Last Updated: 4/9/2025 | 15 min. read

Since the White House announced new global tariffs on April 2, the price of Bitcoin has fallen moderately.[1] Asset markets partially recovered on April 9 with the announcement of a 90 day pause on non-China reciprocal tariffs, but the original tariff announcement had affected virtually all assets. Through the drawdown the decline in Bitcoin was relatively small on a risk-adjusted basis (Exhibit 1). For example, from April 2 to April 8 (before the 90d pause and recovery in valuations), the S&P 500 declined about 12%. Bitcoin’s price volatility is typically around three times higher than the S&P 500.[2] Therefore, if Bitcoin had a 1:1 correlation with equity returns, the decline in the S&P 500 would have implied an 36% drop in the price of Bitcoin. The fact that it declined only 10% during this period highlights the potential diversification benefits of holding Bitcoin in a portfolio, even during a deep drawdown. Following the partial rebound on markets on April 9, both the S&P 500 and Bitcoin are down about 4% since the announcement of reciprocal tariffs.

Exhibit 1: Bitcoin had moderate drawdown in risk-adjusted terms

Over the short term, the global market outlook will likely depend on trade talks between the White House and other countries. Although negotiations could result in lower tariffs, setbacks in the talks could also result in more retaliation. Both realized and implied volatility in traditional markets remain very high, and it is difficult to predict how the trade conflict will evolve in the coming weeks (Exhibit 2). Investors should be mindful about appropriate position sizing in a high-risk market environment. That being said, Bitcoin’s price volatility has increased by much less than equity volatility, and a range of indicators suggest that speculative trader positioning in crypto is relatively low. If macro risks ease over the coming weeks, crypto valuations should be poised to rebound, in our view.

Exhibit 2: Equity implied volatility approached Bitcoin’s

Beyond the very short-term, the impact of higher tariffs on Bitcoin will depend on their consequences for the economy and for international capital flows. In our view, despite the decline in the price of Bitcoin over the last week, the sharp increase in tariffs and the likely changes to global trade patterns should be considered positive for Bitcoin adoption over the medium term. This is because tariffs (and related changes to non-tariff trade barriers) can contribute to “stagflation,” and because they may result in structurally weaker demand for the U.S. Dollar.

Stagflation refers to an economy with low and/or slowing GDP growth and high and/or accelerating inflation. Tariffs raise the price of imported goods and therefore (at least temporarily) contribute to inflation. At the same time, tariffs can slow economic growth due to lower real household incomes as well as the adjustment costs faced by firms. In the longer run this may be offset by higher investment in domestic manufacturing, but most economists expect that the new tariffs will weigh on the economy for at least the next year.[3] Bitcoin is too young for us to know how it would have behaved in past episodes, but historical data shows that stagflation tends to be negative for traditional asset returns and favorable for scarce commodities like gold.

For historical perspective, asset returns during the 1970s provide the most vivid example of the impact of stagflation on financial markets. During that decade, both U.S. equities and longer-term bonds delivered annualized returns of about 6%[4], which was below the average inflation rate of 7.4%. In contrast, the price of gold appreciated an annualized rate of about 30%, significantly above the rate of inflation (Exhibit 3).

Exhibit 3: Traditional assets had negative real returns in the 1970s

Episodes of stagflation are not usually so extreme, but the impact on asset returns is broadly consistent over time. Exhibit 4 shows average annual returns for U.S. stocks, government bonds, and gold from 1900 through 2024, under different regimes for GDP growth and inflation. The idea that returns for different assets vary systematically across the economic cycle is the basis of macro investing.

The historical data highlight three points:

Exhibit 4: Stagflation lowers equity returns and raises gold returns

Whether Bitcoin also appreciates during periods of stagflation depends on whether investors consider it a scarce commodity and monetary asset like gold. Bitcoin’s fundamental properties suggest that it will, and we have been encouraged that officials like Treasury Secretary Bessent have said that “Bitcoin is becoming a store of value.”[5]

Tariffs and trade tensions may also support Bitcoin adoption over the medium term due to pressure on demand for the U.S. Dollar. In part this is mechanical: if gross trade flows with the U.S. decline, and most of those flows are denominated in U.S. Dollars, there will be less transactional demand for the currency. However, if hiking tariffs also creates conflict with other major countries, they could also weaken demand for the Dollar as a store of value.

The Dollar’s share in global foreign exchange reserves greatly exceeds the U.S. share of global economic output (Exhibit 5). There are many reasons for this, but network effects play an important role: countries trade with the United States, borrow in Dollar markets, and typically denominate exports of commodities in Dollars.[6] If trade tensions result in weaker ties to the U.S. economy and/or USD-based financial markets, countries may accelerate the diversification of their foreign exchange reserves.

Exhibit 5: Dollar share of reserves greatly exceeds U.S. share of world economy

Many central banks have already stepped-up purchases of gold following Western sanctions on Russia.[7] To our knowledge, no central bank besides Iran’s currently holds Bitcoin on its balance sheet. However, the Czech National Bank has begun exploring this option, the U.S. has now created a Strategic Bitcoin Reserve, and a few sovereign wealth funds have disclosed investments in Bitcoin.[8] In our view, disruptions to the Dollar-centric international trade and financial system could result in more reserve diversification by central banks, including into Bitcoin.

The moment in U.S. history most comparable to President Trump’s “Liberation Day” announcement is arguably “Nixon Shock” on August 15, 1971. That evening, President Nixon announced 10% across-the-board tariffs and an end to the convertibility of Dollars into gold — a system that had underpinned the global trade and finance since the end of WWII. The action triggered a period of diplomacy between the U.S. and other nations, culminating in the Smithsonian Agreement in December 1971, in which other countries agreed to revalue their currencies higher versus the U.S. Dollar. The greenback eventually depreciated 27% between Q2 1971 and Q3 1978. In the last 50 years there have been several periods of trade tensions followed by (partially negotiated) Dollar weakness (Exhibit 6).

Exhibit 6: Will there be a “Mar-a-Lago Accord” to weaken the Dollar?

Whether negotiated formally as part of a “Mar-a-Lago Accord”[9] or not, we expect that the latest period of trade tensions will again be followed by sustained Dollar weakness. The U.S. Dollar is already overvalued according to standard indicators, the Federal Reserve has room to reduce interest rates, and the White House wants to bring down U.S. trade deficits. Although tariffs change effective import and export prices, a weaker Dollar could bring about the desired rebalancing in trade flows gradually and through a market-based mechanism.

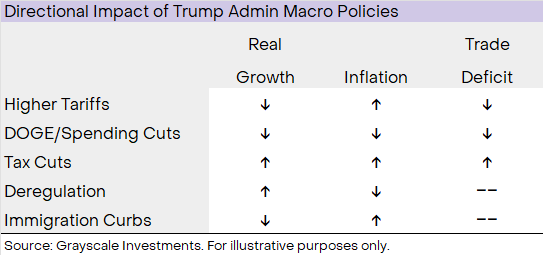

Financial markets are adjusting to an abrupt change in U.S. trade policy that will have a negative short-run impact on the economy. However, market conditions over the last week are unlikely to be the norm over the next four years. The Trump administration is pursuing a range of policy actions will have different implications for GDP growth, inflation, and the trade deficit (Exhibit 7). For example, although tariffs may reduce growth and raise inflation (i.e., contribute to stagflation), certain types of deregulation could raise growth and reduce inflation (i.e., reduce stagflation). The net outcome will depend on the degree to which the White House implements its policy agenda in each of these areas.

Exhibit 7: U.S. macro policy will have range of effects on growth and inflation

While the outlook is uncertain, our best guess is that U.S. government policy will result in sustained Dollar weakness and generally above-target inflation over the next 1-3 years. Tariffs alone will tend to slow growth, but the impact may partly be offset by tax cuts, deregulation, and Dollar depreciation. If the White House also aggressively pursues other, more pro-growth policies, GDP growth could hold up reasonably well despite the initial shock from tariffs. Whether or not real growth remains strong, history suggests that a period of stubborn inflation pressures could be challenging for equity markets and favorable for scarce commodities like gold and Bitcoin.

Moreover, like gold in the 1970s, Bitcoin today has a rapidly improving market structure — underpinned by U.S. government policy changes — that may help broaden the Bitcoin investor base. Since the start of the year, the White House has made a wide range of policy changes that should support investment in the digital assets industry, including withdrawing a range of lawsuits, ensuring assets to traditional commercial banking, and allowing regulated institutions like custodians to offer crypto services. This has in turn triggered a wave of M&A activity and other strategic investments. The new tariffs have been a short-term headwind for digital asset valuations, but the Trump administration’s crypto-specific policies have been supportive of the industry. Taken together, rising macro demand for scarce commodity assets and an improving operating environment for investors could be a potent combination for Bitcoin adoption over the coming years.

[1] Source: Bloomberg. Data as of April 9, 2025.

[2] Since 2019, Bitcoin’s annualized price volatility was 3.3x higher than the S&P 500; over the last year, Bitcoin’s annualized price volatility was 2.8x higher than the S&P 500; based on weekly returns. Source: Bloomberg, Grayscale Investments. Data as of April 8, 2025.

[3] For example, since the end of February the Bloomberg consensus for 2025 GDP growth has fallen from 2.3% to 1.8%, and the consensus for 2025 CPI inflation has risen 2.8% to 3.0%. Source: Bloomberg, Data as f April 9, 2025. For illustrative purposes only.

[4] Source: Triumph of the Optimists, Elroy Dimson, Paul Marsh, and Mike Staunton (DMS), Princeton University Press, 2002; Robert Shiller dataset; Grayscale Investments. According to DMS, nominal equity returns were +6.7% and nominal bond returns were +5.7% in the 1970s. According to Shiller, nominal returns were +5.8% and nominal bond returns were +5.6% in the 1970s.

[5] Interview with Tucker Carlson, April 7, 2025.

[6] See for example “Banking, Trade, and the Making of a Dominant Currency,” Gita Gopinath and Jeremy Stein, Quarterly Journal of Economics 2021; “A Model of the International Monetary System,” Emmanuel Farhi and Matteo Maggiori, Quarterly Journal of Economics 2017.

[7] See for example “Gold as International Reserves: A Barbarous Relic No More?” Serkan Arslanalp, Barry Eichengreen, and Chima Simpson-Bell, IMF Working Paper, January 2023.

[8] Source: CoinDesk, CoinDesk.

[9] For background see, for example, Council on Foreign Relations.