Last Updated: 9/1/2025 | 16 min. read

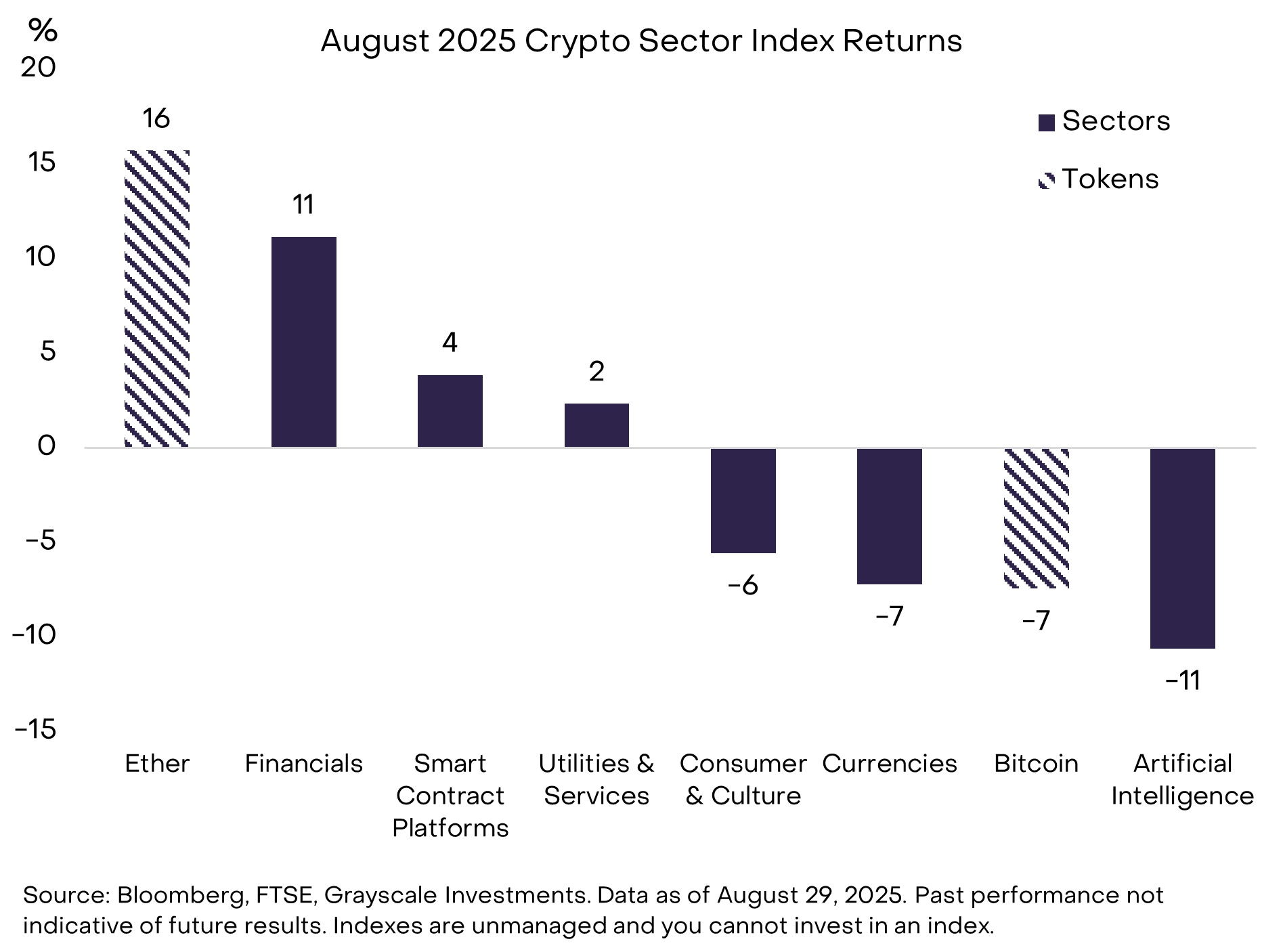

Total crypto market capitalization held steady at about $4 trillion in August 2025, but there were meaningful rotations under the surface. The crypto asset class includes a diverse range of software technologies with different fundamental drivers, so token valuations do not always move in lockstep.

While Bitcoin’s price declined in August, Ether was up 16%.[1] The second-largest public blockchain (by market capitalization) seemed to benefit from investor focus on regulatory changes, which may support adoption of stablecoins, tokenized assets, and decentralized finance (DeFi) applications — areas where Ethereum is the current industry leader.

Exhibit 1 highlights the shifts across market segments in August using our Crypto Sectors framework — a rigorous taxonomy for digital assets and set of index products developed in partnership with FTSE/Russell. The Currencies, Consumer & Culture, and Artificial Intelligence (AI) Crypto Sector indexes each declined modestly month over month. Weakness in the AI Crypto Sector mirrored the underperformance of AI-related stocks in public equity markets. Meanwhile, the Financials, Smart Contract Platforms, and Utilities & Services Crypto Sectors indexes each gained during the month. Although lower month over month, Bitcoin’s price reached a new all-time high of about $125,000 in mid-August; Ether’s price also touched a new all-time high of just under $5,000.[2]

Exhibit 1: Significant rotations across Crypto Sectors in August

In our view, Ethereum’s recent outperformance is tied to fundamentals: most importantly, the improvement in regulatory clarity for digital assets and blockchain technology in the United States. Arguably the single most important policy change this year, in our view, was the passage of the GENIUS Act in July. This legislation provides a comprehensive regulatory framework for payment stablecoins in the U.S. market (for background, see Stablecoins and the Future of Payments). Ethereum is the leading blockchain for stablecoins today (in terms of transactions and balances), and passage of the GENIUS Act sent Ether up nearly 50% in July.[3] The same themes appeared to carry Ether higher in August as well.

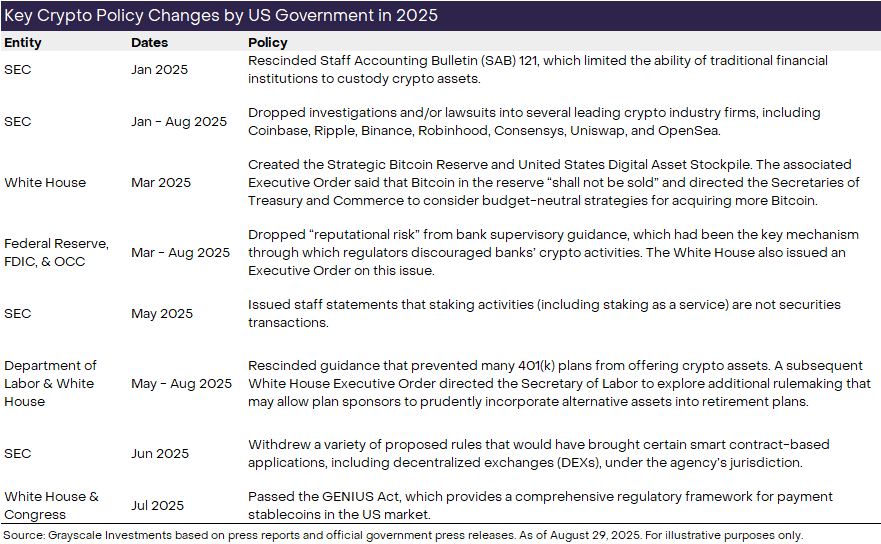

Recent U.S. policy changes this year extend well beyond stablecoins, however, and encompass a wide range of issues from crypto asset custody to bank supervisory guidance. Exhibit 2 summarizes the most important specific policy actions by the Trump administration and federal agencies on digital assets this year, in our view. These policy changes — and more still to come — have stimulated a wave of institutional investment across the crypto industry (for more details, see March 2025: Institutional Chain Reaction).

Exhibit 2: Policy changes creating greater regulatory clarity for crypto industry

Underscoring the changing regulatory picture for digital assets, in August Federal Reserve governors Waller and Bowman both attended a blockchain conference in Jackson Hole, Wyoming — which would have been hard to imagine only a few years ago. The event immediately preceded the Fed’s own annual Jackson Hole economic policy conference. Their speeches stressed that blockchains should be considered an innovation in financial technology, and that regulators should strike a balance between preserving financial stability and creating space for new technologies to grow.[4]

In September, the Senate Banking Committee plans to take up crypto market structure legislation — regulation that will tackle aspects of crypto markets beyond stablecoins. The Senate’s efforts build on the CLARITY Act, which passed the House with bipartisan support in July. Senate Banking Committee Chair Scott said that he expects market structure legislation to also receive bipartisan support in that chamber.[5] However, there are still meaningful issues to iron out. Industry groups are particularly focused on ensuring that market structure legislation incorporates protections for open-source software developers and non-custodial service providers. This issue may see ongoing debate among lawmakers in the coming months (note that Grayscale is a signatory to a recent industry comment letter to members of the Senate Banking and Agriculture Committees).

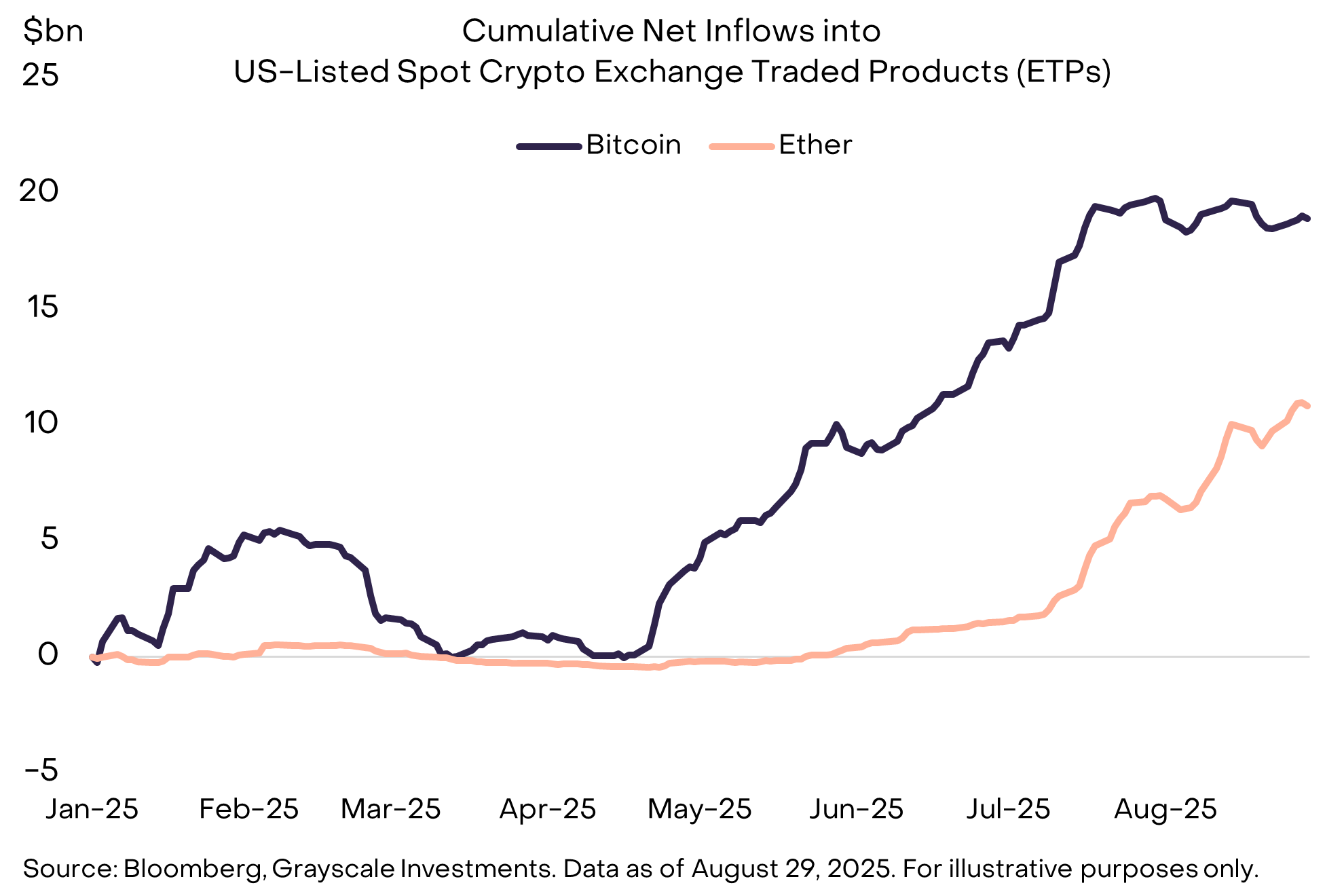

Bitcoin (BTC) underperformance and Ether (ETH) outperformance in August was evident in fund flows across a range of venues and products.

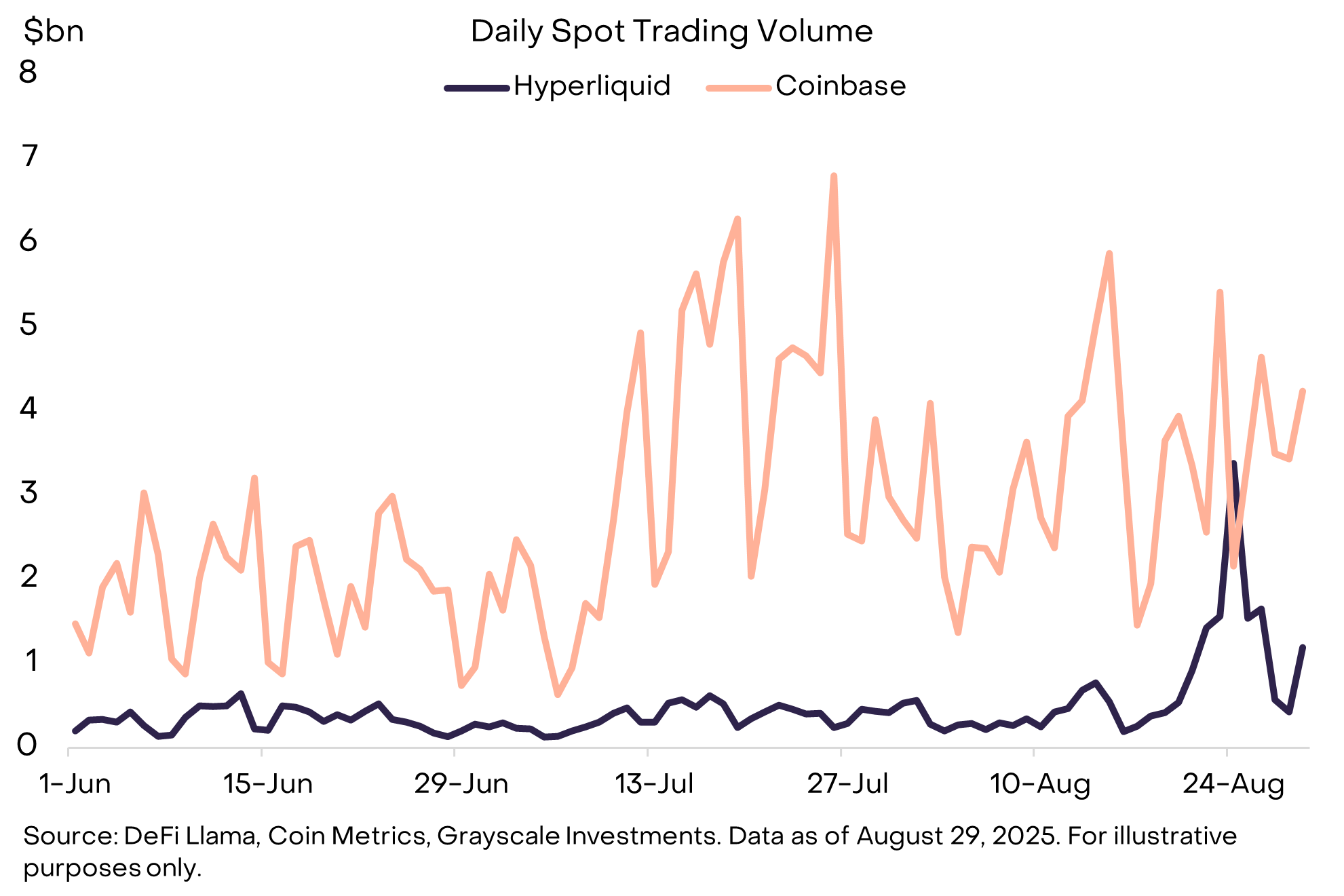

Part of the drama played out on Hyperliquid, a decentralized exchange (DEX) offering both spot trading and perpetual futures (for background, see DEX Appeal: The Rise of Decentralized Exchanges). Starting on August 20, a Bitcoin “whale” (large holder) sold approximately $3.5 billion BTC and immediately bought about $3.4 billion ETH.[6] While we cannot speak to the investor’s motivations, it was encouraging to see a risk transfer of this size take place on a DEX rather than a centralized exchange (CEX). In fact, during the biggest volume day of the month, Hyperliquid spot trading volume was briefly higher than Coinbase spot volume (Exhibit 3).

Exhibit 3: Surge in Hyperliquid spot volume

A similar preference for ETH was apparent in net inflows into crypto exchange-traded products (ETPs) during the month. The U.S.-listed spot Bitcoin ETPs experienced net outflows of $755 million — the first month of net outflows since March. In contrast, the U.S.-listed spot Ether ETPs saw net inflows of $3.9 billion, following net inflows of $5.4 billion in July (Exhibit 4). After the surge in ETH net inflows over the last two months, both BTC and ETH ETPs hold more than 5% of the outstanding supply of their respective tokens.

Exhibit 4: ETP net inflows shifted toward ETH

Bitcoin, Ether, and many other crypto assets have also been supported by purchases from digital asset treasuries (DATs) — public companies that hold crypto on balance sheet and serve as access vehicles for equity investors. Strategy (formerly MicroStrategy), the largest Bitcoin DAT by holdings, purchased an additional 3,666 BTC (~$0.4 billion) in August. Meanwhile, the two largest Ethereum DATs purchased a combined 1.7 million ETH (~$7.2 billion).[7]

According to press reports, at least three new Solana DATs are in the works, including $1 billion-plus vehicles sponsored by Pantera Capital and a consortium including Galaxy Digital, Jump Crypto, and Multicoin Capital.[8] Separately, Trump Media & Technology Group announced plans for a DAT based on the CRO token, associated with Crypto.com and its Cronos blockchain.[9] Other recent DAT announcements have focused on Ethena’s ENA token, Story Protocol’s IP token, and Binance Smart Chain’s BNB token.[10]

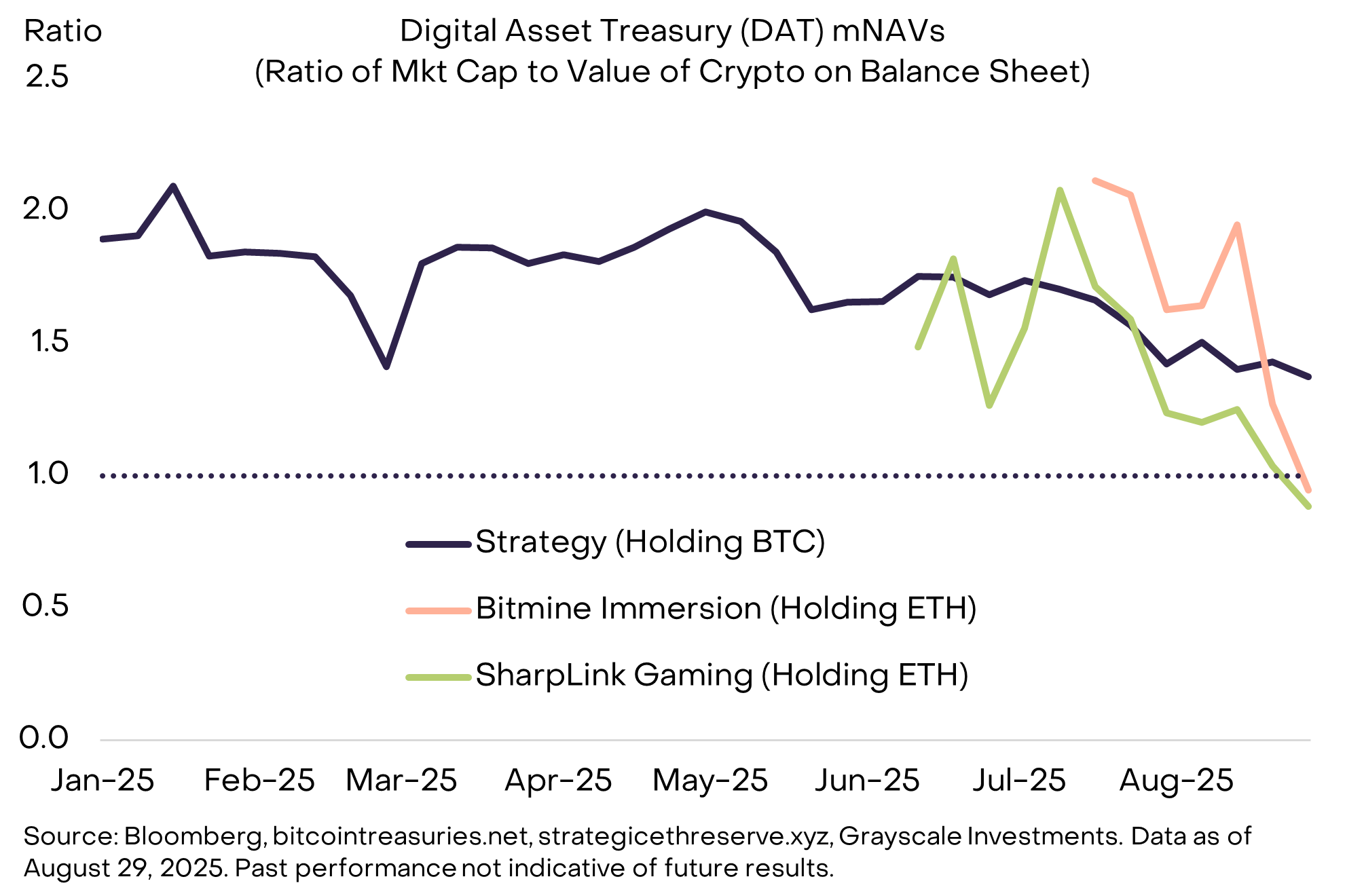

Although sponsors continue to supply these vehicles, price performance indicates investor demand may be getting saturated. To measure the supply/demand imbalance for DATs, analysts typically monitor their “mNAV,” defined as the ratio of the firm’s market capitalization to the value of the crypto assets on balance sheet. If there is excess demand for crypto assets in the form of public equity instruments (i.e., not enough DATs) mNAVs may trade above 1.0; if there is excess supply of crypto assets in the form of public equity instruments (i.e., too many DATs) mNAVs may fall below 1.0. Currently mNAVs for the largest projects appear to be converging toward 1.0, suggesting supply and demand for DATs is coming into balance (Exhibit 5).

Exhibit 5: Valuation premiums for DATs are falling

Like in every asset class, much of the public discussion about crypto markets focuses on short-term issues, like regulatory changes, ETF flows, and DATs. However, it can be helpful to take a step back to consider the core investment thesis. While there are many different assets in crypto, Bitcoin’s raison d’être is to provide a monetary asset and peer-to-peer payments system based on explicit and transparent rules, that is independent of any specific individual or institution. Recently, threats to central bank independence offered another reminder of why many investors are interested in these properties.

For context, most modern economies use a “fiat” money system. This means that the currency has no explicit backing (i.e., it is not tied to a commodity or another currency) and its value is based solely on trust. Throughout history, governments have repeatedly exploited this feature to achieve their short-run goals (like being reelected). This can result in inflation and declining trust in the fiat money system.

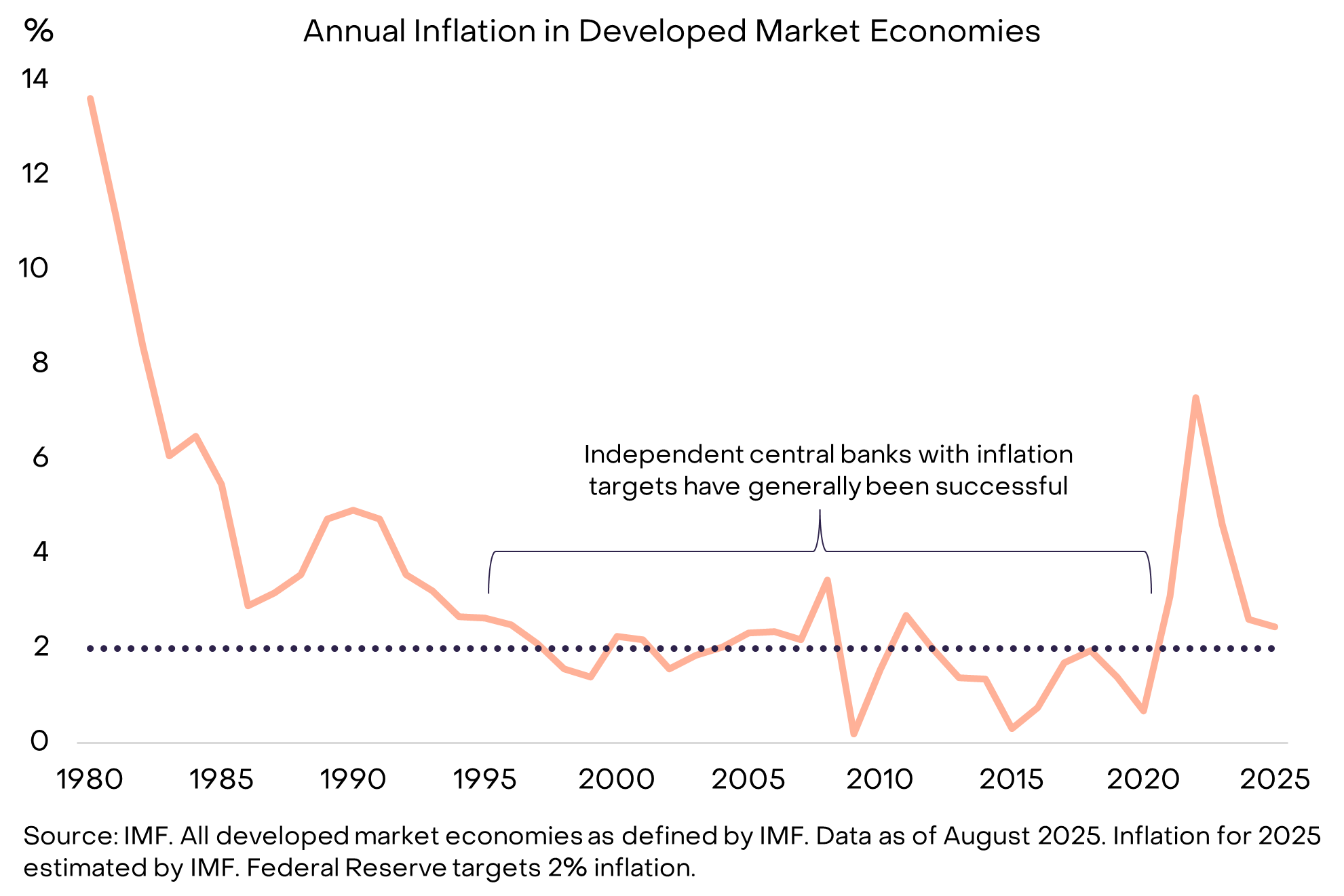

Therefore, to make fiat money effective, there needs to be a way to ensure that governments will honor their commitment not to exploit the system. The approach used in the United States and most developed market economies is to give the central bank explicit goals — usually in the form of an inflation target — and operational independence. Elected officials typically have some oversight of the central bank to ensure democratic accountability. Besides the temporary spike in inflation after Covid, this system of explicit goals, operational independence, and democratic accountability has achieved low and stable inflation in major economies since the mid-1990s (Exhibit 6).

Exhibit 6: Independent central banks achieved low and stable inflation

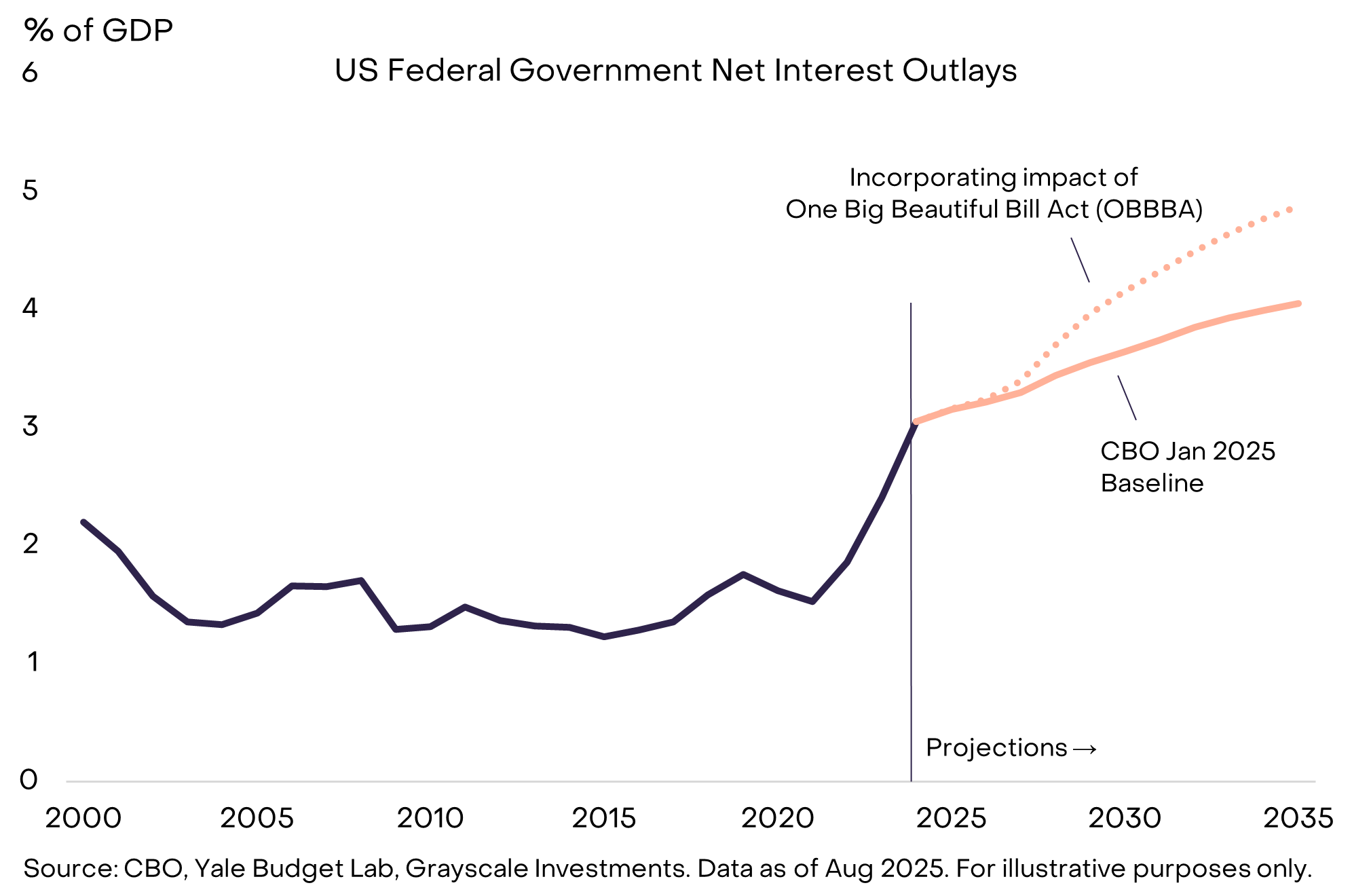

In the United States, this system is now under pressure. The underlying driver is not primarily about inflation; rather, it stems from deficits and interest expense. The U.S. federal government now has a debt stock totaling about $30 trillion or 100% of GDP—the highest since WWII, despite a peacetime economy with a low unemployment rate. As the Treasury refinances the debt at a ~4% interest rate, interest expense in the debt keeps rising, taking resources away from other uses (Exhibit 7).

Exhibit 7: Interest expense eating up more of federal budget

The One Big Beautiful Bill Act (OBBBA), passed in July, will lock in high deficits for the next 10 years. Unless interest rates come down, this would imply even higher interest expenses, and more crowding out of other uses of government revenue. As a result, the White House has repeatedly pressured the Federal Reserve to lower interest rates and called for Fed Chair Powell to resign. These threats to the Fed’s independence escalated in August with the attempted removal of Governor Lisa Cook, one of the six current members of the seven-person Board of Governors.[11] Although it may be useful for elected officials in the short-term, weaker Federal Reserve independence raises the risk of high inflation and currency weakness in the longer-term.

Bitcoin is a money system based on transparent rules and predictable supply growth. When investors lose confidence in the institutions that protect fiat money systems, they turn to alternatives that can be trusted. Unless policymakers take steps to strengthen the institutions that support fiat currencies — such that investors can trust the commitment to low and stable inflation over time — demand for Bitcoin may continue to rise.

Index Definitions: FTSE/Grayscale Crypto Sectors Total Market Index measures the price return of digital assets listed on major global exchanges. The FTSE Grayscale Smart Contract Platforms Crypto Sector Index was developed to measure the performance of crypto assets that serve as the baseline platforms, upon which self-executing contracts are developed and deployed. The FTSE Grayscale Utilities and Services Crypto Sector Index was developed to measure the performance of crypto assets that aim to deliver practical and enterprise-level applications and functionalities. The FTSE Grayscale Consumer and Culture Crypto Sector Index was developed to measure the performance of crypto assets that support consumption-centric activities across a variety of goods and services. The FTSE Grayscale Currencies Crypto Sector Index was developed to measure the performance of crypto assets that serve at least one of three fundamental roles: store of value, medium of exchange, and unit of account. The FTSE Grayscale Financials Crypto Sector Index was developed to measure the performance of crypto assets that seek to deliver financial transactions and services.

[1] Source: Bloomberg. Data as of August 29, 2025. Past performance not indicative of future results.

[2] Source: Bloomberg. Bitcoin all-time high on 8/14; Ether all-time high on 8/24.

[3] Other organizations have recently announced Layer 1 blockchains aimed at the stablecoin use case, including Circle (Arc), Stripe (Tempo), and Bitfinex (Plasma). Google also began promoting its Layer 1 GCUL in August. While Ethereum is the current market leader, many blockchains will compete for a share of stablecoin transaction volume and associated fees.

[5] Source: CoinTelegraph.

[6] Source: mempool.space, hypurrscan.io, etherscan.io, Grayscale investments. Price in USD as of August 29, 2025.

[7] Source: Bitcointreasuries.net, strategicethreserve.xyz, Bloomberg, Grayscale investments. Data as of August 29, 2025.

[8] Source: Unchained, CoinDesk.