Last Updated: 5/27/2025 | 19 min. read

Public blockchains are general-purpose technology like electricity, the internal combustion engine, or the personal computer: they have many different applications and could have a widespread impact across the economy as adoption grows. Bitcoin was the first public blockchain, applied to the use case of sound digital money. But the industry has since expanded well beyond that, bringing blockchain technology to traditional financial services like lending and trading, consumer applications, and many other areas.

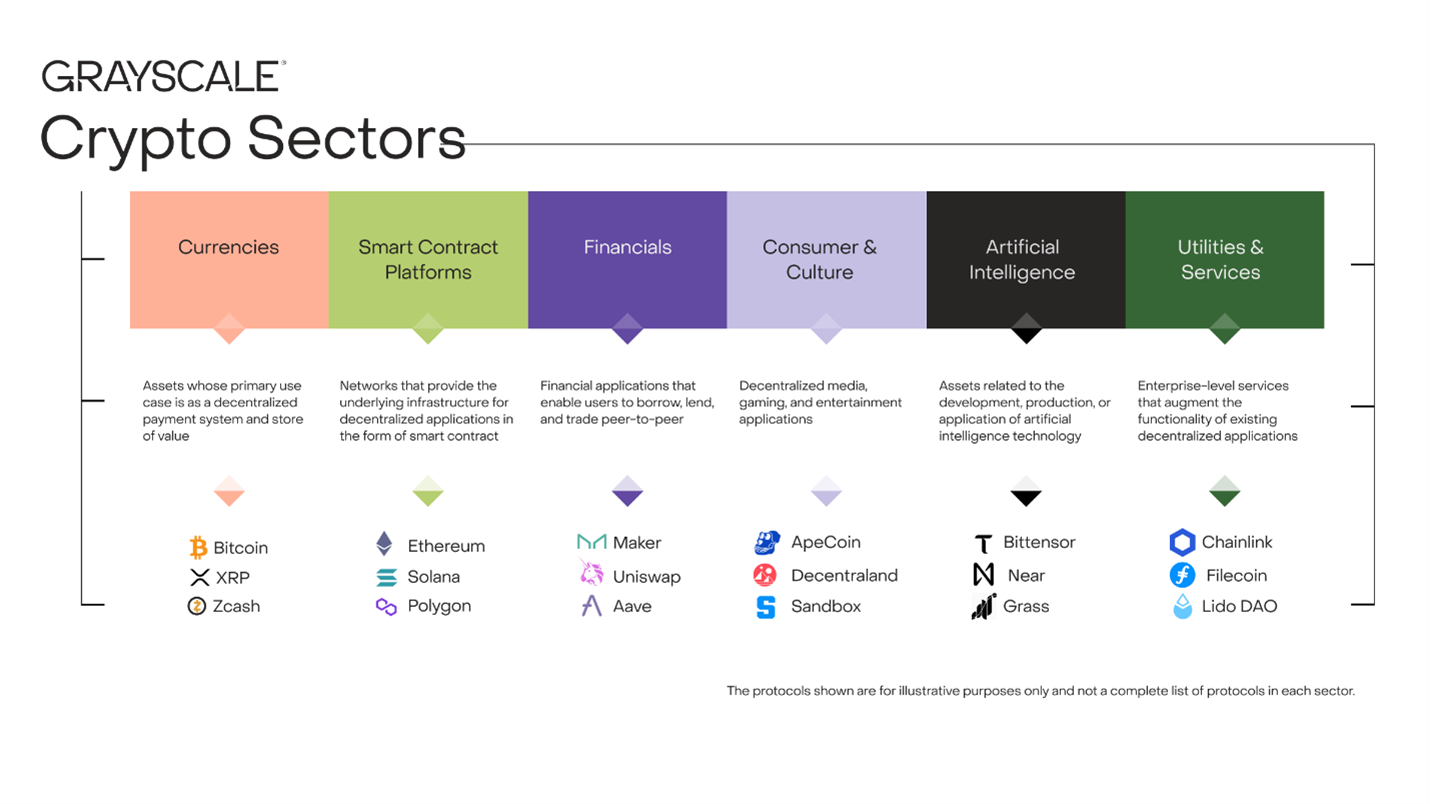

To keep track of it all, Grayscale Research organizes the asset class into distinct Crypto Sectors based on the de facto use of the underlying software. Investors can monitor the performance of each market segment through our Crypto Sectors family of indexes, developed in partnership with FTSE/Russell. The Crypto Sectors framework is analogous to the GICS used for public equities. The five existing Crypto Sectors are Currencies, Smart Contract Platforms, Financials, Consumer & Culture, and Utilities & Services.

Today we are introducing the Artificial Intelligence Crypto Sector, which will include the protocols for which AI applications are the primary use case (Exhibit 1).[2] Like the GICS system, Crypto Sectors is designed to evolve with the asset class over time. For instance, in 2016 S&P/Dow Jones Indices and MSCI created a new Real Estate Sector under the GICS, which consists of assets previously classified as Financials.[3] With this update, Real Estate became the 11th sector in the GICS taxonomy. Similarly, the Artificial Intelligence Crypto Sector will become the sixth sector in our taxonomy and will include certain assets previously included in the Smart Contract Platforms, Consumer & Culture, and Utilities & Services Crypto Sectors.

Exhibit 1: Crypto Sectors now includes six distinct market segments

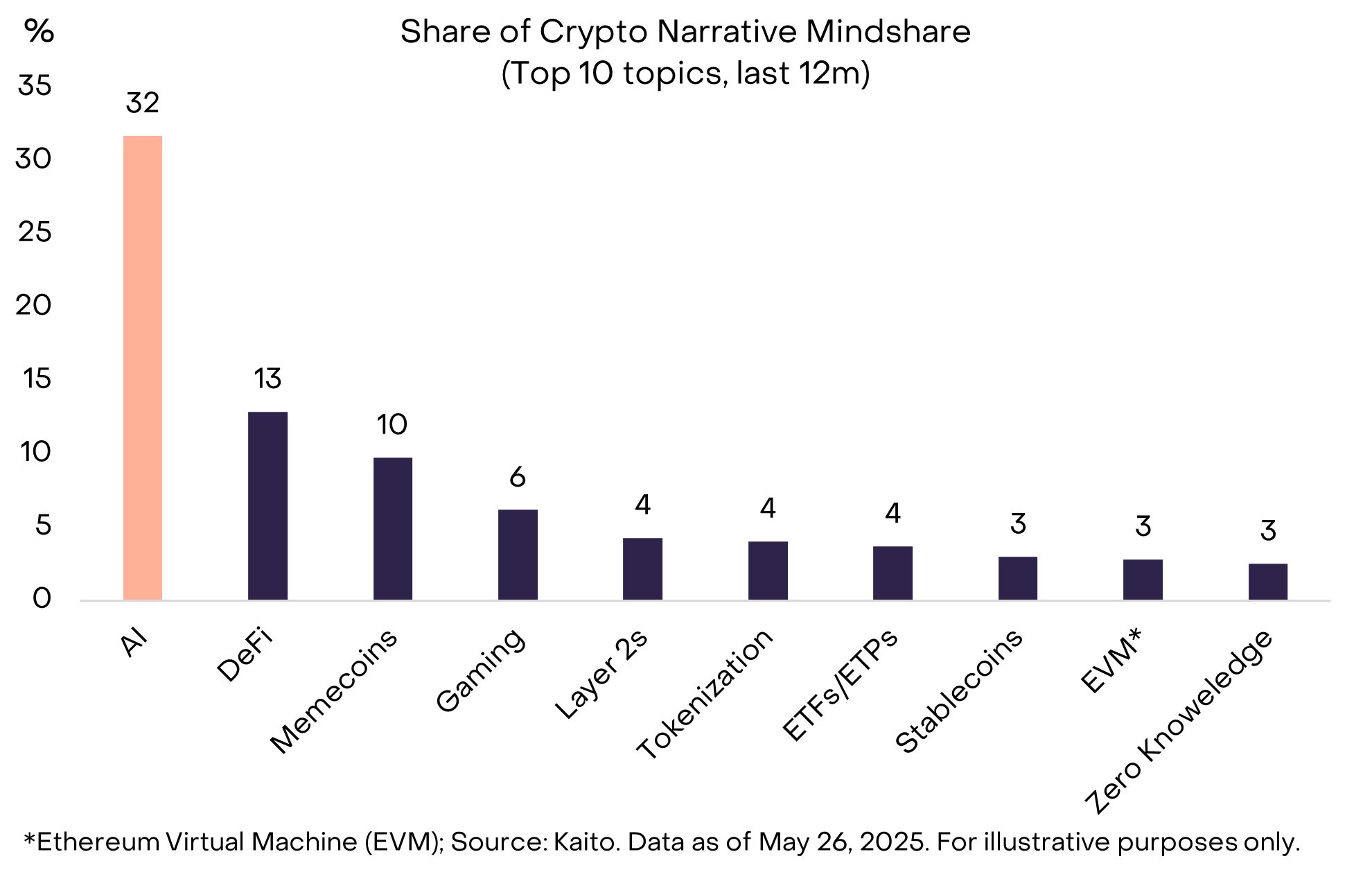

Grayscale Research believes decentralized AI has the potential to complement centralized AI development, and over the last year, AI applications have been the buzziest topic in crypto. For instance, decentralized AI projects have dominated social media “mindshare” (online discourse) according to data provider Kaito (Exhibit 2). Although several of the projects have been around for a few years, some projects like Bittensor have begun to see rising adoption. Moreover, many new tokens have met the market cap and liquidity thresholds for inclusion in Crypto Sectors and we expect several more AI-related projects to launch tokens later this year. For all these reasons, AI deserved its own Crypto Sector.

Exhibit 2: Decentralized AI dominates crypto mindshare

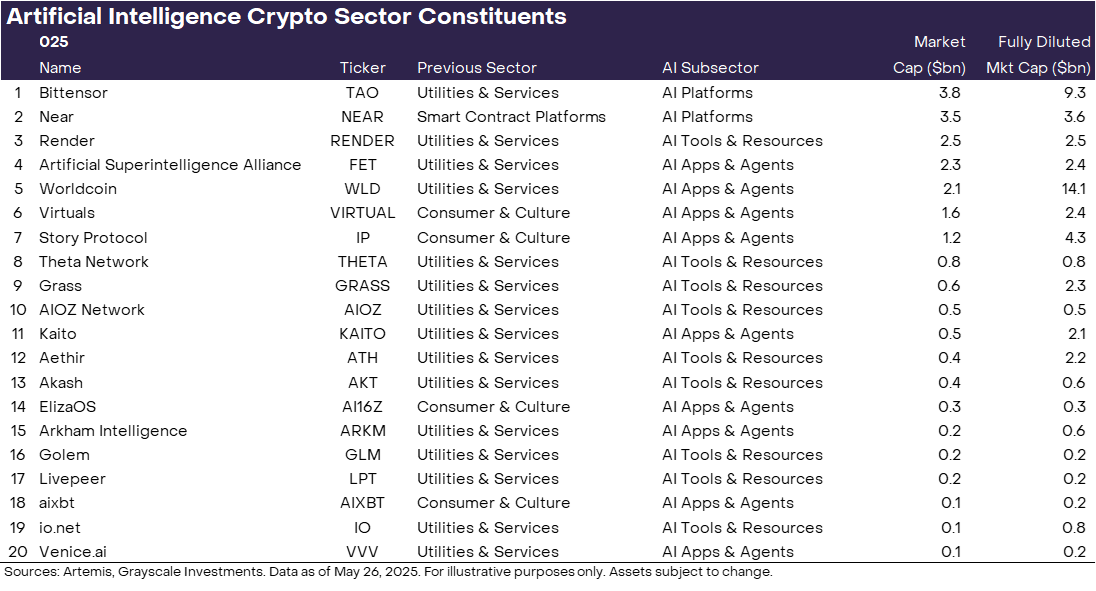

The newly defined AI sector includes 20 assets with a combined circulating market capitalization of about $20 billion (Exhibit 3). At this size the Artificial Intelligence Crypto Sector is the smallest market segment, representing about 0.67% of aggregate market cap. By comparison, the Financials sector, the third-largest sector, is about $519 billion in market cap. In our view, the relatively modest size of this Crypto Sector reflects the early stage of many of the projects. The addressable market of blockchain-based AI applications is potentially very large, and we believe that the Artificial Intelligence Crypto Sector will grow in both absolute terms and relative to the rest of the crypto market.

Exhibit 3: Grayscale Artificial Intelligence Crypto Sector Assets

The Artificial Intelligence Crypto Sector

The Artificial Intelligence Crypto Sector includes crypto assets related to the development, support, or application of artificial intelligence technology. Assets that were moved to this sector were selected because AI is, in some way, core to its primary use case. Among other reasons, this could be because the primary type of activity on a particular network is related to AI or because a protocol provides services for AI labs as a customer.

The Artificial Intelligence Crypto Sector consists of three subsectors: (1) AI Platforms, (2) AI Tools & Resources, and (3) AI Apps & Agents.

Artificial intelligence could be the most consequential technology of the 21st century. But its development today is highly centralized and largely driven by capital-intensive efforts at a handful of incumbent corporations. This concentration of influence has already led to concerns in the past, such as bias in Google’s model or censorship in DeepSeek’s model.[4]

As AI systems gain influence over areas of society, questions of ownership, access, and trust become paramount. How do we ensure that we can trust the models we use with our data? Lacking true transparency, and with the stakes so high, how can we trust that these innovative technologies are being built in our best interests and not at our expense?

The projects in the Artificial Intelligence Crypto Sector aim to address some of these challenges through decentralization and transparency. By leveraging blockchain technology and a global network of participants, these protocols can democratize access, reduce bias, and distribute ownership of AI systems. Grayscale Research believes that decentralized AI technologies have the potential to bring important decisions regarding AI development out from walled gardens and into public ownership.

AI Platforms like Bittensor offer foundational infrastructure for a wide range of AI applications and services (for more details, see Building Block: Bittensor). As AI continues to evolve into a more powerful and essential tool, there could be increasing regulations or restrictions around who can build or access these applications. Bittensor aims to address this by creating an open, collaborative network for AI development where anyone around the world can build, access, and use AI services (more on Bittensor later).

Founded by a leading figure in the AI industry, Near is a blockchain platform tailored for AI use cases. While it offers general-purpose smart contract functionality, the current focus of the Near network is becoming the “blockchain for AI.” As a highly-performant, low cost blockchain, Near leverages features like intents and chain abstraction to simplify blockchain complexities and enable users and AI agents to seamlessly transact assets across chains at scale. Notable applications on its platform include shade agents (multi-chain, user-owned AI agents) and its AI assistant chatbot.

In contrast, projects in the AI Tools & Resources subsector focus on key inputs needed to train and operate AI models — most importantly, data and compute. AI development depends on massive volumes of both, and decentralized networks are emerging to fill these needs. Grass, for example, decentralizes the data scraping process, enabling data collection across millions of global contributors without centralized infrastructure. Akash provides a global marketplace that aggregates idle computing resources needed for AI models. Together, these networks distribute access to the critical resources needed for AI development, reducing reliance on centralized incumbents.

AI Apps & Agents are built to interface with end users. A key innovation here is the rise of AI agents — autonomous software programs capable of acting on a user’s behalf. These agents are expected to play a critical role in facilitating value transfer across the internet. Traditional payment systems like Visa are not designed to support sub-second or sub-cent transactions. In contrast, blockchains were purpose-built for fast, low-cost, and programmable transfers. Grayscale Research believes blockchain infrastructure will be essential to enabling microtransactions and powering agent-driven payments. Early examples of protocols related to this AI agent theme include Virtuals and ElizaOS.

In addition to agent-driven platforms, the AI Apps & Agents subsector includes applications solving AI-related challenges. For instance, Story Protocol is focused on intellectual property in the age of generative AI, while Worldcoin tackles “Proof of Personhood” — a challenge in distinguishing real humans from AI online.

Some legacy assets with ties to the AI theme did not make the sector list. For example, Filecoin and Arweave are decentralized data storage networks that can be seen as relevant to AI due to the growing need for large-scale data storage to support model training. However, AI is not their primary use case today. As a result, even though both have infrastructure that could support AI use cases, they both remain in the Utilities & Services Crypto Sector. These and other assets with associations to AI may be considered for inclusion in this sector if their primary use case shifts more directly toward AI in the future.

Performance and Outlook

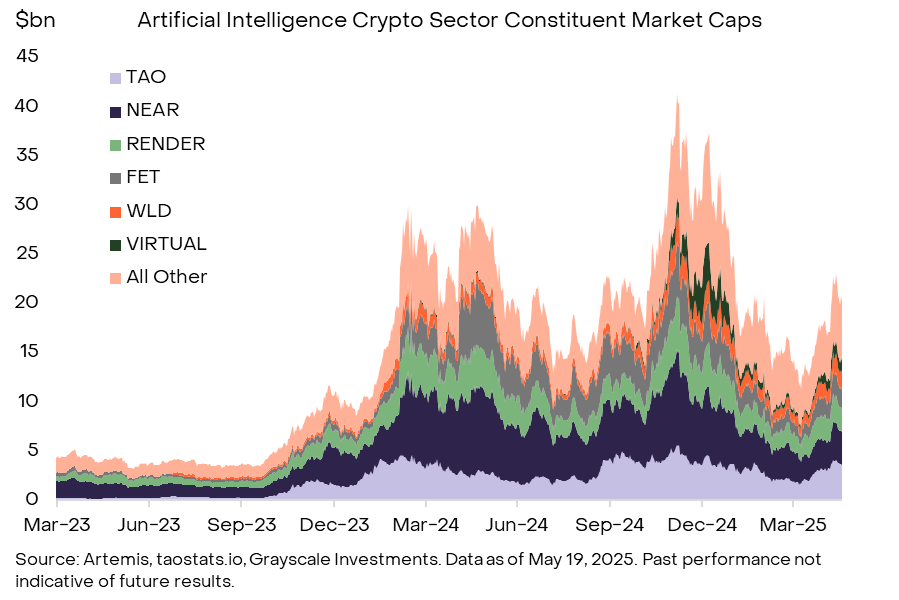

Two years ago, the tokens in the Artificial Intelligence Crypto Sector had a combined market capitalization of just $4.5 billion (Exhibit 4).[5] The aggregate market cap has therefore expanded more than four times over this period. Since the start of this year, the best-performing asset in the Artificial Intelligence Crypto Sector was TAO (+2%) and the worst-performing asset was ElizaOS (-80%).[6]

Exhibit 4: Artificial Intelligence Crypto Sector now ~$20bn market cap

Development of decentralized AI technologies is progressing rapidly. Over the coming months, Grayscale Research expects to focus on a few key themes, including (1) the Bittensor halving and subnet growth, (2) innovations in distributed training, (3) evidence of sustainable revenues, and (4) the use stablecoins by AI agents.

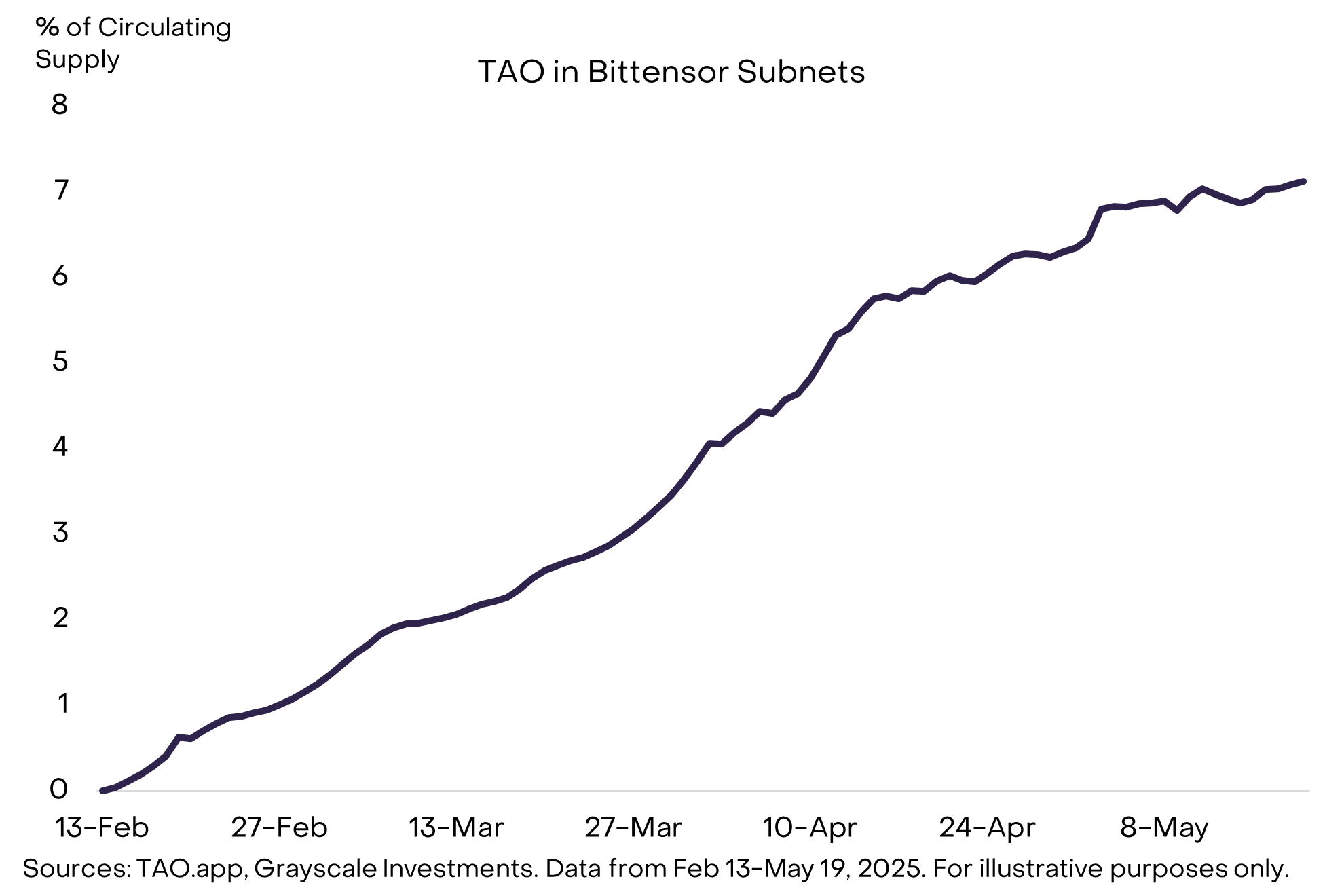

Bittensor halving and subnet growth: Bittensor’s native token, TAO, is currently the largest AI asset by circulating market cap.[7] TAO mirrors Bitcoin’s supply schedule, with a fixed cap of 21 million tokens and a supply issuance “halving” every four years. The first halving event is set to occur later this year. Interest in AI applications on the network — known as subnets — has been accelerating, particularly since the February launch of the dTAO upgrade, which made subnets investible for the first time.[8] In just three months, the share of circulating TAO allocated to subnets has climbed from to more than 7% (Exhibit 5).

Exhibit 5: Growth in subnet TAO emissions reflects growing subnet interest since the dTAO upgrade

Innovations in distributed training: As we’ve highlighted before, we believe distributed training is one of the more promising areas in this sector. Prime Intellect has demonstrated the ability to train models larger than 30 billion parameters using globally distributed GPUs, an approach that contrasts sharply with today’s centralized data center infrastructure.[9] At scale, we believe these types of protocols could have a substantial impact on the AI landscape by tapping into the roughly 30% idle compute capacity sitting in data centers, potentially reducing both the costs and barrier to entry for AI model training.[10] While protocols like Prime, Gensyn, and Nous Research do not yet have native tokens, some could launch tokens later this year and join the AI sector shortly thereafter.

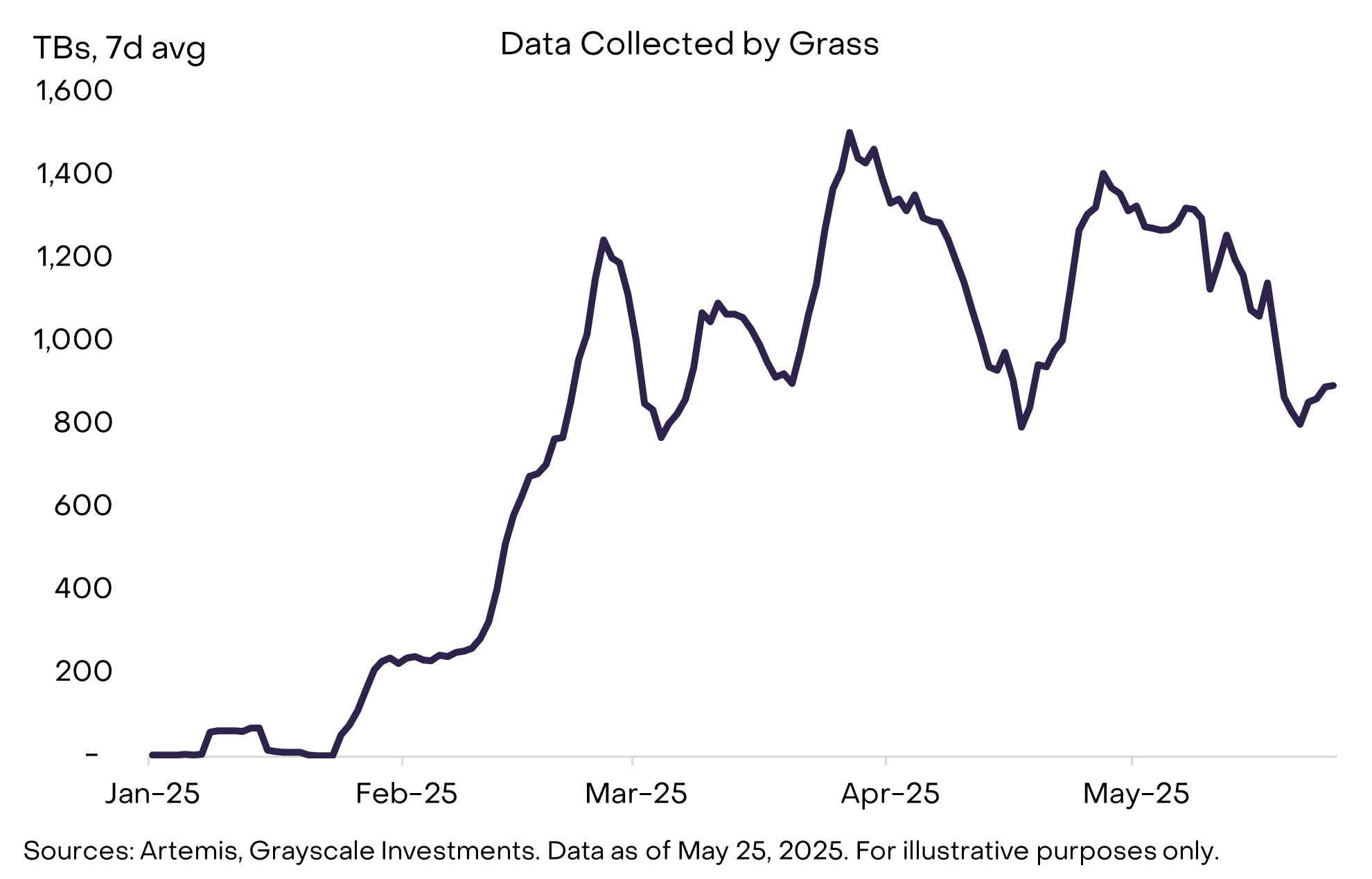

Evidence of sustainable revenue: Earlier this year, it was revealed that the Grass network is producing tens of millions in annualized revenue from selling scraped web data to AI labs.[11] This would make Grass one of the more notable examples of revenue-generating projects for non-financial, non-speculative applications. The network has continued to grow the amount of data scraped for its AI lab customers throughout this year (Exhibit 6). Looking ahead, investors should watch for continued growth in data output as well as the potential launch of a consumer product later this year. Virtuals is another project producing meaningful fee revenue ($30 million annualized as of May 2025), which it earns primarily from trading fees on AI agent tokens on its platform.[12]

Exhibit 6: Grass has grown daily data scraped over the first half of 2025

AI Agents and Stablecoins: With potential regulatory clarity on the horizon, stablecoins represent a potentially transformative unlock for the broader crypto space. Their adoption also strengthens the case for crypto-native AI agents, which rely on seamless, programmable payments. Institutional interest in stablecoins is rising: major Wall Street banks have signaled their willingness to launch stablecoin products under clearer guidelines, Meta has announced plans to enter the market, and Stripe acquired a stablecoin company for $1 billion earlier this year. Coinbase has also introduced a payments standard tailored to AI agents, with built-in support for stablecoins.[13]

Investors should monitor regulatory developments, especially the crypto market structure bill and the GENIUS stablecoin bill, as potential catalysts for broader stablecoin adoption and enablers of this emerging AI agent theme.

Conclusion

The addition of the Artificial Intelligence Crypto Sector reflects the growing importance of decentralized infrastructure in shaping the future of this critical technology. As AI systems become more embedded in society, blockchain-based platforms can help ensure they remain open, accessible, and aligned with public interests. While we are in the first inning of the growing Artificial Intelligence Crypto Sector, Grayscale Research believes that this sector is positioned to become increasingly important alongside growth and technological improvements in the AI industry.

Interested in Investing?

Grayscale offers exposure to tokens within the AI sector through our signature private placements:

If you are an eligible accredited investor** interested in investing, or want to learn more about our products, please reach out to a Grayscale portfolio consultant at 866-775-0313 or info@grayscale.com.

*Holdings as of May 20, 2025. Holdings are subject to change without notice.

**Grayscale’s private placements are only available to Accredited Investors as defined in Rule 501(a) of Regulation D under the Securities Act of 1933, as amended. Most individuals are not Accredited Investors. For additional information, please consult https://www.sec.gov/newsroom/speeches-statements/spch121714laa.

[1] Artemis, Grayscale Investments. Data as of May 21, 2025.

[2] The Artificial Intelligence Crypto Sector will be incorporated into the Grayscale/FTSE Russell family of indexes with the next quarterly rebalance scheduled for 6/20/25.

[3] S&P Dow Jones Indices, & MSCI. (2015, March 13). S&P Dow Jones Indices and MSCI announce August 2016 creation of a real estate sector in the Global Industry Classification Standard (GICS®) structure.

[4] Grayscale Investments. (n.d.). The AI Sputnik Moment, DeepSeek, and Decentralized AI.

[5] Source: Artemis, taostats.io, Grayscale Investments. As of March 31, 2023.

[6] Source: Artemis, taostats.io, Grayscale Investments. Data as of May 21, 2025. Past performance not indicative of future results.

[7] Artemis, Grayscale Investments. Data as of 5/21/2025.

[8] Bittensor. (2025, May 6). Core Dynamic TAO concepts.

[9] Prime Intellect Team. (2025, May 11). INTELLECT-2 release: The first 32B parameter model trained through globally distributed reinforcement learning.

[10] Smith, C. S. (2025, May 19). The secret life of servers: Chronic idleness while waiting for a job. Forbes.

[11] On the Grass Demo hour in March, Grass founder Andrej Radonjic stated he estimated annualized revenue at “mid eight figures.”

[12] Artemis, Grayscale Investments. Data as of May 21, 2025.

[13] Schwartz, L., & Weiss, B. (2025, May 8). Exclusive: Meta in talks to deploy stablecoins three years after giving up on landmark crypto project. Fortune.

CNBC. (2025, February 4). Stripe closes $1.1 billion Bridge deal, prepares for aggressive stablecoin push.

Young, M. (2025, May 7). Coinbase x402 payments protocol to make AI agents more autonomous. Cointelegraph.

Important Information:

Grayscale Operating, LLC (“GSO” d/b/a Grayscale Investments) is the parent holding company of Grayscale Advisors, LLC (“GSA”), an SEC-registered investment adviser, as well Grayscale Securities, LLC (“GSS”), an SEC-registered broker/dealer and member of FINRA, and Grayscale Investments Sponsors, LLC ("GSIS", together with GSO, GSS, and GSA, "Grayscale" or “Grayscale Investments”). GSIS is not registered as an investment adviser under the Investment Advisers Act of 1940 and none of the investment products (“Products”) sponsored or managed by GSIS are registered under the Investment Company Act of 1940.

Private placement securities are speculative, illiquid, and entail a high level of risk, including the risk that an investor could lose their entire investment. The Products are not suitable for any investor that cannot afford loss of the entire investment.

Carefully consider investment objectives, risk factors, fees and expenses before investing. This and other information can be found in each Product’s private placement memorandum, which may be obtained from Grayscale. Read these documents carefully before investing.

The shares of each Product are not registered under the Securities Act of 1933, the Securities Exchange Act of 1934 (except for Products that are SEC reporting companies), the Investment Company Act of 1940, or any state securities laws. The Products are offered in private placements pursuant to the exemption from registration provided by Rule 506(c) under Regulation D of the Securities Act of 1933 and are only available to accredited investors. As a result, the shares of each Product are restricted and subject to significant limitations on resales and transfers. Potential investors in any Product should carefully consider the long-term nature of an investment in that Product prior to making an investment decision.

All content is original and has been researched and produced by Grayscale unless otherwise stated herein. No part of this content may be reproduced in any form, or referred to in any other publication, without the express consent of Grayscale.

This information should not be relied upon as research, legal, tax or investment advice, or a recommendation regarding any products, strategies, or any investment in particular. This material is strictly for illustrative, educational, or informational purposes and is subject to change. This content does not constitute an offer to sell or the solicitation of an offer to sell or buy any security in any jurisdiction where such an offer or solicitation would be illegal. There is not enough information contained in this content to make an investment decision and any information contained herein should not be used as a basis for this purpose.

This content does not constitute a recommendation or take into account the particular investment objectives, financial situations, or needs of investors. Grayscale and its employees may hold certain of the digital assets mentioned herein.

The price and value of assets referred to in this content and the income from them may fluctuate. Past performance is not indicative of the future performance of any assets referred to herein. Fluctuations in exchange rates could have adverse effects on the value or price of, or income derived from, certain investments.

Certain of the statements contained herein may be statements of future expectations and other forward-looking statements that are based on Grayscale’s views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements. In addition to statements that are forward-looking by reason of context, the words “may, will, should, could, can, expects, plans, intends, anticipates, believes, estimates, predicts, potential, projected, or continue” and similar expressions identify forward-looking statements. Grayscale assumes no obligation to update any forward-looking statements contained herein and you should not place undue reliance on such statements, which speak only as of the date hereof. Although Grayscale has taken reasonable care to ensure that the information contained herein is accurate, no representation or warranty (including liability towards third parties), expressed or implied, is made by Grayscale as to its accuracy, reliability, or completeness. You should not make any investment decisions based on these estimates and forward-looking statements.

There is no guarantee that the market conditions during the past period will be present in the future. Rather, it is most likely that the future market conditions will differ significantly from those of this past period, which could have a materially adverse impact on future returns. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. We selected the timeframe for our analysis because we believe it broadly constitutes the most complete historical dataset for the digital assets that we have chosen to analyze.

The Products are distributed by Grayscale Securities, LLC (Member FINRA/SIPC). SIPC coverage does not apply to the crypto asset products or services mentioned.

Index Definitions: The S&P 500 Index is a market-capitalization-weighted index that measures the performance of 500 of the largest publicly traded companies in the United States. The Dow Jones Industrial Average is a stock market index that tracks 30 large, publicly owned blue-chip companies trading on the New York Stock Exchange and Nasdaq. The MSCI World Real Estate Index is a free float-adjusted market capitalization index that consists of large and mid-cap equity. The FTSE Grayscale Consumer and Culture Crypto Sector Index was developed to measure the performance of crypto assets that support consumption-centric activities across a variety of goods and services. The FTSE/Grayscale Crypto Sectors family of indexes measure the price return of digital assets listed on major global exchanges. The FTSE Grayscale Currencies Crypto Sector Index was developed to measure the performance of crypto assets that serve at least one of three fundamental roles: store of value, medium of exchange, and unit of account. The FTSE Grayscale Financials Crypto Sector Index was developed to measure the performance of crypto assets that seek to deliver financial transactions and services. The FTSE Grayscale Smart Contract Platforms Crypto Sector Index was developed to measure the performance of crypto assets that serve as the baseline platforms, upon which self-executing contracts are developed and deployed. The FTSE Grayscale Utilities and Services Crypto Sector Index was developed to measure the performance of crypto assets that aim to deliver practical and enterprise-level applications and functionalities.

© 2025 Grayscale. All trademarks, service marks and/or trade names (e.g., DROP GOLD®, G™, GRAYSCALE®, GRAYSCALE CRYPTO SECTORS™ and GRAYSCALE INVESTMENTS®) are owned and/or registered by Grayscale.