Last Updated: 11/3/2025 | 10 min. read

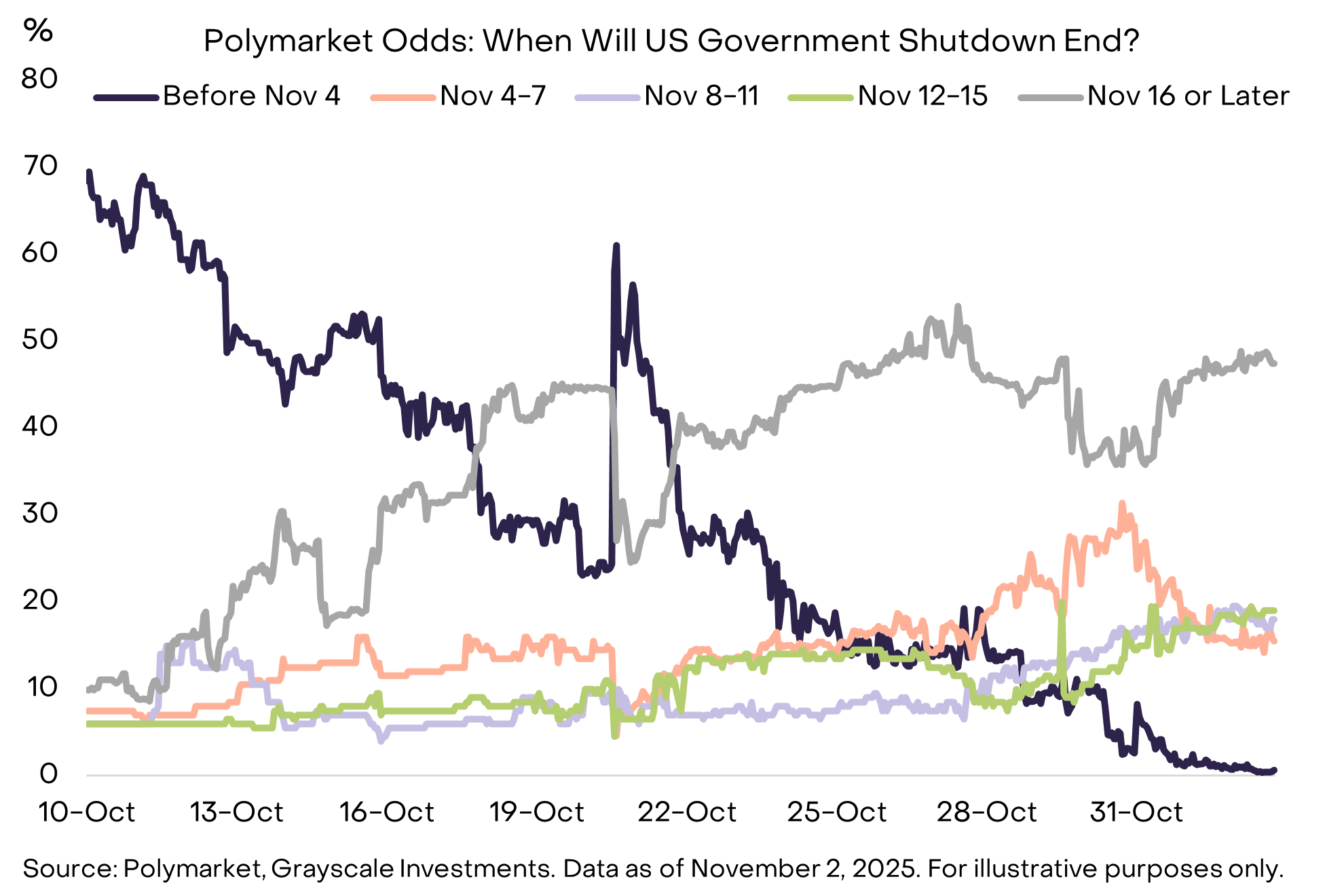

The U.S. government shutdown that began on October 1 continued through the end of the month. According to Polymarket — a blockchain-based prediction market — there is nearly 50% probability that the shutdown will carry on past mid-November (Exhibit 1).[1] A variety of macro risks weighed on markets during October, including the shutdown but also the threat of higher tariffs, emerging pressures in credit markets, and guidance from the Federal Reserve that another rate cut in December is not a done deal. Nonetheless, innovation in the digital assets industry continued apace, potentially setting up markets for recovery into year-end.

Exhibit 1: Uncertainty about end to government shutdown

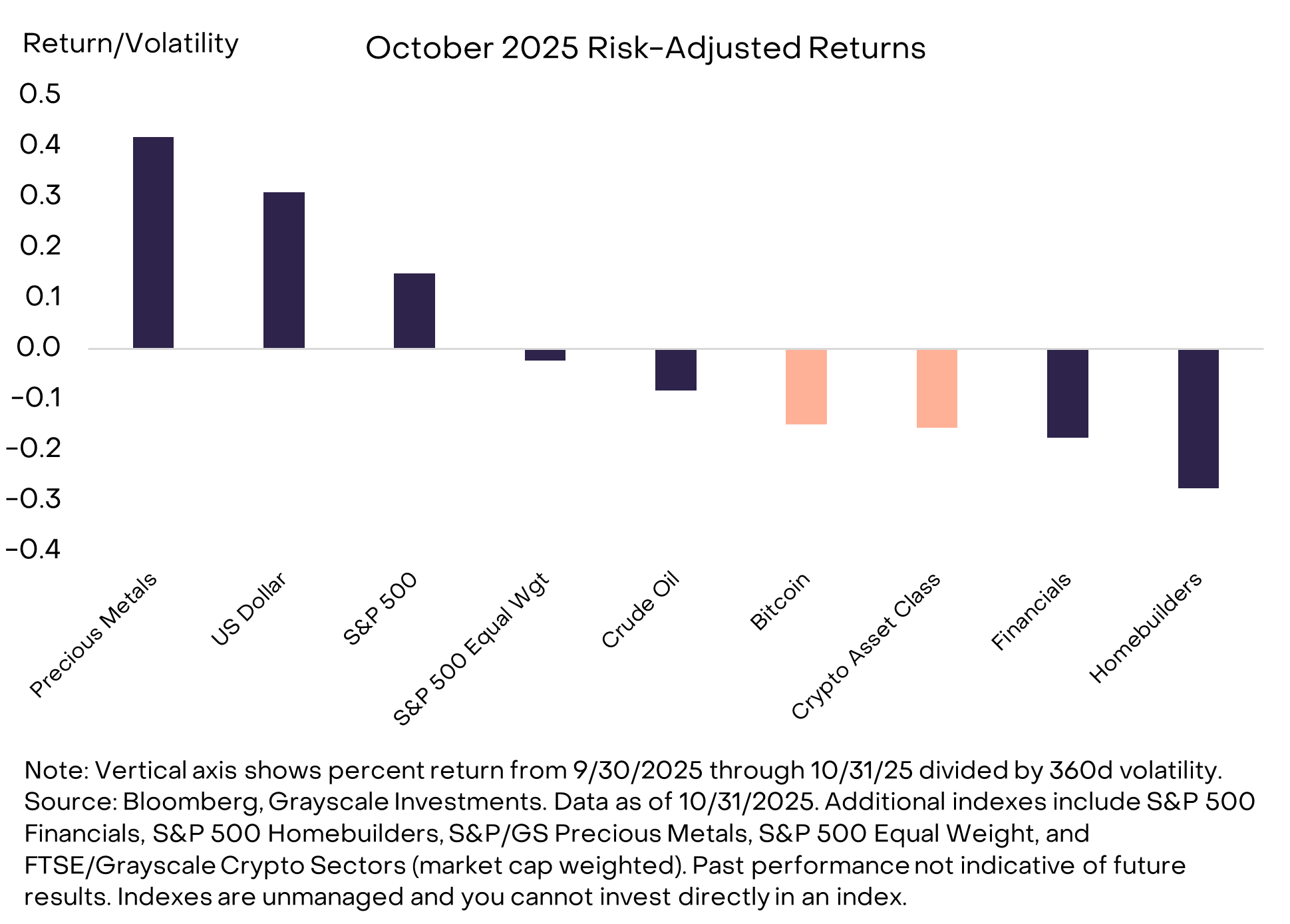

Broader markets were mixed in October, reflecting the assortment of macro risks that investors need to navigate. The market cap-weighted S&P 500 index, for example, ended the month slightly higher, as certain large-cap stocks gained, while its equal-weight counterpart declined (Exhibit 2). Equities in the Financials and Homebuilder categories were among the worst performing. Prices for precious metals like gold and silver were higher month over month, but with a high degree of intramonth volatility: the price of gold increased 13% from the end of September to October 20, then slid 8% from that point to the end of the month. Bitcoin and the crypto asset class were among the underperforming market segments on a risk-adjusted basis (i.e., accounting for each asset’s typical volatility).

Exhibit 2: A mixed month for markets in October

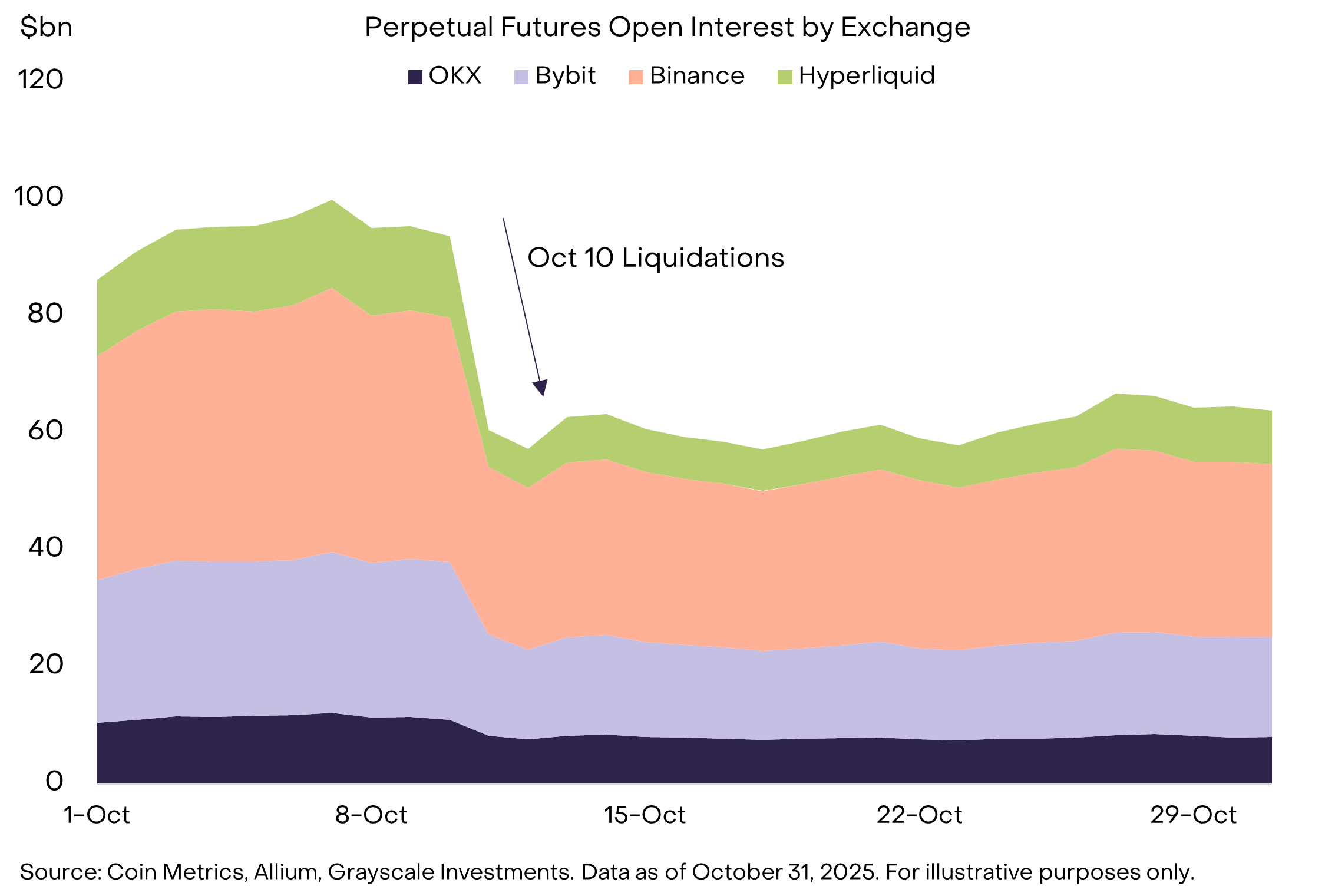

Crypto price volatility on October 10 — which was triggered by concerns over sharply higher tariffs on China — resulted in a sharp deleveraging in perpetual futures contracts. Perpetual futures are a unique part of crypto market structure that can feature rapid liquidations (when trader margin falls below required minimums). This is what happened on October 10, where the four largest futures exchanges reportedly liquidated $19bn in open futures positions — likely a record for the industry.[2] During this period, total open interest in perpetual futures declined by more than $30bn, before stabilizing later in the month (Exhibit 3).

Exhibit 3: Large decline in futures open interest on October 10

As is often the case, crypto asset valuations and underlying fundamentals did not move in lockstep in October. Although token valuations were broadly lower, investors should be encouraged by further steps toward regulatory clarity and institutional adoption, in our view.

First, momentum on market structure legislation in the U.S. Senate seemed to pick back up. In July, the House of Representatives passed its version of this bill, called the CLARITY Act, on a bipartisan basis. The Senate is now working on its own version, called the Responsible Financial Innovation Act (RFIA). The bipartisan process seemed to hit a speed bump in early October over proposals from Senate Democrats related to decentralized finance (DeFi).[3] Later in the month, a group of crypto industry leaders met with lawmakers from both parties.[4] According to press reports, the meetings are “said to have helped mend fences and inspire lawmakers back to the negotiating table.”[5] Grayscale Research is optimistic that crypto market structure legislation can become law in 2026.

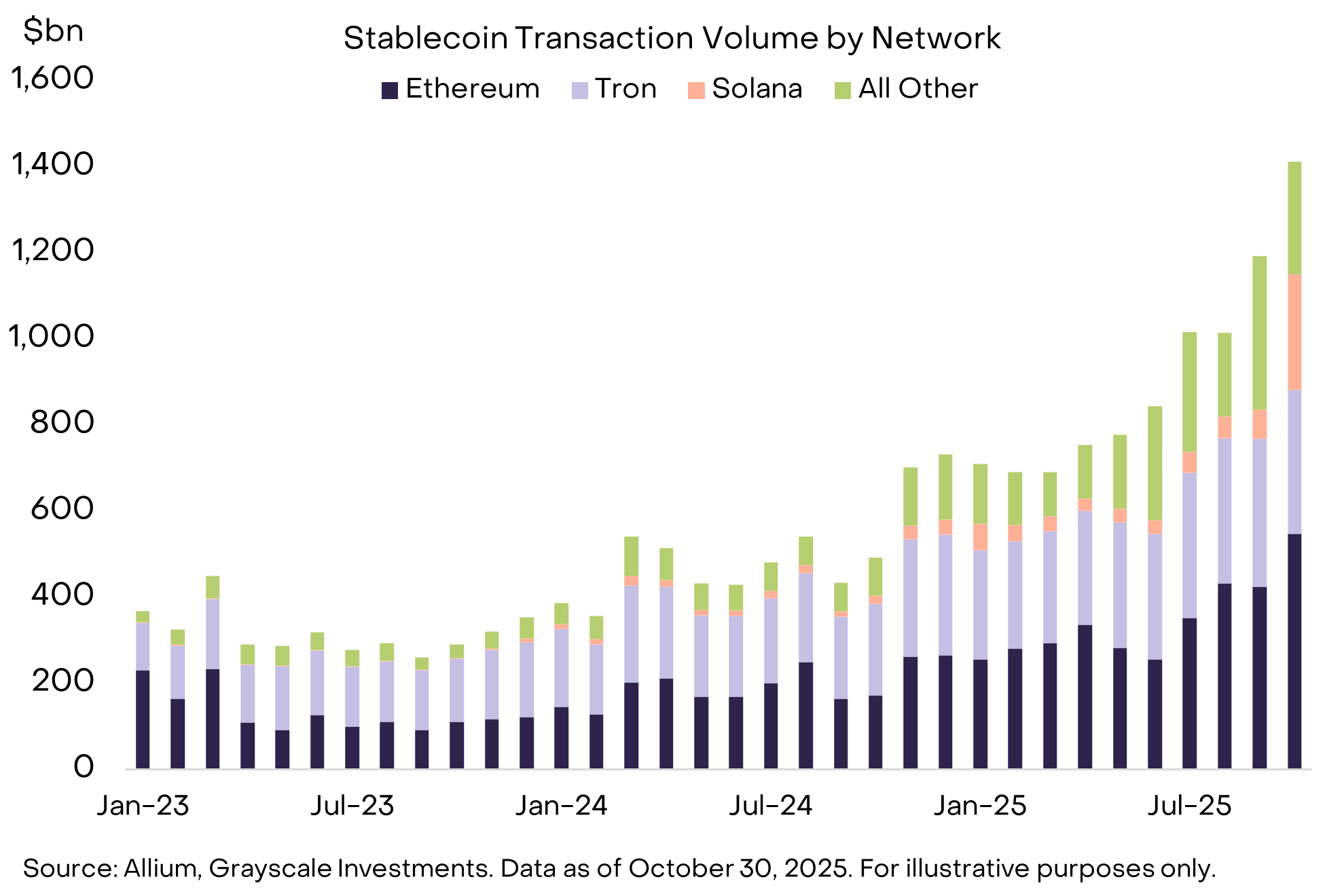

Second, stablecoin adoption continued to accelerate. Based on the adjusted measures produced by data provider Allium, total stablecoin volume reached about $1.4 trillion in October, with much of the increase attributable to Solana (Exhibit 4). Stablecoin supply outstanding also touched $300bn for the first time.[6] A variety of crypto-native and traditional financial services firms also announced investments stablecoin technology: (i) Mastercard said it would acquire stablecoin infrastructure provider Zerohash for nearly $2bn; (ii) Visa announced support for more stablecoins; (iii) Western Union announced a new stablecoin, USDPT, on Solana; (iv) Tempo, a payments-focused blockchain developed by Stripe and Paradigm, raised $500M in a Series A round; and (v) Arc, a payments-focused blockchain developed by Circle, launched in testnet with a range of industry partners.[7]

Exhibit 4: Stablecoin transaction volume reached new highs

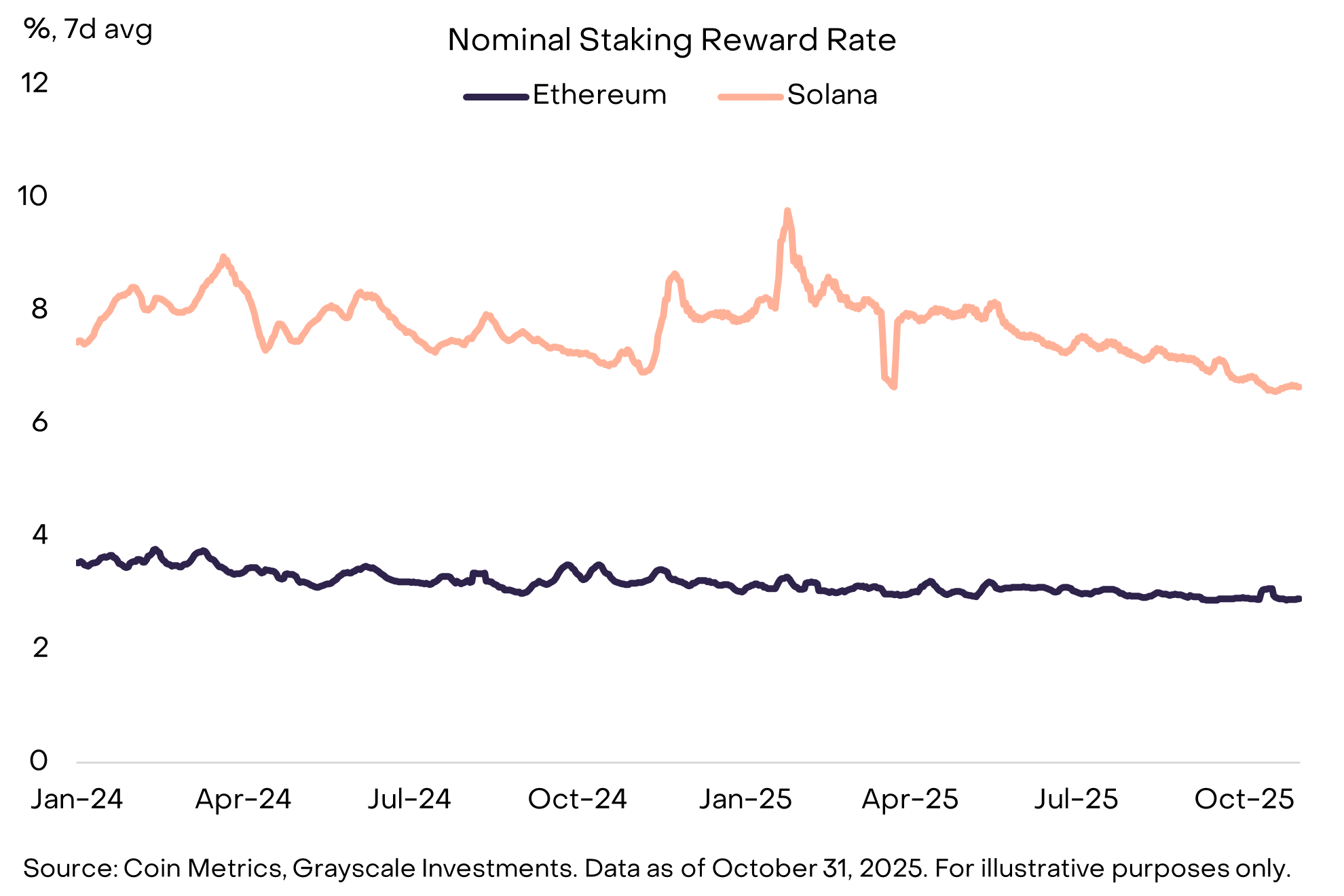

Third, there was further innovation in crypto investment products. In particular, issuers of U.S. exchange-traded products (ETPs) introduced both staking rewards and spot exposure to new “altcoins” — crypto assets with lower market caps than Bitcoin. Staking is the process of validating transactions and securing the blockchain in exchange for rewards (for background, see Staking 101: Secure the Blockchain, Earn Rewards). Ethereum currently offers a staking reward rate of about 3%, while Solana offers a staking reward rate of about 7% (Exhibit 5). The new altcoin ETPs were brought to market under the Generic Listing Standards approved by the Securities and Exchange Commission (SEC) in September, including spot Solana products.[8] The new Generic Listing Standards should provide a more streamlined process for bringing crypto ETPs to market (for more background, see Market Byte: Here Come the Altcoins).

Exhibit 5: Certain crypto ETPs now offering staking rewards

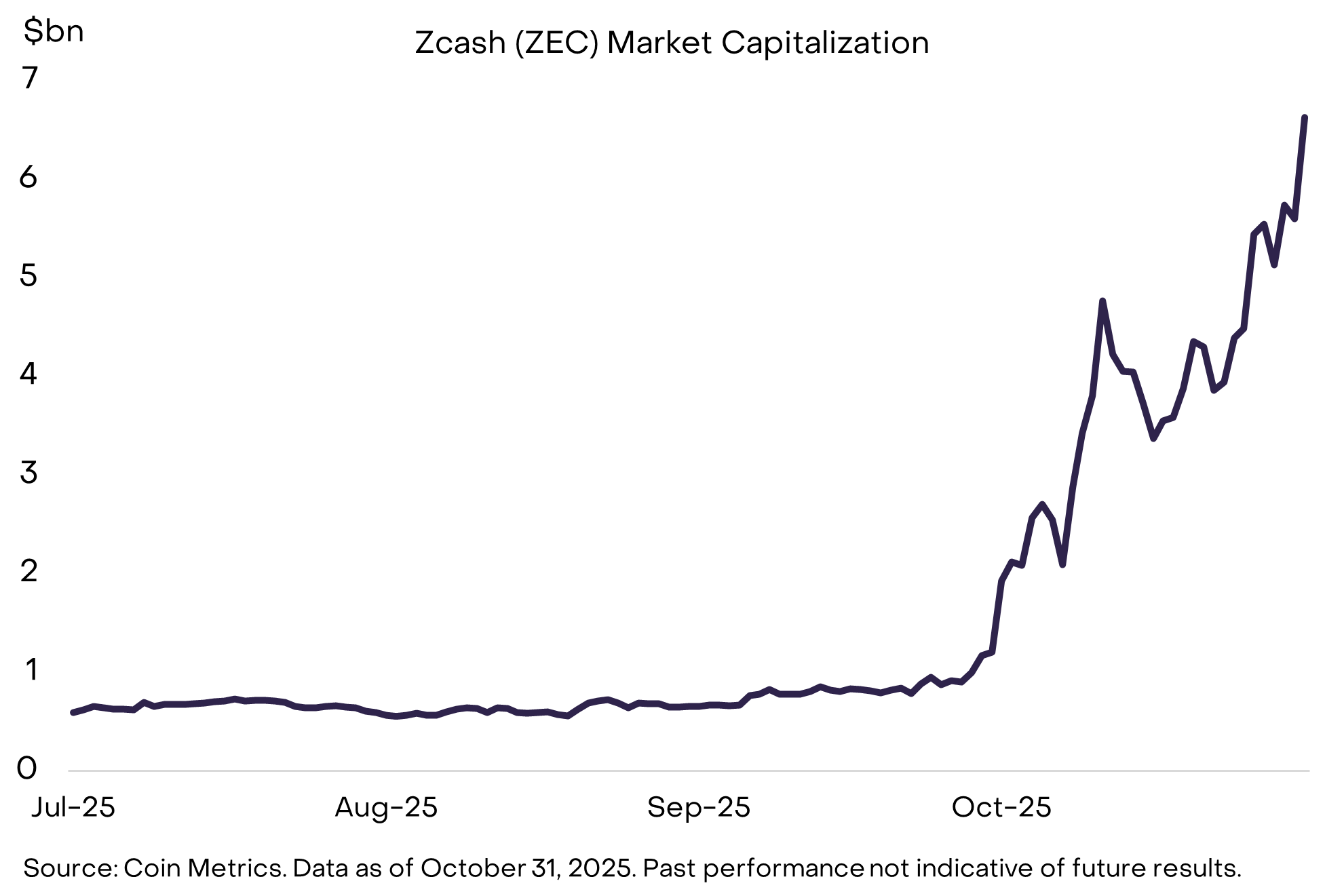

Although crypto valuations were broadly lower in October, a notable exception was the Zcash network’s ZEC token, which gained 248% during the month and reached a market cap of about $6.5bn (Exhibit 6). Zcash is a decentralized digital currency like Bitcoin but incorporates optional privacy features through “shielded”[9] accounts and transactions. The demand for these features has increased significantly: the share of ZEC supply held in shielded addresses has increased to about 30% from an average of about 10% in 2024.[10] In our view, blockchain technology cannot reach its full potential without privacy-related elements: many users do not want their assets, income, and spending behavior visible on a transparent public ledger. As public blockchains become more deeply integrated into mainstream finance, Grayscale Research anticipates more demand for privacy-related technologies, as well as more institutional investment in this category.

Exhibit 6: Zcash outperforming with increase in use of privacy features

Heading into year-end, we expect that macro factors will dominate short-term crypto price action. An end to the government shutdown, a favorable resolution to trade talks between the U.S. and China, limited further stress in credit markets, and another rate cut by the Federal Reserve could each support markets. Although crypto is a unique alternative asset class, token valuations will have some sensitivity to broad macro news, especially as mainstream investor adoption increases.

From a crypto-specific standpoint, we will be focused on progress in the Senate on market structure legislation, the introduction of even more altcoin ETPs, and major industry events including Ethereum’s Devconnect (Buenos Aires, November 17-22) and Solana’s Breakpoint (Abu Dhabi, December 11-13). Key technical developments for investors to monitor include upcoming protocol upgrades for Ethereum (Fusaka) and Solana (Alpenglow), as well as the first halving event for Bittensor, a leading project in the Artificial Intelligence Crypto Sector.[11]

[1] Intercontinental Exchange (ICE), owner of the New York Stock Exchange (NYSE), made a large strategic investment in Polymarket during October. Source: Reuters.

[2] Source: Coin Metrics, Allium, Grayscale Investments. Data as of October 31, 2025.

[5] Source: Crypto in America.

[6] Source: DeFi Llama. Data as of October 31, 2025.

[7] Source: Fortune, The Block, ConDesk, Fortune, The Block.

[9] “Shielded” accounts refer to Zcash’s use of zero-knowledge proofs (zk-SNARKs) that allow transactions in which the sender, receiver, and amount are encrypted—verifiable by the network but hidden from public view.

[10] Source: Coin Metrics. Data as of October 31, 2025.