Last Updated: 8/1/2025 | 16 min. read

On July 18, President Trump signed into law the GENIUS Act,[1] new legislation that provides a comprehensive regulatory framework for stablecoins in the U.S. In a way, its enactment can be considered the "end of the beginning” for the crypto asset class: public blockchain technology is moving from an experimental phase to the center of the regulated financial system. Debate about whether blockchains can bring benefits to mainstream users is over, and regulators have pivoted toward ensuring the industry’s growth incorporates the right guardrails for consumer protection and financial stability.

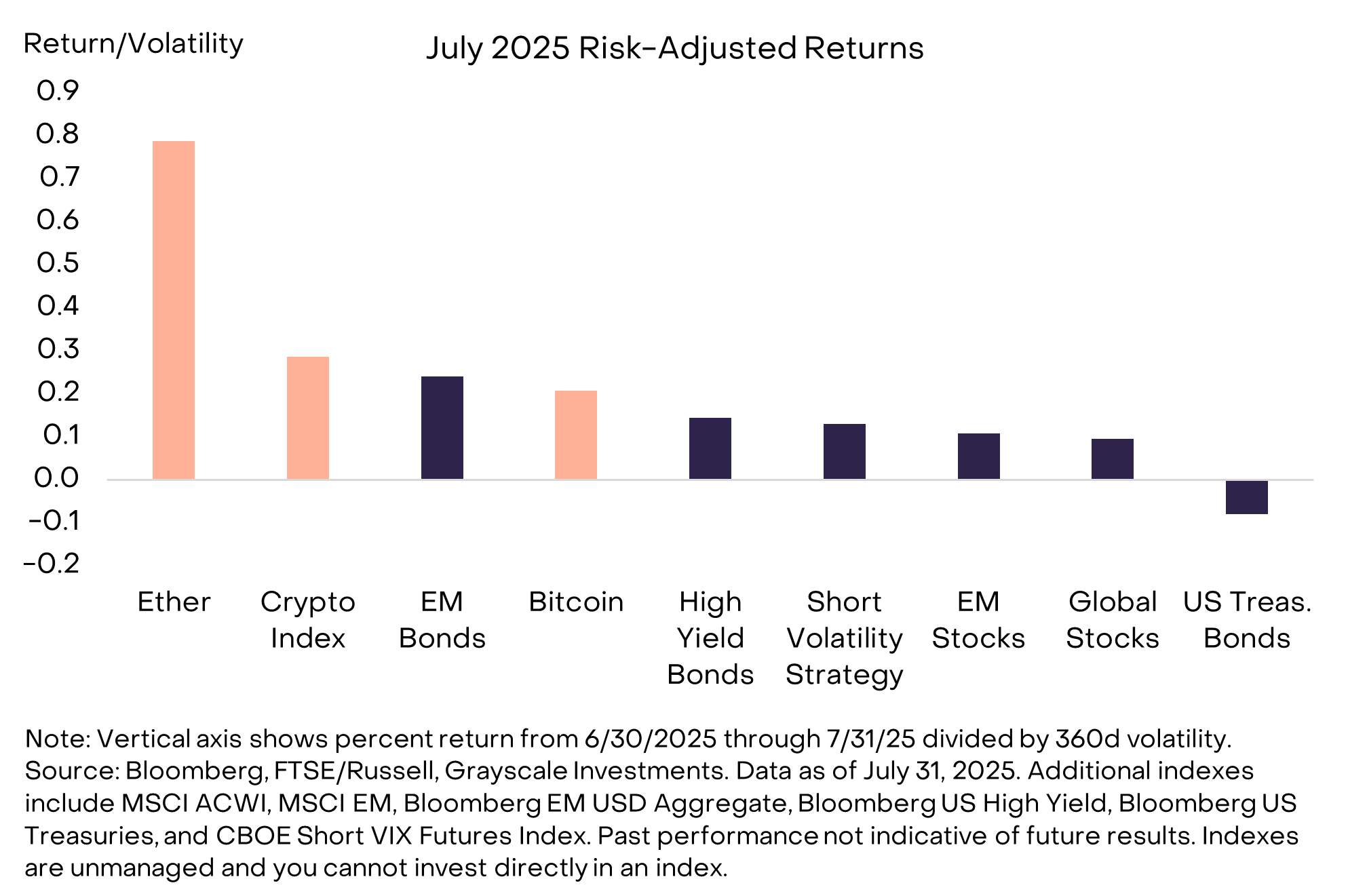

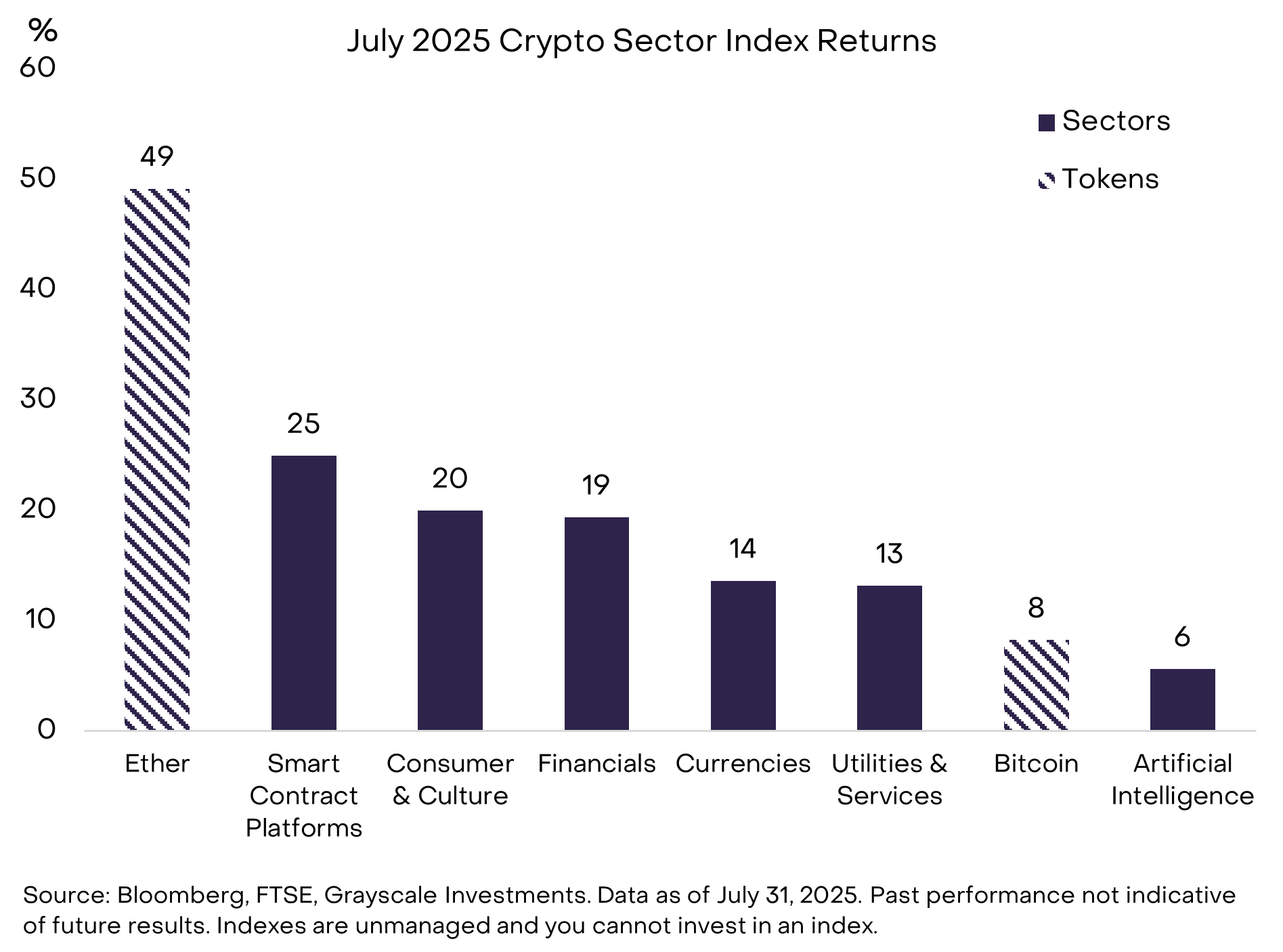

Crypto markets cheered the passage of GENIUS and were also supported by favorable macro market conditions during July. Equity indexes gained in most regions, and returns across fixed income were led by higher-risk market segments, like U.S. high-yield corporate bonds and emerging-market (EM) bonds (Exhibit 1). Strategies that benefit from declining volatility also performed well. The FTSE/Grayscale Crypto Sectors Market Index — a market cap-weighted index of investible digital assets — gained 15%, while Bitcoin’s price increased by 8%. The star performer was the Ethereum network’s Ether (ETH) token, which gained 49% in July and is up more than 150% since its low in early April.

Exhibit 1: Ether shined in a solid month for crypto assets

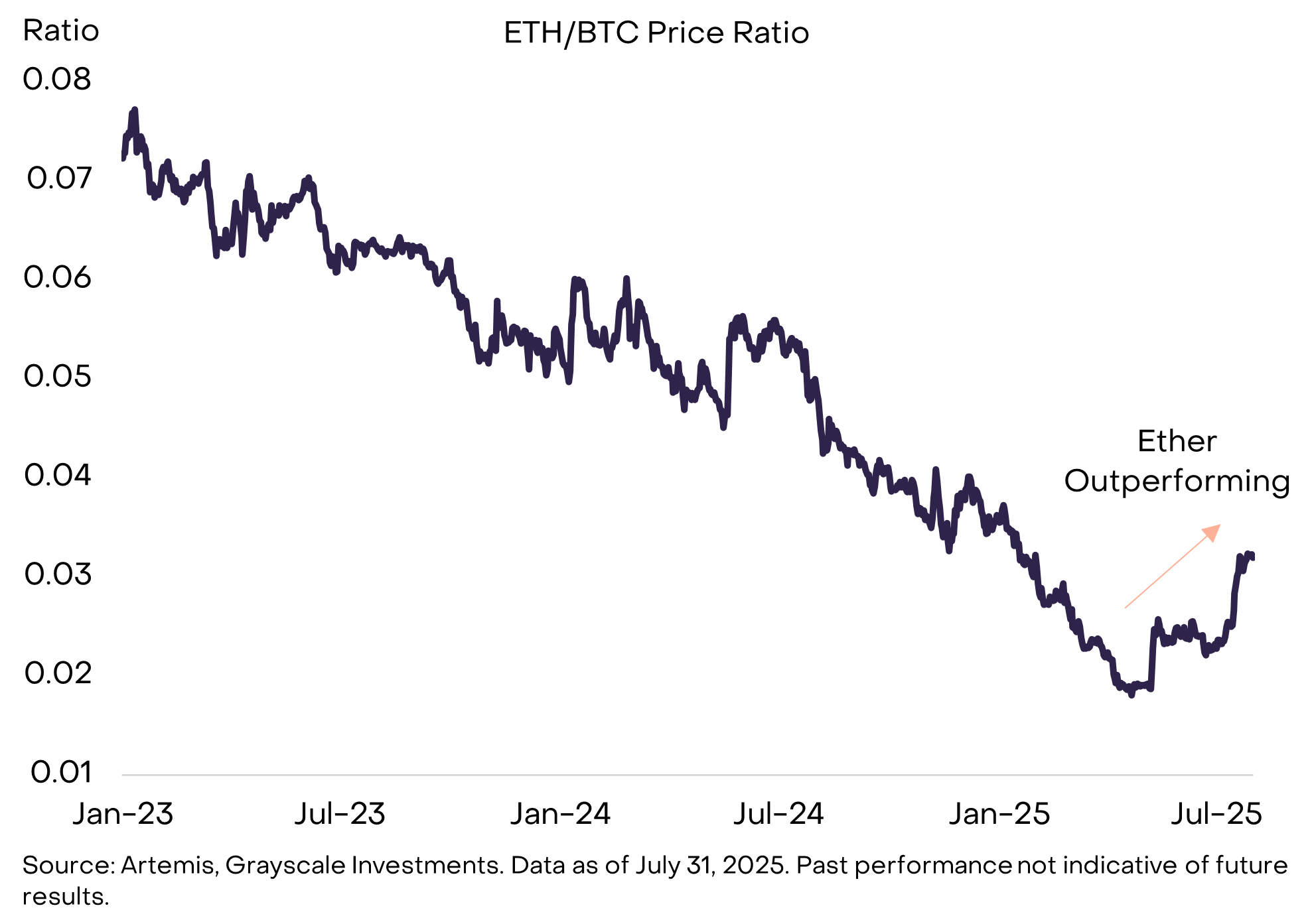

Ethereum is the largest smart contract platform by market capitalization and serves as critical infrastructure for blockchain-based finance (for more background, see Ethereum: The OG Smart Contract Blockchain). However, until recently, the price of Ether had significantly underperformed Bitcoin — as well as certain other smart contract platforms like Solana — leading to some questioning of the platform’s development strategy and its competitive position with the industry (Exhibit 2).

Exhibit 2: Ether has outperformed Bitcoin since May

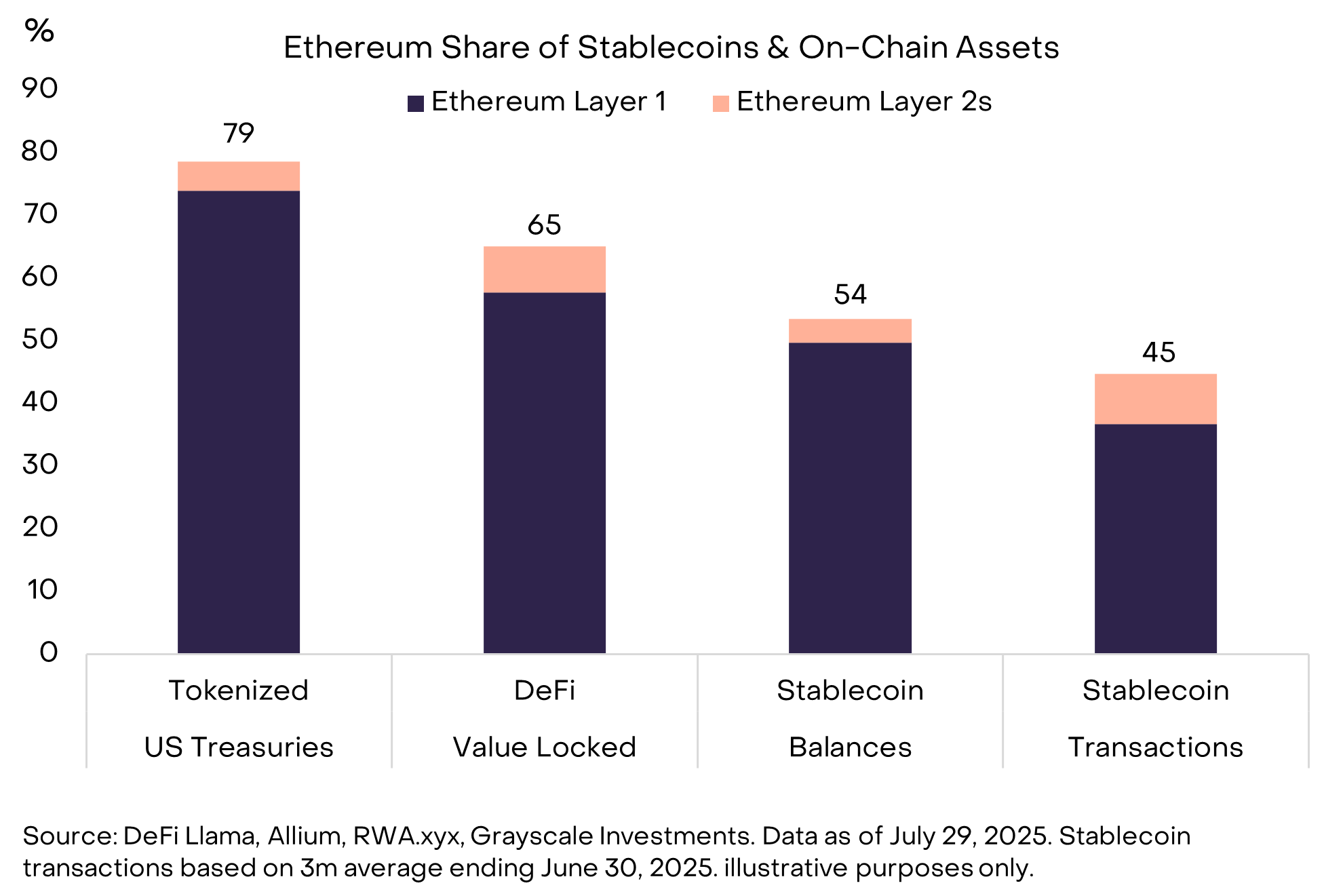

Renewed enthusiasm about Ethereum and ETH likely reflect a market focus on stablecoins, tokenization, and institutional blockchain adoption — areas where Ethereum stands apart from its peers (Exhibit 3). For example, including its Layer 2 networks, the Ethereum ecosystem hosts more than 50% of all stablecoin balances and processes about 45% of stablecoin transactions (by Dollar value). Ethereum is also home to about 65% of all value locked in decentralized finance (DeFi) protocols and almost 80% of tokenized U.S. Treasury products. For many institutions building in crypto — including Coinbase, Kraken, Robinhood, and Sony — Ethereum has been the network of choice.[2]

Exhibit 3: Ethereum is the leading blockchain for stablecoins and tokenized assets

Rising adoption of stablecoins and tokenized assets should benefit Ethereum as well as other smart contract platforms. Grayscale Research believes stablecoins can disrupt aspects of the global payment industry by offering lower costs, faster settlement times, and greater transparency (for more background, see Stablecoins and the Future of Payments). There are two types of stablecoin-related revenues at stake: the net interest margin (NIM) earned by stablecoin issuers (e.g., Tether, Circle) and the transaction fees earned by the blockchains that process the transactions. Because it already leads in stablecoins, the Ethereum ecosystem seems likely to benefit from rising stablecoin adoption through higher transaction fees.

The same goes for tokenization, which is the process of bringing traditional assets on-chain (for more background, see Public Blockchains and the Tokenization Revolution). The market for tokenized assets today is tiny (~$12 billion in total)[3] but it may be poised for growth. Tokenized U.S. Treasuries are the largest category of tokenized assets today, and Ethereum is the market leader. In alternative assets, Apollo Global recently launched an on-chain credit fund in partnership with Securitize.[4] A smaller but growing segment is tokenized equities: Robinhood introduced tokenized shares of private companies like SpaceX and OpenAI, and eToro announced plans to tokenize stocks on Ethereum.[5] The Apollo product is available on several blockchains whereas the tokenized equity products from Robinhood and eToro will be offered within the Ethereum ecosystem.

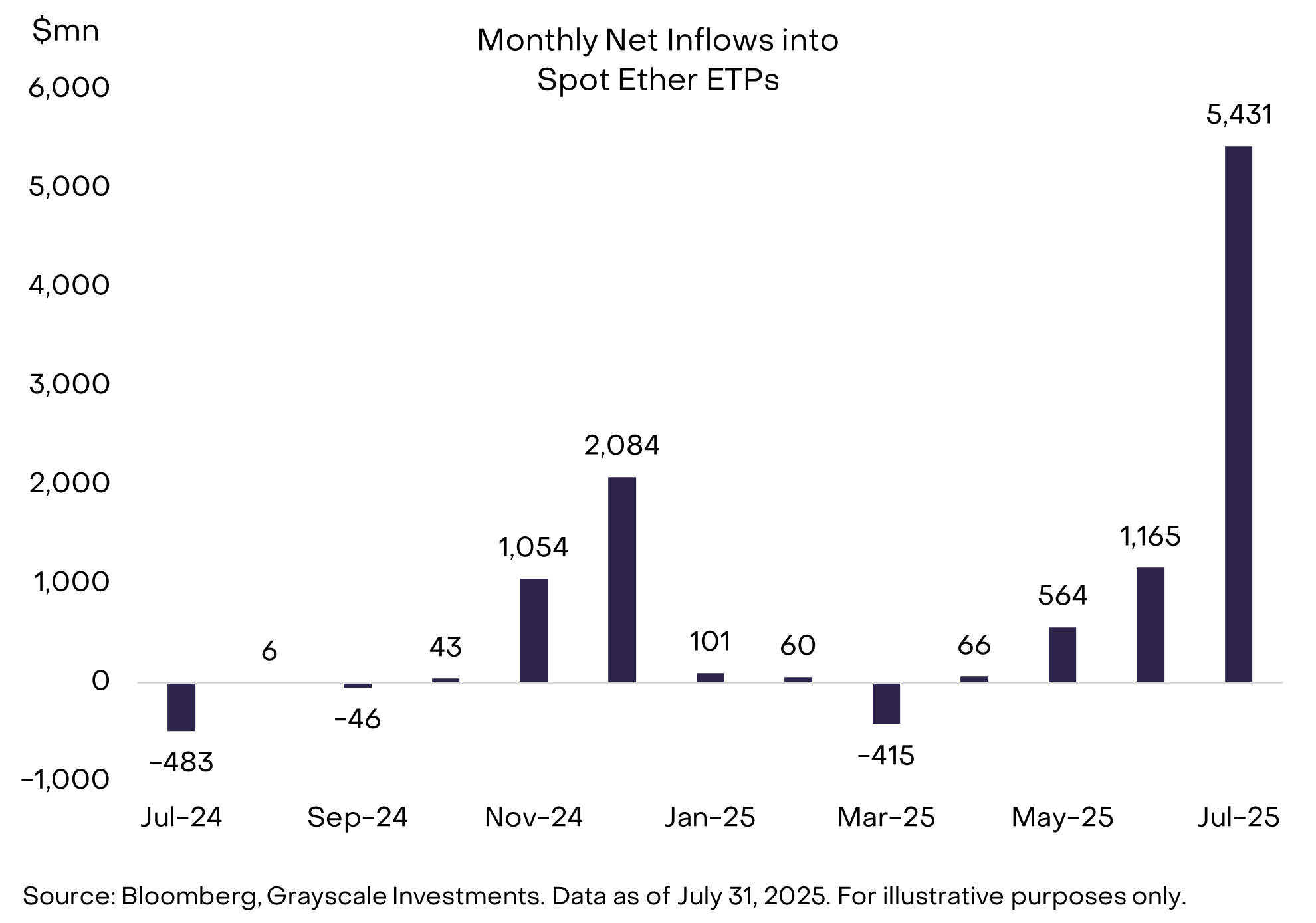

Investor interest in Ethereum resulted in meaningful net inflows into spot ETH exchange-traded products (ETPs). For the month of July, U.S.-listed spot ETH ETPs saw net inflows of $5.4 billion — by far the largest month for net inflow since these products launched last year (Exhibit 4). The ETH ETPs now hold about $21.5 billion or nearly six million Ether — about 5% of the total circulating supply. Based on data from CFTC’s Commitment of Traders Report, we estimate that only $1 billion to $2 billion of net inflows into Ether ETPs reflects the hedge fund “basis trade,” and the remainder reflects long-only capital.[6]

Exhibit 4: Net inflows into Ether ETPs exceeded $5 billion

Several public companies have also begun accumulating ETH to provide access to the token through an equity instrument. The two largest “crypto treasury corporation” holders of ETH are Bitmine Emersion Technologies ($BMNR) and SharpLink Gaming ($SBET). Combined these two firms hold more than 1 million ETH, worth a total of $3.9 billion.[7] A third public company, BTCS ($BTCS), said in late July that it planned to raise $2 billion for additional ETH purchases by issuing common and preferred stock (BTCS currently holds ~70,000 ETH worth ~$250 million today).[8] Buying pressure from Ethereum corporate treasury companies likely contributed to the rise in price, in addition to the net inflows into the ETH ETP products.

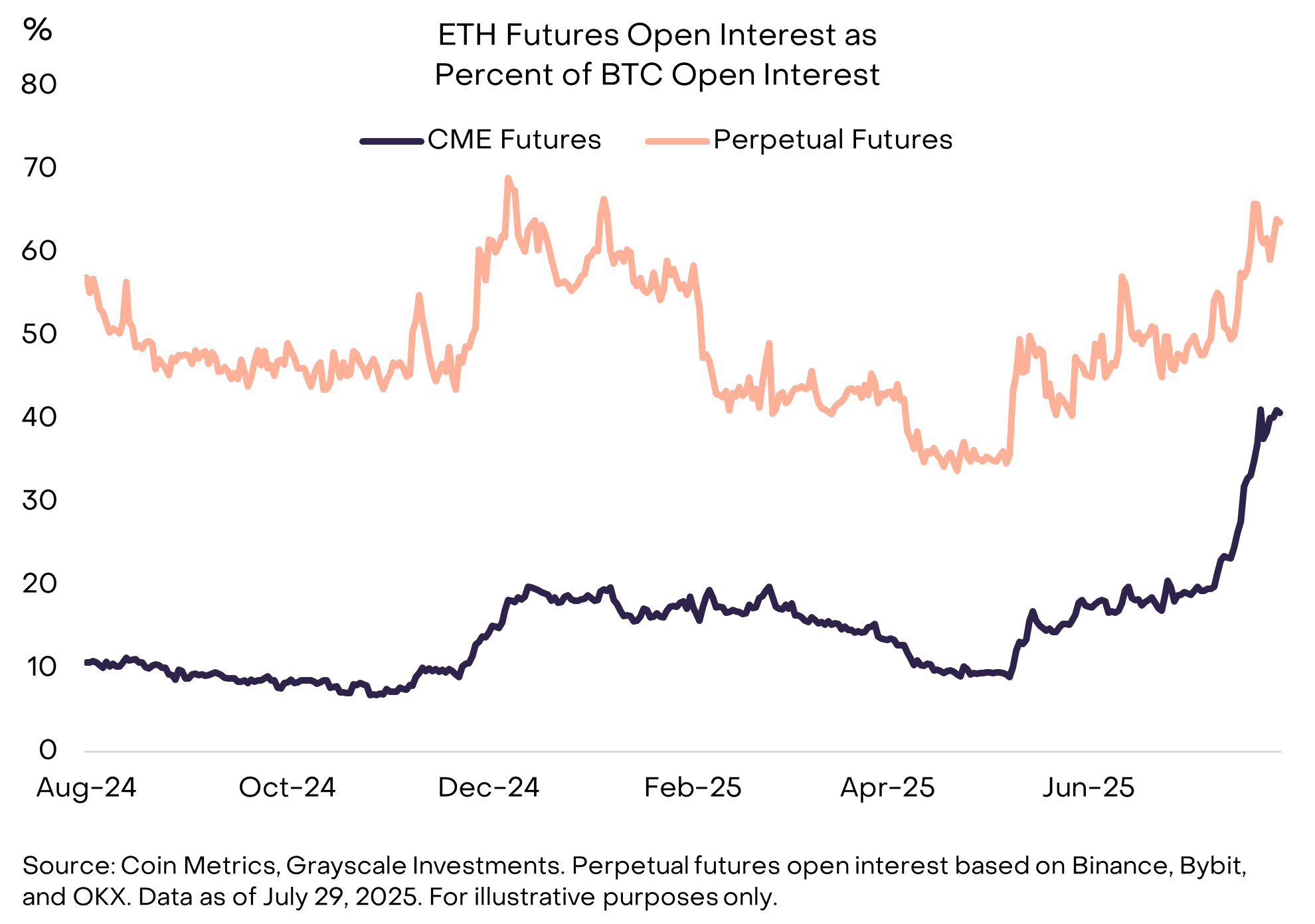

Separately, Ethereum gained market share in crypto derivative markets during the month, suggesting rising speculative interest in the asset. For traditional futures listed on the Chicago Mercantile Exchange (CME), open interest (OI) for ETH futures increased to about 40% of Bitcoin (BTC) futures OI (Exhibit X). For perpetual futures contracts, ETH OI increased to about 65% of BTC OI. Ether perpetual futures also saw greater trading volume than Bitcoin perpetual futures during the month.

Exhibit 5: Increase in open interest for ETH futures

Although Ether was in the spotlight for much of July, Bitcoin investment products also continued to see steady investor demand. The U.S.-listed spot Bitcoin ETPs experienced net inflows of $6 billion and now hold an estimated 1.3 million BTC. A variety of public companies also expanded their Bitcoin treasury strategies. Market leader Strategy (formerly MicroStrategy) issued $2.5 billion of a new type of preferred stock to purchase additional Bitcoin.[9] Separately, early Bitcoin pioneer and Blockstream CEO Adam Back announced a new Bitcoin treasury strategy corporation — the Bitcoin Standard Treasury Company ($BSTR). The vehicle will be capitalized with Bitcoin from Back and other early adopters and will also raise equity capital. The BSTR transaction closely resembled an earlier SPAC (special purpose acquisition company) deal organized by Cantor Fitzgerald for Twenty One Capital — another large Bitcoin treasury strategy corporation backed by Tether and Softbank.[10]

Valuations increased across all crypto market segments in July. From a Crypto Sectors standpoint, the best-performing market segment was Smart Contracts — helped by the 49% increase in ETH — and the worst-performing market segment was Artificial Intelligence — held back by idiosyncratic weakness in a few tokens (Exhibit 6). Futures open interest and funding rates (the cost of financing leveraged long positions) increased for many crypto assets during July, suggesting higher investor risk appetite and speculative net length.

Exhibit 6: All crypto market segments gained in July

After a period of strong returns, there is always a risk of some pullback in valuations or a period of consolidation. The passage of the GENIUS Act was a major positive catalyst for the crypto asset class, which warranted strong absolute and risk-adjusted returns. Congress is also considering crypto market structure legislation, and the version from the House of Representatives, known as the CLARITY Act, passed that chamber with bipartisan support on July 17.[11] However, the Senate is considering its own version of market structure legislation, and little progress is expected before September. As a result, there will likely be fewer legislative catalysts to support higher crypto valuations over the short term.

Nonetheless, we continue to see a very bright outlook for the asset class over the coming months. First, regulatory tailwinds can continue even without legislation. For example, the White House recently released a detailed report on digital assets, which included 94 specific recommendations to support the development of the industry in the U.S. Of that total, 60 recommendations are under the jurisdiction of a regulatory agency (the remaining 34 require action from Congress or both Congress and regulators). Enhancements to crypto investment products — like staking and/or a wider range of spot crypto ETPs — can be facilitated by regulators and may bring new capital into the asset class.[12]

Second, we expect that macro backdrop to remain favorable for crypto assets, which provide exposure to blockchain innovation while also being insulated from certain risks to traditional assets. In addition to passing crypto-related legislation in July, President Trump also signed into law the One Big Beautiful Bill Act, which locks in large federal government budget deficits for the next decade. The president has also made clear his desire for the Federal Reserve to lower interest rates, has emphasized that a weaker Dollar would benefit American manufacturers, and has raised tariffs on a variety of products and trading partners. Large budget deficits and lower real interest rates may continue to weigh on the value of the Dollar, especially if implicitly endorsed by the White House. Scarce digital commodities like Bitcoin and Ether may benefit from this environment and could act as a partial hedge in portfolios that are at risk from sustained Dollar weakness.

Index Definitions: The MSCI ACWI captures large and mid cap representation across 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries.The MSCI Emerging Markets Index is designed to measure the financial performance of companies in fast-growing economies around the world and tracks mid-cap and large-cap stocks in 25 countries. The Bloomberg Emerging Markets USD Aggregate Bond Index is a flagship hard currency Emerging Markets debt benchmark that includes fixed and floating-rate US dollar-denominated debt issued from sovereign, quasi-sovereign, and corporate EM issuers. The Bloomberg-Barclays US High Yield Index measures the return of non-investment grade corporate bonds. The Bloomberg-Barclays US Treasury Index measures the total returns of nominal US government notes and bonds with greater than one year remaining maturity. FTSE/Grayscale Crypto Sectors Total Market Index measures the price return of digital assets listed on major global exchanges. The FTSE Grayscale Smart Contract Platforms Crypto Sector Index was developed to measure the performance of crypto assets that serve as the baseline platforms, upon which self-executing contracts are developed and deployed. The FTSE Grayscale Utilities and Services Crypto Sector Index was developed to measure the performance of crypto assets that aim to deliver practical and enterprise-level applications and functionalities. The FTSE Grayscale Consumer and Culture Crypto Sector Index was developed to measure the performance of crypto assets that support consumption-centric activities across a variety of goods and services. The FTSE Grayscale Currencies Crypto Sector Index was developed to measure the performance of crypto assets that serve at least one of three fundamental roles: store of value, medium of exchange, and unit of account. The FTSE Grayscale Financials Crypto Sector Index was developed to measure the performance of crypto assets that seek to deliver financial transactions and services. The Cboe Short VIX Futures Index represents a theoretical portfolio that continuously shorts a combination of near-term VIX futures contracts.

[1] Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act.

[2] L2 BEAT, Unchained, and Sony. Each are building Layer 2s on Ethereum.

[3] Source: RWA.xyz. Data as of 7.31.25

[4] Source: Securitize

[6] Source: Grayscale Research estimate based on data from Bloomberg and CFTC. The “basis trade” involves entering a long position in crypto spot products (e.g. ETPs) and a short position in crypto futures. This structure benefits from small differences in prices. Data as of July 31, 2025.

[7] Source: strategicethreserve.zyx. Data as of July 31, 2025.

[11] Source: Cointelegraph

[12] Outside the U.S. policy momentum is also tangible. For example, Hong Kong will switch on its Stablecoin Ordinance on 1 August 2025, giving fiat-pegged token issuers a clear HKMA licensing route.