Last Updated: 3/3/2025 | 13 min. read

Crypto markets in February 2025 were a study in contrasts, with falling valuations but mostly positive fundamental news. Despite the short-term setback, improving fundamentals should create a strong foundation for technological development and user adoption over time.

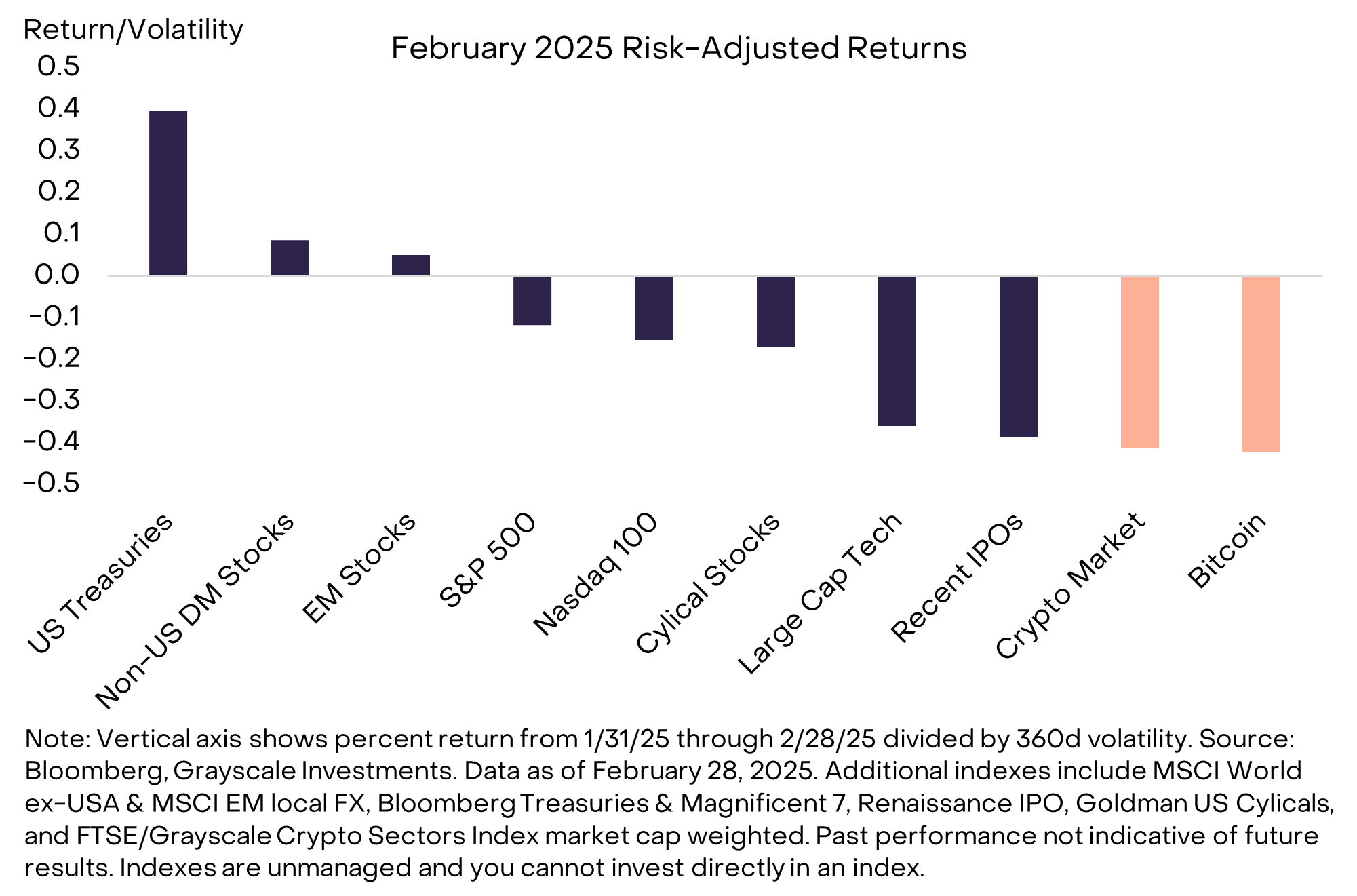

Our market cap-weighted Crypto Sectors price index declined by 22% in February 2025. On a risk-adjusted basis (i.e., accounting for each asset’s volatility), crypto market performance during the month was comparable to the declines in cyclical and technology-oriented equity market segments (Exhibit 1). Bitcoin performed moderately better than the crypto market as a whole, falling 18%, although its risk-adjusted returns were worse than the crypto market overall (reflecting Bitcoin’s typically lower volatility). Worries about the U.S. growth outlook resulted in lower Treasury yields and strong bond price returns, and non-U.S. equity markets outperformed.

Exhibit 1: Crypto valuations declined along with technology shares

Following the Trump administration’s executive order on crypto in January, the Securities and Exchange Commission (SEC) under acting Chairman Uyeda has begun shifting its approach to the industry. First, the agency ended or paused its investigations into several crypto institutions, including Coinbase, Binance, OpenSea, Uniswap, Consensys, and Robinhood.[1] Second, the SEC dropped its appeal in a lawsuit over the controversial “dealer rule,” which would have subjected a variety of decentralized finance (DeFi) protocols to traditional securities regulation.[2] Third, the agency announced the creation of a Cyber and Emerging Technologies Unit to replace the Crypto Assets and Cyber Unit.[3] Based on the press release, the intention appears to be to refocus the SEC’s enforcement efforts on criminal misconduct while creating space for legitimate development.

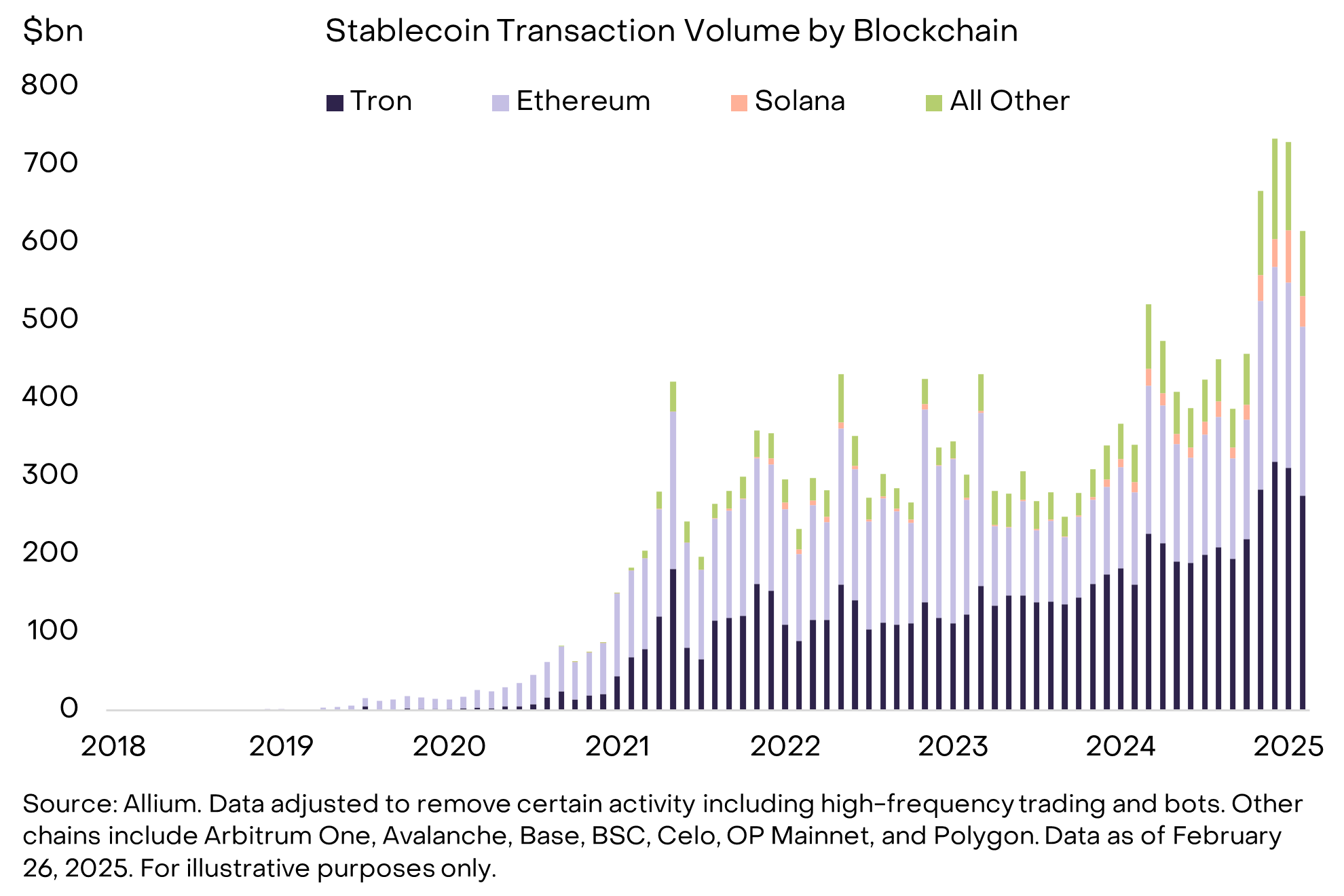

Meanwhile, a bipartisan group of senators introduced the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act. This legislation, which builds on related efforts from the previous Congress, is intended to provide a comprehensive regulatory framework for the issuance of payment stablecoins in the United States. Key provisions include defining the notion of a “permitted payment stablecoin issuer” and mandating that stablecoins are backed at least 1:1 by Treasury bills, insured deposits, or closely related instruments.[4] According to data from Allium, stablecoins currently process more than 100 million transactions per month totaling around $600bn (Exhibit 2; data are adjusted to exclude high-frequency trading and bots).

Exhibit 2: Growth in stablecoin transactions

Crypto’s improving market structure may be driving greater involvement by institutional investors. Hundreds of institutional investors already have crypto exposure through stakes in venture capital funds and hedge funds[5], and we are now seeing greater involvement through Bitcoin exchange-traded products (ETPs). For example, recently released 13F filings for Q4 showed an investment in the U.S.-listed Bitcoin ETPs by Mubadala Investment Company, the sovereign wealth fund for the government of Abu Dhabi.[6] Similarly, the Financial Times reported in February that U.S. foundations and university endowments have begun investing in Bitcoin or are considering allocating to the crypto asset class. In our view, crypto can potentially be an appropriate allocation for investors like sovereign wealth funds and endowments managing diversified portfolios with long-term time horizons.

Although the crypto industry is benefiting from greater regulatory clarity and institutional adoption, the industry has also faced a few recent setbacks. Most importantly, on February 21, the second-largest exchange in crypto by volume, ByBit, lost approximately $1.5bn in Ether and similar assets in a hack believed to be perpetrated by North Korea’s Lazarus Group.[7] The hack was the largest in crypto history based on total funds lost, highlighting the need for continued improvement in cybersecurity. At the same time, no user funds were lost in the incident, and observers generally praised the exchange’s crisis response efforts.[8] ByBit spot trading volume had broadly normalized by the end of February. Although crypto cybercrime remains an important issue, the Dollar value lost through hacks has declined over time relative to the size of the crypto market.[10]

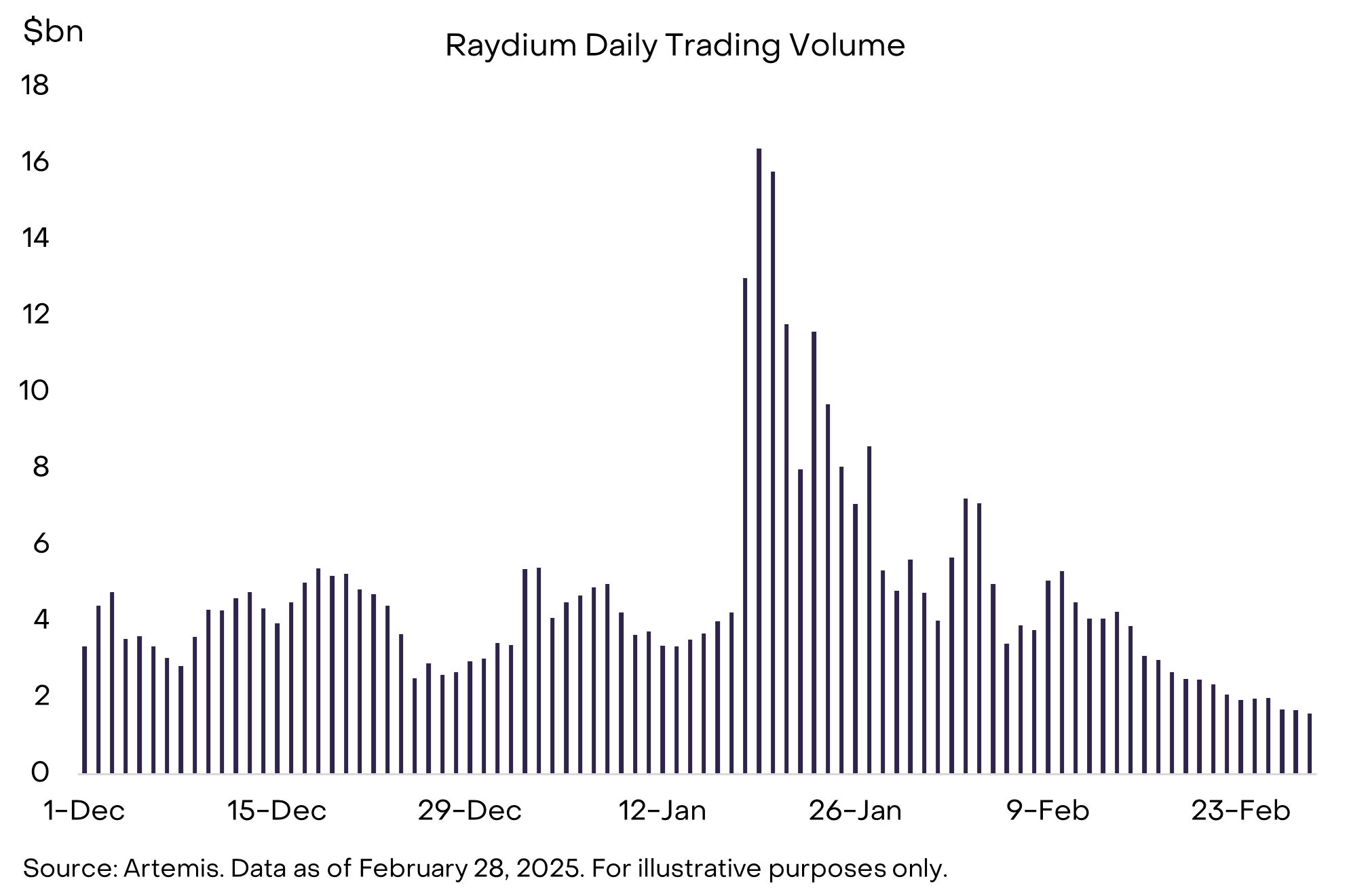

Separately, the booming Solana ecosystem cooled recently due to a turn lower in memecoin activity. Prior to last month, memecoin activity was driving a significant amount of transaction volume and fee revenue on the Solana blockchain — drawing in even President Trump and the first lady (for more background, see our January 2025 monthly report). However, the launch of a memecoin tied to Argentine President Javier Milei — and related disclosures about malpractice by certain memecoin promotors[11] — seemed to trigger a turn in market sentiment.

Since that time, valuations of popular memecoins have declined by 15%-35%[12], and trading volume on leading Solana decentralized exchanges (DEXs) like Raydium has declined (Exhibit 3). Memecoins can be considered digital collectibles and we believe they will likely remain a permanent feature of crypto markets; however, the latest wave of extremely high new issuance and trading volume on Solana may be over. Nonetheless, Solana is a leading blockchain in other key categories — including Decentralized Physical Infrastructure (DePIN) projects — and lower memecoin trading activity does not materially affect the long-term investment thesis for the blockchain’s native SOL token, in our view.

Exhibit 3: Memecoin trading on Solana has slowed

We expect crypto markets to quickly move beyond news about the ByBit hack and recent developments in memecoins. However, macro market conditions could remain a source of volatility over the coming months. The Trump administration has begun to implement its economic policy agenda, which includes cuts to immigration, higher tariffs, and reductions in government spending. While many voters are likely in favor of these policies — they were central elements of President Trump’s campaign — most economists expect that they will subtract from economic growth over the short term.[13] Moreover, equity markets may still be adjusting to the release of DeepSeek’s open-source large language model and its potential impact on AI-related capital spending. Given relatively high equity valuations and growing macro risks, we could envision a period of investor risk reduction and higher equity market volatility. Although crypto markets and equity markets are not perfectly correlated — making crypto a good portfolio diversifier — we expect significant equity market volatility could spill over to crypto valuations to some degree.

Given steadily improving fundamentals, however, we would not expect any sustained weakness in crypto valuations. The outlook for the crypto asset class looks bright, due to improving market structure and regulatory clarity, rising adoption of stablecoins and other technologies, breakthroughs in decentralized AI development, and growing demand for Bitcoin as a sound money asset. For the many investors underweight the crypto asset class — i.e., with a very small allocation or none at all — lower valuations may therefore be an opportunity to increase allocations and participate in the potential upside.

Some links are for articles which may sit behind a paywall and may require a subscription to access them in full.

Index Definitions:The MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 Developed Markets countries (excluding the US) and 24 Emerging Markets countries. The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets countries. The Bloomberg-Barclays US Treasury Index measures the total returns of nominal US government notes and bonds with greater than one year remaining maturity. The Bloomberg Magnificent 7 Total Return Index (BM7T) is an equal-dollar weighted index that tracks seven of the most widely-traded companies in the United States. The Renaissance IPO index is a portfolio of companies that have recently completed an initial public offering ("IPO") and are listed on a U.S. exchange. The racks how a group of cyclical stocks performs compared to a group of defensive stocks. The FTSE/Grayscale Crypto Sectors Index (CSMI) measures the price return of digital assets listed on major global exchanges. The Nasdaq 100 Index is a stock index of the 100 largest companies by modified market capitalization trading on Nasdaq exchanges. The S&P 500 Index is a market-capitalization-weighted index of 500 leading publicly traded companies in the US.

[1] Source: Fortune, Reuters, WSJ, Coin Telegraph.

[3] Source: SEC, Davis Polk.

[4] Source: GENIUS Act.

[5] Source: Preqin, Grayscale Investments. Data as of February 2025.

[6] Source: Bloomberg.

[7] Source: ByBit, Elliptic. Second largest by volume as of January 2025.

[9] Source: Coin Metrics.

[10] Source: Chainalysis, Artemis, Grayscale Investments. Data as of 2024.

[12] Source: Kaito, Artemis, Grayscale Investments. Returns from Feb 14 through Feb 28. Based on top 20 memecoins by Kaito mindshare. Data as of February 28, 2025.

[13] Source: CBO, Tax Foundation, CNBC