Last Updated: 3/15/2024 | 15 min. read

With Bitcoin near all-time highs, candidates running in the 2024 elections have begun to weigh in on crypto market topics. In a CNBC interview this week, for example, former President Trump said that Bitcoin has “taken on a life”, and that he allows supporters to pay for merchandise with Bitcoin.[1] Ahead of the election, a survey conducted by Harris Poll on Grayscale’s behalf indicated that crypto investors are likely to focus on candidates’ views on Bitcoin, as well as any clues about possible crypto legislation from the next Congress.

But Bitcoin is also a macro asset: it is an alternative money system and “store of value” that competes with the US Dollar. Therefore, the macroeconomic and geopolitical issues at stake in the US election—like the amount of deficit spending and the US role in the world—could have a bearing on demand for the largest cryptocurrency. In our view, election results that add to the risk of Dollar depreciation could be positive for Bitcoin over the medium-term.

Macro issue #1: Government deficits and debt

At a certain level, rising government debt can potentially have negative implications for a nation’s currency.[2] For the United States, which has a large economy and mature institutions, risk to the Dollar primarily comes through the “twin deficits” mechanism. This theory says that because marginal demand for government bonds may come from foreign investors, both the budget deficit and trade deficit will tend to widen at the same time.

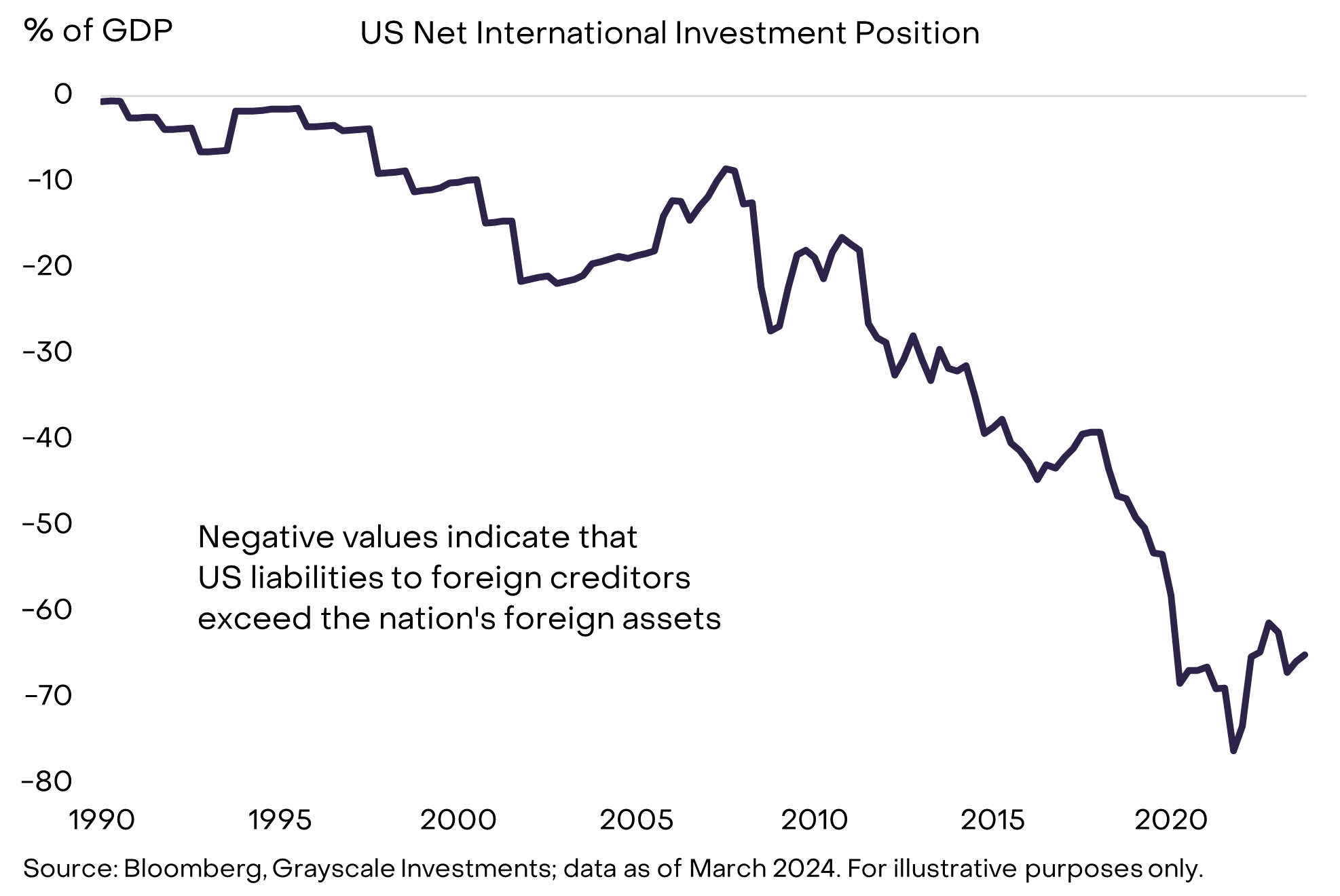

About half of US government debt is held by overseas investors, and federal government budget deficits have historically resulted in wider trade deficits.[3] Moreover, for the country as a whole, the amount of international liabilities (i.e. debts for foreigners) is much larger than the amount of international assets, with net US liabilities now totalling 65% of GDP (Exhibit 1). Because the federal debt stock is expected to increase sharply in the coming years[4], there may come a point where overseas investors have more limited or no appetite for US government bonds, and begin to move away from the Dollar, potentially to alternatives like Bitcoin.

Exhibit 1: Foreign investors may lose appetite for buying US debt

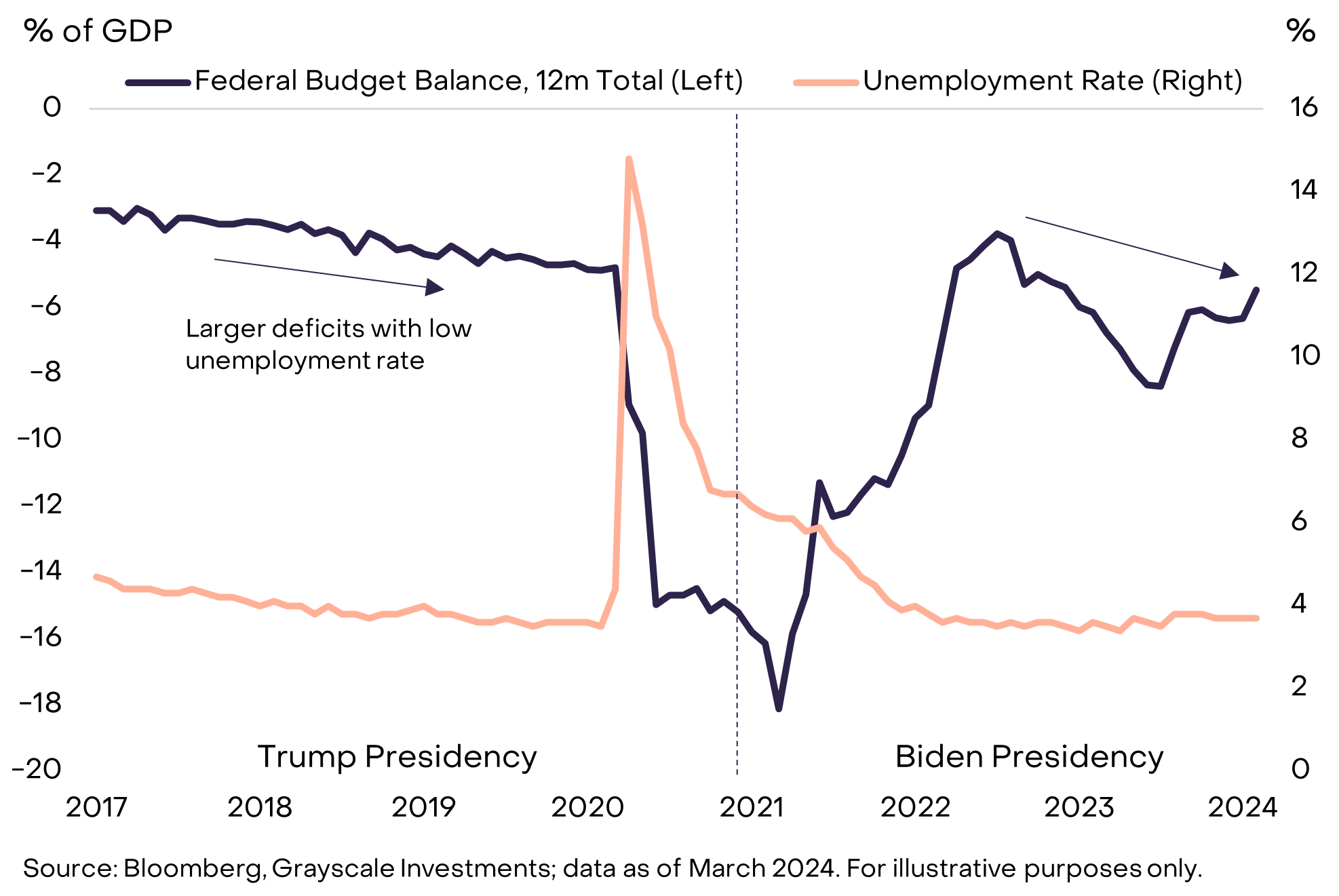

Both President Trump and President Biden left a record of rising government debt and procyclical budget deficits, although the COVID pandemic complicates reading of the historical record in both cases. Prior to COVID[5], President Trump oversaw an increase in the level of public debt, as well as widening budget deficits despite a falling unemployment rate (Exhibit 2).[6] Government analysts also estimated that the 2017 Tax Act increased budget deficits over the medium term.[7] After COVID, President Biden similarly governed during a period when the federal budget deficit increased even as the unemployment rate held at historically low levels. Moreover, neither candidate has prioritized balancing the budget in a second term. President Trump has said he hopes to enact additional tax cuts, whereas estimates suggest President Biden’s plans for green energy investment would significantly widen the deficit.[8]

Exhibit 2: Presidents Trump and Biden both governed under wide budget deficits

Because public debt could increase under both candidates, a more important consideration may be whether either party controls both the White House and Congress. Under current practices[9], a party with a simple majority in Congress can pass fiscal policy legislation, and both President Trump and President Biden enacted major legislation under unified government at the start of their terms. The implication for Bitcoin: Demand may rise if one party controls both the White House and Congress, because it will be easier to pass deficit-widening legislation.

Macro issue #2: Inflation and Fed independence

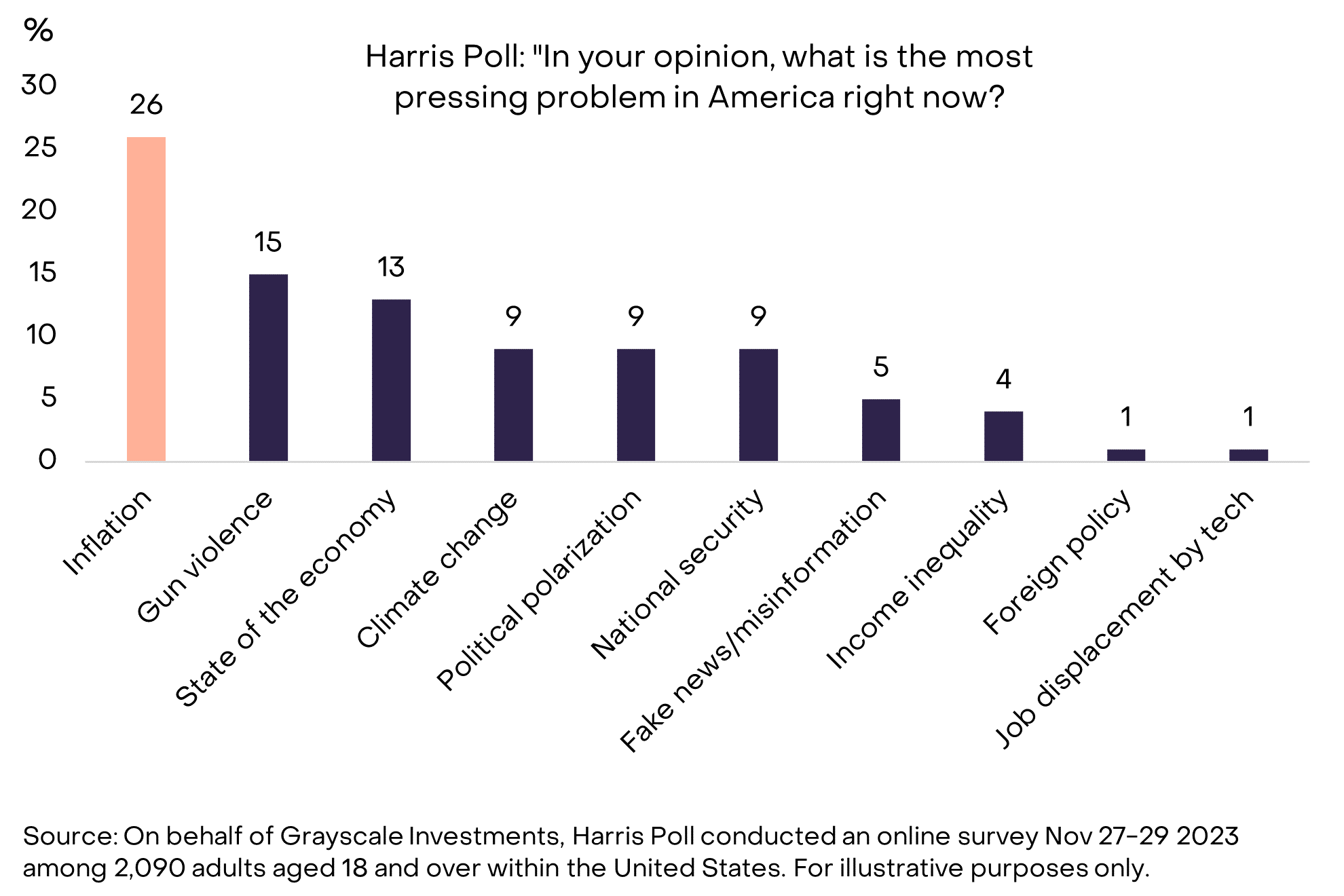

In a partnership with Harris Poll, Grayscale surveyed likely voters on their views about crypto and the upcoming election. Strikingly, respondents said that inflation was the most pressing problem for the country by a wide margin (Exhibit 3).

Exhibit 3: Inflation single most pressing problem for the USA

In our view, Bitcoin can be considered a “store of value” asset and hedge against Dollar debasement—an erosion of purchasing power through inflation and/or nominal depreciation. One way in which the election could affect the risks of Dollar debasement is through its impact on Federal Reserve independence. Academic research finds that independent central banks—those with mandates for low and stable inflation and outside the day-to-day control of the elected officials—are better able to achieve price stability.[10] Therefore, actions that erode central bank independence could increase the chances of high inflation and Dollar debasement over the medium-term. Fed Chair Jerome Powell’s term expires in 2026, so the next President will have an opportunity to shape the institution.

While in office, President Trump offered frequent public criticism of the Fed, saying, for instance, that he was “not even a little bit happy” with his selection of Powell and calling the FOMC’s (Federal Open Market Committee’s) policy choices “way off base”.[11] He has continued his criticism more recently, calling Powell “political” and indicating that any move to cut rates would be designed to “help the Democrats”.[12] President Biden, in contrast, has taken a more traditional line, saying his approach to reducing inflation follows the principle: “Respect the Fed, respect the Fed’s independence”.[13] The implication for Bitcoin: Demand may rise if President Trump is elected and markets see a chance that he would weaken Fed independence during a second term.

Macro issue #3: The US role in the world

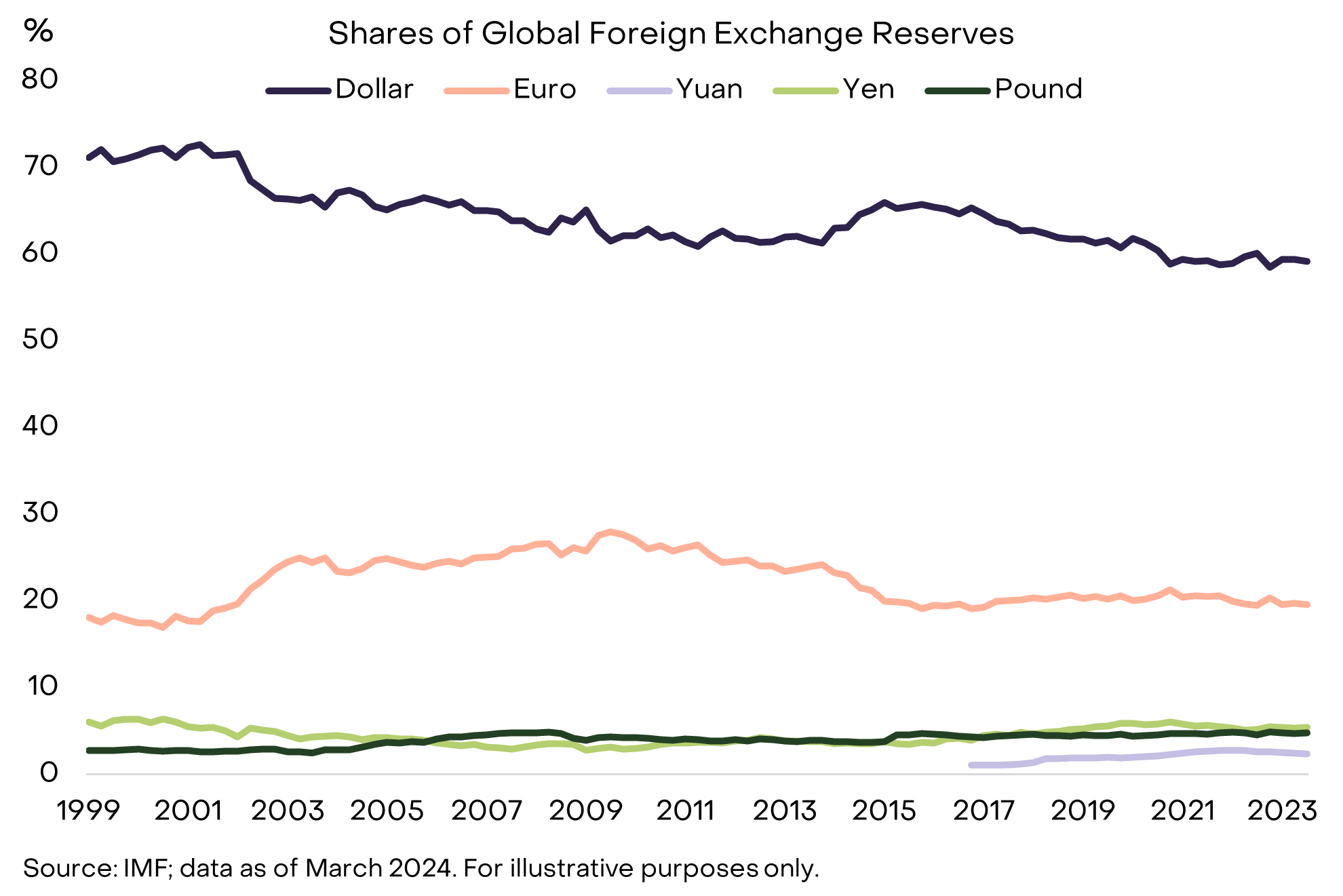

Outside the United States, many of the largest holders of US Dollars are foreign governments. For example, for most countries the Dollar makes up their largest share of foreign exchange reserves—the government’s official holdings of foreign assets (Exhibit 4). Therefore, international demand for Dollars can be shaped by both economic and political factors. For instance, countries that host US military bases often hold more Dollars in their foreign exchange reserves.[14] Because demand for the Dollar depends on both politics and economics, actions by the next president that reduce US geostrategic influence may weaken demand for Dollars—and this, in turn, may open up room for competitor money systems like Bitcoin.

Exhibit 4: Dollar dominates global trade and finance

President Trump has offered more negative views on US international commitments than President Biden, and his statements and actions occasionally caused friction with allies. Trump has been frequently critical of NATO, withdrew the US from the Trans-Pacific Partnership (TPP), placed tariffs on a wide range of imported goods (including on products from Canada, Mexico, and the European Union), and pressured Japan and South Korea to offer larger financial incentives for the US military protections.[15] As a candidate, Trump has proposed a 10% across-the-board tariff increase, and said that tariffs on China would be more than 60%.[16]

The Biden Administration has offered more support for existing alliances and multilateral institutions. Examples include support for NATO and for Ukraine funding—featured in his recent State of the Union Address—and a more positive take on the TPP. The Biden Administration has also abstained from major new tariffs. However, after Russia’s invasion of Ukraine, the United States and allies sanctioned Russia’s central bank—perhaps the most important policy decision for the international role of the US Dollar in recent years. This action caused Russia to “de-Dollarize” its economy—to diversify away from the Dollar and towards gold and other currencies. In the future, other countries facing sanctions risk may also attempt to diversify away from the Dollar. The implication for Bitcoin: More isolationist policies and/or aggressive use of extraterritorial sanctions may weigh on the Dollar and support alternatives like Bitcoin.

Bitcoin on the Ballot

In addition to the macro policy issues on the ballot in November, crypto investors will be watching for guidance on industry-specific legislation. The last Congress debated several pieces of crypto legislation. These included two comprehensive bills[17], the McHenry-Thompson Bill and the Lummis-Gillibrand Bill, which both touch on requirements for registration of crypto asset exchanges as well as SEC and CFTC jurisdiction over crypto assets. Two other important bills that crypto investors will be watching include the “Stablecoin Bill”, which intends to provide greater regulatory clarity on stablecoins[18], and the Digital Asset Anti-Money Laundering Act, which focuses on preventing illicit financial activity in crypto.[19]

Regardless of how the US regulatory landscape for crypto evolves, the macroeconomic and geopolitical trends driving the Dollar and Bitcoin seem likely to continue. In our view, these trends include large government budget deficits and rising debt, higher and more volatile inflation, and declining trust in institutions. Bitcoin is an alternative “store of value” that competes with the US Dollar. If the longer-term outlook for the US economy and the Dollar were to deteriorate, we would expect to see rising demand for Bitcoin.

For the presidential election, both candidates have held the office before, so investors can partly assess the impact of a second term from their prior statements and actions. Given the historical record, government debt may continue to rise under either Trump or Biden—if the same party also controls Congress. Another period of large deficits despite a healthy US economy may create downside risks for the US Dollar. Similarly, any policies that raise the risk of inflation and/or reduce the demand for Dollars by foreign governments could result in a weaker currency, and potentially benefit the Dollar’s competitors like other national currencies, precious metals, and Bitcoin.

[1] Source: CNBC.

[2] Economists posit that excessive government borrowing can affect a nation’s currency through three main channels: (i) through a “fiscal risk premium” due to the risk of default, (ii) due to “fiscal dominance”, where the government insists that the central bank hold interest rates too low in order to help finance government borrowing, or (iii) through the “twin deficits'' effect. For representative research literature on these topics, see see Carlson and Osler, “Determinants of Currency Risk Premiums”, Federal Reserve Bank of New York working paper, February 1999; Calomiris, “Fiscal Dominance and the Return of Zero-Interest Bank Reserve Requirements”, Federal Reserve Bank of St Louis Review, Q4 2023; and Bluedorn and Leigh, “Revisiting the Twin Deficits Hypothesis”, IMF Fiscal Policy Conference, June 2011.

[3] See, for example, Kumhof and Laxton, “Fiscal Deficits and Current Account Deficits”, IMF Working Paper October 2009.

[4] Source: CBO, “The Budget and Economic Outlook: 2024 to 2034”, February 2024.

[5] We consider the COVID outbreak period in the US to be from March 2019 through spring 2022.

[6] From December 2016 to February 2019, federal government debt held by the public increased from 76% of GDP to 80% of GDP; Source: Grayscale Investments calculations based on Bloomberg data.

[7] Source: CBO, “The Budget and Economic Outlook: 2018 to 2028”, April 2018.

[8] Source: CBO, “The Budget and Economic Outlook: 2024 to 2034”, February 2024.

[9] Through the Reconciliation process, which typically demands that policy changes which widen the deficit expire before the end of the ten-year budget scoring window.

[10] For an introduction to this topic, see “Why Central Bank Independence Matters”, The World Bank Research and Policy Briefs, November 2021.

[11] Source: CNBC.

[12] Source: Fox Business.

[13] Source: Politico.

[14] Source: Eichengreen, Mehl, and Chitu, “Mars or Mercury? The Geopolitics of International Currency Choice.” NBER Working Paper, December 2017. See also Goldberg and Hannaoui, “Drivers of Dollar Share of Foreign Exchange Reserves.” Federal Reserve Bank of New York Staff Report, March 2024.

[15] Source: Reuters.

[16] Source: CNN.

[17] The two comprehensive bills refer to 1. The Financial Innovation and Technology for the 21st Century Act (McHenry-Thomson Bill) and Responsible Financial Innovation Act (Lummis-Gillibrand Bill).

[18] Congress

[19] Coindesk

Important Information

Investments in digital assets are speculative investments that involve high degrees of risk, including a partial or total loss of invested funds. Investments in digital assets are not suitable for any investor that cannot afford loss of the entire investment.

All content is original and has been researched and produced by Grayscale Investments, LLC (“Grayscale”) unless otherwise stated herein. No part of this content may be reproduced in any form, or referred to in any other publication, without the express consent of Grayscale.

This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any investment in particular. This material is strictly for illustrative, educational, or informational purposes and is subject to change. This content does not constitute an offer to sell or the solicitation of an offer to sell or buy any security in any jurisdiction where such an offer or solicitation would be illegal. There is not enough information contained in this content to make an investment decision and any information contained herein should not be used as a basis for this purpose.

This content does not constitute a recommendation or take into account the particular investment objectives, financial situations, or needs of investors.

Investors are not to construe this content as legal, tax or investment advice, and should consult their own advisors concerning an investment in digital assets. The price and value of assets referred to in this content and the income from them may fluctuate. Past performance is not indicative of the future performance of any assets referred to herein. Fluctuations in exchange rates could have adverse effects on the value or price of, or income derived from, certain investments.

Certain of the statements contained herein may be statements of future expectations and other forward-looking statements that are based on Grayscale’s views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements. In addition to statements that are forward-looking by reason of context, the words “may, will, should, could, can, expects, plans, intends, anticipates, believes, estimates, predicts, potential, projected, or continue” and similar expressions identify forward-looking statements. Grayscale assumes no obligation to update any forward-looking statements contained herein and you should not place undue reliance on such statements, which speak only as of the date hereof. Although Grayscale has taken reasonable care to ensure that the information contained herein is accurate, no representation or warranty (including liability towards third parties), expressed or implied, is made by Grayscale as to its accuracy, reliability, or completeness. You should not make any investment decisions based on these estimates and forward-looking statements.

There is no guarantee that the market conditions during the past period will be present in the future. Rather, it is most likely that the future market conditions will differ significantly from those of this past period, which could have a materially adverse impact on future returns. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. We selected the timeframe for our analysis because we believe it broadly constitutes the most complete historical dataset for the digital assets that we have chosen to analyze.