Last Updated: 6/26/2025 | 13 min. read

Grayscale Research Insights: Crypto Sectors in Q3 2025

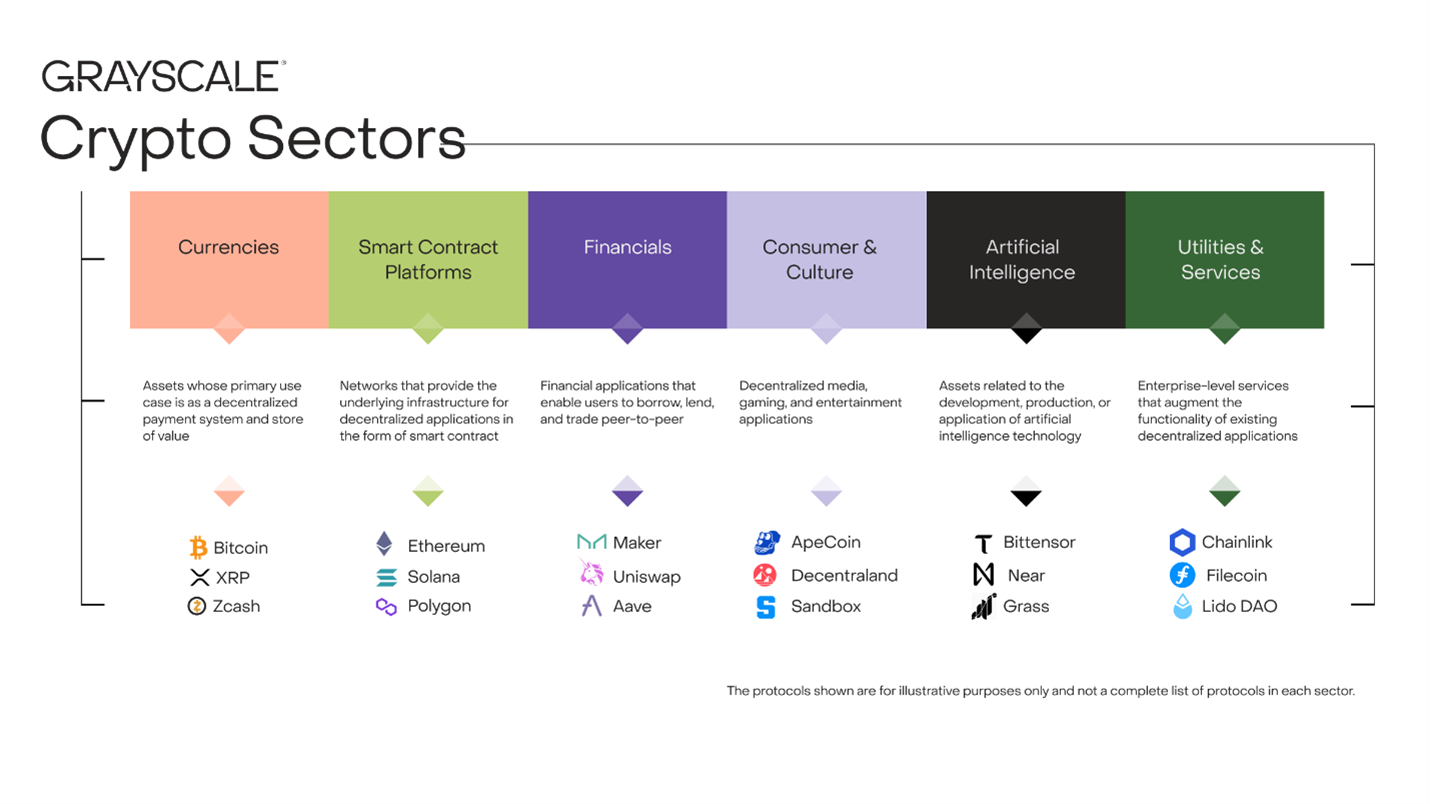

Every asset in crypto is somehow related to blockchain technology[2] and shares the same basic market structure — but that’s where the commonalities end. The asset class includes an incredible array of software technologies with applications in consumer finance, artificial intelligence (AI), media and entertainment, and other fields. To keep things organized, Grayscale Research uses a proprietary taxonomy and family of indexes known as Crypto Sectors, developed in partnership with FTSE/Russell (Exhibit 1). As of latest rebalance, the Crypto Sectors framework now covers six distinct market segments — including the Artificial Intelligence Crypto Sector, discussed below. Together they include 261 tokens and have a combined market cap of $3 trillion.[3]

Exhibit 1: Crypto Sectors framework helps organize digital asset markets

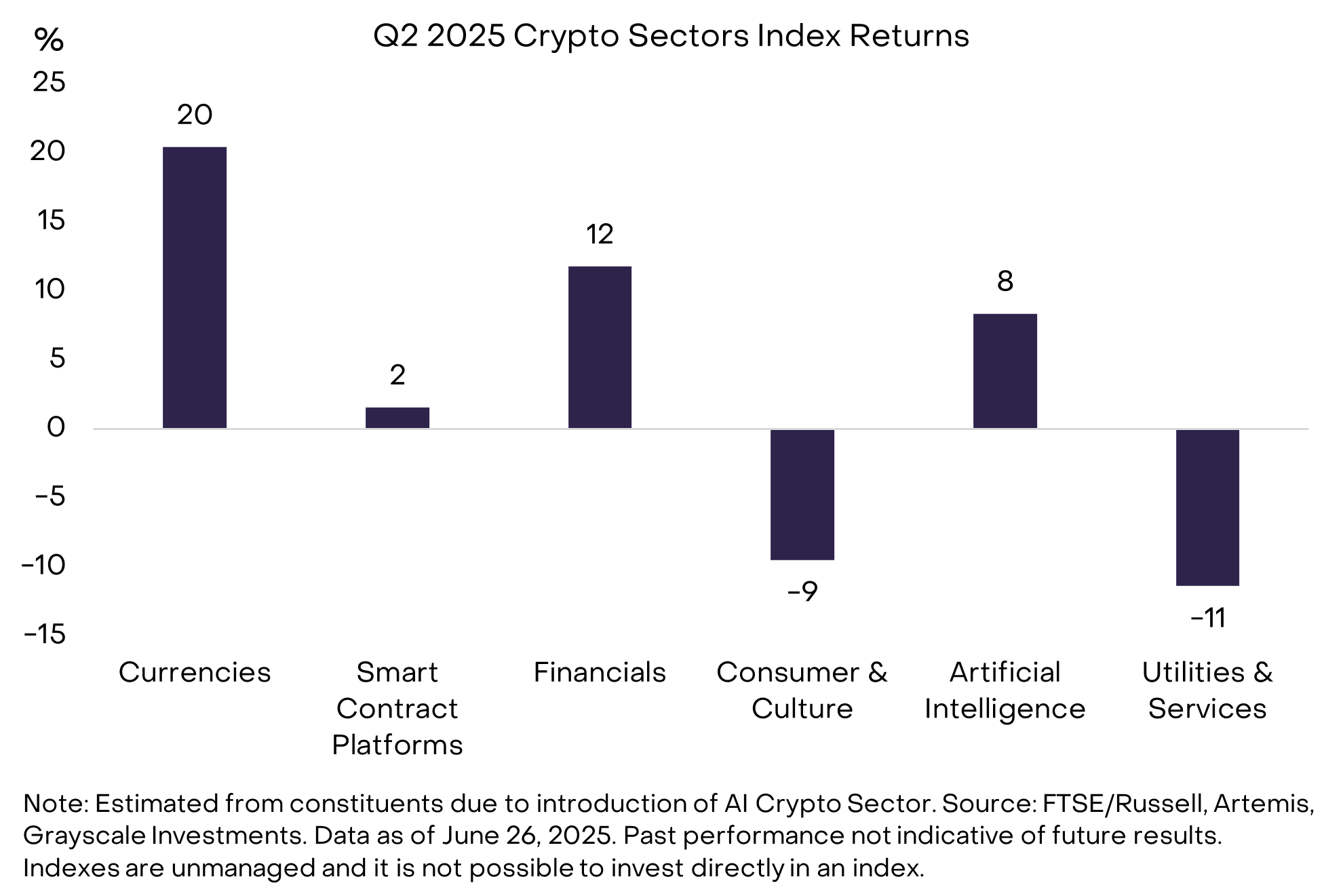

Returns were mixed in Q2 2025, a quarter that featured both the “liberation day” tariff announcement and U.S. military action in the Middle East. Our market cap-weighted aggregate FTSE/Grayscale Crypto Sectors Total Market Index was about unchanged for the quarter (Exhibit 2). The Currencies Crypto Sector index outperformed, thanks to a 30% increase in the price of Bitcoin over this period.[4] The FTSE/Grayscale Financials Crypto Sector Indexand FTSE/Grayscale Artificial Intelligence Crypto Sector Index also saw moderate gains. In contrast, the FTSE/Grayscale Consumer & Culture Crypto Sector Index declined due to weakness in certain memecoins and gaming-related tokens. The FTSE/Grayscale Utilities & Services Crypto Sector Index also declined, reflecting broad-based weakness in its constituents.

Exhibit 2: Mixed returns across Crypto Sectors in Q2 2025

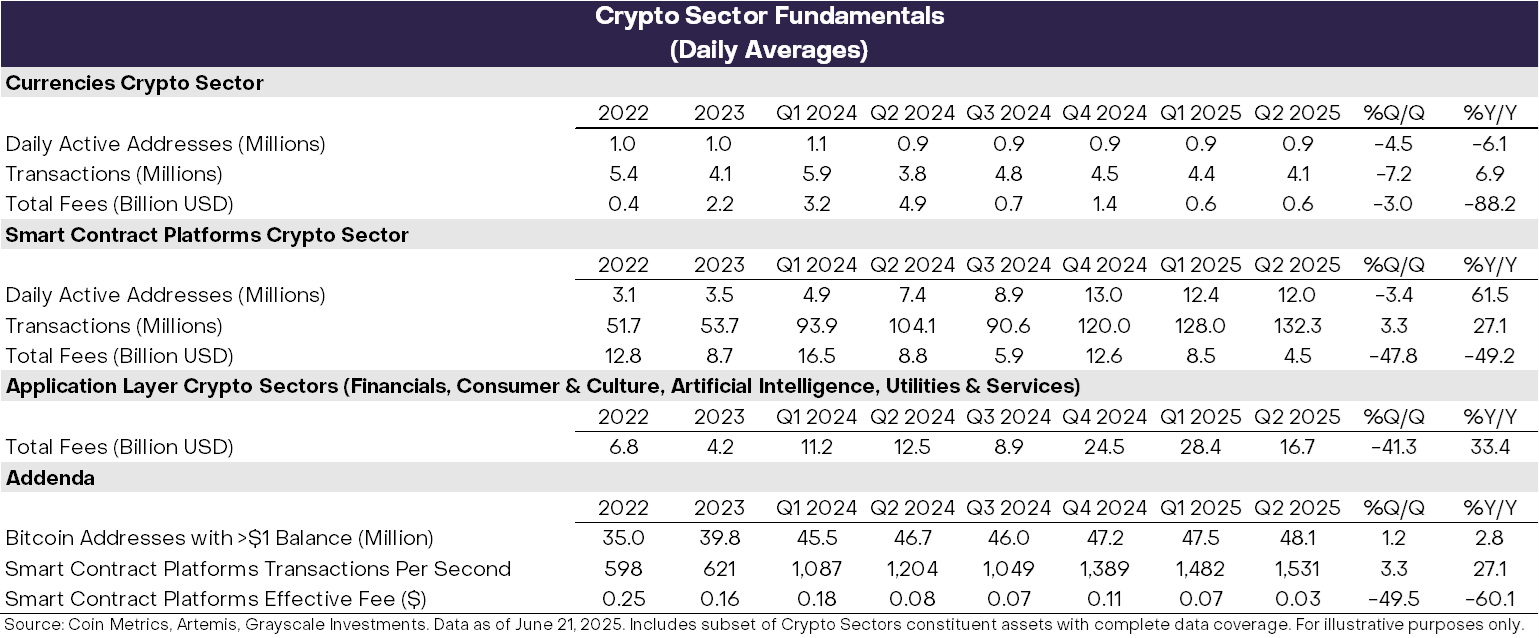

Blockchains are not businesses, but it is possible to measure their economic activity and financial health in an analogous way. The three most important measures of on-chain activity are users, transactions, and transaction fees. Because blockchains are pseudonymous, analysts typically use “active addresses” (blockchain addresses with at least one transaction) as an imperfect proxy for the number of users.

Similar to token price returns, measures of blockchain financial health were also mixed in Q2 2025. On the one hand, the average number of transactions processed by Smart Contract Platforms climbed to more than 130 million or about 1,500 transactions per second; transaction volume has increased nearly 30% over the last year (Exhibit 3). On the other hand, transaction fees paid by users declined across the board. In part this reflects a further cooling of memecoin trading activity on Solana, which was a major source of transaction fees in prior quarters. Based on the blockchains included in this analysis, the effective Smart Contract Platform transaction fee was about $0.03 (i.e., three cents per transaction). Although application layer fees declined quarter over quarter, they are running at an annualized rate of $5 billion to $10 billion over the last four quarters.[5]

Exhibit 3: Transaction fees declined across Crypto Sectors

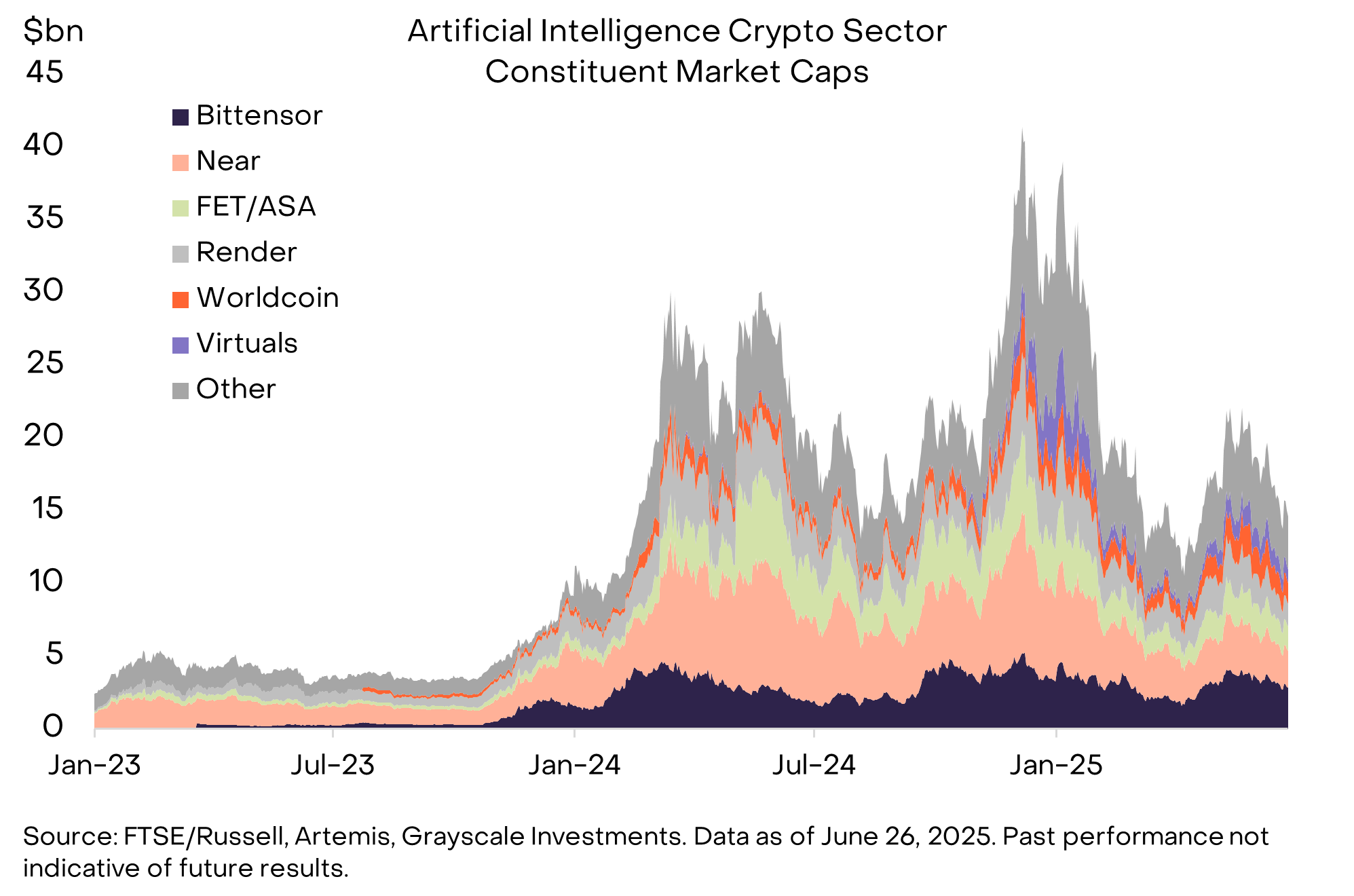

Last month we introduced the Artificial Intelligence Crypto Sector, and this change was formally incorporated into the FTSE/Grayscale Crypto Sectors family of indexes with the latest rebalance. The Artificial Intelligence Crypto Sector currently includes 24 tokens with a combined market capitalization of about $15 billion — up from about $5 billion in 2023 but still less than 1% of Bitcoin’s market cap (Exhibit 4). The largest asset by market cap in the Artificial Intelligence Crypto Sector is Bittensor, a platform designed to incentivize decentralized AI development.[6]

Exhibit 4: Artificial Intelligence Crypto Sector has 24 assets and $15bn market cap

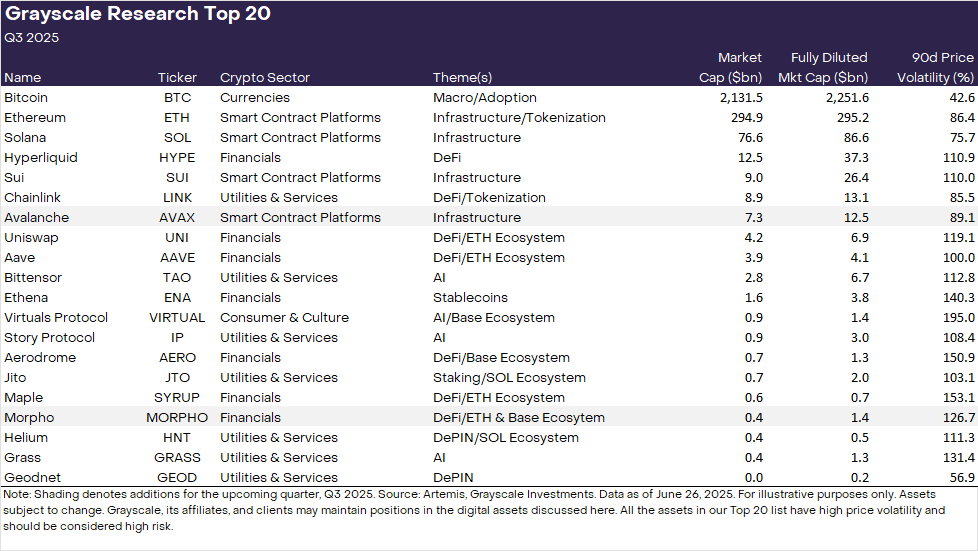

Each quarter the Grayscale Research team analyzes hundreds of digital assets to inform the rebalancing process for the FTSE/Grayscale Crypto Sectors family of indexes. Following this process, Grayscale Research produces a Top 20 list of assets within the Crypto Sectors universe. The Top 20 represents a diversified set of assets across Crypto Sectors that, in our view, have high potential over the coming quarter (Exhibit 5). Our approach incorporates a range of factors, including network growth/adoption, upcoming catalysts, sustainability of fundamentals, token valuation, token supply inflation, and potential tail risks.

Over the past quarter, crypto markets were focused on stagflation and other macroeconomic risks — which likely benefited Bitcoin — as well as progress on stablecoin and market structure regulation in the U.S. — which seemed to support Ethereum and assets related to decentralized finance (DeFi). These themes, as well as advancements in decentralized AI, were already well represented in the Top 20 list.

This quarter we are therefore making only two changes, which relate more closely to protocol-specific fundamentals rather than new themes. Specifically, we are adding:

Exhibit 5: AVAX and MORPHO added to Top 20 for Q3 2025

To make room for Avalanche and Morpho, this quarter we are removing Lido DAO (LDO) and Optimism (OP). Both projects are leaders in their categories (staking and Layer 2s, respectively) and are central to the Ethereum ecosystem.[11] However, Lido may face fee competition from centralized staking providers if U.S. regulatory changes allow greater use of staking services (e.g., in crypto exchange-traded products, ETPs). Optimism’s technology is used extensively by Ethereum Layer 2 networks, including Coinbase’s Base chain, Uniswap’s Unichain, and the OP Mainnet itself. But limited fee revenue has accrued to the OP token. Moreover, we are unsure how the vision for an Optimism “superchain” will work with the Ethereum Foundation’s own efforts to improve interoperability, possibly through alternative rollup designs (i.e., “based” and “native” rollups). The longer-term theses for both LDO and OP remain intact: Lido provides core liquid staking services, and Optimism is leading efforts to scale Ethereum. However, we are less sure about near-term prospects and are therefore removing both assets for the coming quarter.

Investing in the crypto asset class involves risks, some of which are unique to the crypto asset class, including smart contract vulnerabilities and regulatory uncertainty. Moreover, all the assets in our Top 20 have high volatility and should be considered high risk and are therefore not suitable for all investors. In light of the risks to the asset class, any investment in digital assets should therefore be considered in the context of a portfolio and with consideration of an investor’s financial goals.

Index Definitions: The FTSE/Grayscale Crypto Sectors Index (CSMI) measures the price return of digital assets listed on major global exchanges. The FTSE Grayscale Smart Contract Platforms Crypto Sector Index was developed to measure the performance of crypto assets that serve as the baseline platforms, upon which self-executing contracts are developed and deployed. The FTSE Grayscale Utilities and Services Crypto Sector Index was developed to measure the performance of crypto assets that aim to deliver practical and enterprise-level applications and functionalities. The FTSE Grayscale Consumer and Culture Crypto Sector Index was developed to measure the performance of crypto assets that support consumption-centric activities across a variety of goods and services. The FTSE Grayscale Currencies Crypto Sector Index was developed to measure the performance of crypto assets that serve at least one of three fundamental roles: store of value, medium of exchange, and unit of account. The FTSE Grayscale Financials Crypto Sector Index was developed to measure the performance of crypto assets that seek to deliver financial transactions and services. The FTSE Grayscale Artificial Intelligence Crypto Sector Index was developed to measure the protocols for which AI applications are the primary use case.

[1] Source: Artemis. Data as of June 26, 2025.

[2] Technically distributed ledger technology, of which blockchains are the most common type.

[3] Source: Artemis. Data as of June 26. 2025.

[4] Within each Crypto Sector tokens are weighted by the square root of their market capitalization.

[5] Based on projects included in Exhibit 3. Source: FTSE/Russell, Artemis, Grayscale Investments, Data as of June 21, 2025.

[6] Source: Artemis. Data as of June 26, 2025.

[7] Source: Artemis. Data as of June 26, 2025.

[8] Source: Coin Metrics.

[9] Source: DeFi Llama. Data as of June 26, 2025.

[11] For example, Lido is the leading liquid staking protocol by TVL, and the OP Stack codebase is used in three of the four largest Ethereum rollups by TVL. Source: DeFi Llama, L2 Beat. Data as of June 26, 2025.