Last Updated: 10/31/2025 | 11 min. read

Key Takeaways

Exchange-traded products (ETPs) offering spot exposure to the Solana network’s SOL token have started trading. Over the coming weeks, the number of additional “altcoins ” — crypto assets with a lower market cap than Bitcoin’s — available through spot ETP products will likely increase significantly, due to recent regulatory changes.

Introducing Bitcoin ETPs to the U.S. market took more than a decade, from the first filing in 2013 to their listing in 2024.[1] For new crypto ETPs, investors can expect a more streamlined listing process. On September 17, the Securities and Exchange Commission (SEC) approved generic listing standards for crypto asset ETPs.[2] Instead of reviewing every token one-by-one, the SEC will consider whether the asset meets certain generic criteria.[3] If it passes this test, exchanges may list and trade ETPs for that token once there has been an effective registration statement for such ETP.

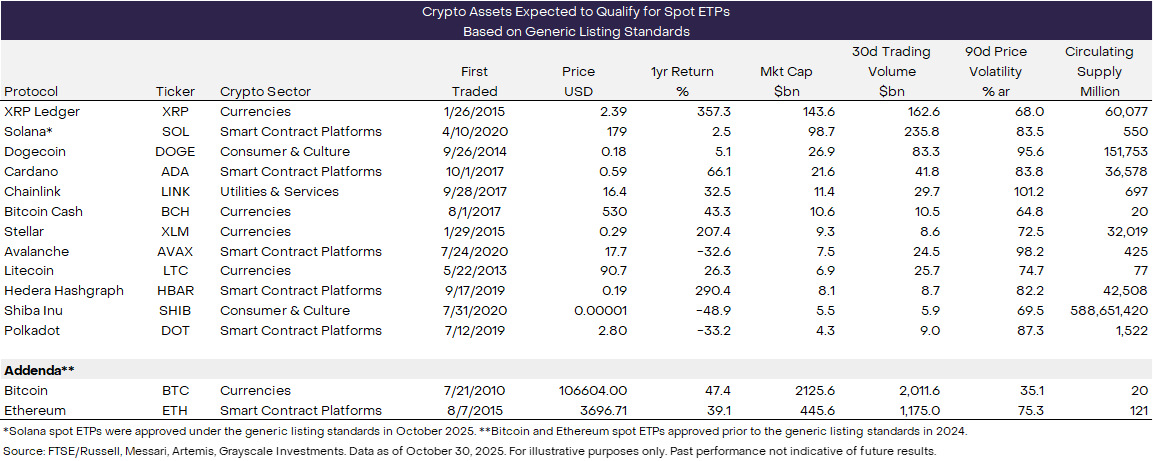

In addition to Solana, Grayscale expects that 11 distinct crypto assets will qualify for ETPs based on the generic listing standards (Exhibit 1). Over time, the number of crypto assets that qualify under the new criteria will likely increase further.

Exhibit 1: Diverse set of assets may soon be available as U.S. ETPs

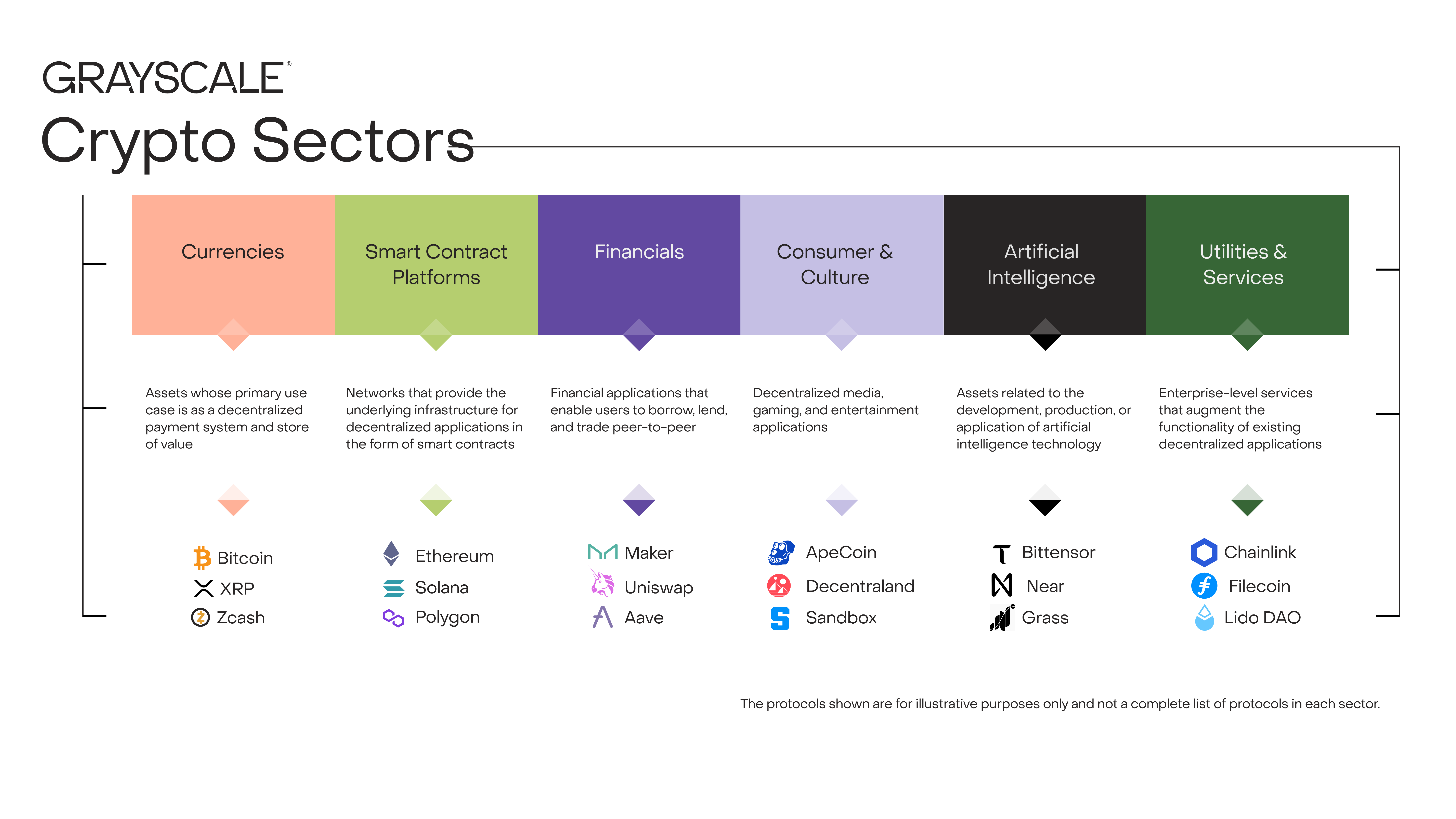

Public blockchains are a general-purpose technology with a wide range of use cases, and the crypto asset class is increasingly diverse. To keep things organized, Grayscale uses a proprietary taxonomy and set of index tools called Crypto Sectors, developed in partnership with FTSE/Russell (Exhibit 2).

Exhibit 2: Crypto Sectors framework helps organize digital asset markets

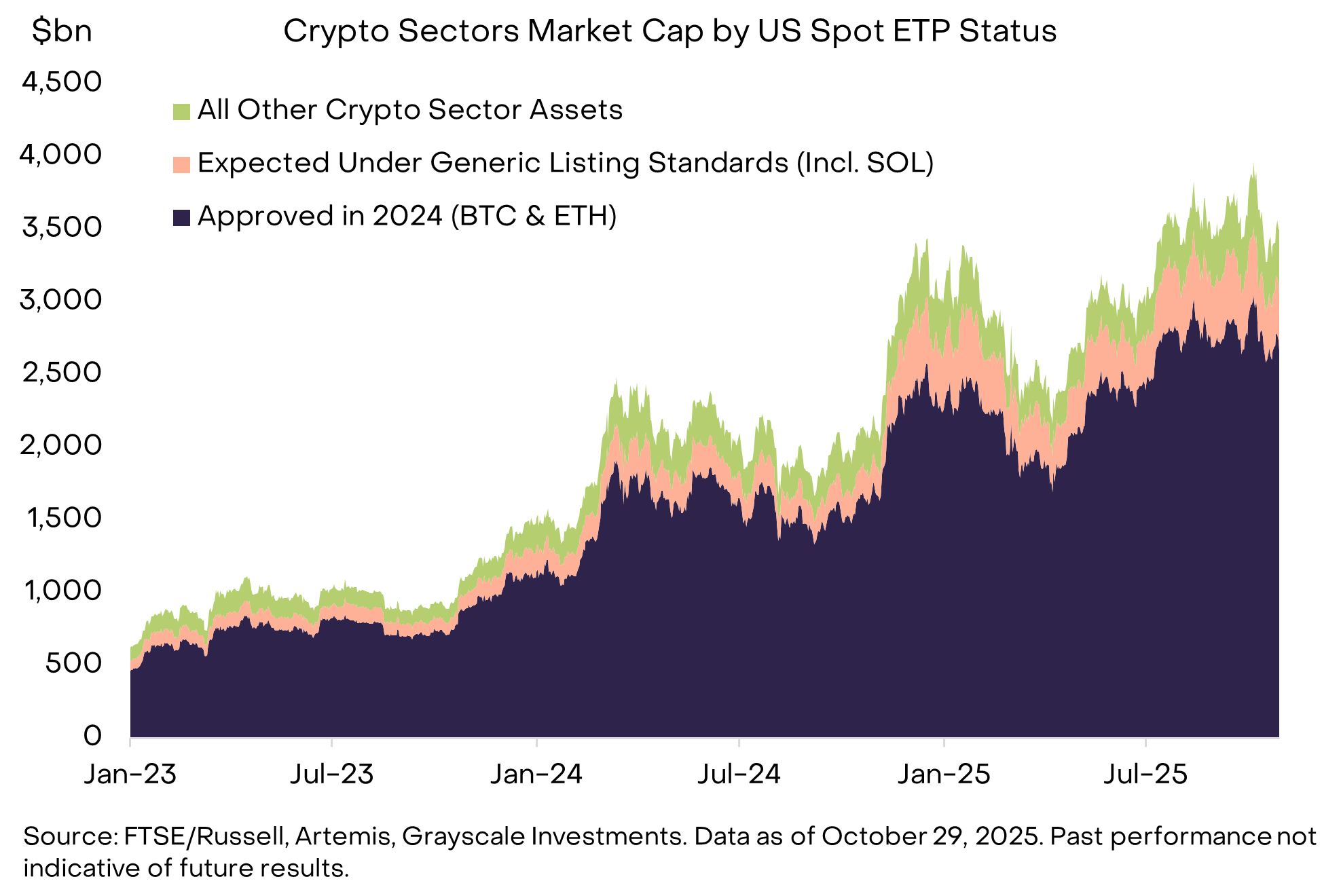

The altcoins qualifying for ETPs under the new generic listing standards (including Solana) represent four of the six Crypto Sectors, and account for roughly 11% of total Crypto Sectors market capitalization (Exhibit 3).[4] Combined with Bitcoin and Ethereum, the assets available to U.S. investors through spot ETP products will account for about 90% of the Crypto Sectors market cap.

Exhibit 3: Crypto Sectors framework helps organize digital asset markets

Below are brief summaries of each of the 14 assets available as spot ETPs already or to be listed in the relatively near future, sorted by market cap. Investors should consider each token’s unique use case and risks and consider the potential benefits of holding a diversified basket of crypto assets.

For more crypto educational resources, see research.grayscale.com.

Bitcoin (BTC)

Market Cap: $2,200bn[5]; Crypto Sector: Currencies

Bitcoin was the first decentralized blockchain network, created as a peer-to-peer digital currency that is designed to enable secure and trustless transactions without intermediaries. The supply of Bitcoin is transparent, predictable, and capped at a total of 21 million coins. Like physical gold, their utility derives partly from the fact that they are unchanging and detached from political systems (for more background see The Macro Case for Crypto).

Ethereum (ETH)

Market Cap: $466bn; Crypto Sector: Smart Contract Platforms

Ethereum is a smart contract platform that serves as the foundation for many aspects of blockchain-based finance, including stablecoins, tokenized assets, and decentralized finance (DeFi). Unlike many other blockchains, activity in the Ethereum ecosystem takes place both on the Layer 1 (L1) Ethereum mainnet and on a constellation of Layer 2 (L2) networks (for more background see Ethereum: The OG Smart Contract Blockchain).

XRP Ledger (XRP)

Market Cap: $150bn; Crypto Sector: Currencies

The XRP Ledger (XRPL) is a mature blockchain with ambitions to improve cross-border payments and deliver other digital finance innovations. Created in 2012, XRP remains among the largest and most widely traded digital assets.

Solana (SOL)

Market Cap: $103bn; Crypto Sector: Smart Contract Platforms

Solana is a smart contract platform blockchain that stands out for the depth and diversity of its on-chain activity. Today it’s one of the category leaders in terms of users, transaction volume, and transaction fees[6] — arguably the three most important measures of blockchain activity (for more background, see Solana: Crypto’s Financial Bazaar).

Dogecoin (DOGE)

Market Cap: $28bn; Crypto Sector: Consumer & Culture

Dogecoin is a functioning blockchain like XRP Ledger or Solana, but based on the “Doge” internet meme, a Shiba Inu dog that gained viral attention worldwide. Memecoins can be thought of as tokenized and investable representations of internet culture. Dogecoin’s community culture and viral origins have contributed to its enduring visibility.

Cardano (ADA)

Market Cap: $23bn; Crypto Sector: Smart Contract Platforms

Cardano is a smart contract blockchain developed through peer-reviewed academic research[7] and supported by a dedicated community around the world. The ADA token powers the Cardano network, enabling users to stake their tokens, participate in governance, and pay for transactions.

Chainlink (LINK)

Market Cap: $12bn; Crypto Sector: Utilities & Services

Chainlink is a decentralized oracle platform that aims to connect smart contracts with real-world data, cross-chain messaging, and off-chain systems — providing the secure middleware that enables tokenized assets, decentralized finance, and enterprise blockchain applications to function reliably. The LINK token is Chainlink’s native utility token, used to pay for oracle services, reward node operators, and serve as an economic and staking asset that aligns incentives and underpins the security of the Chainlink network (for more background, see Building Block: Chainlink).

Bitcoin Cash (BCH)

Market Cap: $11bn; Crypto Sector: Currencies

Bitcoin Cash is a peer-to-peer electronic cash system created through a Bitcoin hard fork in 2017 after a contentious debate over scaling (i.e., whether and how to change Bitcoin to offer faster and cheaper transactions). Bitcoin Cash attempts to achieve greater scale by allowing more bytes in each block.

Stellar (XLM)

Market Cap: $10bn; Crypto Sector: Currencies

Stellar is a decentralized payments network designed to facilitate fast, low-cost cross-border transfers between currencies and financial institutions, with a focus on connecting traditional banking systems to blockchain-based settlements. The Lumen token (XLM) is Stellar’s native token used to pay transaction fees, help prevent spam on the network, and serve as a bridge currency that enables efficient exchange between different fiat and digital assets.

Avalanche (AVAX)

Market Cap: $8bn; Crypto Sector: Smart Contract Platforms

Avalanche is a smart contract platform blockchain that provides a high degree of customization for distinct use cases. Through its unique design choices, the Avalanche protocol has evolved over time into a diverse, flexible, and multifaceted ecosystem.

Litecoin (LTC)

Market Cap: $7.3bn; Crypto Sector: Currencies

Litecoin is a decentralized digital currency that offers fast, low-cost global payments, positioning it as a practical alternative to Bitcoin for everyday use. It is based on Bitcoin’s source code but offers faster block times and lower transaction costs[8]. Litecoin also offers some privacy-preserving features.

Hedera Hashgraph (HBAR)

Market Cap: $8.4bn; Crypto Sector: Smart Contract Platforms

Hedera is a “permissioned” smart contract platform blockchain overseen by a council of major institutions[9]. Anyone can create applications for the Hedera network, but only designated entities can participate in network consensus and validate transactions.

Shiba Inu (SHIB)

Market Cap: $5.9bn; Crypto Sector: Consumer & Culture

Like Dogecoin, the Shiba Inu token is a dog-based memecoin with economic value as a digital collectible. Unlike Dogecoin, Shiba Inu is not its own blockchain, but exists as a token on the Ethereum blockchain.

Polkadot (DOT)

Market Cap: $4.4bn; Crypto Sector: Smart Contract Platforms

Polkadot is a blockchain protocol designed to be the connective tissue of Web 3.0 — the vision for digital commerce based on blockchain technology first articulated by Polkadot founder and Ethereum co-founder Gavin Wood. Within the Polkadot ecosystem, specialized blockchains called parachains connect with a coordinating relay chain.

Some links are for articles which may sit behind a paywall and may require a subscription to access them in full.

[2] Technically, commodity-based trust shares.

[3] The criteria relate to listings of specific products on qualifying venues. For more details, see SEC pages 5-6.

[4] Source: FTSE/Russell, Grayscale Investments. As of October 29, 2025.

[5] Source: Artemis, data as of October 31, 2025. All market caps listed below are from Artemis as of October 31, 2025.

[6] Source: Artemis. As of October 30, 2025.