Last Updated: 12/3/2025 | 10 min. read

Three years after the launch of ChatGPT, some of the world’s most valuable public and private companies are now those at the center of the AI investment boom.[2] But as AI advances, power and ownership are becoming increasingly concentrated among a few large companies. This has sparked growing concern over who controls the future of AI and who benefits from it.

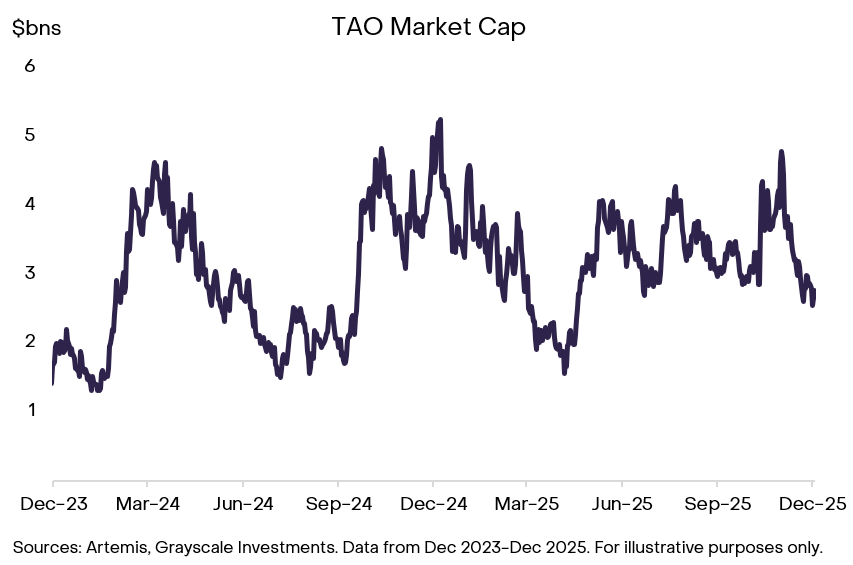

Bittensor offers an alternative. Founded in 2021 through a fair launch[3] and developed through a grassroots community, Bittensor is an open network where anyone can create, train, and access AI. Just as Bitcoin is a credibly neutral platform for money, Bittensor aims to be a neutral platform for AI development (for more on Bittensor, see the Token Overview & Investment Thesis).[4] Amid strong supply and demand-side tailwinds, Bittensor has grown in market cap meaningfully over the past few years.

Exhibit 1: TAO market cap has grown amid supply and demand-side tailwinds

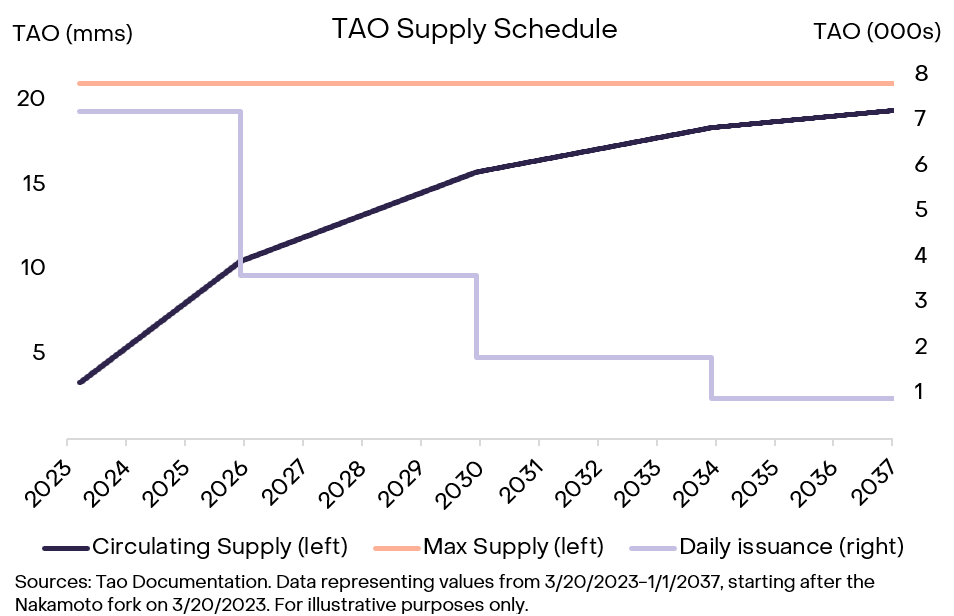

Bittensor follows the same supply schedule as Bitcoin (BTC), with the same scarcity and token limit of 21 million. Economic incentives on Bittensor run through the platform’s native token, TAO. On the Bitcoin network, BTC emissions incentivize miners to help secure the network with Proof of Work. On the Bittensor network, TAO emissions incentivize miners to produce AI-related digital commodities (e.g. compute or data storage).

Like Bitcoin, Bittensor follows a four-year halving cycle. The network’s first halving — expected as soon as December 14, 2025 — will cut new issuance in half, from 1 TAO minted per block (~7,200 per day) to 0.5 TAO minted per block (~3,600 TAO per day).[5]

This reduction in supply will lower emissions to network participants and increase TAO’s scarcity. Bitcoin’s history shows that reduced supply can enhance network value despite smaller rewards, as its network security and market value have strengthened through four successive halvings.[6] Similarly, Bittensor’s first halving marks a key milestone in the network’s maturation as it progresses toward its 21 million token supply cap (Exhibit 2).

Exhibit 2: TAO supply has a four-year halving cycle and a max of 21 million tokens

The halving arrives as Bittensor experiences strong adoption and expanding institutional access.

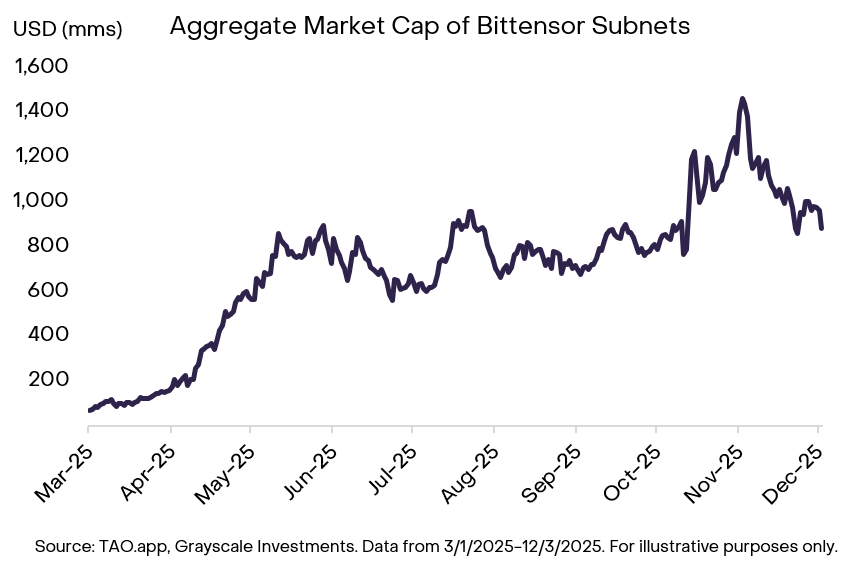

Bittensor functions like a “Y-Combinator of Decentralized AI development,” with TAO funding the development of different subnets — akin to AI startups — building specialized products or services on the network.

In February, Bittensor introduced “dynamic TAO,” enabling subnets to become directly investible for the first time.[7]Since then, the network has expanded to 129 active subnets spanning diverse use cases including compute, data storage, AI agents, and deepfake detection.[8] Aggregate subnet market cap has expanded sharply since launch (Exhibit 3).

While many subnets are still early in development, some have demonstrated product market fit. For example:

Chutes, the largest subnet on Bittensor by market cap, is an inference provider offering serverless compute for developers running AI models.[9] As of this past month, Chutes ranked as the leading inference provider by usage on OpenRouter, one of the most popular AI model aggregation platforms, placing it ahead of established centralized AI incumbents.[10]

Ridges, a subnet focused on crowdsourced AI agent development, recently produced an agent that outperforms Anthropic’s Claude 4 on benchmark coding tests.[11]

These examples provide evidence that subnets powered by the Bittensor network can potentially produce AI services that rival or exceed leading centralized AI competitors.

Exhibit 3: Aggregate subnet market cap has grown since the launch of dTAO in February 2025

Institutional investors now have easier exposure to TAO and the broader subnet ecosystem:

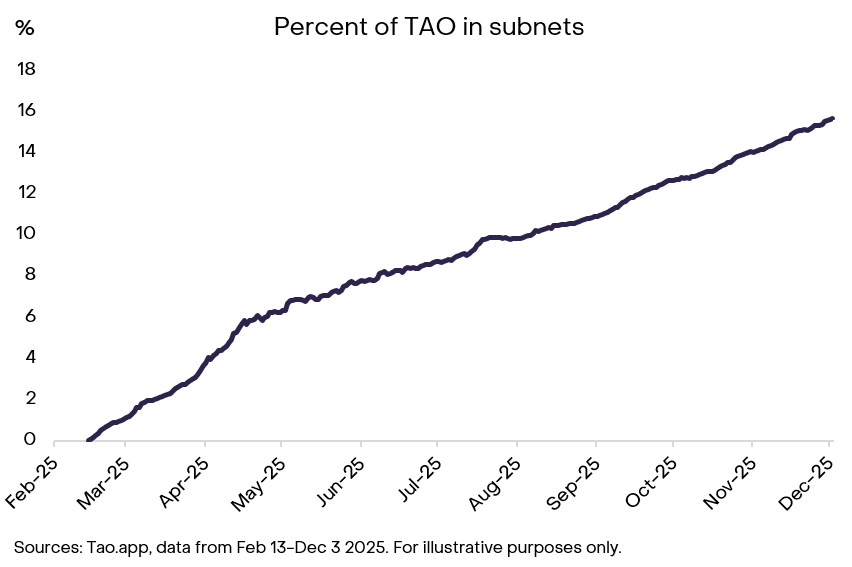

These developments — spanning network adoption and institutional access — have helped to drive growth across key metrics, including the number of active subnets, growth in number of accounts across the network, and a rise in the share of circulating TAO allocated to subnets (Exhibit 4).

Exhibit 4: Growth of circulating supply of TAO in subnets reflects growing investor access to and interest in subnets

Conclusion

As the AI industry continues to expand, so too does the need for decentralized alternatives that enable open ownership and participation in AI development. Bittensor, the largest asset in the Artificial Intelligence Crypto Sector by market cap, holds a first-mover advantage in this emerging sector in our view and has begun to show early signs of network effects taking hold.[15] The early success of certain subnet-based applications and an increase in institutional capital in the Bittensor ecosystem, combined with the forthcoming TAO supply halving, could be a positive catalyst for price, in our view.

* An accredited investor, as defined in Rule 501(a) of Regulation D under the Securities Act of 1933, as amended, is an individual with income over $200,000 ($300,000 with spouse) in each of the past two years, an individual with net worth over $1 million, excluding primary residence, an individual holding certain financial licenses (e.g., Series 7, 65, or 82), or an entity with over $5 million in assets or all equity owners who are accredited.

Glossary

Blockchain: A distributed and immutable digital ledger that processes and records transactions across a network of computers.

Mining: A process by which new tokens on proof of work blockchains are generated, where computers solve computationally intensive problems to earn “block rewards.”

Nakamoto fork: An upgrade of the Bittensor network in 2021 that was made to address early design issues on the network.

Proof of Work: A consensus mechanism in blockchain where participants (miners) solve complex mathematical puzzles to validate and add transactions to the blockchain.

Subnet: A discrete sovereign protocol designed to operate within a layer 1 blockchain (blockchains that process and record transactions of decentralized applications).

[1] Approximately four years based on circulating supply.

[2] Companies Marketcap, Yahoo Finance, data as of 11/7/25

[3] A fair launch refers to the release of a network or token without venture capital pre-sales or insider allocations—tokens are distributed openly to the public, often via mining or community participation.

[4] “Credibly neutral” in the sense that no individual can decide to censor any Bitcoin transactions or be biased towards any network participant, in the same way that Bittensor aims to be a platform for AI development without bias or censorship.

[5] Bittensorhalving.com

[6] Glassnode, data as of 12/3/2025

[7] Bittensor docs, https://docs.learnbittensor.org/

[8] Taostats, data as of 11/3/25.

[9] Tao.app. Data as of 11/7/2025.

[10] Chutes.ai

[11] Unsupervised Capital

[12] Yuma AI, which is not affiliated with Grayscale

[13] Jason Calacanis Twitter account

[14] Simplytao.ai

[15] FSTE Russell, Grayscale. Data as of 11/7/25.