Last Updated: 1/5/2026 | 12 min. read

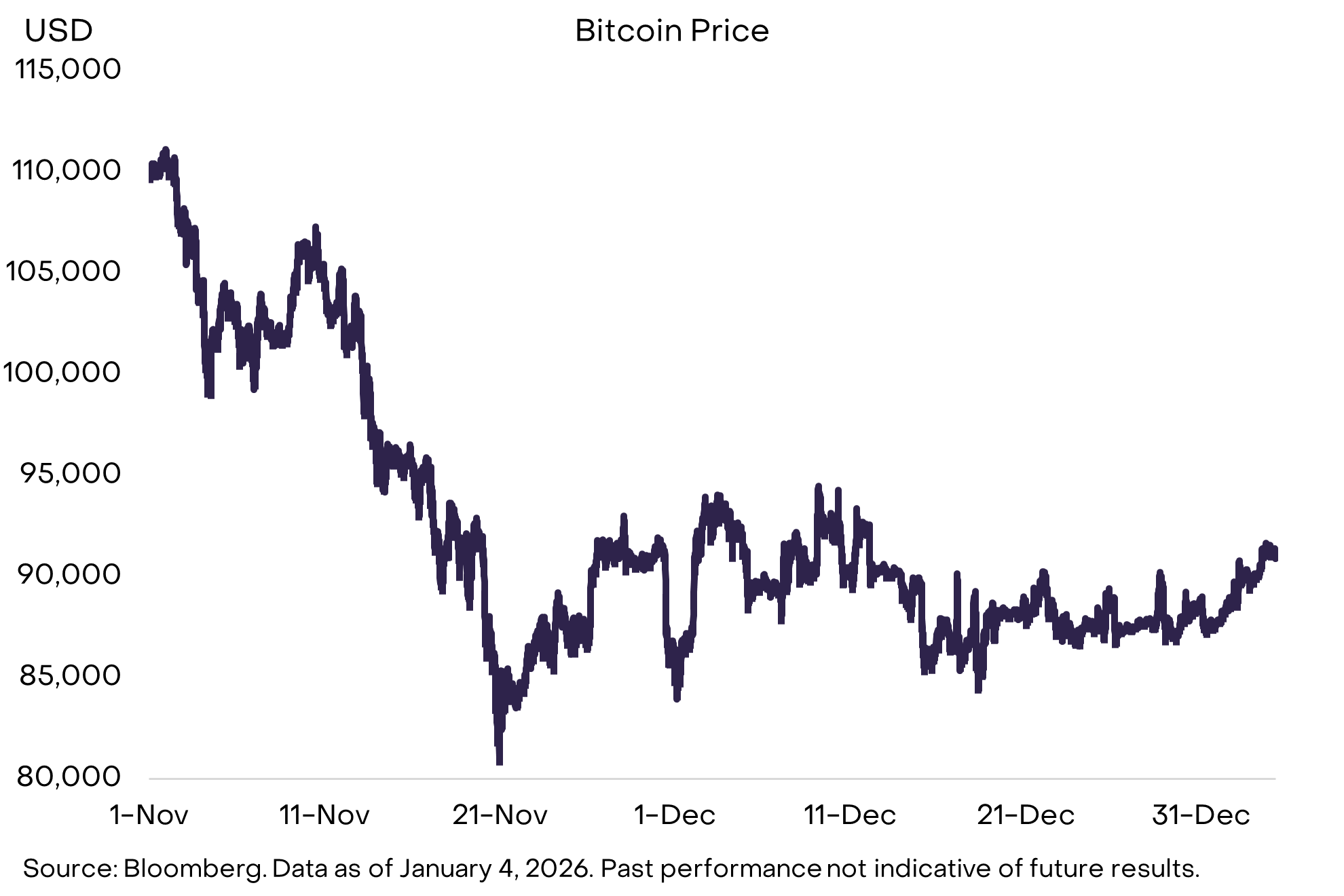

Crypto markets were relatively quiet in December 2025, following a significant drawdown in November. Bitcoin’s price held in a relatively narrow range of approximately $85,000-$95,000 during the month (Exhibit 1). In the second half of December, Bitcoin’s price volatility fell to just 20%-25%, potentially indicating low trader activity over the holiday period. Both price and volume perked up in the first few trading days of 2026, suggesting crypto’s winter freeze may be short-lived.

Exhibit 1: Bitcoin in narrow range in December 2025

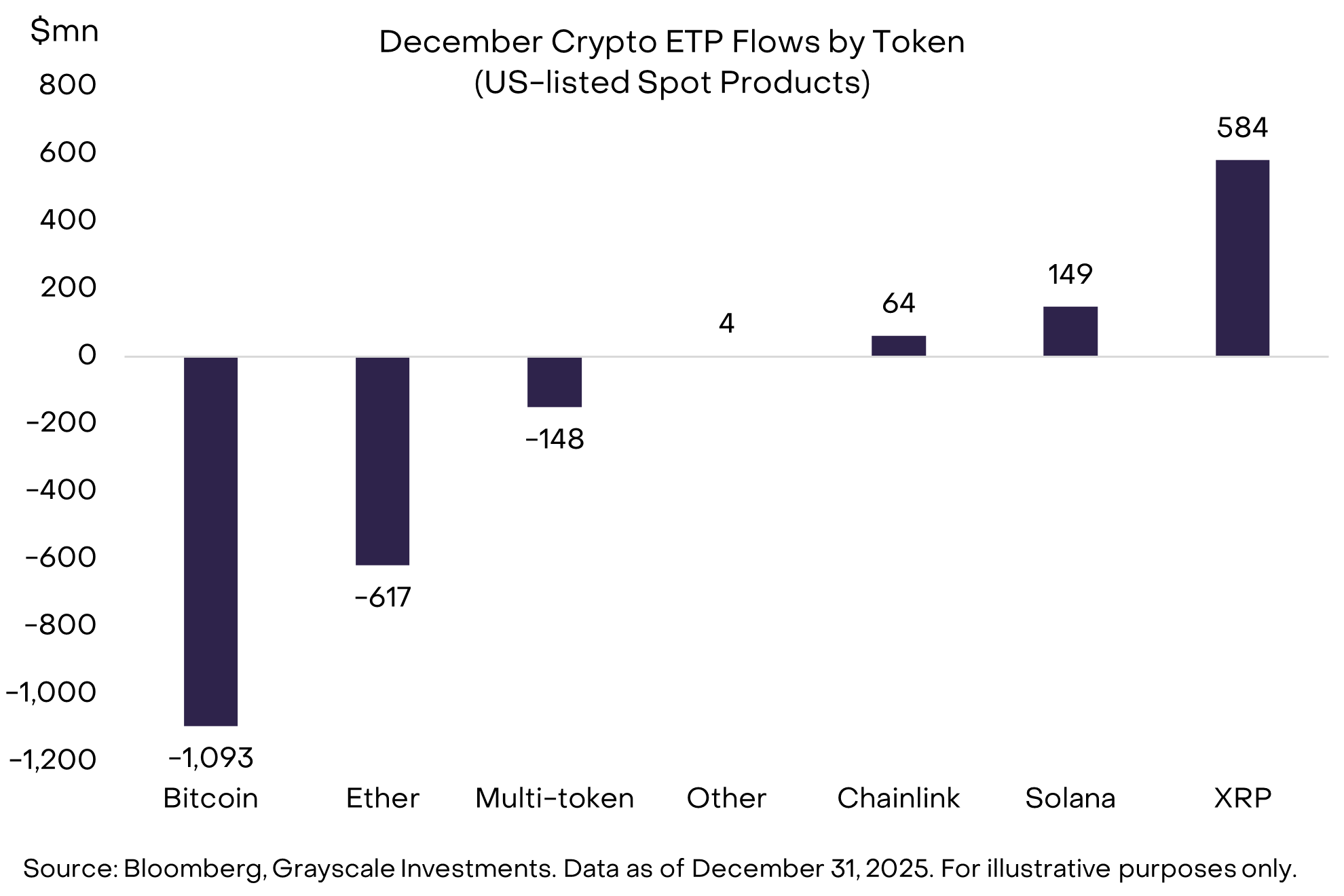

Net inflows into Bitcoin exchange-traded products (ETPs) were negative, possibly due to efforts by investors to realize capital losses before the end of the tax year (Exhibit 2). For example, U.S.-listed spot Bitcoin ETPs saw net outflows of about $1 billion in December. However, these same products experienced net inflows of almost $500 million on January 2, the first trading day of the new year.[1] The quick reversal suggests year-end flows may have had more to do with taxes than sustained shifts in demand. Although Bitcoin and Ether ETPs experienced net outflows during December, altcoin ETPs as a whole saw net inflows, led by spot XRP products (Exhibit 2). Despite sizable ETP inflows, the price of the XRP token underperformed, suggesting at least some of the inflow may have reflected in-kind creations rather than new purchases with fiat currency.

Exhibit 2: Investors sold Bitcoin and Ether ETPs in December

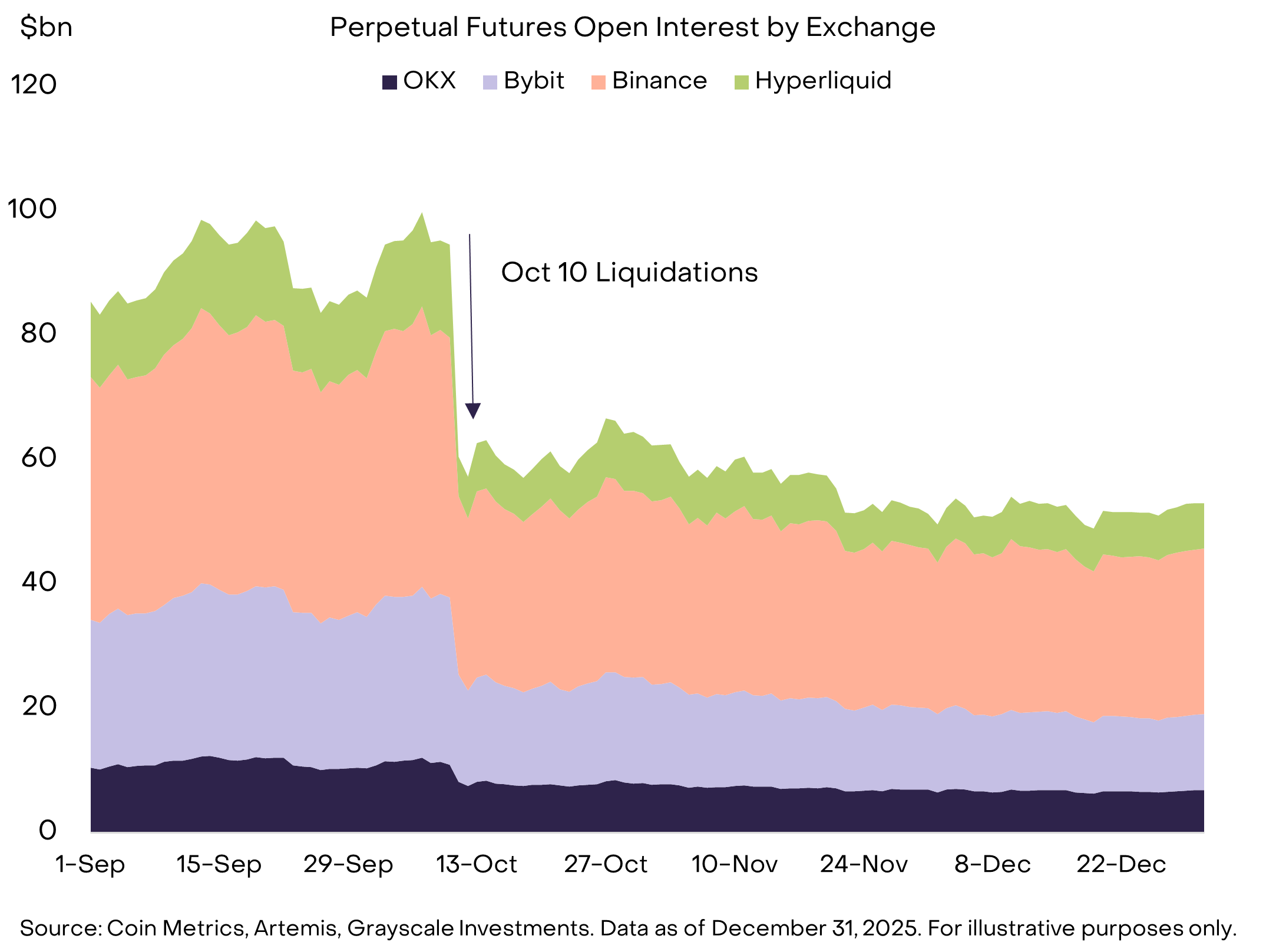

Crypto derivative markets were also mostly quiet in December. After record liquidations of perpetual futures contracts on October 10, open interest has remained broadly stable. For example, across the four largest perpetual futures exchanges (Binance, Bybit, OKX, and Hyperliquid), open interest has steadied around $50 billion and increased incrementally during December (Exhibit 3). Given broadly stable open interest, we no longer believe that post-October 10 deleveraging has been a meaningful driver of valuations in recent weeks. Although futures open interest increased slightly during the month, options open interest declined sharply due to concentrated expirations on December 26.[2]

Exhibit 3: Futures open interest edged higher in December

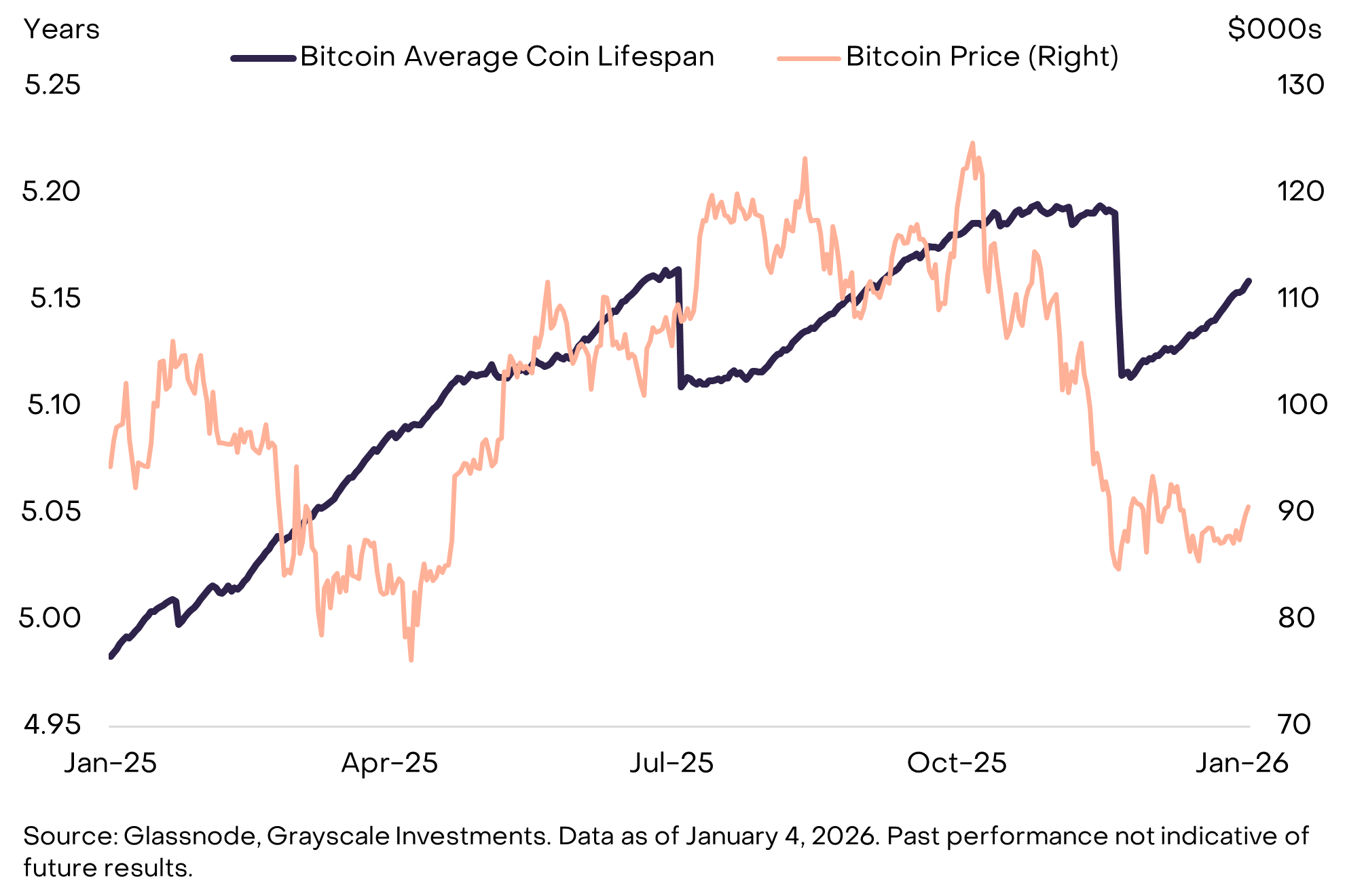

Lastly, there was no evidence of Bitcoin selling by “OG whales” (large early Bitcoin investors), which had been a factor earlier in the year, especially in July and November. On the Bitcoin blockchain we can observe when each coin was last transacted.[3] From this data we can derive a measure of “average lifespan,” or the weighted average time that Bitcoin last moved on-chain. Large changes in average lifespan [4] can indicate selling by early investors. During December, Bitcoin’s average lifespan crept higher, indicating that this source of sell pressure was probably not a factor last month (Exhibit 4).

Exhibit 4: Rising average Bitcoin lifespan suggests limited selling by “OG whales”

Although December was a quiet month for crypto price action and fund flows, it was a busy month for a few key themes, especially asset tokenization, token holder rights, and development of the Ethereum and Solana blockchains.

Asset tokenization: December marked a clear shift in how tokenization is being pursued by large financial institutions (for background, see Public Blockchains and the Tokenization Revolution). On December 11, the Depository Trust & Clearing Corporation (DTCC) received a no-action letter[5] from the Securities and Exchange Commission (SEC) to launch a tokenization service, initially on the Canton network and the DTCC’s own (EVM-compatible) blockchain. The DTCC processes roughly $3.7 quadrillion in annual securities transactions and provides custody for nearly $100 trillion in assets, so its tokenization efforts are especially noteworthy.[6]

Separately, JP Morgan Asset Management announced the launch of My OnChain Net Yield Fund (“MONY”), a tokenized money market fund on the Ethereum blockchain.[7] What distinguishes current efforts from those prior is that tokenization is being integrated directly into institutional infrastructure and distribution channels, increasing the potential for smart contract platforms to become a durable component of future market infrastructure.

Token holder rights: A long-running debate around token holder rights emerged again in December, this time due to a proposal related to revenue from the Aave lending platform. At issue was whether AAVE token holders — who govern the protocol and implicitly backstop its risk — should also control critical assets such as the Aave brand, frontend, and associated revenue streams, or whether those should remain with Aave Labs, the venture-backed entity responsible for development.[8] While the specific proposal ultimately failed, the debate itself revealed structural fragilities in how many leading DeFi protocols are organized. Similar questions surfaced around Uniswap’s recent “UNIfication” discussions and the acquisition of the development company behind Axelar (where AXL token holders received no value). We expect these issues to be addressed in conjunction with crypto market structure legislation working its way through Congress (see next section).

Ethereum and Solana development: In early December, development efforts related to Ethereum and Solana offered guidance on the future of both blockchains. Ethereum executed the Fusaka hard fork, which included PeerDAS (peer-based data availability sampling), an upgrade intended to facilitate more scaling by Layer 2 networks without sacrificing decentralization.[9] Ethereum cofounder Vitalik Buterin argued in a subsequent social media post that the combination of PeerDAS and ZKEVMs[10] mean that Ethereum has solved the blockchain trilemma (the idea that blockchains struggle to simultaneously maximize decentralization, security, and scalability).

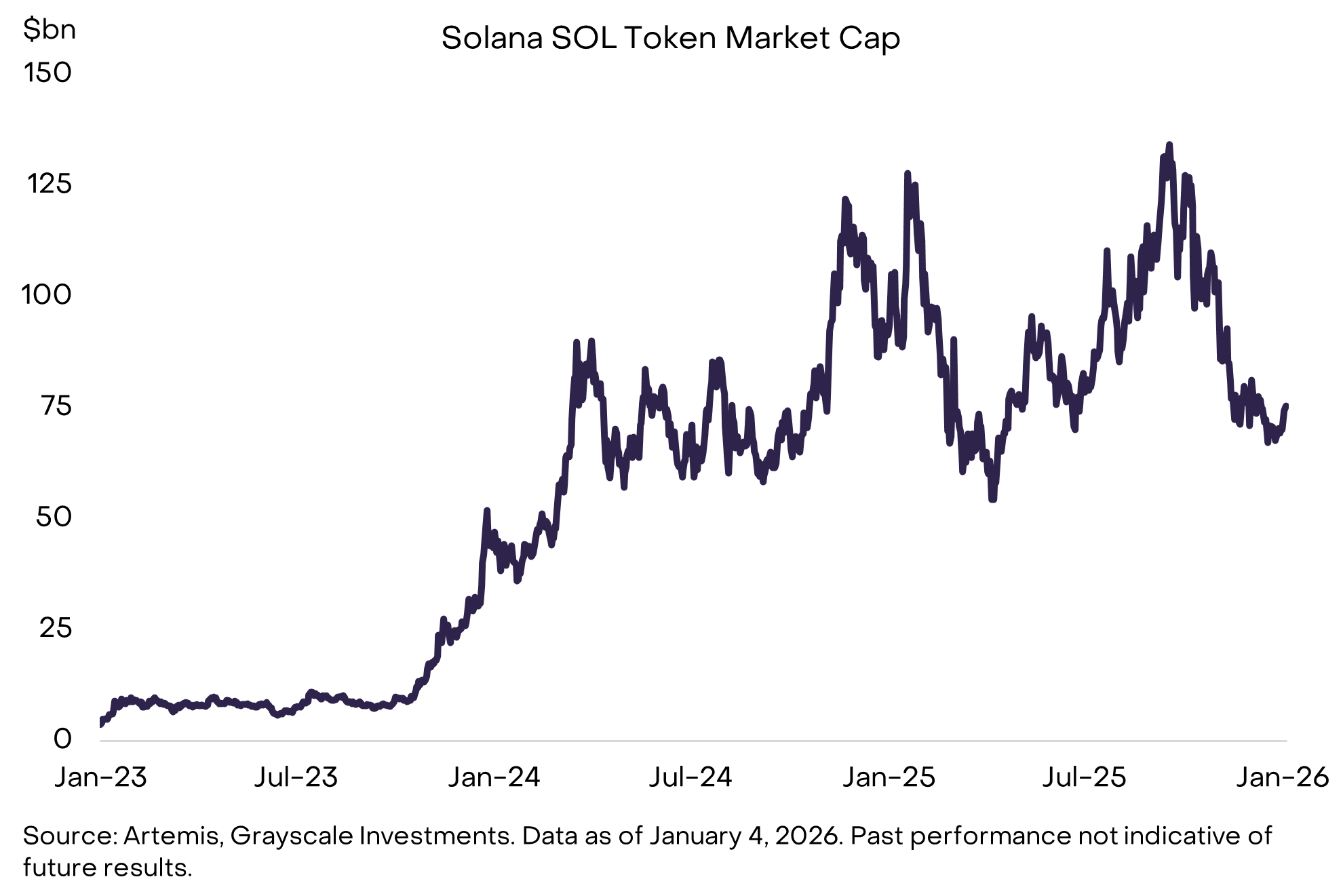

Separately, Solana’s Breakpoint conference reinforced the network’s long-term positioning around performance, resilience, and user experience, with a clear focus on improving both throughput and finality (Exhibit 5). The most consequential development was continued progress on Firedancer, a second validator client built by Jump Crypto, which featured prominently at Breakpoint as a cornerstone of Solana’s performance strategy. Breakpoint also highlighted Alpenglow, a proposed overhaul of Solana’s consensus mechanism aimed at achieving near-instant finality (~150 milliseconds).[11] Unlike Firedancer, Alpenglow does not target higher TPS (transactions per second) but instead focuses on reducing consensus latency and complexity by simplifying block propagation and voting.

Exhibit 5: Solana focused on performance, resilience, and user experience

As discussed in detail in our annual outlook report, Dawn of the Institutional Era, Grayscale expects rising crypto valuations in 2026, underpinned by two major themes: macro demand for alternative stores of value and improved regulatory clarity. Both issues seem likely to be in focus already in January.

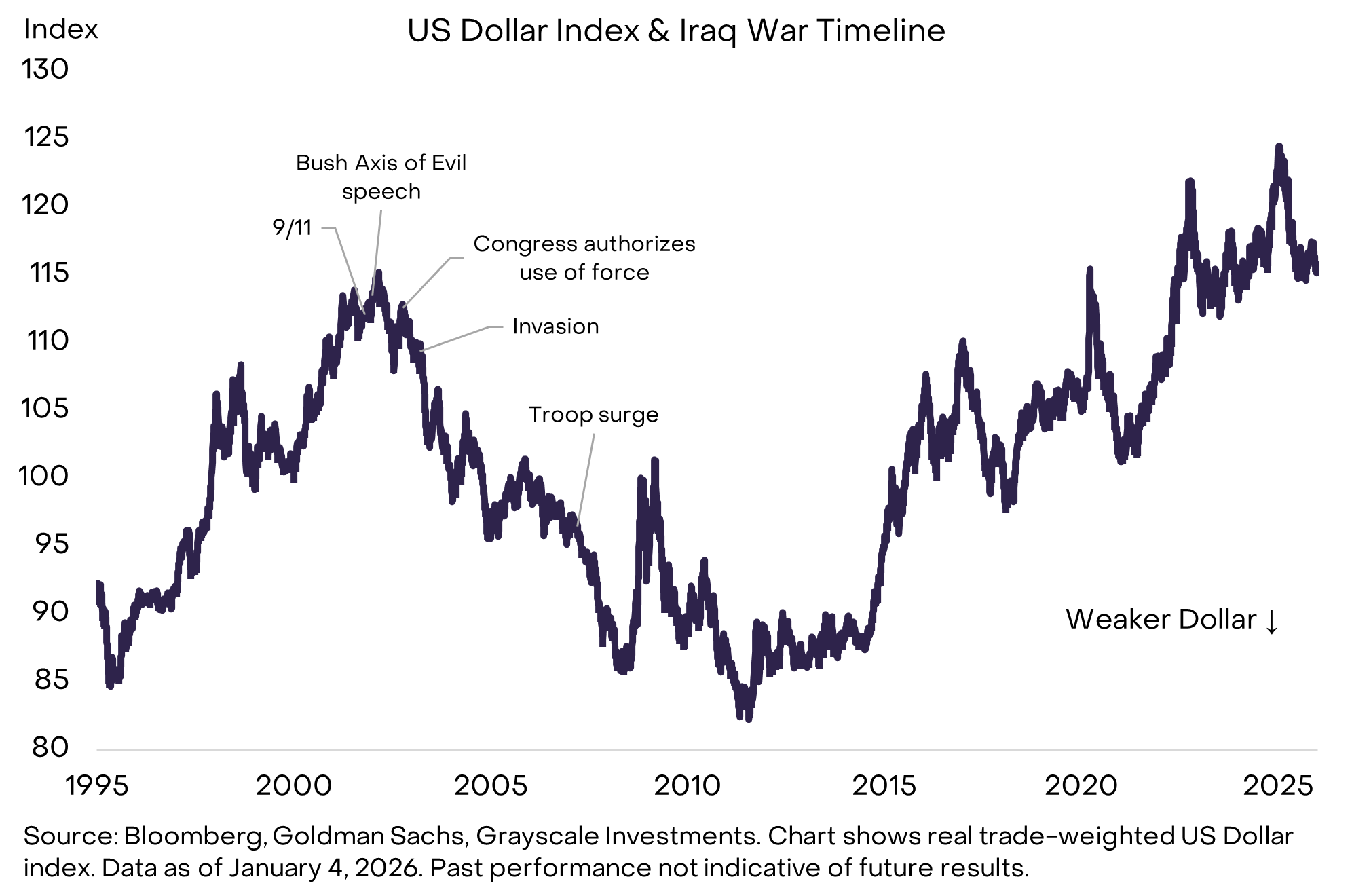

Needless to say, the capture by the U.S. of Venezuelan President Nicolás Maduro has increased geopolitical uncertainty for global markets. It will take some time to determine the medium-term implications for the U.S. and global economies, but a prolonged conflict could have implications for U.S. deficits and debt, as well as international demand for the Dollar. While there are many important differences, the last major peak in the value of the Dollar occurred around the onset of the second Iraq war (Exhibit 6). Geopolitical factors including Russia’s war with Ukraine have been one factor driving demand for gold and other alternatives to the U.S. Dollar. If the U.S. conflict with Venezuela proves to have broader political implications, it could potentially drive further interest to alternative stores of value, including physical gold and silver and digital Bitcoin and Ether.

Exhibit 6: Military conflict could have macro and market implications over time

On the regulatory side of things, the Senate Banking Committee has agreed to January 15 for a markup of its version of the crypto market-structure bill, currently known as the Responsible Financial Innovation Act.[12] During this process, senators will review the bill line by line and propose amendments. If there is sufficient support, it could see a committee vote and be recommended for the full Senate (where it will need to be merged with the Senate Agriculture Committee’s version of the bill). Grayscale expects a bipartisan crypto market structure bill to become law in 2026. In practice, a more complete regulatory framework for crypto assets across the U.S. and other major economies could mean that regulated financial services firms report digital assets on balance sheet and begin transacting on the blockchain. It may also allow for on-chain capital formation, with both startups and mature firms issuing regulated tokens.

Ultimately, December reflected a pause rather than a reversal. With tax-driven flows fading, fundamentals improving, and regulatory momentum building, crypto markets enter 2026 with a firmer footing than year-end prices alone might suggest.

Index Definition: Goldman Sachs Real Trade Weighted Dollar Index is a trade-weighted, inflation-adjusted index that measures the value of the U.S. dollar against the currencies of major U.S. trading partners.

[1] Source: Bloomberg, Grayscale Investments. Data as of January 5, 2026. For illustrative purposes only.

[3] Technically the measure is based on unspent transaction outputs (UTXOs).

[4] Or, equivalently, a large increase in coin days destroyed.

[8] Source: Aave governance forum

[9] Source: Ethereum Foundation.

[10] Ethereum virtual machine (EVM) using zero-knowledge (ZK) cryptography.

[12] Source: Crypto in America.