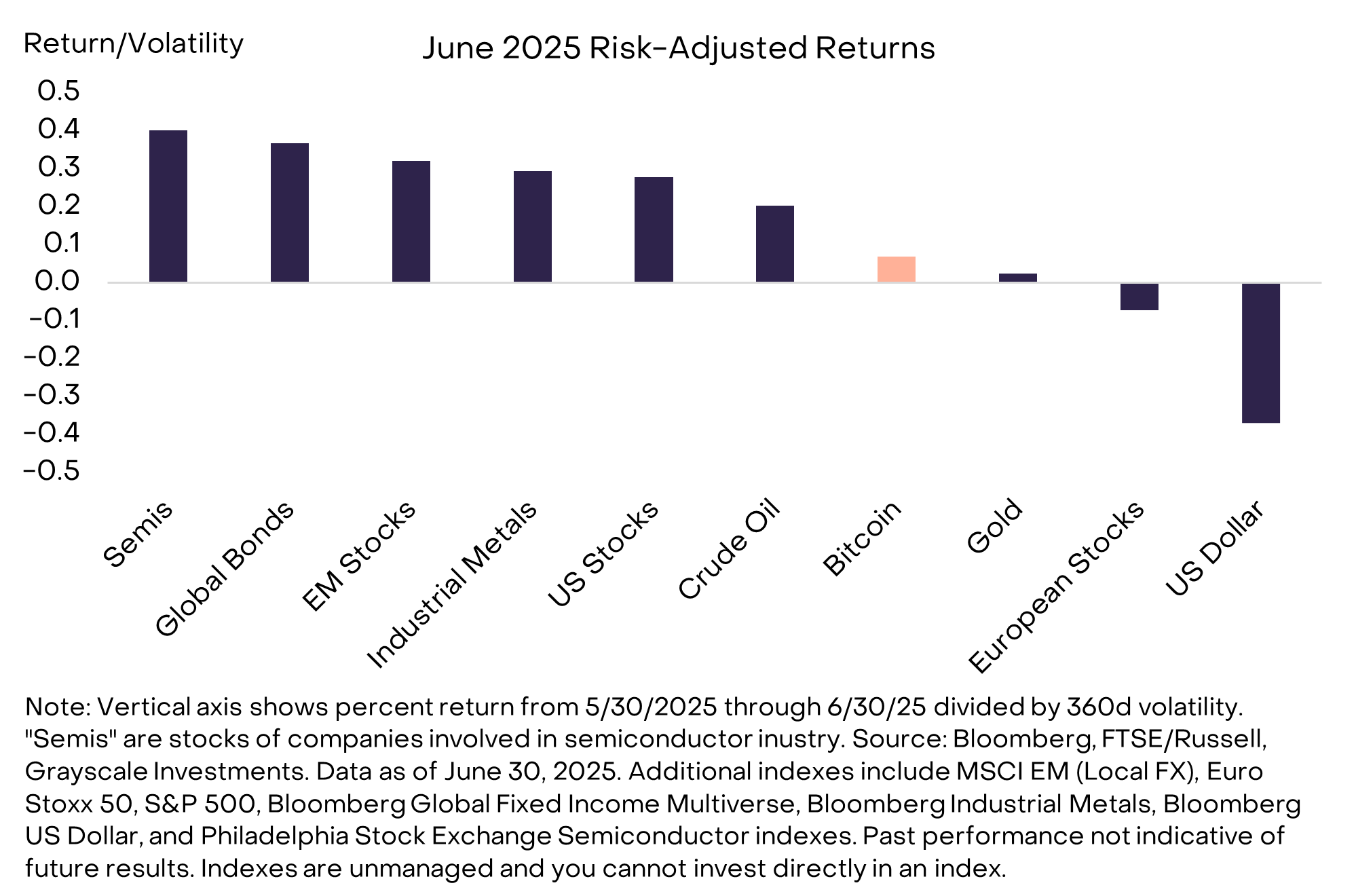

Asset returns in June had a pro-growth tilt. Emerging-market (EM) stocks, high-yield bonds, and industrial metals led other market segments on a risk-adjusted basis (i.e., after accounting for each asset’s volatility), consistent with improved investor risk appetite (Exhibit 1). The U.S. Dollar continued to slide and has now fallen about 10% since its peak in January (based on the Bloomberg USD Index). Bitcoin’s price increased by 3% in June, a relatively small amount considering the asset’s typical volatility.[2] The market cap-weighted FTSE/Grayscale Crypto Sectors Total Market Index increased 1.5% during the month.[3]

Exhibit 1: Strong returns for most equity and bond markets

The crypto industry has started to use the phrase “stablecoin summer” to describe the many recent breakthroughs in this market segment. It’s worth noting the irony: today stablecoins are widely used in emerging-market economies in the Southern Hemisphere… where it’s winter. But it is true that the latest news relates to regulatory changes and corporate adoption that may bring greater stablecoin use to the U.S. and other developed economies.

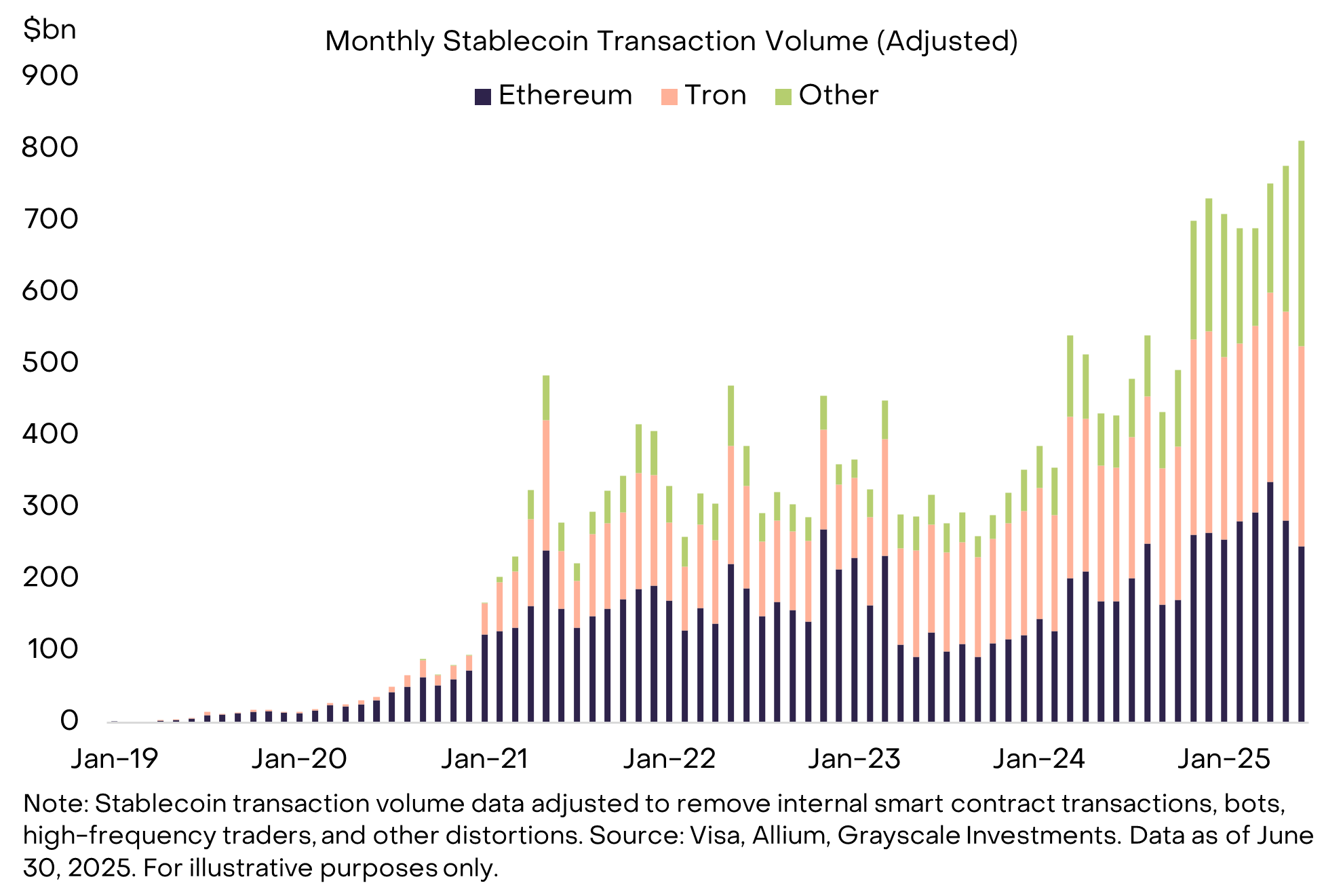

Stablecoins are a type of digital dollar on a blockchain. Their structure resembles a money-market fund — they are tradable stable-dollar-value instruments backed by safe collateral (e.g., U.S. Treasury bills) — but their purpose is for digital payments. We already have digital dollars in the form of commercial bank balances (checking accounts), but when tokenized on a blockchain, a digital dollar can benefit from the blockchain’s functionality, which includes borderless payments, near-instant settlement, potentially lower cost, and a high degree of transparency. Estimates from Visa and crypto data specialists suggest stablecoins are used for about $800 billion in digital transactions per month (Exhibit 2). For comparison, Visa processed about $1.1 trillion in payment volume per month in 2024.[4]

Exhibit 2: Stablecoins used for ~$800 billion in transaction volume per month

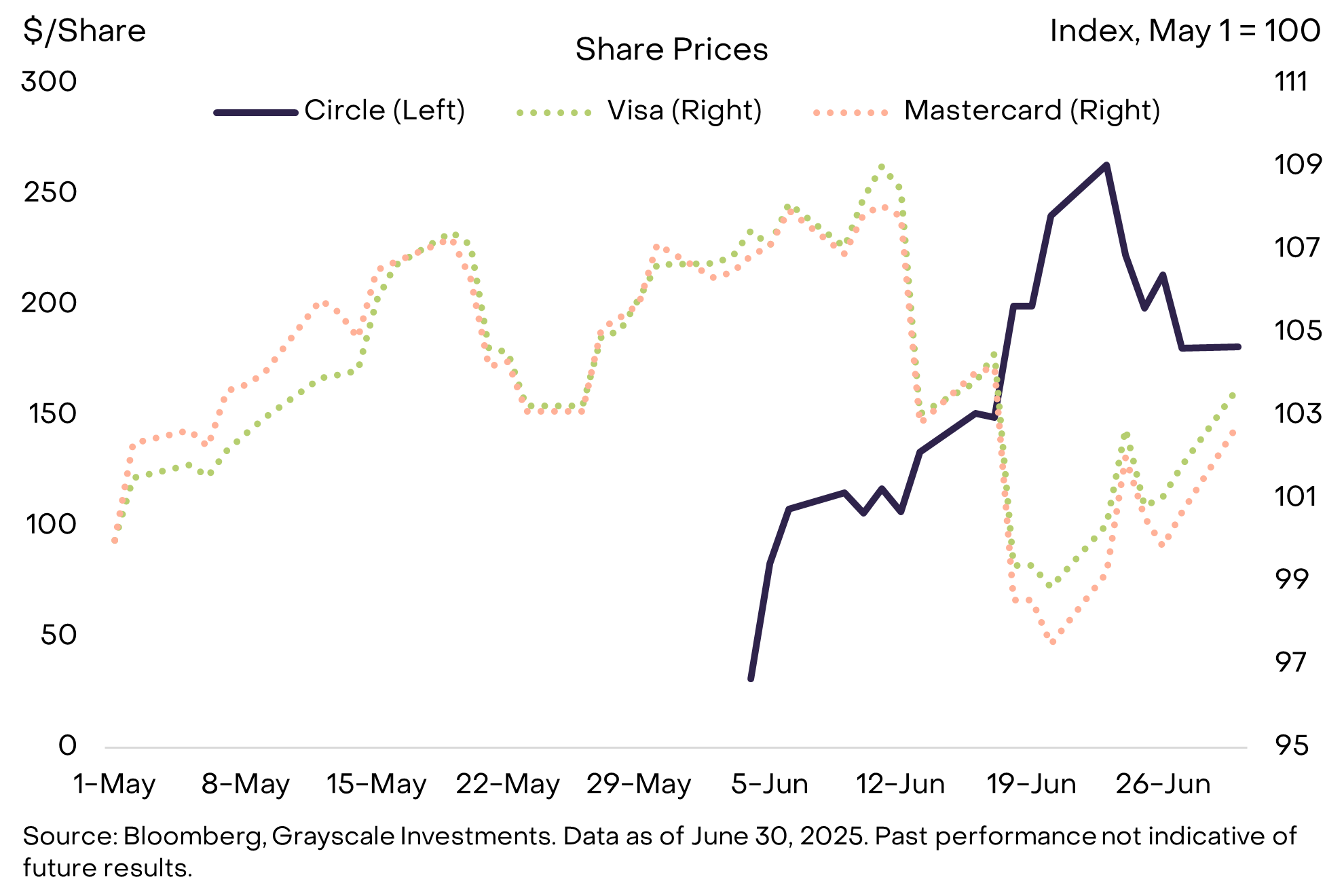

Like commercial bank money, stablecoins are issued by private sector entities. Issuers earn the difference between the interest on their assets (such as Treasury bills) and the (currently) zero interest paid on their liabilities (the stablecoins themselves), making it a profitable model. U.S.-based Circle, which issues the second-largest stablecoin, USDC, went public on June 4 (ticker: $CRCL). Equity investors seemed enthusiastic about the stablecoin thesis: the company’s stock traded up from an IPO price of $31 per share to $181 by month-end. At that price, Circle trades at more than 150 times its 2024 EBITDA[5], suggesting that investors see high growth prospects for the USDC stablecoin and Circle revenues. Interestingly, the post-IPO success of Circle’s stock was mirrored by weakness in the share prices of Visa and Mastercard — firms associated with traditional digital payments (Exhibit 3).

Exhibit 3: Circle’s share price negatively correlated with Visa and Mastercard

Meanwhile, Congress made further progress on comprehensive stablecoin legislation. The GENIUS Act (Guiding and Establishing National Innovation for US Stablecoins Act) passed the Senate on June 17 with bipartisan support and now moves onto the House. The act provides a legal framework for payment stablecoins in the U.S. market, including reserve composition requirements, as well as rules for anti-money laundering compliance, disclosures, and audits. It would bar interest-bearing stablecoins (presumably because they would compete with commercial bank deposits), as well as non-financial issuers. Grayscale Research believes that interest-bearing stablecoins would benefit U.S. consumers and should be reconsidered in future legislation or rulemaking. More broadly, however, the GENIUS Act will likely support stablecoin adoption in the U.S. while incorporating sensible safeguards for consumer protection and financial stability.

Likely encouraged by progress on regulatory clarity, many non-crypto businesses have recently announced investments or exploratory work related to stablecoins. There are almost too many to mention, but the list includes commercial banks (e.g., JPMorgan and SocGen), market infrastructure providers (e.g., the Depository Trust & Clearing Corporation, DTCC), fintechs (e.g., Shopify, Fiserv, and Revolut), and non-financial firms (e.g., Amazon and Walmart).[6] This is a diverse mix of leading firms, all of which see the potential benefits of stablecoins for efficiency and/or cost reduction in digital payments.

Shortly after taking office, President Trump signed an executive order on digital assets that tasked the relevant working group with developing supportive policy proposals within 180 days. Policymakers have been busy announcing changes ahead of that deadline in late July. For example, the Securities and Exchange Commission (SEC) said on June 13 that it was withdrawing unfinished rules (drafted under the previous administration) that would have labeled certain DeFi applications as securities exchanges.[7] Separately, Federal Housing Finance Agency Director William Pulte ordered federal mortgage finance firms Fannie Mae and Freddie Mac to consider digital assets as part of homebuyers’ net worth for their underwriting standards.[8] Lastly, the Federal Reserve announced that it would no longer consider “reputational risk” in its supervisory standards, a mechanism that had limited banking access to parts of the crypto industry.[9]

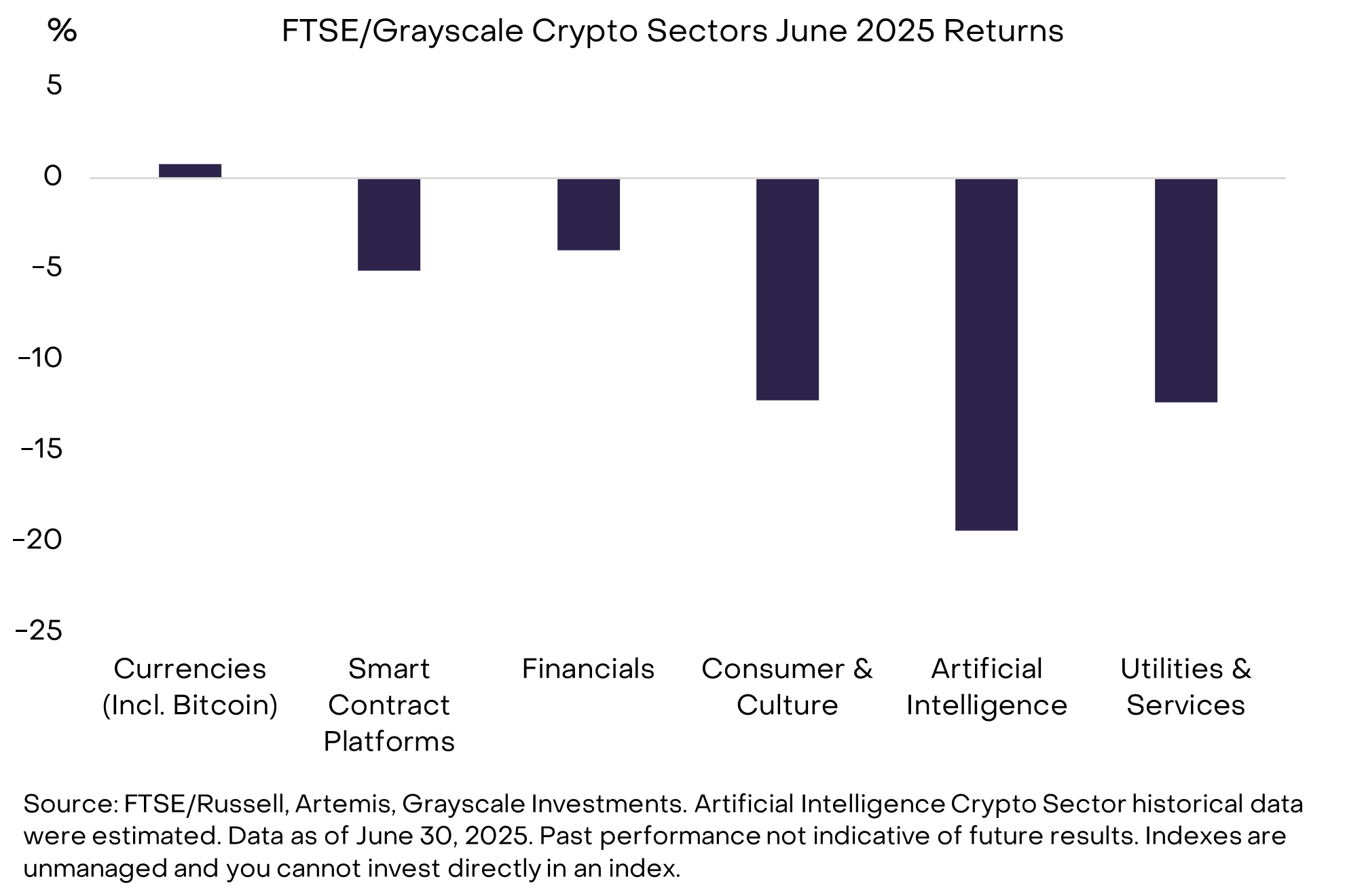

Across crypto market segments, the Currencies Crypto Sector and Financials Crypto Sector outperformed, based on the FTSE/Grayscale family of indexes (Exhibit 4). The gain for the Currencies Crypto Sector reflected the small increase in the price of Bitcoin. Within the Financials Crypto Sector, the largest positive contributions came from Hyperliquid, Uniswap, Aerodrome, Maple Finance/Syrup, and Aave[10], all of which are currently featured in the Grayscale Research Top 20 list. Decentralized exchanges (DEXs) like Hyperliquid, Uniswap, and Aerodrome are now price competitive with centralized exchanges (CEXs) and may continue to dominate in the long tail of assets issued on-chain (for more details, see DEX Appeal: The Rise of Decentralized Exchanges).

Exhibit 4: Currencies and Financials Crypto Sectors held up better

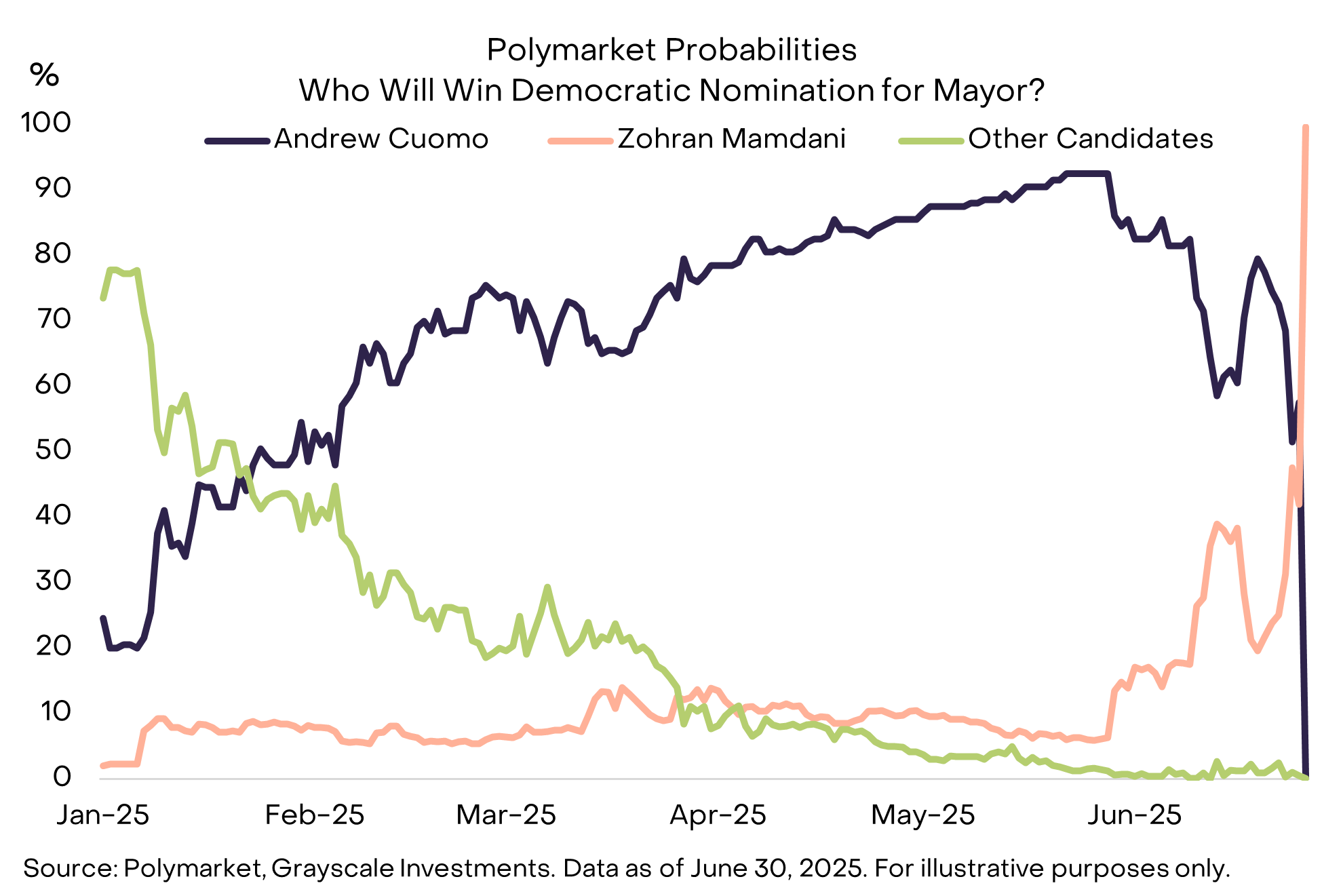

In our view, aside from stablecoins, no crypto application has seen more breakout success over the last year than prediction markets (for more background, see Polymarket: Crypto’s Election-Year Breakout App). Interest in Polymarket surged again in late June due to public focus in New York’s mayoral election, Game 7 of the NBA finals, and global conflicts (Exhibit 5). The two largest prediction markets by volume, Polymarket and Kalshi, both secured additional funding from investors during June. Polymarket raised $200 million at a more than $1 billion valuation from Founders Fund and others, while Kalshi raised $185 million at a $2 billion valuation from Paradigm and others.[11]

Exhibit 5: Polymarket captured shifts in NYC Democratic mayoral primary

Macro demand for Bitcoin has arguably been the single most important driver of the crypto asset class to date. But developments in June were a good reminder of the breadth of technologies that underpin blockchain-based finance, including stablecoins, decentralized exchanges, and prediction markets. Although overall crypto valuations pulled back slightly in June 2025, fundamentals for the industry moved forward, and we believe this will likely be reflected in valuations over time.

Moreover, the macro policy backdrop will likely remain supportive in the months ahead. In the near term, the One Big Beautiful Bill Act may be signed by President Trump relatively soon.[12] Budget experts estimate that the legislation as written would add about $3 trillion to the federal deficit over the next 10 years, and possibly as much as $5 trillion if certain expiring provisions were to be extended.[13] In addition, the president has also repeatedly called for lower interest rates from the Fed. Although the Federal Reserve is an independent agency, the president will have the opportunity to appoint a new Fed Chair next year (subject to Senate approval). Taken together, we believe persistent fiscal deficits, lower real interest rates, and potentially a weaker U.S. Dollar should be a favorable combination for Bitcoin and the crypto asset class.

Some links are for articles which may sit behind a paywall and may require a subscription to access them in full.

Index Definitions: FTSE/Grayscale Crypto Sectors Total Market Index measures the price return of digital assets listed on major global exchanges. The FTSE Grayscale Smart Contract Platforms Crypto Sector Index was developed to measure the performance of crypto assets that serve as the baseline platforms, upon which self-executing contracts are developed and deployed. The FTSE Grayscale Utilities and Services Crypto Sector Index was developed to measure the performance of crypto assets that aim to deliver practical and enterprise-level applications and functionalities. The FTSE Grayscale Consumer and Culture Crypto Sector Index was developed to measure the performance of crypto assets that support consumption-centric activities across a variety of goods and services. The FTSE Grayscale Currencies Crypto Sector Index was developed to measure the performance of crypto assets that serve at least one of three fundamental roles: store of value, medium of exchange, and unit of account. The FTSE Grayscale Financials Crypto Sector Index was developed to measure the performance of crypto assets that seek to deliver financial transactions and services. The S&P 500 Index is a market-capitalization-weighted index that measures the performance of 500 of the largest publicly traded companies in the United States. The MSCI Emerging Markets (EM) Local FX index measures the performance of emerging market currencies against the U.S. dollar. The EURO STOXX 50 Index is a market capitalization-weighted stock index of 50 large, blue-chip European companies operating within eurozone nations. The Bloomberg Multiverse Index provides a broad-based measure of the global fixed-income bond market. The Bloomberg Industrial Metals Subindex index is composed of futures contracts on aluminum, copper, nickel, lead and zinc. The Bloomberg's U.S. Dollar Index offers a real time measure of the greenback against a diversified, dynamic basket of emerging and developed market currencies. The PHLX Semiconductor Sector Index is designed to track the performance of a set of companies engaged in the design, distribution, manufacture, and sale of semiconductors.

[2] Source: Bloomberg. Data as of June 30, 2025.

[3] FTSE Russell, Grayscale Investments. Data as of 6/30/2025

[4] Visa reported $13.2 trillion in payments volume in 2024, or $1.1 trillion per month. Source: Visa.

[5] Source: Bloomberg. Data as of May 30, 2025. Earnings before interest, taxes, depreciation, and amortization (EBITDA).

[6] Source: CNBC, Reuters, The Block, Forbes, Barrons, Decrypt, WSJ.

[10] Source: FTSE/Russell, Artemis, Grayscale Investments. Data as of June 30, 2025. Contributions based on percent change in price and weight index.

[11] Source: Reuters, Reuters.

[12] Source: Washington Post.

[13] Source: Yale Budget Lab.