Last Updated: 2/13/2025 | 10 min. read

Replacing a portion of portfolio allocations to Nasdaq 100 stocks with Bitcoin may allow investors to enhance returns, reduce risk without sacrificing returns, or move out the efficient frontier.

The stocks in the Nasdaq 100 index and Bitcoin are distinct but complementary portfolio exposures. The Nasdaq 100 includes the largest non-financial equities listed on the tech-heavy Nasdaq exchange. Bitcoin was the first public blockchain, and today is the largest crypto asset by market capitalization.[1] Both the Nasdaq 100 index and Bitcoin can be considered high-growth investments at the forefront of the economy’s digital transition. In a portfolio, replacing a portion of investments in Nasdaq 100 stocks with Bitcoin allows investors to reduce U.S. equity concentration risk and may help optimize risk-adjusted returns.

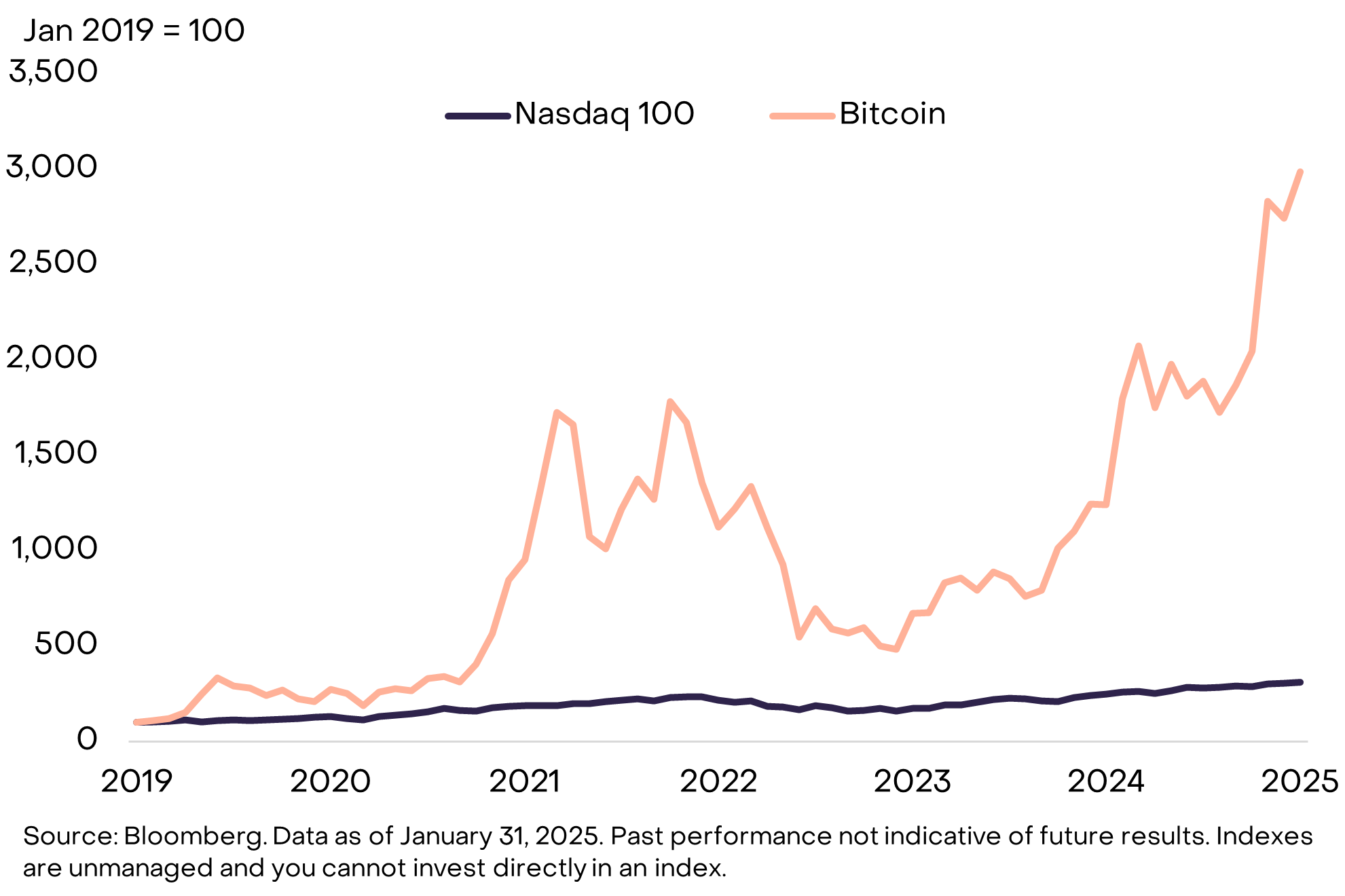

Nasdaq 100 index returns and Bitcoin returns have a moderate correlation and significantly different volatilities. Since 2019, Bitcoin’s monthly returns have had a ~40% correlation with Nasdaq 100 index returns (Exhibit 1). At the same time, Bitcoin returns had an annualized volatility of 71.5%, compared to 20.5% for the Nasdaq 100 index. However, investors who held for multiple years were typically compensated for Bitcoin’s higher risk with higher returns. Bitcoin’s cumulative returns were nearly 10 times greater over this period: the Nasdaq 100 increased roughly 3x while Bitcoin’s price rose about 30x. The Sharpe Ratio for both Bitcoin and the Nasdaq 100 was 1.0.[2]

Exhibit 1: Bitcoin vs. Nasdaq since 2019: ~40% correlation and ~10x higher return

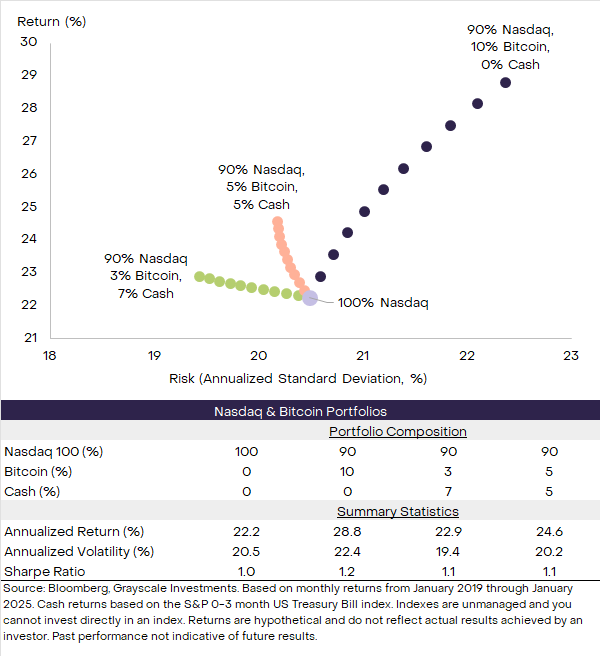

Given these properties, in a portfolio with an existing Nasdaq 100 position, a Bitcoin allocation along with cash could potentially be used to enhance expected returns, reduce risk without sacrificing expected returns, or move out the “efficient frontier” — i.e., achieve higher expected returns without higher volatility. As a hypothetical example, here we consider the potential portfolio impact of moving 10% of an allocation from the Nasdaq 100 to combinations of Bitcoin and cash.[3]

- Bitcoin for potentially enhancing expected returns. Since 2019, the Nasdaq 100 index has produced an annualized return of 22.2% on annualized volatility of 20.5%, for a Sharpe Ratio of 1.0. A hypothetical portfolio with 90% allocated to the Nasdaq 100 and 10% to Bitcoin would have produced an annualized return of 28.8% on annualized volatility of 22.4%, for a Sharpe Ratio of 1.2 (Exhibit 2). In other words, a Bitcoin allocation will shift the portfolio to a higher mix of risk and return, with some diversification benefit and a slightly higher Sharpe Ratio.

- Bitcoin for reducing risk without sacrificing expected returns. Alternatively, we can consider portfolios that allocate to both Bitcoin and cash, reflecting Bitcoin’s higher volatility. For example, since 2019, a hypothetical portfolio with 90% allocated to the Nasdaq 100, 3% allocated to Bitcoin, and 7% allocated to cash would have produced an annualized return of 22.9% on volatility of 19.4%, for a Sharpe Ratio of 1.1 — i.e., slightly higher returns and significantly lower portfolio volatility. This result reflects the fact that Bitcoin offers both higher risk and higher expected returns and therefore can contribute to capital efficiency in a portfolio (similar to the strategic use of leverage).

- Bitcoin for moving out the efficient frontier. Different combinations of Bitcoin and cash (or relatively low-volatility stocks) can potentially allow an investor in the Nasdaq 100 to move out the efficient frontier — i.e., to achieve higher expected returns without higher volatility. For example, since 2019, a hypothetical portfolio with 90% allocated to the Nasdaq 100 and 5% each to Bitcoin and cash would have produced an annualized return of 24.6% on annualized volatility of 20.2%. In other words, adding a balanced combination of Bitcoin and cash hypothetically would have achieved roughly a 2%-point higher annualized return with comparable volatility than a Nasdaq 100 position alone.

Investors should consider their own circumstances and financial goals before investing in crypto. The asset class should be considered high risk and may not be suitable for investors with near-term capital needs and/or high-risk aversion. However, for investors seeking high-growth exposure to innovative technologies, Bitcoin may complement existing allocations like the Nasdaq 100 stocks, and could help investors reduce concentration risk to U.S. equities.

Exhibit 2: Hypothetical impact of adding Bitcoin to Nasdaq 100 allocations

HYPOTHETICAL SIMULATED PERFORMANCE RESULTS HAVE CERTAIN INHERENT LIMITATIONS. There is no guarantee that the market conditions during the past period will be present in the future. Rather, it is most likely that the future market conditions will differ significantly from those of this past period, which could have a materially adverse impact on future returns. Unlike an actual performance record, simulated results do not represent actual trading or the costs of managing the portfolio. Also, since the trades have not actually been executed, the results may have under or overcompensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. We selected the timeframe for our analysis because we believe it broadly constitutes the most complete historical dataset for the digital assets that we have chosen to analyze. For additional risk disclosure pertaining to hypothetical performance see end disclosures.

The hypothetical simulated performance results are based on a model that used inputs that are based on assumptions about a variety of conditions and events and provides hypothetical, not actual results. As with all mathematical models, results may vary significantly depending upon the value of the inputs given, so that a relatively minor modification of any assumption may have a significant impact on the result. Among other things, the hypothetical simulated performance calculations do not take into account all aspects of the applicable asset’s characteristics under certain conditions, including characteristics that can have a significant impact on the results.

Further, in evaluating the hypothetical simulated performance results herein, each prospective investor should understand that not all of the hypothetical assumptions used in the model are described herein, and conditions and events that are not accounted for by the model may have a significant adverse effect on the performance of the assets described herein.

Prospective investors should consider whether the behavior of these assets should be tested based on different and/or additional assumptions from those included in the information herein.

IN ADDITION TO OTHER DIFFERENCES, PROSPECTIVE INVESTORS IN A PRODUCT SHOULD NOTE THE FOLLOWING POTENTIALLY SIGNIFICANT DIFFERENCES BETWEEN THE ASSUMPTIONS MADE IN THE HYPOTHETICAL SIMULATED PERFORMANCE RESULTS INCLUDED HEREIN AND THE CONDITIONS UNDER WHICH A PRODUCT WILL PERFORM, WHICH COULD CAUSE THE ACTUAL RETURN OF SUCH PRODUCT TO DIFFER CONSIDERABLY FROM RETURNS SET FORTH BY THE HYPOTHETICAL SIMULATED PERFORMANCE, TO BE MATERIALLY LOWER THAN THE RETURNS AND TO RESULT IN LOSSES OF SOME OR ALL OF THE INVESTMENT BY PROSPECTIVE INVESTORS.

IN ADDITION, THE HYPOTHETICAL SIMULATED PERFORMANCE RESULTS DO NOT ASSUME ANY GAINS OR LOSSES FROM TRADING AND THEREFORE DO NOT REFLECT THE POTENTIAL LOSSES, COSTS AND RISKS POSED BY TRADING AND HOLDING ACTUAL ASSETS. The hypothetical simulated performance results do not reflect the impact the market conditions may have had upon a portfolio were it in existence during the historical period selected. The hypothetical simulated performance results do not reflect any fees incurred by a portfolio. If such amounts had been included in the hypothetical simulated performance, the results would have been lowered.

AS A RESULT OF THESE AND OTHER DIFFERENCES, THE ACTUAL RETURNS OF A PORTFOLIO MAY BE HIGHER OR LOWER THAN THE RETURNS SET FORTH IN THE HYPOTHETICAL SIMULATED PERFORMANCE RESULTS, WHICH ARE HYPOTHETICAL AND MAY NEVER BE ACHIEVED. Reasons for a deviation may also include, but are by no means limited to, changes in regulatory and/or tax law or generally unfavorable market conditions.

[1] Source: Artemis. Data as of January 31, 2025.

[2] Source: Bloomberg, Grayscale Investments. Based on monthly return data through January 31, 2025. Past performance not indicative of future results.

[3] All results based on monthly returns between January 2019 and January 2025.