Last Updated: 7/1/2024 | 10 min. read

Crypto markets pulled back in June 2024 as pockets of Bitcoin selling pressure triggered a broader reduction in investor risk appetite, but Grayscale Research maintains a constructive outlook for the asset class.

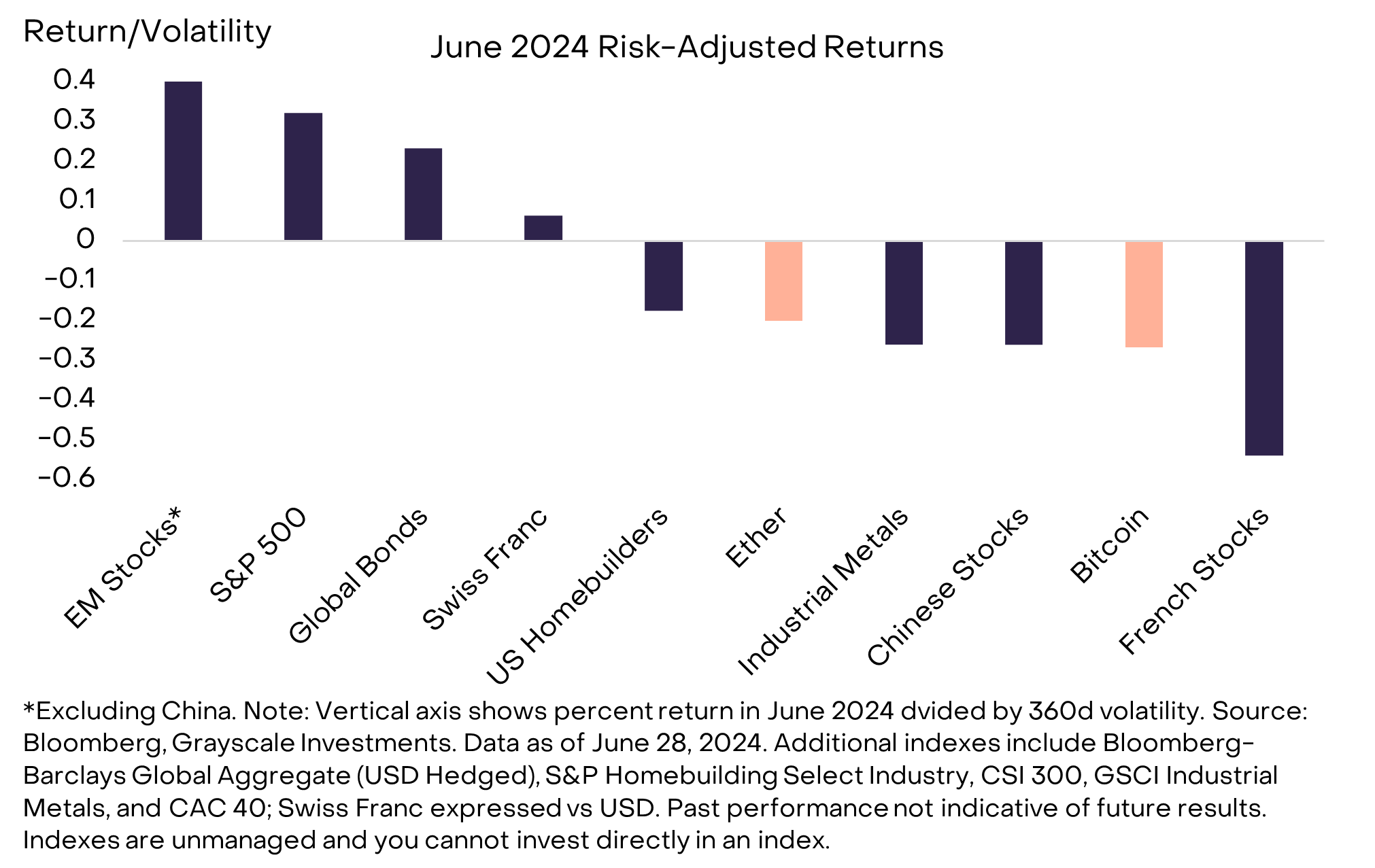

Returns across traditional assets were mixed in June as markets digested a variety of new risks (Exhibit 1). Several market segments underperformed because of these risks, including U.S. homebuilders (on signs that the housing market has cooled), Chinese equities and certain industrial metals (on renewed weakness in the Chinese economy), and French stocks (on a potential change in government). In contrast, global bonds, emerging market shares ex-China, and the S&P 500 delivered relatively solid risk-adjusted returns, as did the Swiss Franc — often a barometer of rising tail risks internationally. Both Bitcoin and r declined about 10%[1] and were among the underperforming market segments on a risk-adjusted basis.

Exhibit 1: Crypto valuations pulled back in June in a mixed month for traditional assets

In Grayscale Research’s view, actual and expected selling pressure from several sources contributed to Bitcoin’s drawdown during the month. Weakness in Bitcoin, in turn, appeared to spill over to the rest of crypto. The major new sources of selling pressure included:

In addition to these new sources of selling pressure, Bitcoin miners continued to reduce their holdings: according to Glassnode, miners sold ~1560 Bitcoin (~$100 million) over the last 30 days.[7] On the other hand, the public company Microstrategy reportedly purchased nearly 12,000 Bitcoin (valued $786 million) during mid-June, possibly supporting Bitcoin’s price.[8]

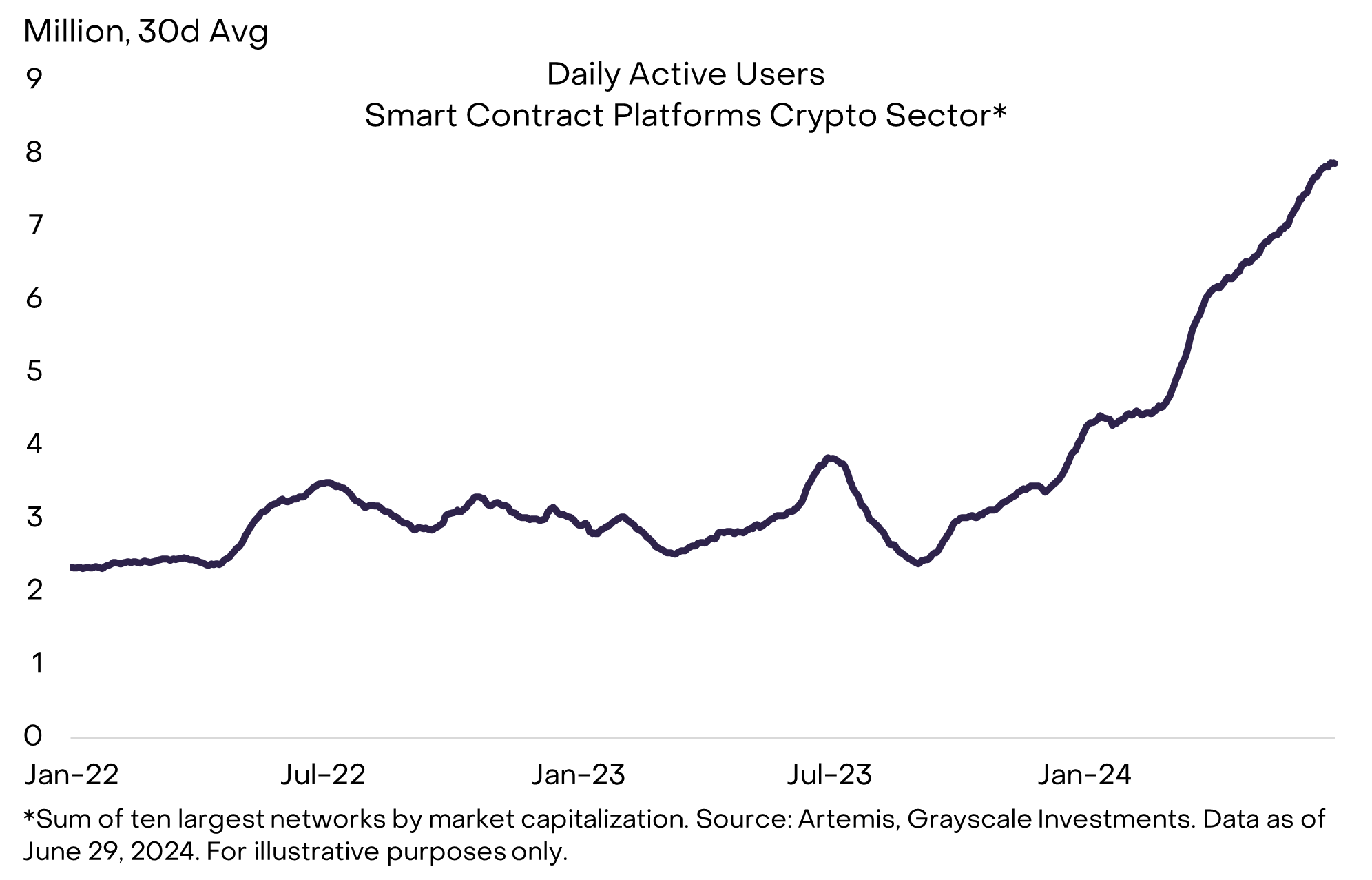

While these short-term flows may have weighed temporarily on Bitcoin’s price, we do not see meaningful changes in the asset’s fundamentals. For example, although the U.S. Dollar strengthened moderately, markets priced in additional Fed rate cuts for this year and next on a further easing of consumer price inflation.[9] In addition, certain adoption metrics for smart contract platforms showed continued growth. As shown in Exhibit 2, for instance, daily active users for the 10 largest components in our Smart Contract Platforms Crypto Sector (by market capitalization) have continued to increase in recent months.

Exhibit 2: Growth in daily active users of major smart contract platforms

Separately, there appeared to be further progress toward the listing of spot Ether ETPs in the U.S. market. In late May, the Securities and Exchange Commission (SEC) approved Form 19b-4 filings from several issuers to list these products on U.S. exchanges. On June 13, SEC Chair Gensler said that regulators could approve the remaining filings “sometime over the course of this summer”. While timing remains uncertain, for the purposes of our market analysis, Grayscale Research assumes that these products will begin trading in Q3 2024. Like with the spot Bitcoin ETPs that launched in January 2024, the Grayscale Research team expects the new Ether products to produce meaningful net inflows (albeit less than Bitcoin ETPs), potentially supporting valuations for Ethereum and tokens within its ecosystem (for more details, see our report The State of Ethereum).

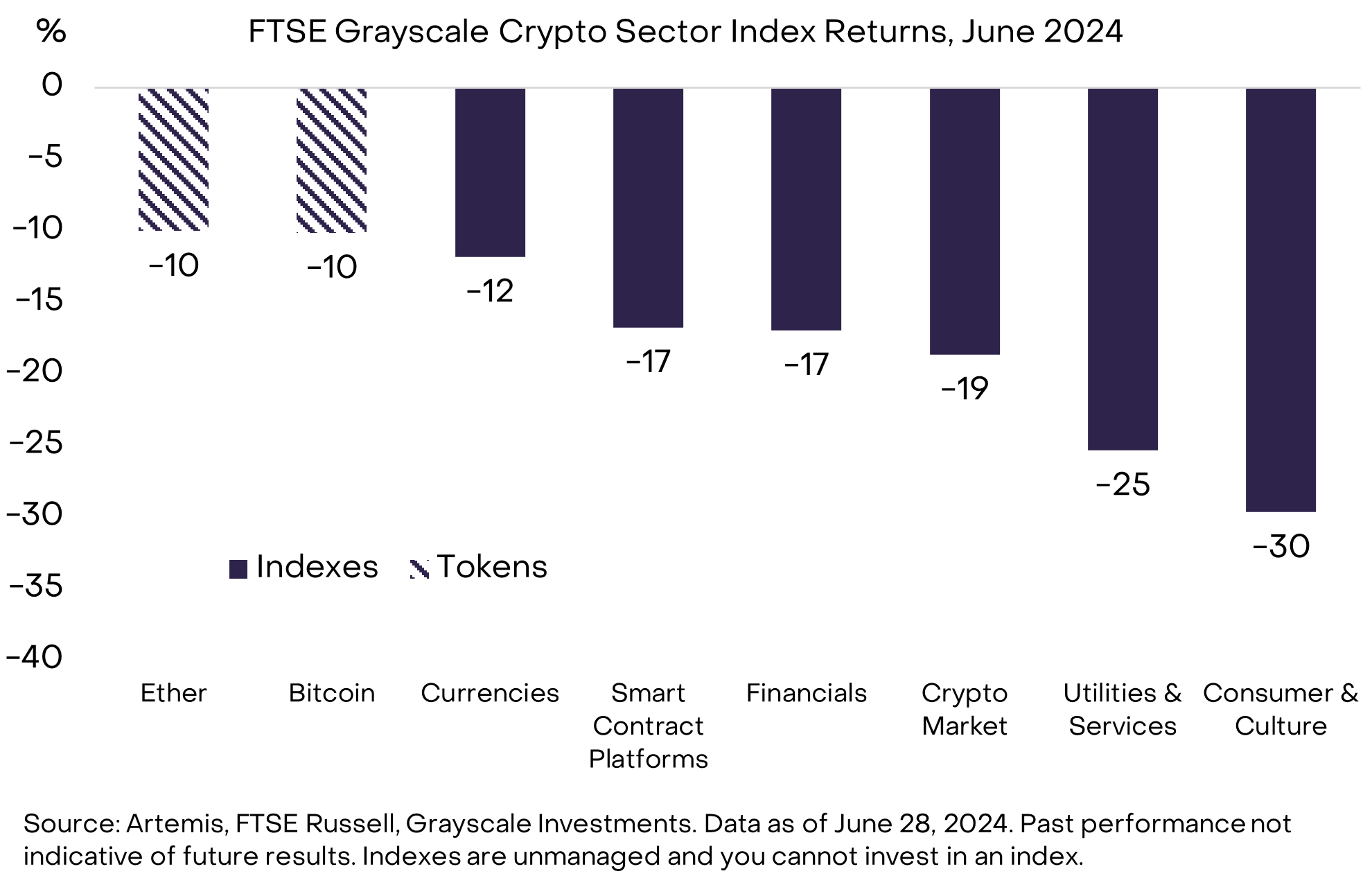

Although Bitcoin and Ether both declined last month, they both outperformed the broader crypto market, as measured by the FTSE Grayscale Crypto Sectors Index Series (Exhibit 3). Our Crypto Sectors Market Index (CSMI) — which measures the performance of digital asset markets as a whole — fell 19% in June. The worst performing market segment during the month was the Consumer & Culture Crypto Sector, due to weakness in memecoins (tokens held primarily for entertainment value and related to internet culture). The Currencies Crypto Sector, which includes Bitcoin, and Financials Crypto Sector performed comparatively better.

Exhibit 3: Broad-based decline across Crypto Sectors

Although most token prices declined in June, a notable exception was Toncoin (TON), the 3rd largest asset in our Smart Contract Platforms Crypto Sector (by market capitalization), and a component of the for the coming quarter.[12] The TON blockchain is integrated within Telegram's secure messaging app and has the potential to leverage the distribution of Telegram's 900 million monthly active users, making it an attractive platform for app developers. Spurred in part by its Open League token incentives program and Telegram games that have been rising in popularity,[13] the network has grown significantly from an average of 27,000 daily active users in January to over 400,000 daily active users in June.[14] Additionally, Tether's USDT stablecoin launched on the TON network in April 2024, achieving rapid adoption. In March, the Financial Times reported that Telegram was considering an IPO,[15] which could have implications for the value of public blockchain tokens integrated with the application, in our view.

Despite the crypto market setback in June, Grayscale Research remains optimistic about the outlook for valuations for the balance of the year. In our view, the macro backdrop remains broadly supportive for the crypto asset class, with a growing economy, potential Federal Reserve rate cuts, and buoyant equity markets. Although a U.S. recession would likely weigh on crypto markets, a period of slower but positive growth still appears to be the central scenario for the economy. Moreover, Ether ETP approval has the potential to introduce more investors to the concept of smart contracts and decentralized applications — and therefore to the potential for public blockchains to transform digital commerce.

[1] Through June 28.

[2] Source: Mt Gox Estate.

[3] Source: Arkham Intelligence. Data as of June 28, 2024.

[4] Source: Bitcoin Magazine.

[5] Source: Arkham Intelligence. Data as of June 28, 2024. Dollar valued based on Bitcoin price of $60,000.

[6] Source: Bloomberg, Grayscale Investments. Data as of June 28, 2024.

[7] Source: Glassnode. Data as of July 1, 2024. Dollar value calculated by taking the price of Bitcoin on the day it was transferred

[8] Source: CoinDesk.

[9] Source: Bloomberg, Grayscale Investments. Federal Reserve interest rate cut pricing based on Dec. 24 and 25 SOFR futures contracts. As of June 28, 2024.

[10] Source: Bloomberg.

[11] Source: CryptoSlate.

[12] The Grayscale Research Top 20 represents a diversified set of assets across Crypto Sectors that, in our view, have high potential over the coming quarter, due to a combination of (i) immediate catalysts or trending themes, (ii) favorable protocol-specific adoption trends, and (iii) low or moderate token supply inflation. Several of the assets in our Top 20 list have high price volatility and should be considered high risk. This content does not constitute a recommendation or take into account the particular investment objectives, financial situations, or needs of investors.

[13] Source: Decrypt.

[14] Source: Artemis. Data as of June 28, 2024.

[15] Source: Financial Times.