Last Updated: 12/29/2025 | 14 min. read

Q4 2025 marked a pause in crypto’s momentum, as markets digested earlier gains and recalibrated expectations for the year ahead. After a broadly positive third quarter, returns declined across the crypto asset class, reflecting a more cautious tone amid evolving regulatory and technological considerations. Within this environment, performance varied across crypto markets, with privacy-related assets among the segments that held up better than others during the quarter, as reflected across our Crypto Sectors framework.

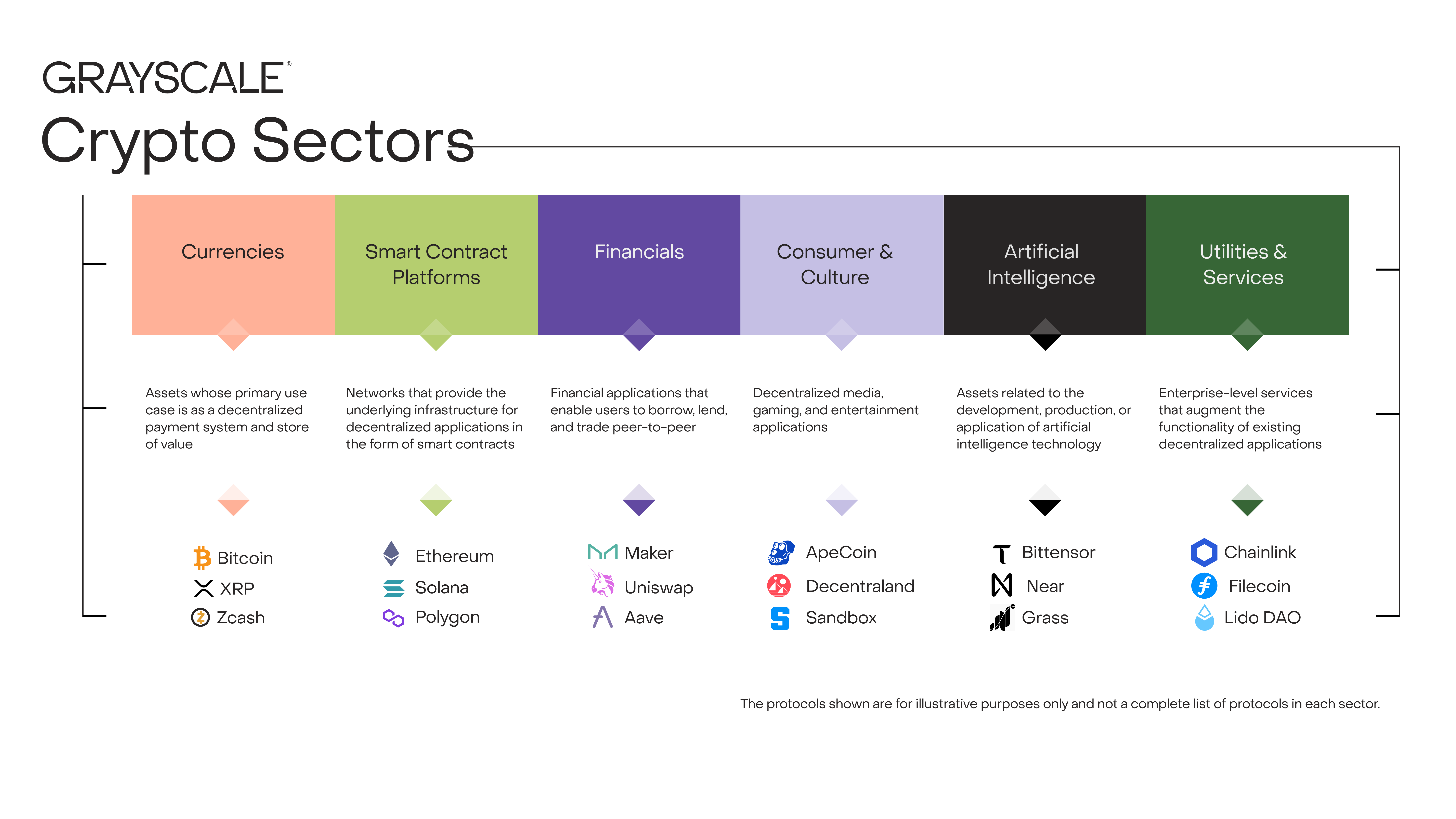

The crypto asset class includes a diverse range of investable tokens, all of which are related to public blockchain technology. The underlying software technologies have applications in consumer finance, artificial intelligence (AI), media and entertainment, and other fields. To keep things organized, Grayscale Research uses a proprietary taxonomy and family of indexes known as Crypto Sectors, developed in partnership with FTSE/Russell. The Crypto Sectors framework covers six distinct market segments (Exhibit 1). Together they include 208 tokens and have a combined market cap of $2.63 trillion as of the December 2025 rebalance.[1]

Exhibit 1: Crypto Sectors framework helps organize digital asset markets

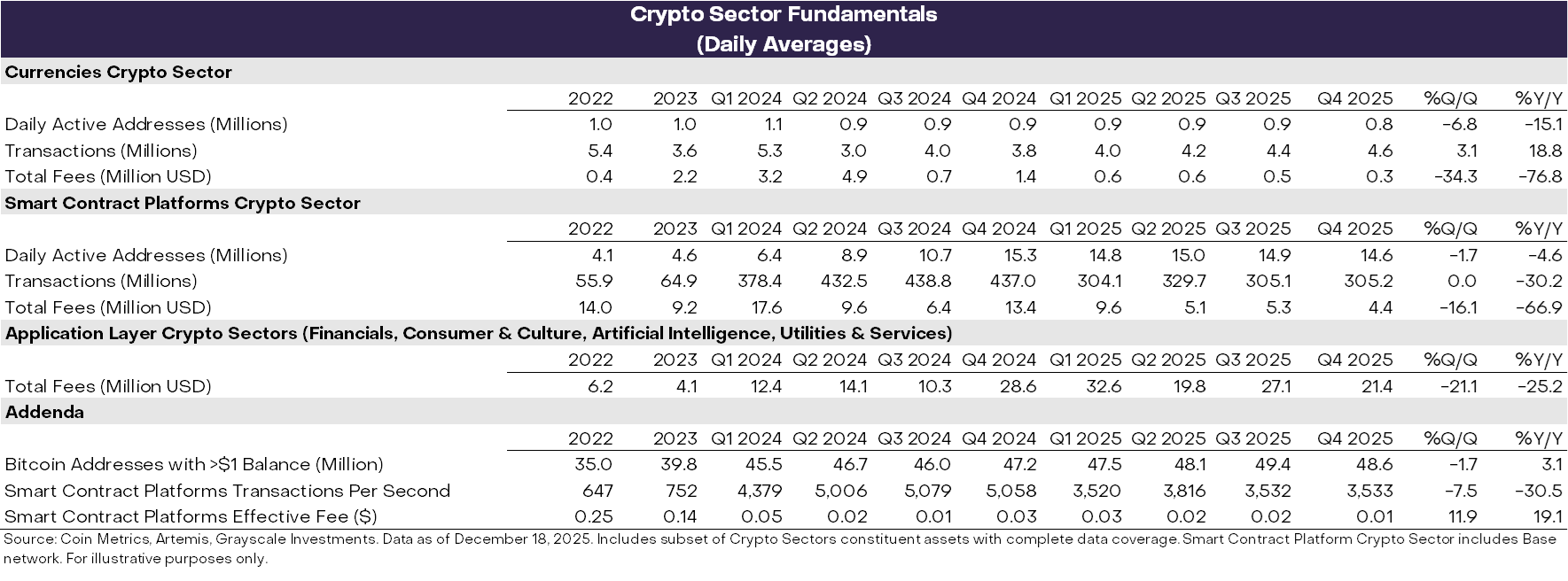

Blockchains are not businesses, but it is possible to measure their economic activity and financial health in an analogous way. The three most important measures of on-chain activity are users, transactions, and transaction fees (Exhibit 2). Because blockchains are pseudonymous, analysts typically use “active addresses” (blockchain addresses with at least one transaction) as an imperfect proxy for the number of users.

Fundamental measures of blockchain health generally deteriorated in Q4 2025. Total fees across smart contract platforms declined both quarter over quarter and year over year. A similar downward trend was observed in application-layer fee revenue. Other fundamental indicators, such as the number of active addresses in the Currencies and Smart Contract Platforms Crypto Sectors, also declined from the previous quarter. This contraction in on-chain activity broadly mirrors the decline in asset prices during the same period.

While on-chain activity softened in Q4 2025, similar pullbacks in usage metrics have historically occurred during market drawdowns and are not necessarily indicative of a longer-term structural deterioration in blockchain fundamentals. Relative to peak activity in Q4 2024 and Q1 2025, the recent decline in usage metrics reflects reduced speculative activity—particularly memecoin trading—consistent with a more risk-off market environment.

Despite the predominantly negative quarter-over-quarter trends, there were a few positive signals. Transaction volumes in the Currencies Crypto Sector increased modestly, driven primarily by rising Bitcoin transaction activity since the first half of 2025. Longer-term trends also remain encouraging. Although application-layer fees declined sequentially, Q4 2025 fee revenue for application-layer protocols was more than double that of Q3 2024 and meaningfully higher than in prior quarters. This longer-term trend underscores the continued maturation of the asset class, as a growing share of activity and fee generation migrates to the application layer with the development of new use cases and applications.

Exhibit 2: Blockchain fundamentals largely declined in Q4 2025

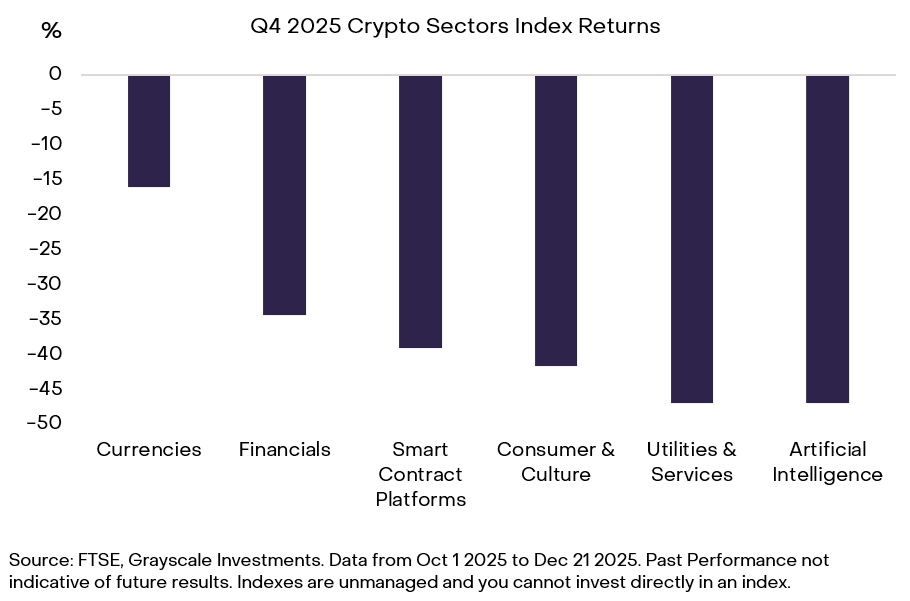

Following a quarter in which every crypto sector produced positive returns in Q3, crypto asset returns were negative across all six Crypto Sectors in Q4 2025 (Exhibit 3). The Currencies Crypto Sector outperformed other Crypto Sectors, led by the performance of several privacy-preserving tokens (discussed further below), suggesting more defensive positioning within crypto markets. Application-layer sectors underperformed, with the Artificial Intelligence Crypto Sector posting the weakest returns, reflecting heightened investor sensitivity to risk appetite and the relatively nascent nature of many assets in the sector.

Exhibit 3: Returns for each sector were negative in Q4 2025

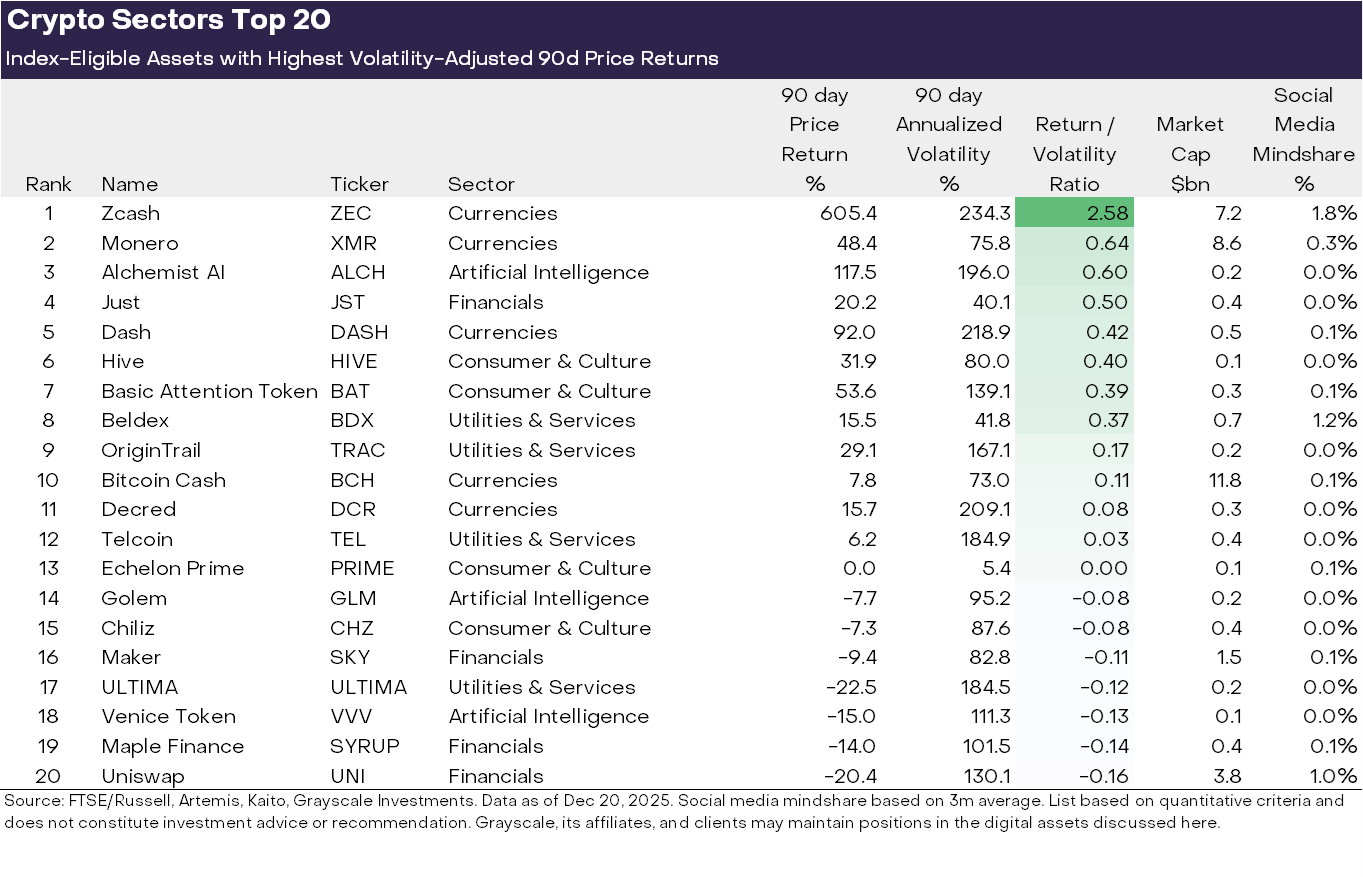

The diversity of the crypto asset class means that there are frequent changes in dominant themes and shifts in market leadership. In Exhibit 4, we display the Top 20 index-eligible[2] tokens for Q3 2025 based on volatility-adjusted price returns.

Given that Q4 was broadly negative in performance, only a limited number of assets across select themes generated positive risk-adjusted returns. This marked a contrast to Q3, when top performers included several large-cap assets like Ethereum, Solana, Chainlink, BNB, and Avalanche.

The list of Top 20 performers in Q4 featured several privacy-related tokens, including Zcash (ZEC), Monero (XMR), Dash (DASH), Decred (DCR), Basic Attention Token (BAT), and Beldex (BDX). Tokens in this theme dominated in mindshare (Exhibit 4), suggesting that price performance was driven at least in part by strength in narrative momentum. This coincided with rising usage across several privacy networks including Zcash and Dash.

Outside of the privacy theme, the Top 20 also featured a small number of protocols associated with the AI theme, including Alchemist, a Solana-based no code tooling platform for developers to create apps and games; OriginTrail, a decentralized knowledge graph for AI-based knowledge sharing; and Golem, a decentralized computing network.

Exhibit 4: Top 20 highlights performance of privacy theme

The dominant crypto investing theme in Q4 was privacy. As we discussed in our 2026 outlook report, privacy is a normal part of the financial system: almost everyone has an expectation that their paychecks, taxes, net worth, and spending habits will not be visible on a public ledger. However, most blockchains are transparent by default. If public blockchains are going to be more deeply integrated into the financial system, they will need much more robust privacy infrastructure — and this is becoming obvious now that regulation is facilitating that integration (via market structure legislation).

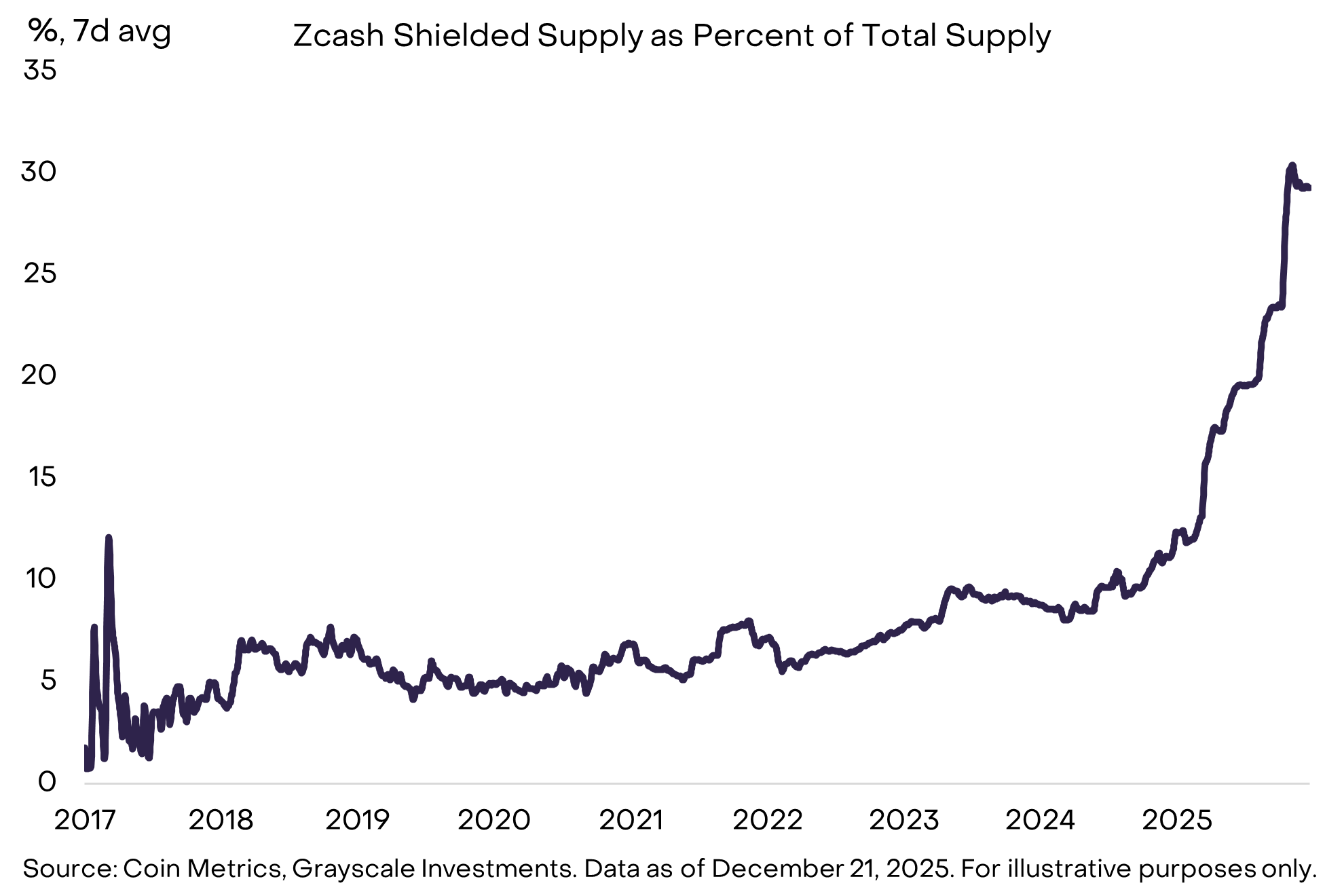

The rising focus on privacy led to outperformance of crypto asset with these features in Q4, especially Zcash[3] (ZEC). Zcash is a decentralized digital currency like Bitcoin but incorporates optional privacy features through “shielded” accounts and transactions. Shielded balances increased during 2025 as a share of token Zcash supply, indicating rising demand for the protocol’s privacy-preserving features (Exhibit 5).

Exhibit 5: Increase in usage of Zcash’s privacy features

Several other privacy-preserving protocols outperformed in Q4 2025.

Monero (XMR) is a network that uses stealth addresses and confidential transaction details. Monero has historically been the largest privacy-preserving asset in crypto by market cap, although the recent success of Zcash has increasingly challenged its long-standing market share dominance.[4]

Decred (DCR) is a digital currency network that offers user governance and privacy-enhancing functionality through its CoinShuffle++ feature.[5]

Dash (DASH) is a digital payments platform that features an optional privacy feature called PrivateSend and more than doubled daily transactions over the course of Q4.[6]

Basic Attention Token (BAT) is a blockchain-based advertising platform and internet browser. BAT is the native token of the Brave Browser ecosystem, a privacy-focused web browser, which surpassed 100mm monthly users this past quarter.[7]

Beldex (BDX) is a network offering a full stack of privacy-oriented products, including an encrypted messaging application and private browsing and payments services. Beldex recently integrated with LayerZero, allowing for cross-chain interoperability.[8]

As 2025 comes to a close, two themes are currently dominating debates among crypto investors: (i) market structure legislation in the U.S. Congress and (ii) the vulnerability of traditional cryptographic methods to quantum computing.

Grayscale expects a bipartisan crypto market structure bill to become law in 2026. The House passed its version of this legislation in July — known as the Clarity Act — and the Senate has since taken up its own process. While there are many details to be ironed out, broadly speaking the legislation provides a traditional finance rulebook for crypto capital markets, including registration and disclosure requirements, classifications of crypto assets, and rules for insiders. In practice, a more complete regulatory framework for crypto assets across the U.S. and other major economies could mean that regulated financial services firms report digital assets on balance sheet and begin transacting on the blockchain (for more details, see 2026 Digital Asset Outlook: Dawn of the Institutional Era).

Quantum vulnerability is an important topic, but we ultimately expect it to be a “red herring” for 2026 — the topic will generate a lot of debate but is unlikely to move prices, in our view. If technical progress on quantum computing continues, most blockchains will eventually require updates to their cryptography. Theoretically, a sufficiently powerful quantum computer could derive private keys from public keys, which could then be used to create valid digital signatures to spend users’ coins. Therefore, Bitcoin and most other blockchains — and virtually everything else in the economy that uses cryptography — will eventually need to be updated for post-quantum tools. Although these risks currently appear far off, markets may begin to evaluate blockchains on the basis of their ability to address the quantum challenge when it arrives. Together, these debates highlight the regulatory and technological landscape informing crypto markets heading into 2026.

Index Definitions: The FTSE/Grayscale Crypto Sectors Index (CSMI) measures the price return of digital assets listed on major global exchanges. The FTSE Grayscale Smart Contract Platforms Crypto Sector Index was developed to measure the performance of crypto assets that serve as the baseline platforms, upon which self-executing contracts are developed and deployed. The FTSE Grayscale Utilities and Services Crypto Sector Index was developed to measure the performance of crypto assets that aim to deliver practical and enterprise-level applications and functionalities. The FTSE Grayscale Consumer and Culture Crypto Sector Index was developed to measure the performance of crypto assets that support consumption-centric activities across a variety of goods and services. The FTSE Grayscale Currencies Crypto Sector Index was developed to measure the performance of crypto assets that serve at least one of three fundamental roles: store of value, medium of exchange, and unit of account. The FTSE Grayscale Financials Crypto Sector Index was developed to measure the performance of crypto assets that seek to deliver financial transactions and services. The FTSE Grayscale Artificial Intelligence Crypto Sector Index was developed to measure the protocols for which AI applications are the primary use case.

[1] FTSE, Grayscale, data as of 12/29/2025

[2] To be included in Crypto Sectors, tokens must be listed on a minimum number of qualifying exchanges and meet minimum market cap and liquid thresholds.

[3] Artemis, data as of 12/29/2025

[4] Artemis, data as of 12/29/2025

[6] Bitinfocharts, data as of 12/29/2025