Last Updated: 6/2/2025 | 15 min. read

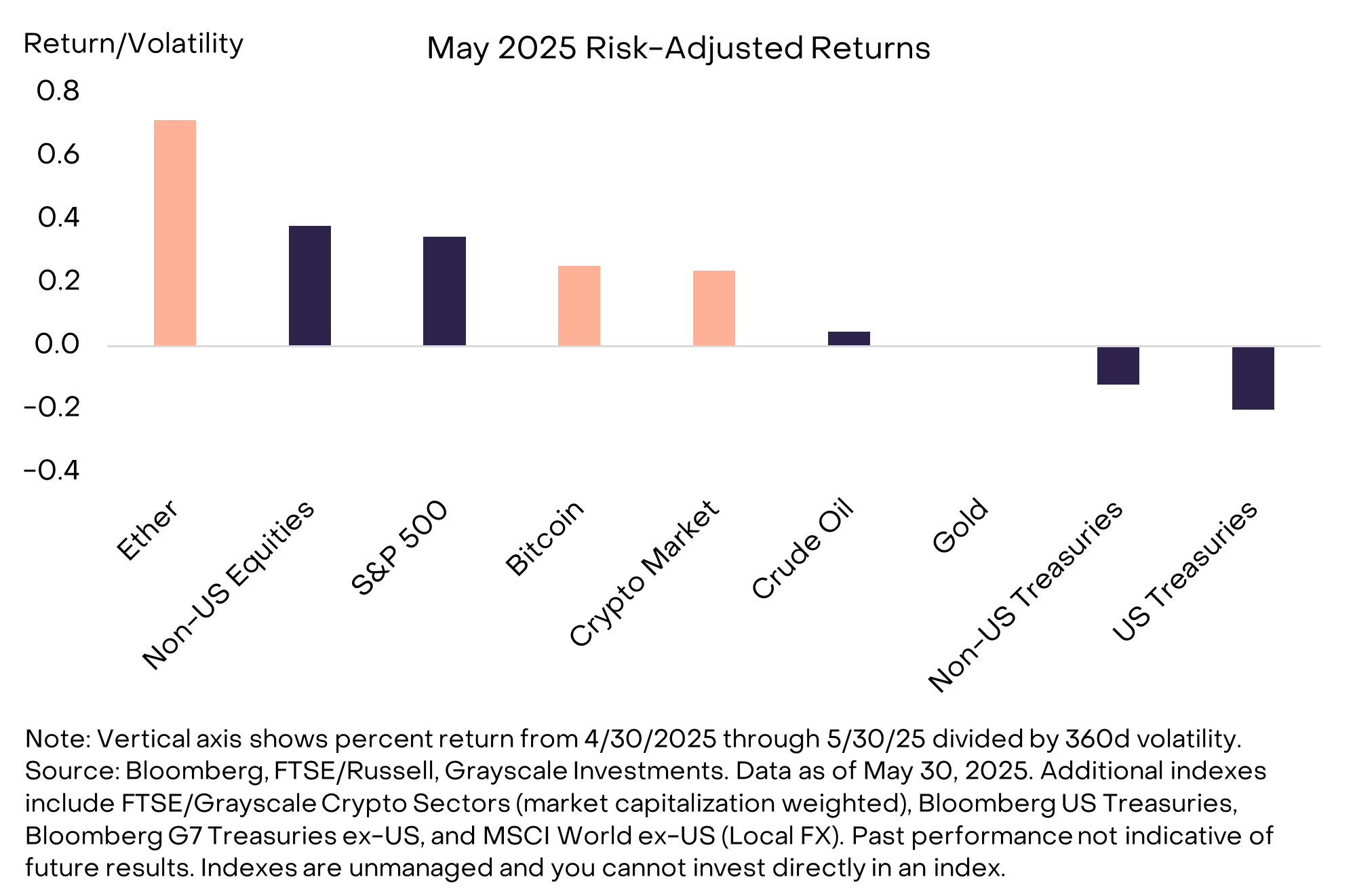

Equity markets recovered in May after the U.S. and China agreed to a temporary détente in the tariff conflict. However, the gains in May followed declines over the prior three months and the S&P 500 remains about 4% below its high.[1] In contrast to healthier equity market conditions, bond markets saw negative returns (in higher quality market segments), seemingly due to high government deficits and the corresponding heavy issuance of long-maturity government bonds. Bitcoin and the crypto asset class as a whole — based on the market-cap weighted FTSE Grayscale Crypto Sectors index — delivered risk-adjusted returns comparable to global equities (Exhibit 1). Bitcoin gained 11% and reached a new all-time high of $112k during the month. Ether, the native token of the Ethereum blockchain, appreciated 44%, clawing back some earlier underperformance versus Bitcoin.[2]

Exhibit 1: Crypto market kept pace with equities on risk-adjusted basis

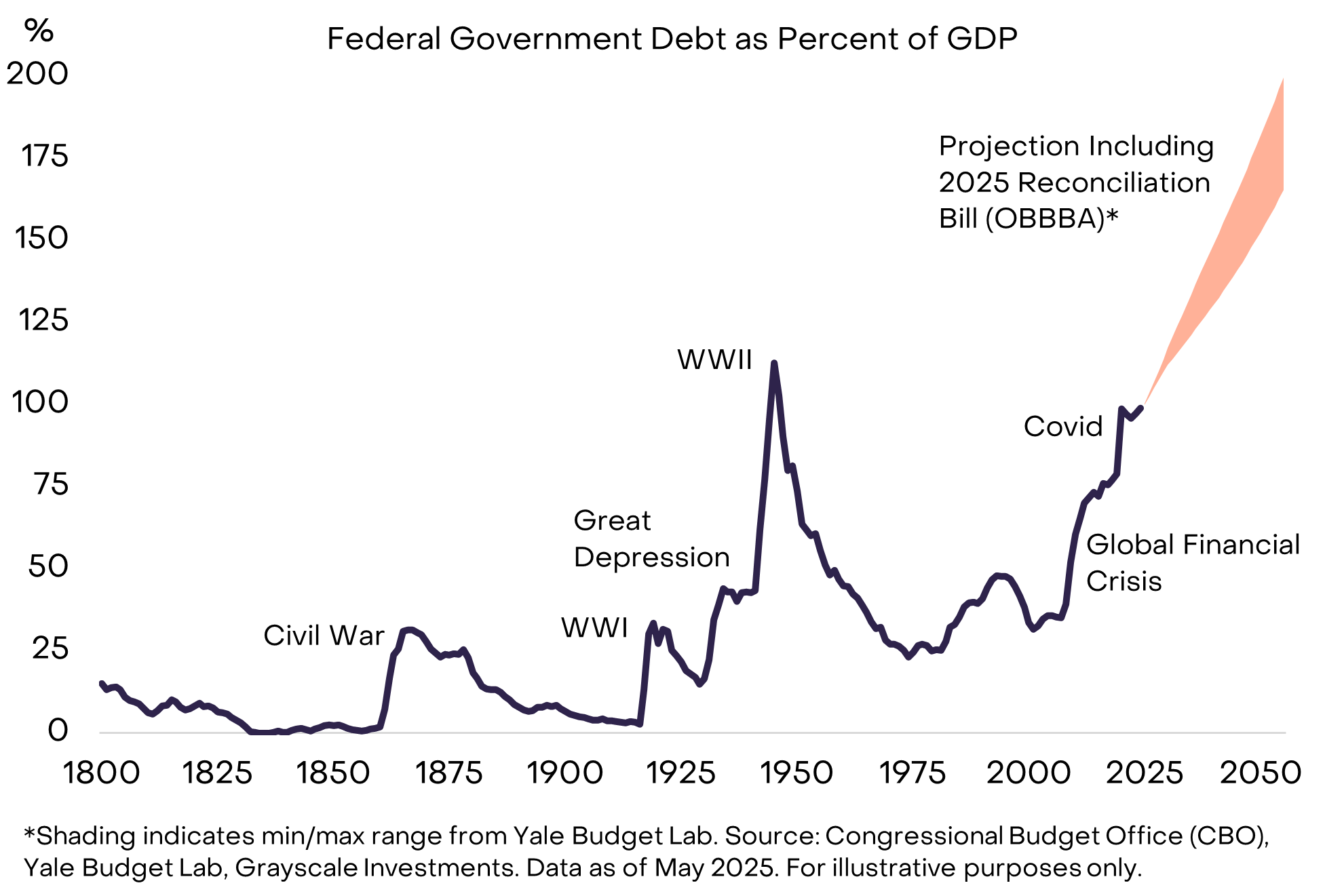

Demand for Bitcoin tends to rise when investors become concerned about the credibility of fiat money systems. And during the month of May, these concerns were again in the spotlight. On May 22, the U.S. House of Representatives passed the comprehensive tax and spending legislation now officially known as the “One Big Beautiful Bill Act” (OBBBA). Budget experts estimate that the legislation as written would add about $3 trillion to the federal deficit over the next 10 years, and possibly as much as $5 trillion if certain expiring provisions were to be extended.[3] If the bill becomes law, the resulting mix of revenues and spending would keep the U.S. national debt on an unsustainable path (Exhibit 2). Partly due to the direction of U.S. fiscal policy, Moody’s downgraded the U.S. sovereign credit rating to double-A from triple-A on May 16.[4] The U.S. government is not close to default, but the unsustainable debt path increases the risk of macro mismanagement over time and increases investor interest in non-sovereign stores of value like gold and Bitcoin.

Exhibit 2: “Big Beautiful Bill” keeps U.S. on unsustainable fiscal path

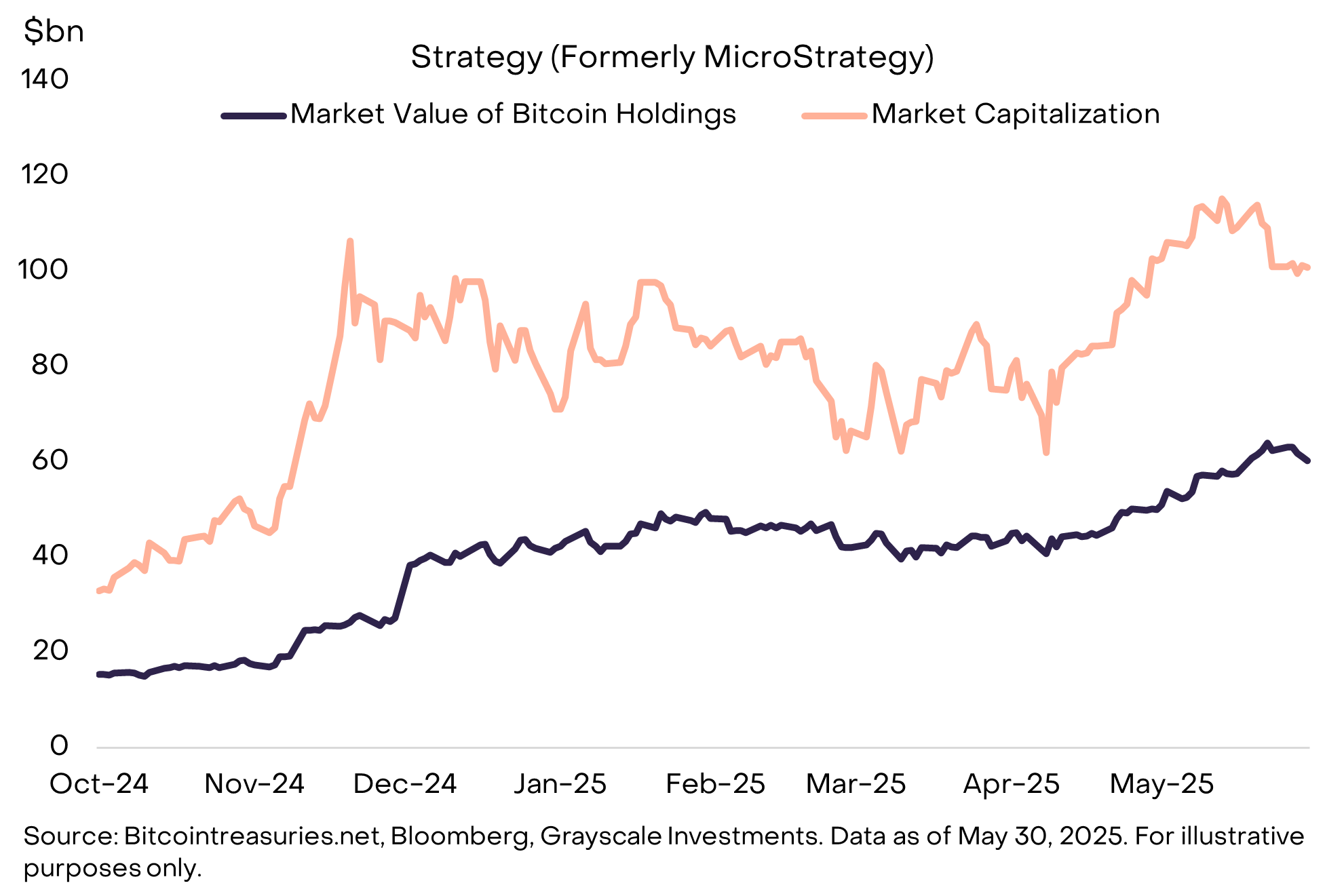

The U.S.-listed spot ETPs have arguably been the single most important source of new demand for Bitcoin since they launched. These products continued to see elevated net inflows during May, totaling $5.2bn[5]. In the coming months, the volume of Bitcoin purchases from the spot Bitcoin ETPs could potentially be matched or exceeded by purchases from “Bitcoin treasury” corporations — i.e., public companies purchasing Bitcoin for their balance sheet. Strategy (formerly MicroStrategy), which pioneered corporate Bitcoin investing, purchased an additional ~27k Bitcoin (~$2.8bn) in May.[6] Strategy’s market cap is well in excess of the value of the Bitcoin on its balance sheet, indicating excess demand for Bitcoin exposure in the form of an equity instrument (Exhibit 3).

Exhibit 3: Strategy valued at premium to its Bitcoin holdings

Because equity markets will pay a premium for Bitcoin in this structure, more firms are pursuing the strategy, and some have expanded it beyond Bitcoin to other digital assets. For example, a consortium including Tether, Bitfinex, and SoftBank created Twenty One Capital, which will initially hold 42,000 Bitcoin (~$4.4bn), mostly provided by Tether.[7] Similarly, Bitcoin Magazine CEO David Bailey has converted an existing public company, KindlyMD, into a Bitcoin treasury company under the name Nakamoto Holdings. The firm intends to issue about $700mn in equity and convertible bonds in the U.S. market to purchase Bitcoin, then plans to repeat the strategy in other countries around the world.[8] Lastly, Trump Media & Technology Group, the holding company behind the president’s Truth Social app, announced that it would raise $2.5bn to purchase Bitcoin for its balance sheet.[9]

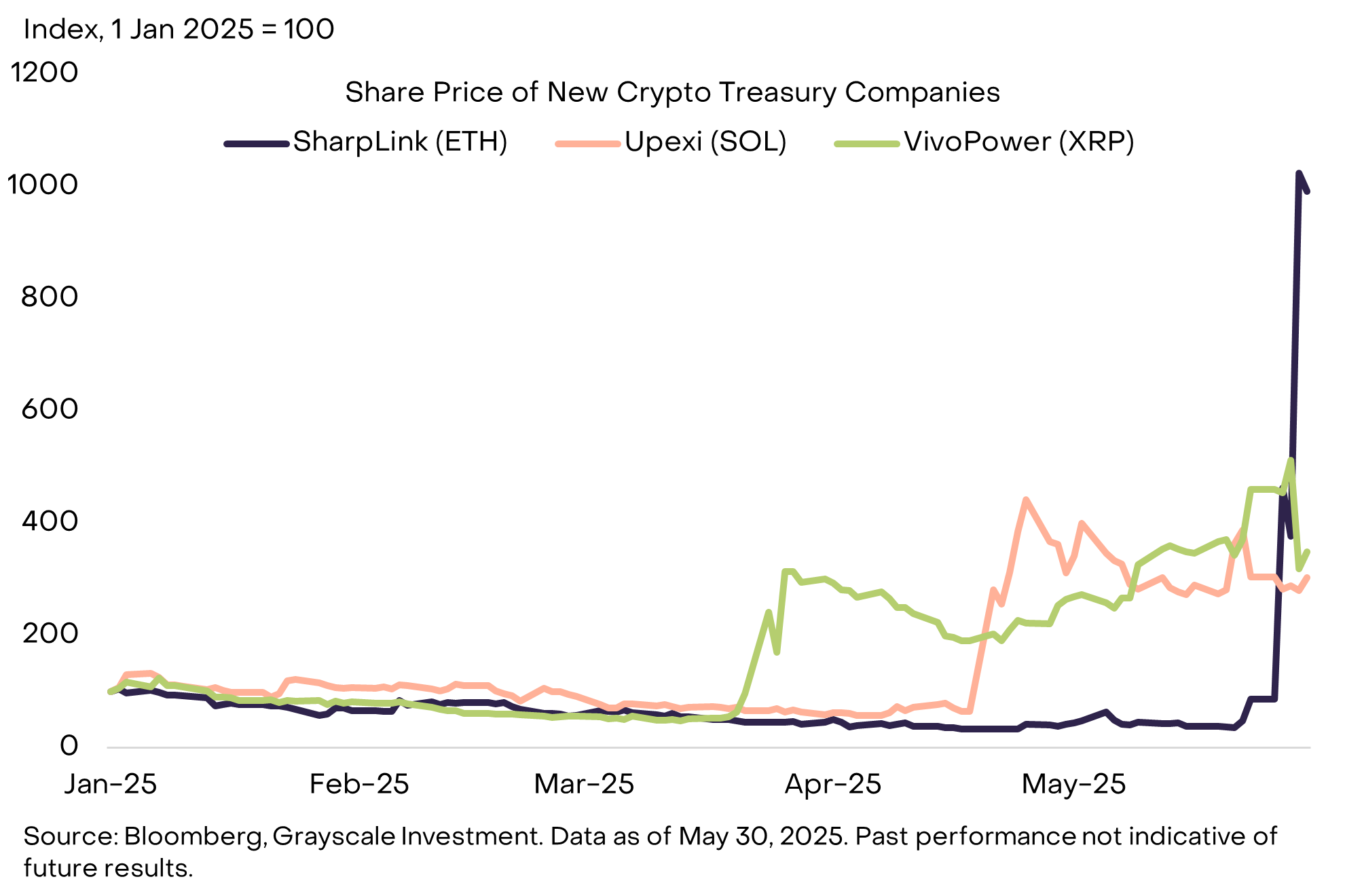

Beyond Bitcoin, SharpLink Gaming said that it would become an Ether treasury company, with support from Consensys and a variety of other crypto-focused investors (Exhibit 4).[10] Other entrepreneurs have taken the model further, creating crypto treasury companies for Solana (Upexi), XRP (VivoPower), and even the Trump memecoin (Freight Technologies).[11] It’s clear from the proliferation of crypto treasury corporations that there is significant investor interest in crypto exposures that are listed and traded on a stock exchange. However, demand for crypto treasury corporations may ultimately be limited by the availability of spot crypto ETPs, which more efficiently track the underlying token price.

Exhibit 4: Proliferation of crypto treasury corporations

On the legislative front, the White House and Congress continued to make progress on legislation governing the regulation of digital assets in the United States. On May 5, the House Financial Services Committee and the House Agricultural Committee released a draft of the digital asset market structure bill — a comprehensive piece of financial services legislation comparable in scope to Dodd-Frank or Sarbanes-Oxley.[12] The House plans a hearing on updated draft legislation on June 4.[13] Separately, the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) cleared a Senate cloture vote on May 19 with bipartisan support. The bill will now go through an amendment process. Although both pieces of legislation have many further steps before becoming law, the progress to date and bipartisan support are encouraging signs for eventual passage.

Since the U.S. elections in November, the potential for clearer crypto regulation seems to have catalyzed an increase in institutional investment in the industry (for more details, see March 2025: Institutional Chain Reaction). The trend continued in May with a number of major transactions and/or changes in policy. Most importantly, Coinbase acquired crypto options specialist Deribit for $2.9bn, the largest M&A deal in the industry’s history.[14] Coinbase also joined the S&P 500 during the month and today ranks number 187.[15] Coinbase competitor Kraken — which has also been active in M&A — announced in May that it will begin offering tokenized equities in non-U.S. markets, while Robinhood said it will acquire Canadian crypto platform WonderFi.[16] Other notable institutional developments include the disclosure that Brown University has established a position in the Bitcoin ETPs, passage of legislation in New Hampshire allowing the state to invest in crypto in public funds, and the reporting that Morgan Stanley would bring crypto trading to its E-Trade product.[17]

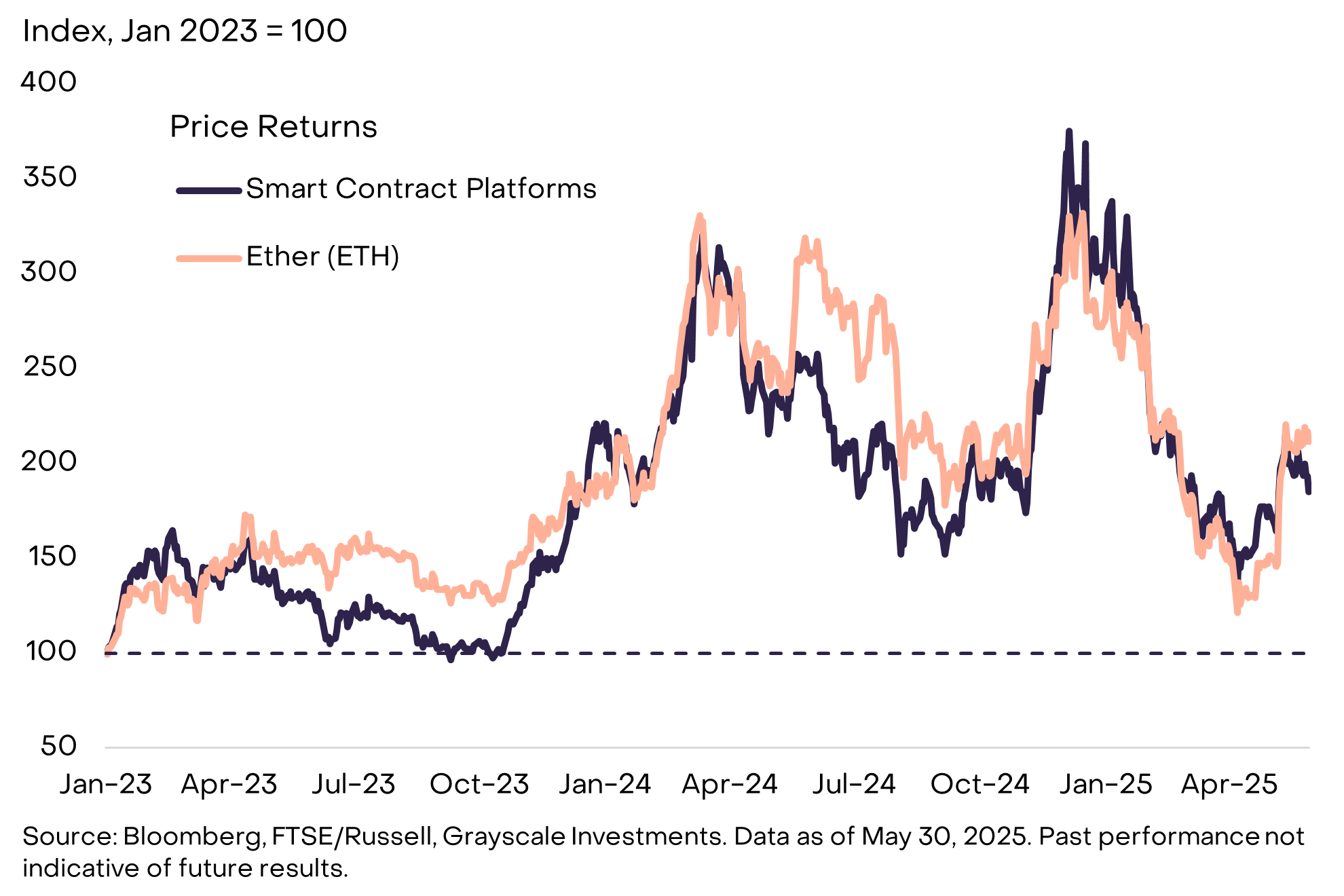

Ether (ETH) significantly outperformed Bitcoin during May, but this partly reflects timing: since the start of 2023, ETH has performed broadly in line with the Smart Contract Platforms Crypto Sector (Exhibit 5). We expect that smart contract platforms will benefit from U.S. regulatory changes, which should result in broader adoption of stablecoins, tokenized assets, and decentralized finance — all of which depend on smart contract platform infrastructure. Although this is a competitive crypto market segment, Ethereum has certain advantages, including a large amount of on-chain capital, and a culture that prioritizes decentralization, network security, and neutrality (for more detail, see Ethereum: The OG Smart Contract Blockchain). The ETH token price, however, would benefit from more activity on the Ethereum Layer 1, rather than on the constellation of Layer 2 networks. The Pectra upgrade in May brought some helpful changes but will not immediately increase Layer 1 activity.

Exhibit 5: Ether has performed broadly in line with its Crypto Sector

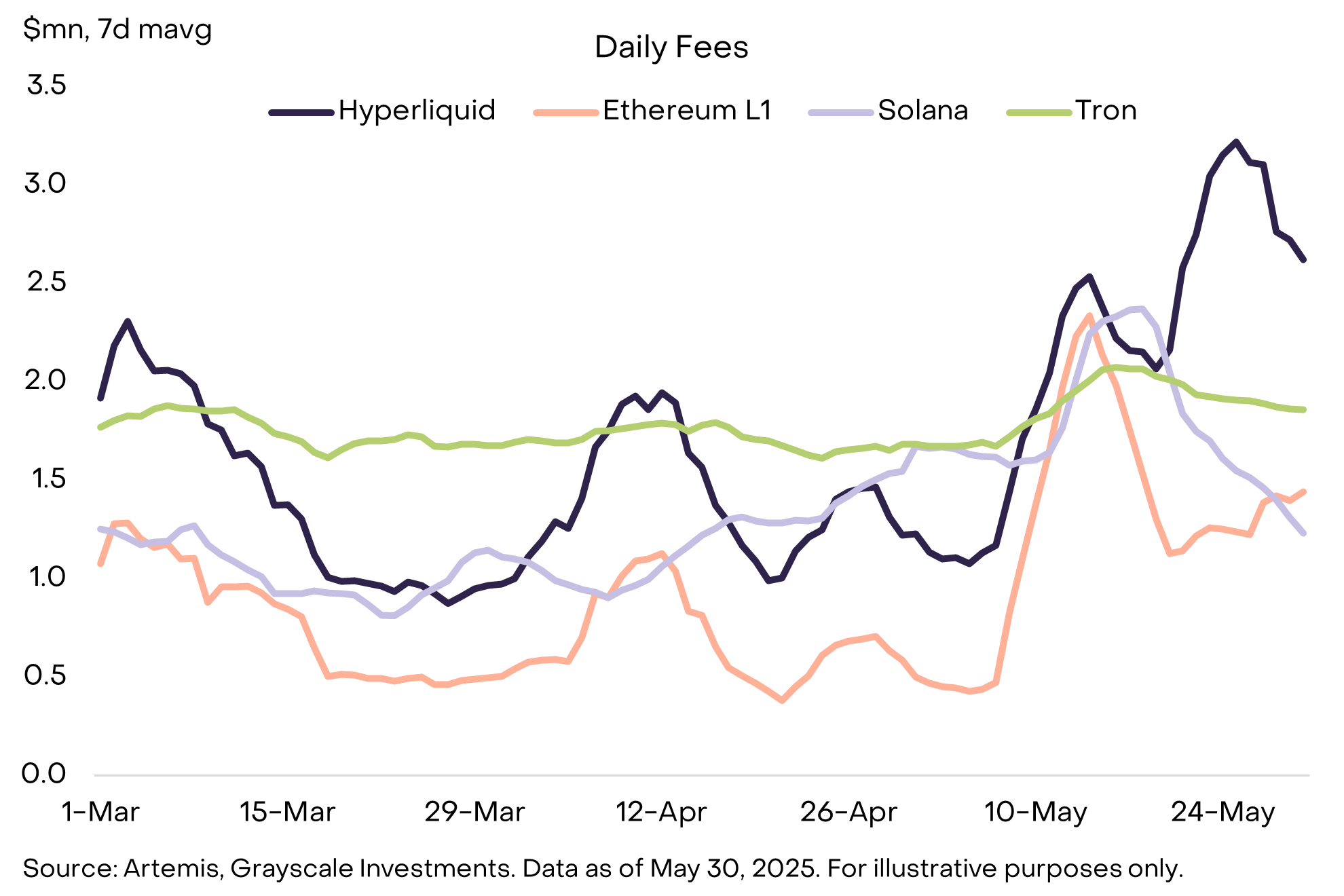

Although ETH had a strong month, the standout performer among large-cap assets (greater than $5bn in market cap) was Hyperliquid’s HYPE token. Hyperliquid is a decentralized exchange (DEX) specializing in perpetual futures (perps) as well as a general-purpose smart contract platform. The chain’s Hypercore product now commands over 80% of on-chain perps trading volume. During the month of May, Hypercore surpassed $17 billion in perps trading volume and, toward the end of the month, its daily revenue outpaced the three largest smart contract platforms (by fee revenue) — Ethereum, Tron, and Solana (Exhibit 6). Last year the protocol famously distributed the largest airdrop in crypto history — over $8bn at current prices — prompting industry-wide reconsideration of tokenomics and funding models in the absence of venture-capital backing. Hyperliquid has seen consistently high organic usage and robust liquidity and should increasingly compete with centralized derivative exchanges like Binance and Bybit.

Exhibit 6: Hyperliquid fees outpacing largest smart contract platforms

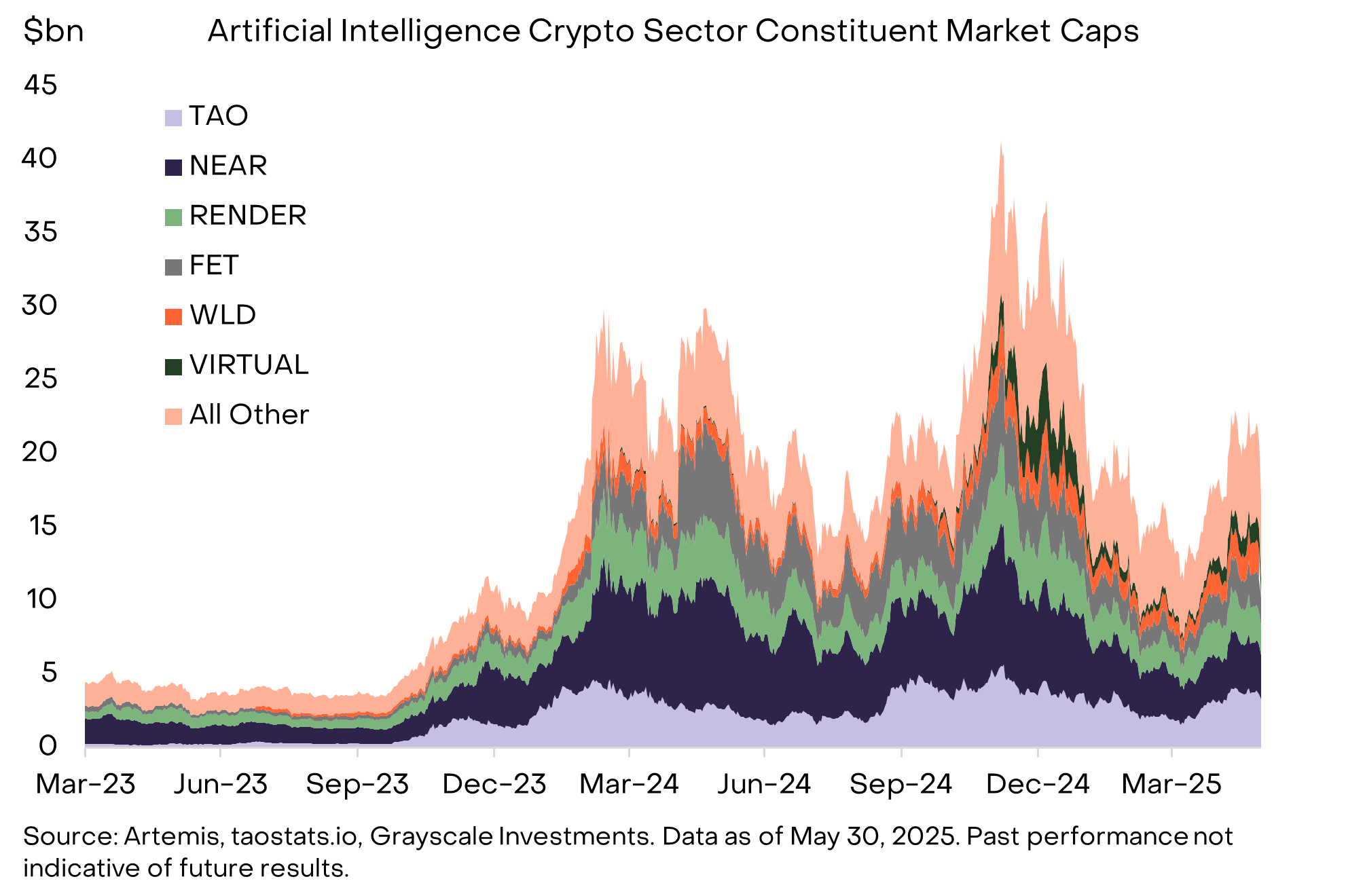

Reflecting the rapid development of blockchain-based AI technologies, Grayscale Research recently introduced the Artificial Intelligence Crypto Sector, a sixth distinct market segment in our Crypto Sectors framework (for more details, see Introducing the Artificial Intelligence Crypto Sector). Today the Artificial Intelligence Crypto Sector includes 20 tokens with an aggregate market capitalization of around $20bn (Exhibit 7).

Exhibit 7: Artificial Intelligence Crypto Sector now ~$20bn market cap

One project in this sector with notable recent developments is Worldcoin, an identity network founded by Sam Altman that aims to establish “proof of personhood,” a solution to the rising challenge of distinguishing real humans from bots in the age of AI. This month, Worldcoin announced a major milestone: a $135 million funding round, structured as an open market purchase of WLD tokens by a16z and Bain Capital Crypto.[18] The project made headlines with its expansion into the U.S. market, marked by a Time magazine cover story and the rollout of its iris-scanning orbs and World App crypto wallet. Other notable developments related to blockchain-based AI include increased interest in Bittensor subnets[19], and Tether, a leading stablecoin issuer, revealed plans to launch an AI agent network built on crypto-native rails.[20]

In the months ahead, crypto markets are likely to be driven by many of the same trends: macro demand for Bitcoin in the context of stagflation risks and tariff uncertainty, an improving regulatory environment in the United States and overseas, and innovations in blockchain-based AI and other areas. The asset class has performed well over the 2+ years and continues to have support from improving fundamentals.

Index Definitions: The Bloomberg-Barclays US Treasury Index measures the total returns of nominal US government notes and bonds with greater than one year remaining maturity. The FTSE/Grayscale Crypto Sectors family of indexes measure the price return of digital assets listed on major global exchanges. The Bloomberg G7 Treasuries ex-US Index measures the performance of local-currency-denominated sovereign debt issued by the governments of the G7 countries, excluding the United States. The MSCI World ex USA Index (Local FX) captures large- and mid-cap equity performance across developed markets, excluding the United States, with returns measured in each country’s local currency (not USD-hedged). The S&P 500 Index is a market-capitalization-weighted index that measures the performance of 500 of the largest publicly traded companies in the United States.

[1] Source: Bloomberg. Data as of May 30, 2025.

[2] Source: Bloomberg. Data as of May 30, 2025.

[3] Source: CBO, Committee for a Responsible Federal Budget, and Yale Budget Lab.

[5] Source: Bloomberg. Data as of May 30, 2025.

[6] Source: Bitcointreasuries.net, Bloomberg, Grayscale Investments. Data as of May 30, 2025.

[7] Source: SEC, Bloomberg, Grayscale Investments. Twenty One will go public through a special purpose acquisition company (SPAC) known as Cantor Equity Partners (CEP). Bitcoin price as of May 30, 2025.

[11] Source: Upexi, VivoPower, Freight Technologies.

[12] Source: House Financial Services.

[13] Source: Crypto in America.

[15] Source: Coinbase, Bloomberg. As of May 30, 2025.

[16] Source: Kraken, Robinhood.

[17] Source: Bloomberg, The Hill, Fortune.

[18] Source: BeInCrypto.

[19] Bittensor has increasingly grown percentage of circulating TAO allocated towards subnets. See report on AI crypto Sector