Last Updated: 10/27/2021 | 29 min. read

Decentralized Finance (DeFi) is an emerging crypto innovation that goes beyond banking and beyond borders to create a new internet-native global financial ecosystem. DeFi has started to reshape global finance and e-commerce, yet the asset category remains mysterious to many investors. Our first Grayscale DeFi Primer offered an overview of DeFi, discussed use cases, and examined the native tokens of several well-known protocols. In this DeFi report, we will take a deeper dive into the financial system powering the Web 3.0 crypto cloud economy.

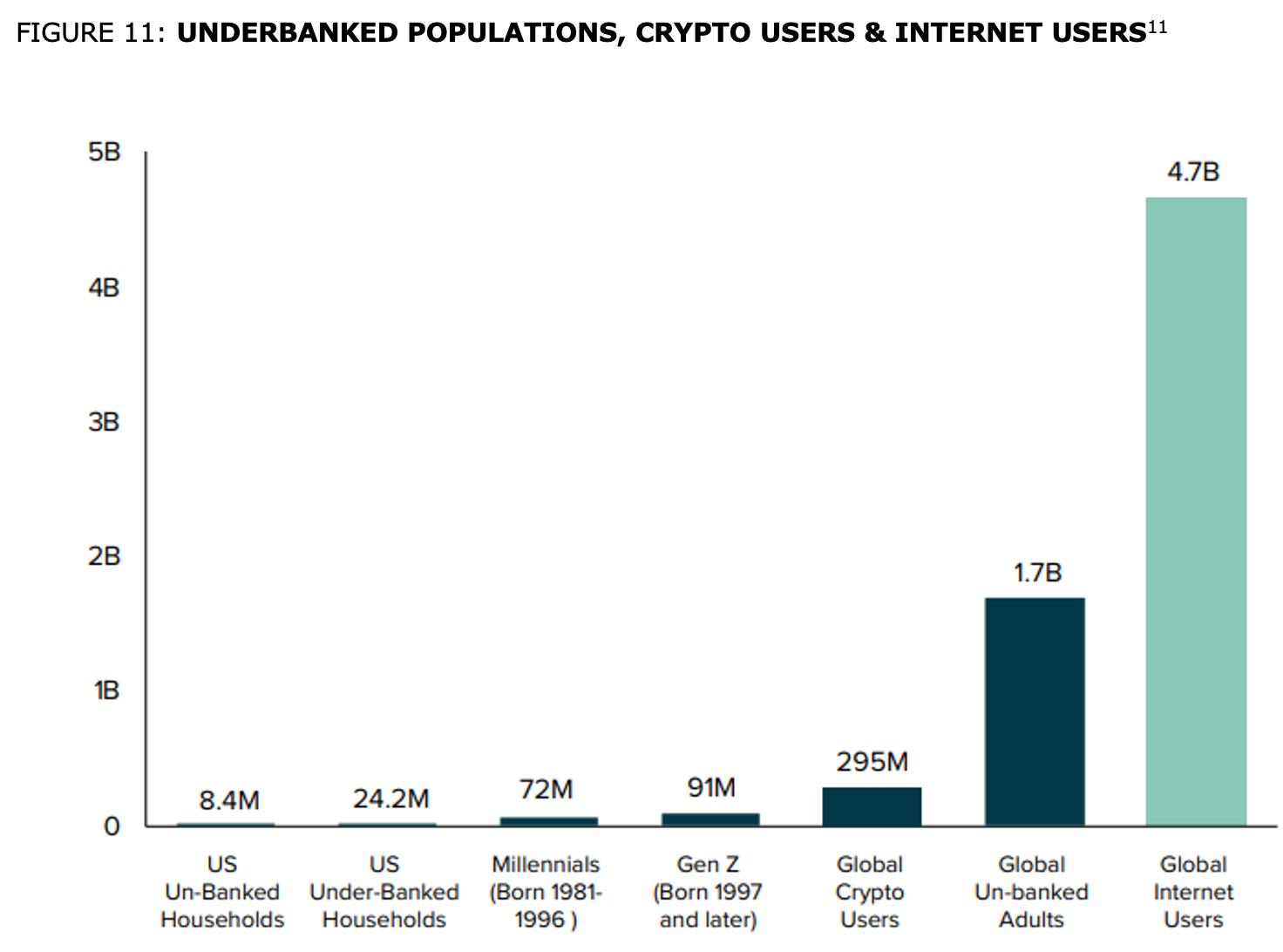

Crypto creates an internet owned by its users and DeFi empowers those users to own a piece of that financial ecosystem. DeFi is the third wave of crypto cloud economy growth and the next wave of fintech innovation. The internet expanded access to information and DeFi has the power to do the same for banking. DeFi seeks to transform the way people establish trust on the internet and provide 33 million U.S. underbanked households, 1.7 billion underbanked adults globally, and 4.6 billion internet users a new banking alternative.

The internet continues to evolve as the technology stack expands. DeFi applications represent one of the newest layers of the stack. As new advancements built on innovations that came before, they have unlocked new use cases, driven massive value creation, and led to future layers of the stack. Several of the key advancements that have led to the innovation of crypto and then DeFi have originated from:

These technology stack advancements have combined to create the crypto economy we know today. Crypto offers a new investment frontier sitting at the intersection of the internet and emerging markets. These crypto cloud economies continue to see rapid growth by exporting internet goods and services to traditional economies across the globe. DeFi represents ownership of the financial networks powering this internet paradigm shift called Web 3.0.

FIGURE 1: THE NEW INTERNET STACK [1]

[1] Grayscale, Bain Capital Ventures Inspired

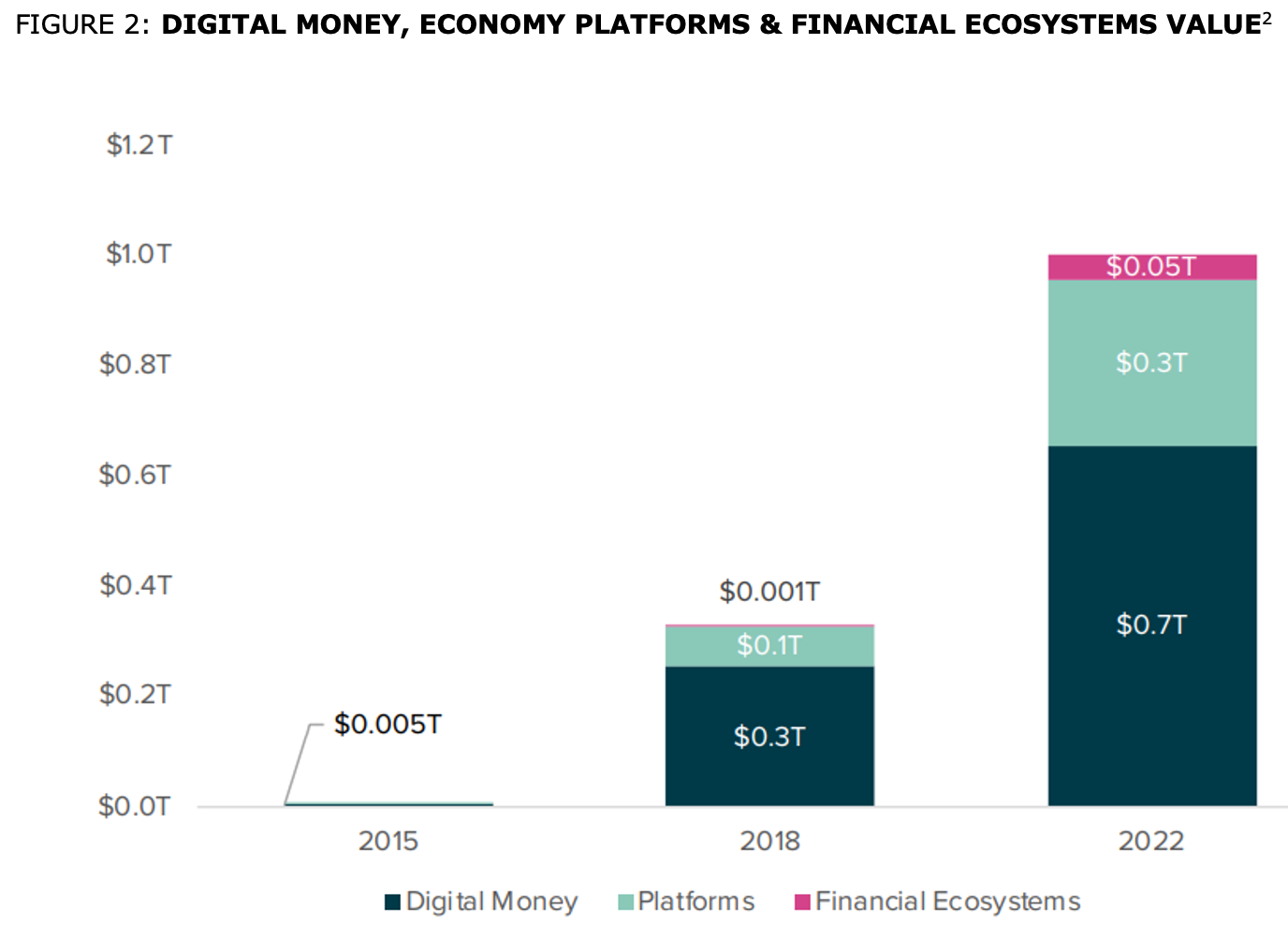

Crypto economies have evolved in phases of growth that have allowed increasingly complex internet-native communities to form. Digital Money, Economy Platforms, and Financial Ecosystems have been the three most pronounced phases of crypto maturity thus far. Similar to the Web 1.0 and Web 2.0 phases of the internet, each new phase of crypto Web 3.0 was built on and enhanced the prior stages:

As new innovations emerge, they benefit those that came before, and combine to accelerate growth of the crypto economy. DeFi is the latest wave of progress in the crypto universe.

FIGURE 2: DIGITAL MONEY, ECONOMY PLATFORMS & FINANCIAL ECOSYSTEMS VALUE[2]

[2] Grayscale, Coinmetrics: Data only included Coinmetrics supported assets within the following category groupings: Digital Money (currency, privacy & remittance), Cloud Economy Platforms (Platforms), Financial Ecosystems (DeFi). Market caps are average yearly value. Data data for 2022 as of 12/1/22.

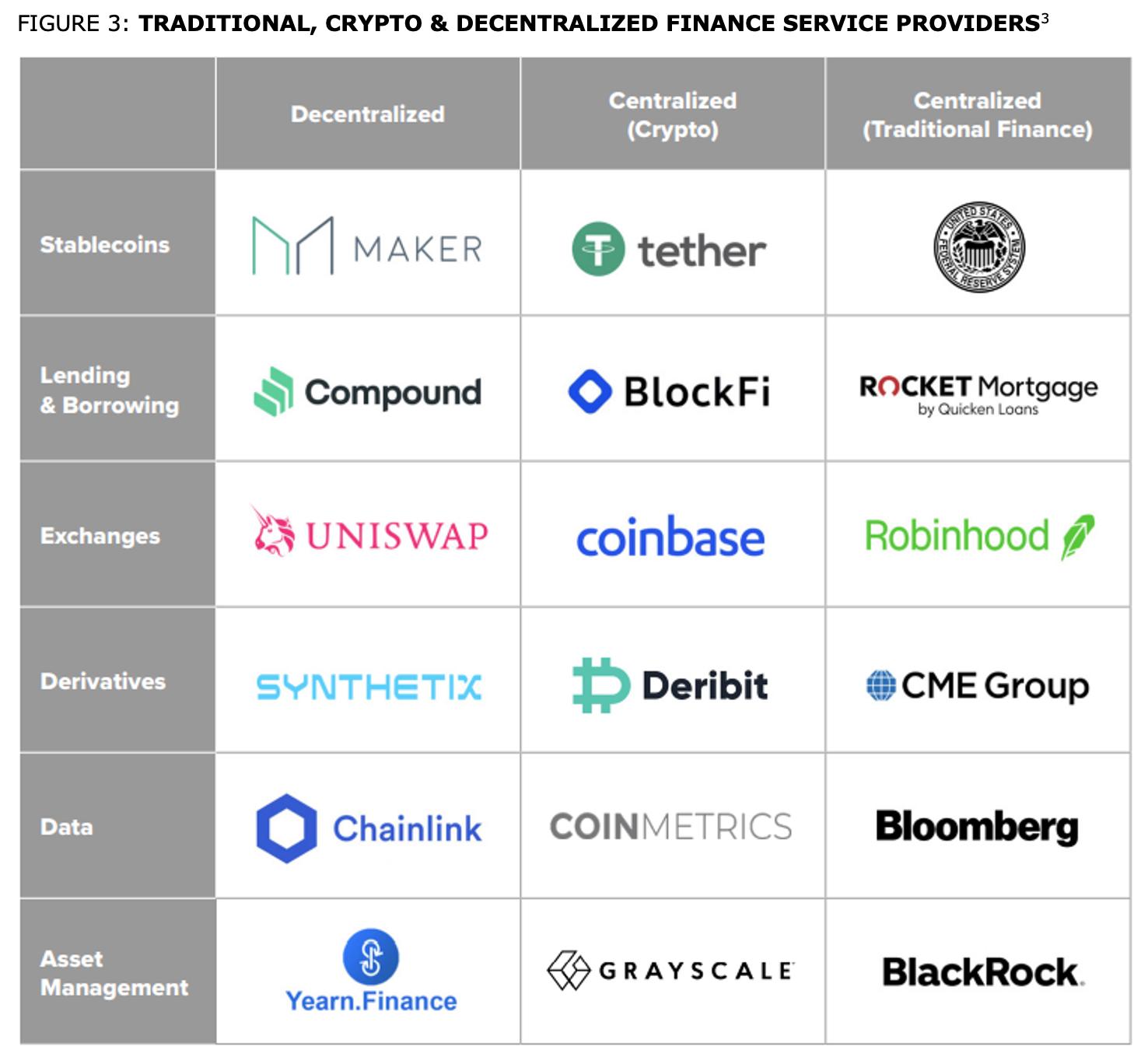

DeFi is an ecosystem of internet-native banking services enabled by software applications that run on crypto cloud economy platforms like Ethereum. DeFi applications, often termed dApps (Decentralized Applications) due to their global nature, make financial services available to anyone with an internet connection anywhere across the globe. DeFi dApps leverage open-source software protocols governed by crypto network users to disintermediate many services offered by traditional finance companies. DeFi has only recently emerged, but the sector has rapidly matured to facilitate several foundational banking services, including stablecoins, lending & borrowing, exchanges, derivatives, data, asset management, and others.

FIGURE 3: TRADITIONAL, CRYPTO & DECENTRALIZED FINANCE SERVICE PROVIDERS[3]

[3] Grayscale

Since MakerDAO was launched in 2015, many other DeFi applications have continued to emerge across banking sectors. After several years of technology iterations, 2020 became the year that DeFi found product-market-fit and really took off. DeFi saw the value of leading protocols rise from under $1 billion to near $42 billion today.

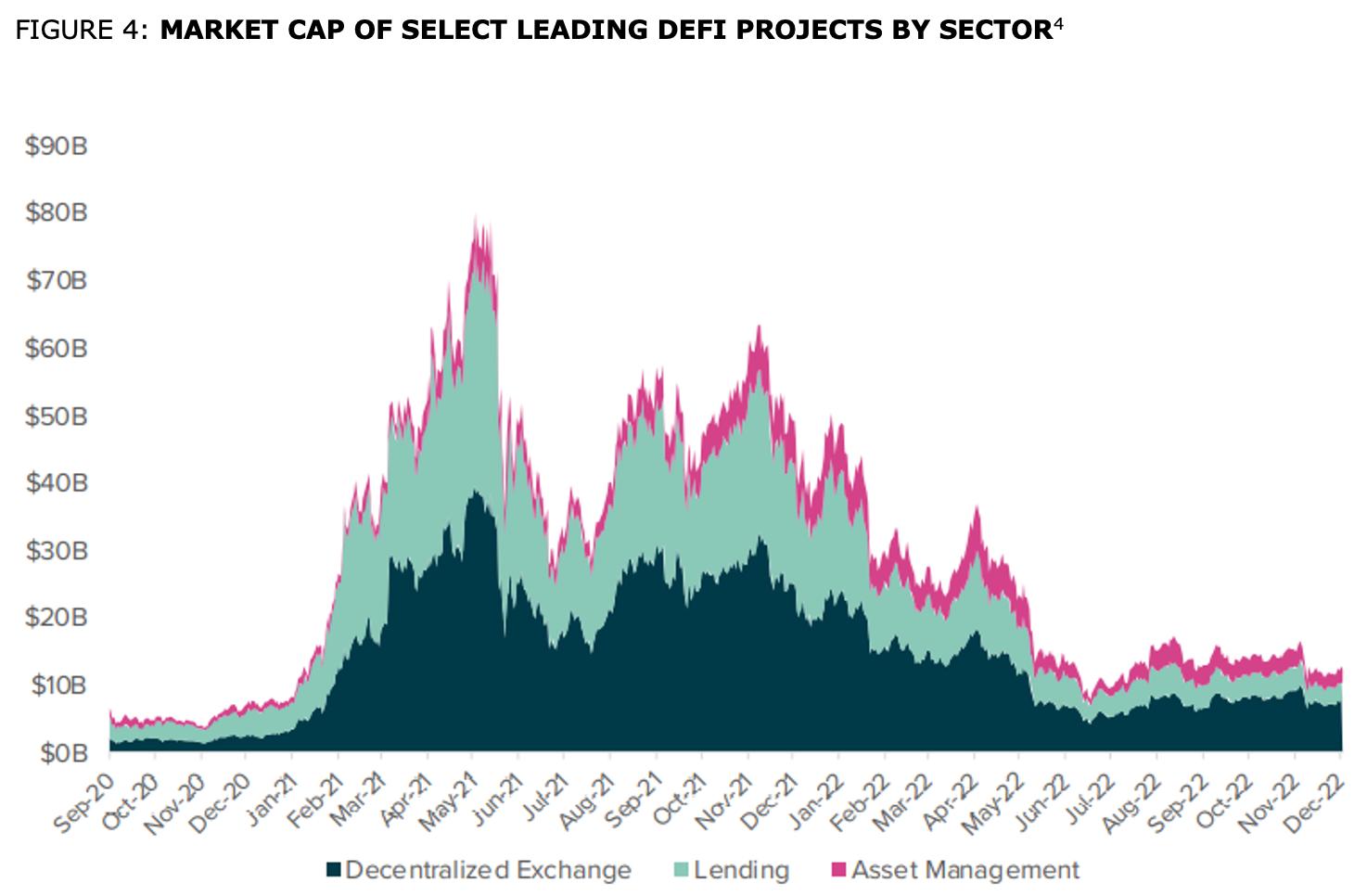

DeFi value creation has varied across sectors, with decentralized exchanges and lending platforms capturing the lion’s share of growth thus far, while other segments of the space continue developing as the technology matures.

FIGURE 4: MARKET CAP OF SELECT LEADING DEFI PROJECTS BY SECTOR[4]

[4] Grayscale, Token Terminal: Top 10 assets in each sector (9/30/20 - 12/1/22)

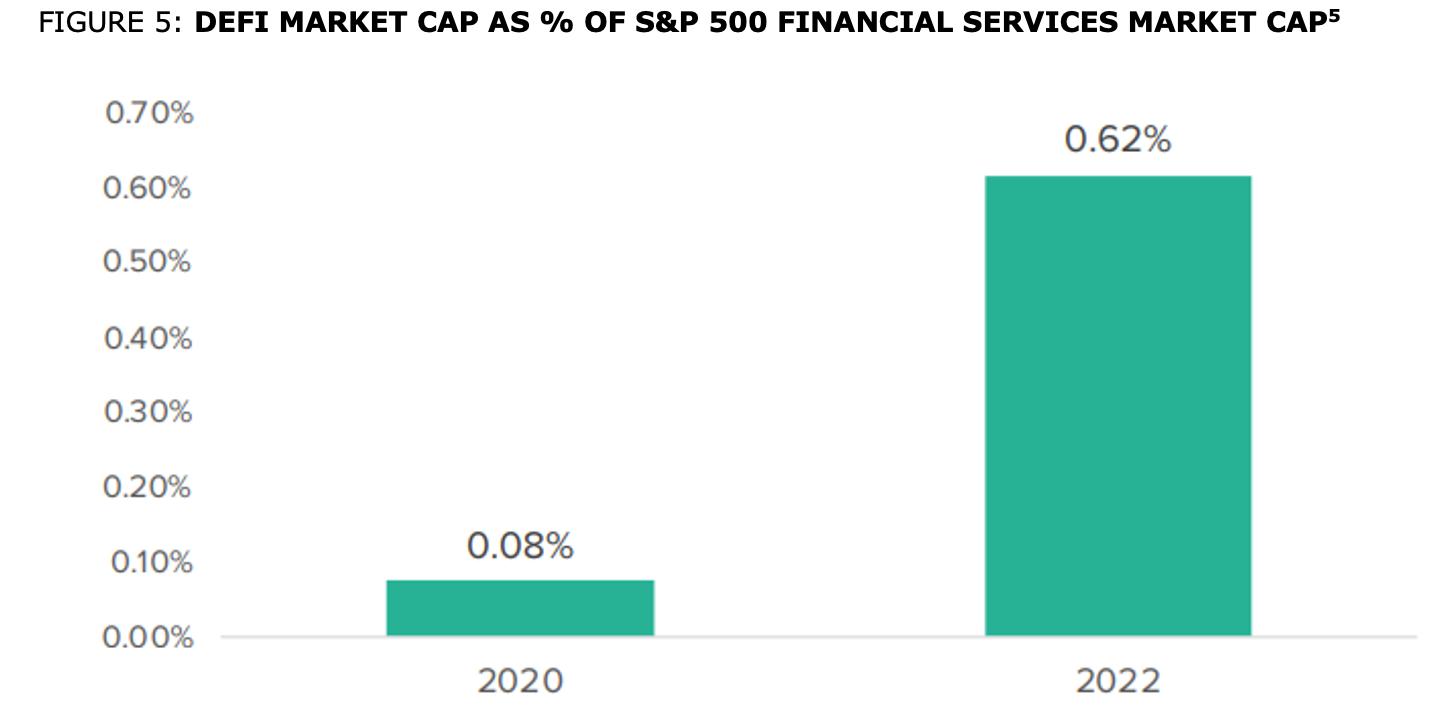

DeFi is quickly reaching a point of critical mass where the nascent ecosystem of protocols may be starting to seriously compete with incumbent financial services firms. The market cap of leading DeFi assets is now ~1% of the $4.3 trillion market cap of the S&P 500 Financial Services Sector.

More impressive is the speed at which DeFi has grown its market share. In relative terms, DeFi has risen by 10x from ~0.10% to ~1% of the U.S. Financial Sector in a little under two years.

FIGURE 5: DEFI MARKET CAP AS % OF S&P 500 FINANCIAL SERVICES MARKET CAP[5]

[5] Grayscale, Bloomberg, Coinmetrics (12/1/22)

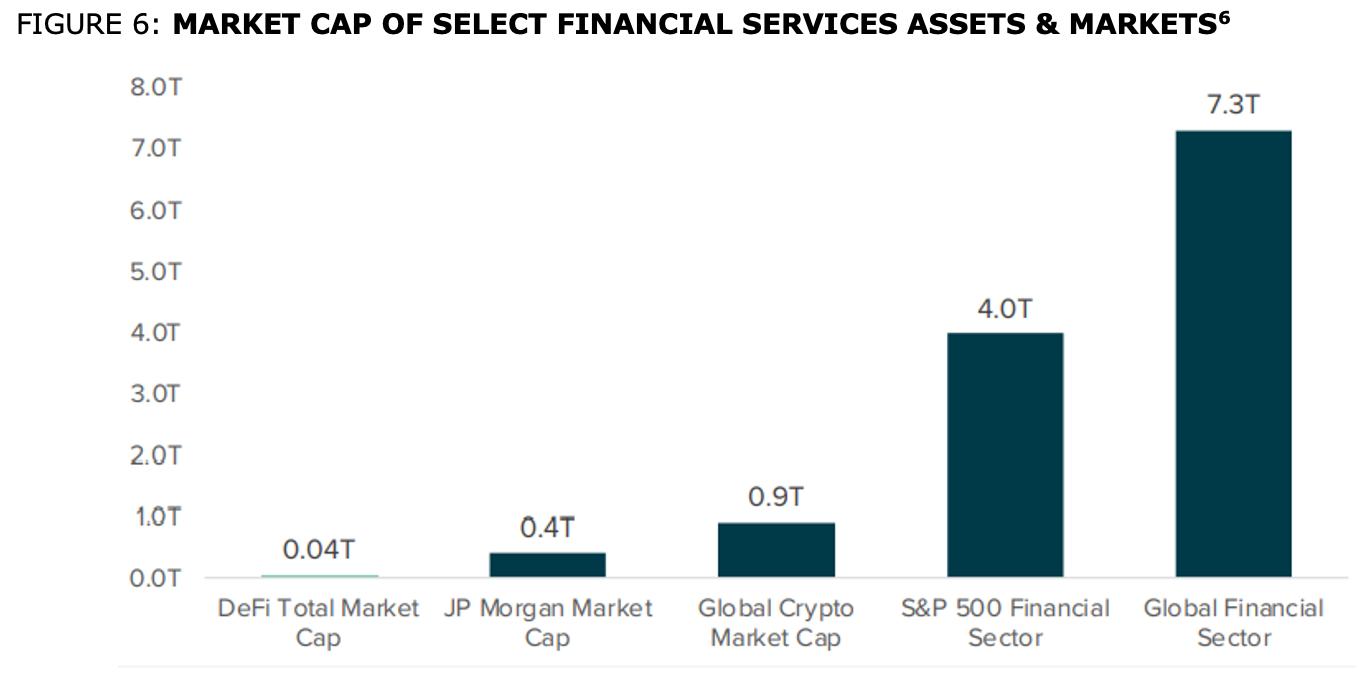

The DeFi ecosystem is still in its early innings compared to the Total Addressable Market (TAM) opportunity. The total DeFi market cap is still only ~0.5% of the $8 trillion market value of the global financial services industry. Meanwhile, the market cap of JP Morgan alone is nearly 10x the size of the entire DeFi ecosystem.

DeFi has the potential to grow by both absorbing share from the legacy financial industry and by growing share as a proportion of the nearly $800 billion value of the crypto economy.

FIGURE 6: MARKET CAP OF SELECT FINANCIAL SERVICES ASSETS & MARKETS[6]

[6] Grayscale, DeFi Market: CoinMarketCap (12/1/2022). JP Morgan: Bloomberg (10/6/21). Crypto Total: CoinMarketCap (12/1/2022). S&P 500 Financial Sector: Bloomberg (12/1/2022). Global Finance Sector: MSCI World Financials Index (12/1/2022).

DeFi seeks to offer a paradigm shift from the way traditional banking is delivered today across several channels:

FIGURE 7: TRADITIONAL FINANCE & DECENTRALIZED FINANCE DIFFERENCES[7]

[7] Grayscale, Race Capital Inspired

Banks have been notoriously anti-competitive and reluctant to allow customers to share their information or integrate with other financial services providers, with the aim of maintaining market share in a mature industry. However, what’s best for banks has not always been best for consumers.

These practices have led to siloed banking systems that don’t interoperate optimally with each other, inefficient sharing of consumer’s past financial data which has limited access to credit, and an environment that has slowed financial innovation. Problems like these have pushed policy makers to pass “Open Banking” legislation in places like the European Union (E.U.).

Open Banking initiatives have given rise to a wave of E.U. “challenger banks” that sprung up to compete with legacy institutions now required to offer greater access to their system APIs. Yet, these regulations haven’t gone as far as many hoped. Now, many challenger banks have turned to partnering with legacy banks instead of competing with them to improve the system for users.

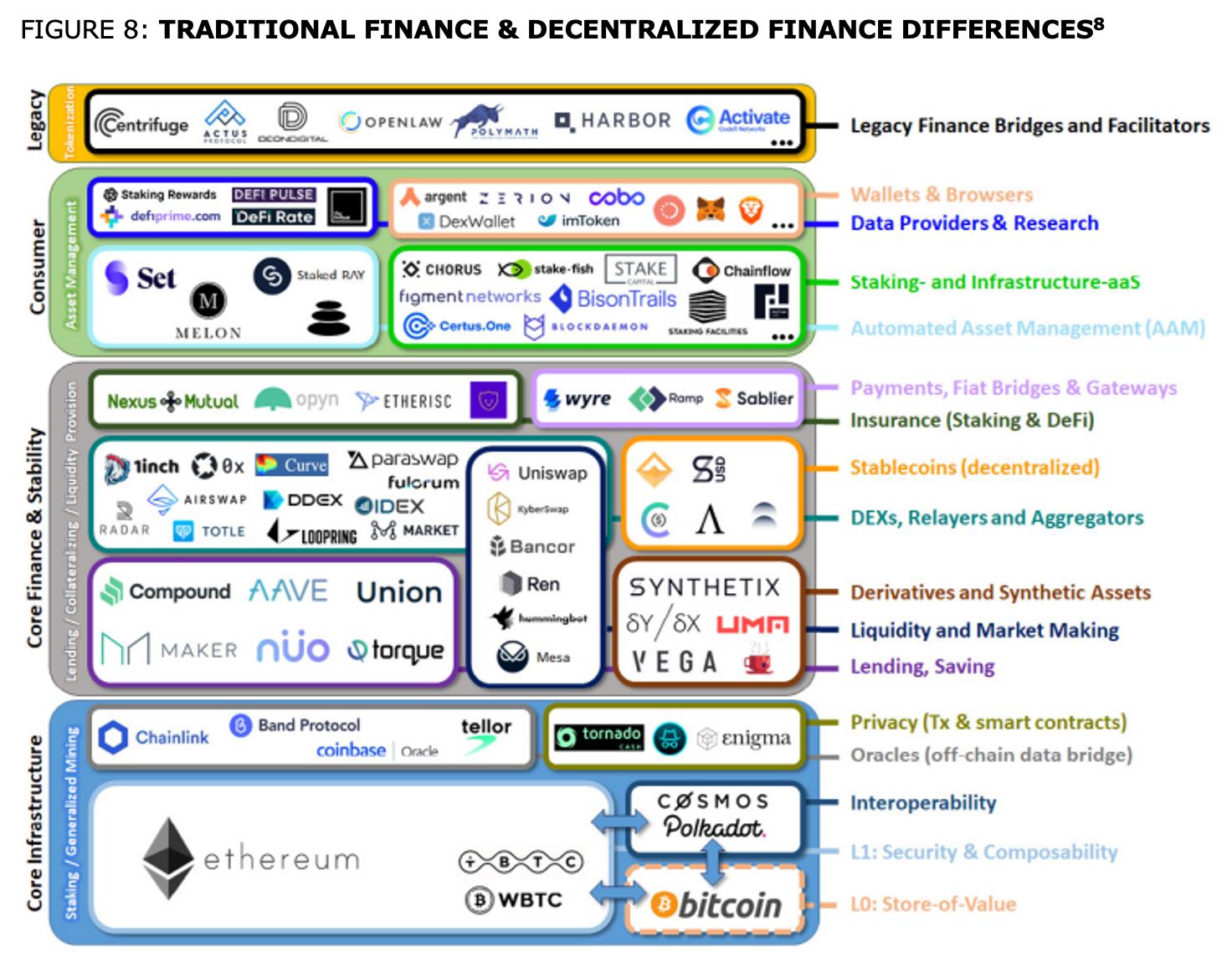

DeFi protocols offer their services using permissionless, transparent, and interoperable open-source software systems. As a result, DeFi dApps can innovate on each other without any permission or risk of losing access to critical infrastructure layers, while users are free to bring their assets and data with them across the ecosystem. DeFi’s open architecture has led to a Cambrian explosion of innovation that’s unbundling financial services into “banking as an API” much like the internet and YouTube unbundled TV packages.

FIGURE 8: TRADITIONAL FINANCE & DECENTRALIZED FINANCE DIFFERENCES[8]

[8] Staking Rewards

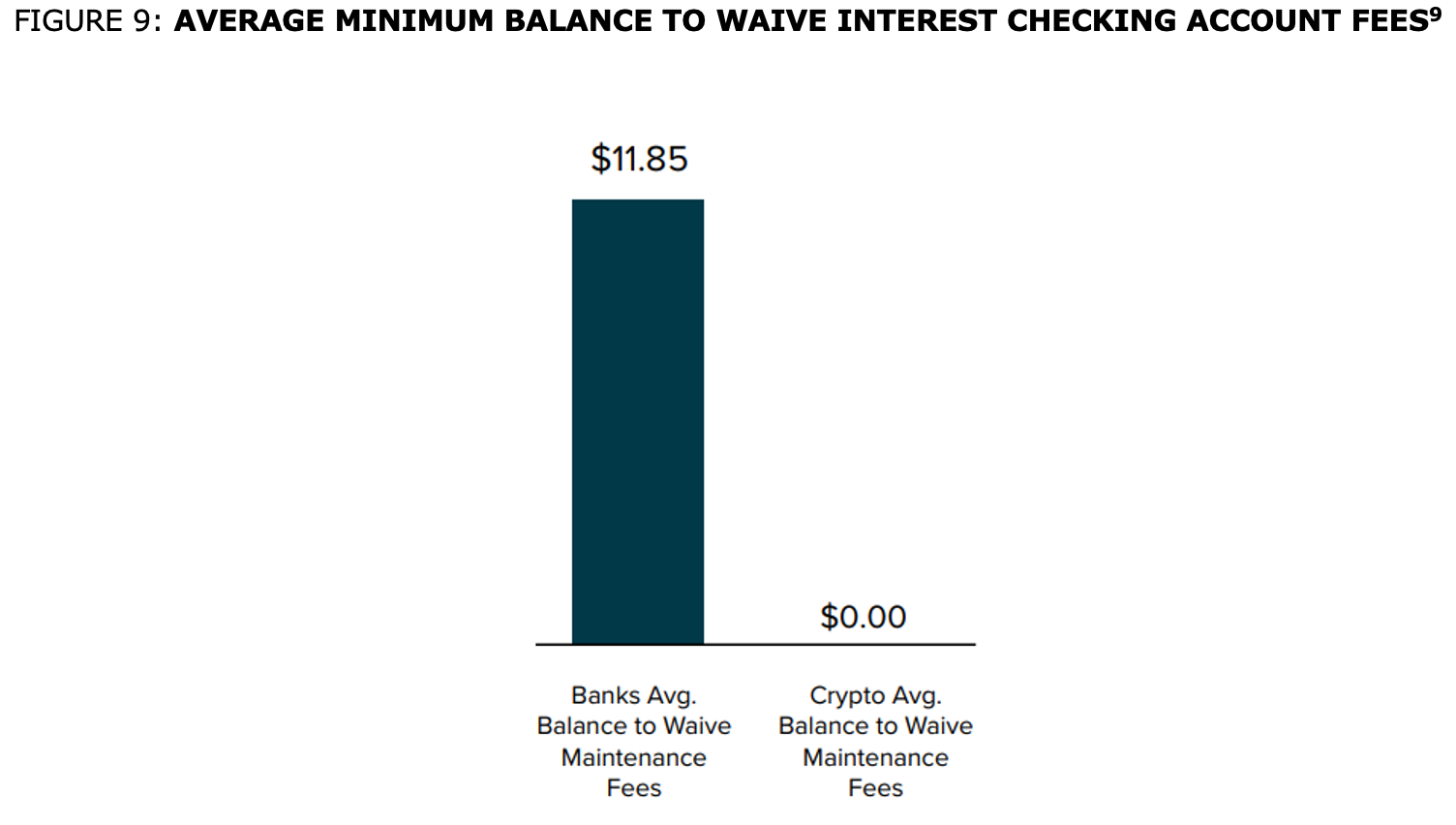

Banking’s most basic function has historically been safely holding their depositor’s funds. Yet, restrictive bank account opening processes combined with average balance requirements of nearly $10,000 to waive the monthly service fee on an interest checking account, have made basic banking services inaccessible to many. Bitcoin solved this problem over a decade ago by allowing users to self-custody their funds for free in a digital wallet accessible to anyone anywhere.

However, banks offered consumers something Bitcoin historically could not, an interest return on savings deposits. Not only has this advantage eroded as the interest rates U.S. and global banks pay consumers on savings deposits have fallen to near zero, but DeFi also enabled crypto savers to lend their assets, including Bitcoin, in exchange for interest.

FIGURE 9: AVERAGE MINIMUM BALANCE TO WAIVE INTEREST CHECKING ACCOUNT FEES[9]

[9] Grayscale, Bankrate, US News

Investment access has been a key gateway to financial freedom for generations of American workers. The power of open and free capital market access is underscored by the nearly 2.5x increase in the number of working hours it takes to buy the S&P 500 since 2006.

The promise of fintech social trading platforms was to bring cheap and convenient financial market access to a new generation of U.S. investors. Yet, the meme stock trading frenzy proved to many that fintech firms still primarily cater to the large institutions and not their once loyal users.

DeFi Decentralized Exchange (DEX) services aim to solve this problem for future investors across the globe. DeFi DEXs fundamentally change the brokerage account trading experience in several key ways:

FIGURE 10: WORKING HOURS TO BUY THE S&P 500 (2006 - 2021)[10]

[10] Grayscale, Bloomberg, Federal Reserve

The massive consumer base that banks have left behind underscores the opportunity for DeFi user growth. Market segments that have been either uninterested or unable to access banking that could easily shift to DeFi include:

FIGURE 11: UNDERBANKED POPULATIONS, CRYPTO USERS & INTERNET USERS[11]

[11] Grayscale, Crypto Users: Crypto.com Jan 2022, US Underbanked Households & Younger Workers: Credit Suisse January 2020 report based on 2017FDIC Survey, Global Underbanked Adults: FINDEX 2017 Report, Global Internet Users: Data Reportal 2021.

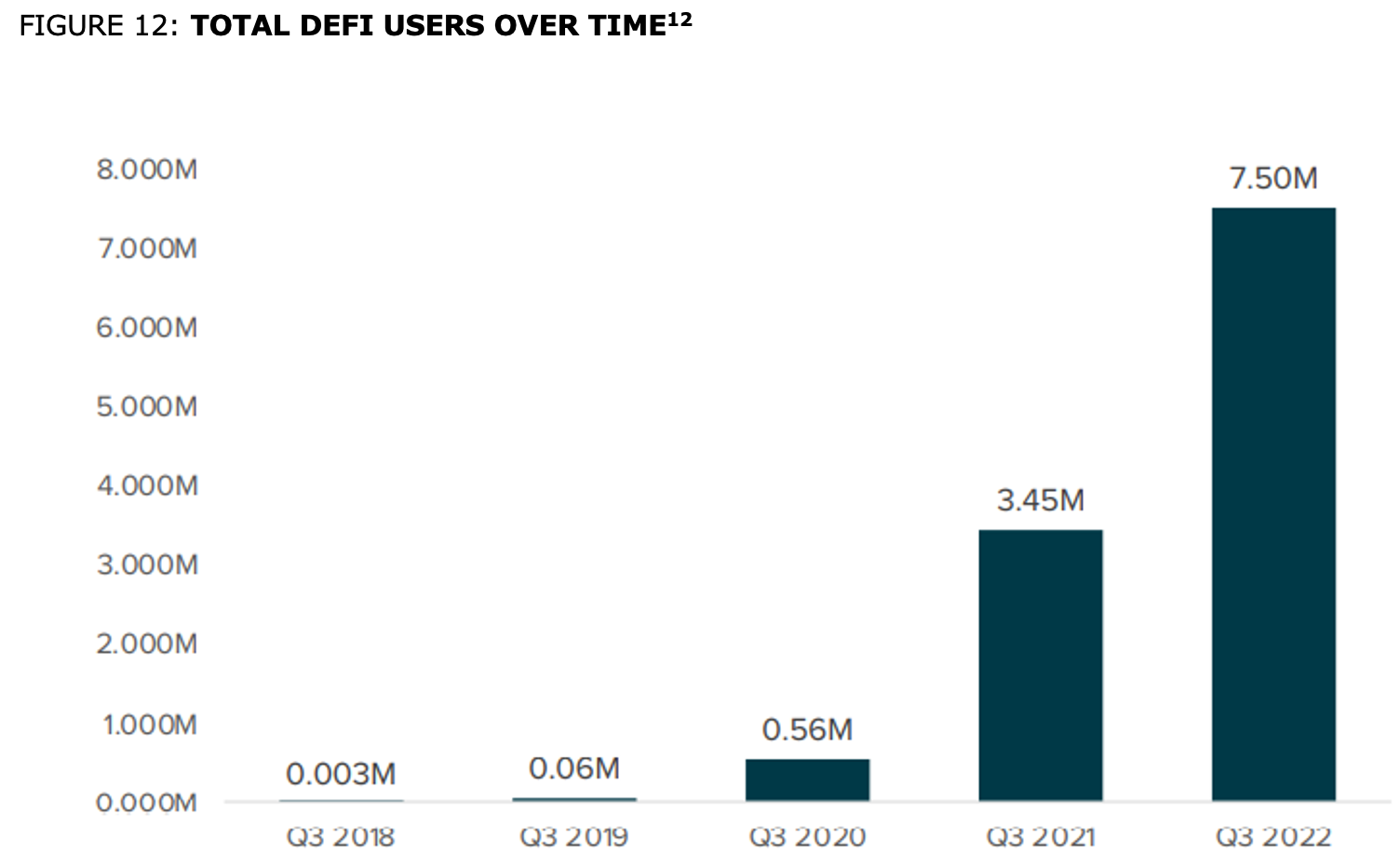

Adoption of DeFi has grown rapidly over recent years. The total number of addresses using DeFi applications reached more than 7 million at the end of Q3 2022, representing over 2x growth from Q3 of the prior year. The rapid growth of DeFi users offers evidence that consumers are demanding a different financial services experience.

FIGURE 12: TOTAL DEFI USERS OVER TIME[12]

[12] Grayscale, Dune Analytics

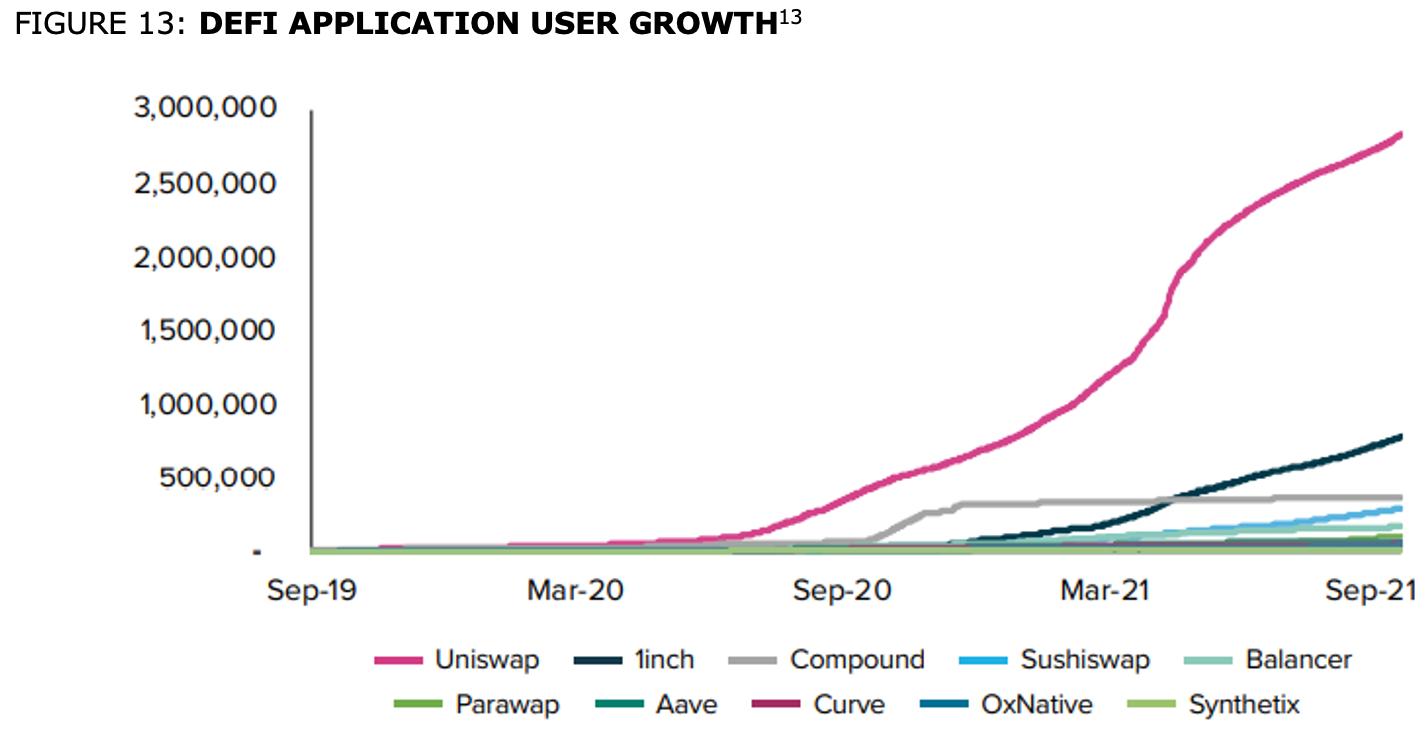

Many popular individual DeFi protocols have seen user growth go from linear to exponential in the last year as several applications have proved out their technological viability and competitive utility.

FIGURE 13: DEFI APPLICATION USER GROWTH[13]

[13] Grayscale, Dune Analytics

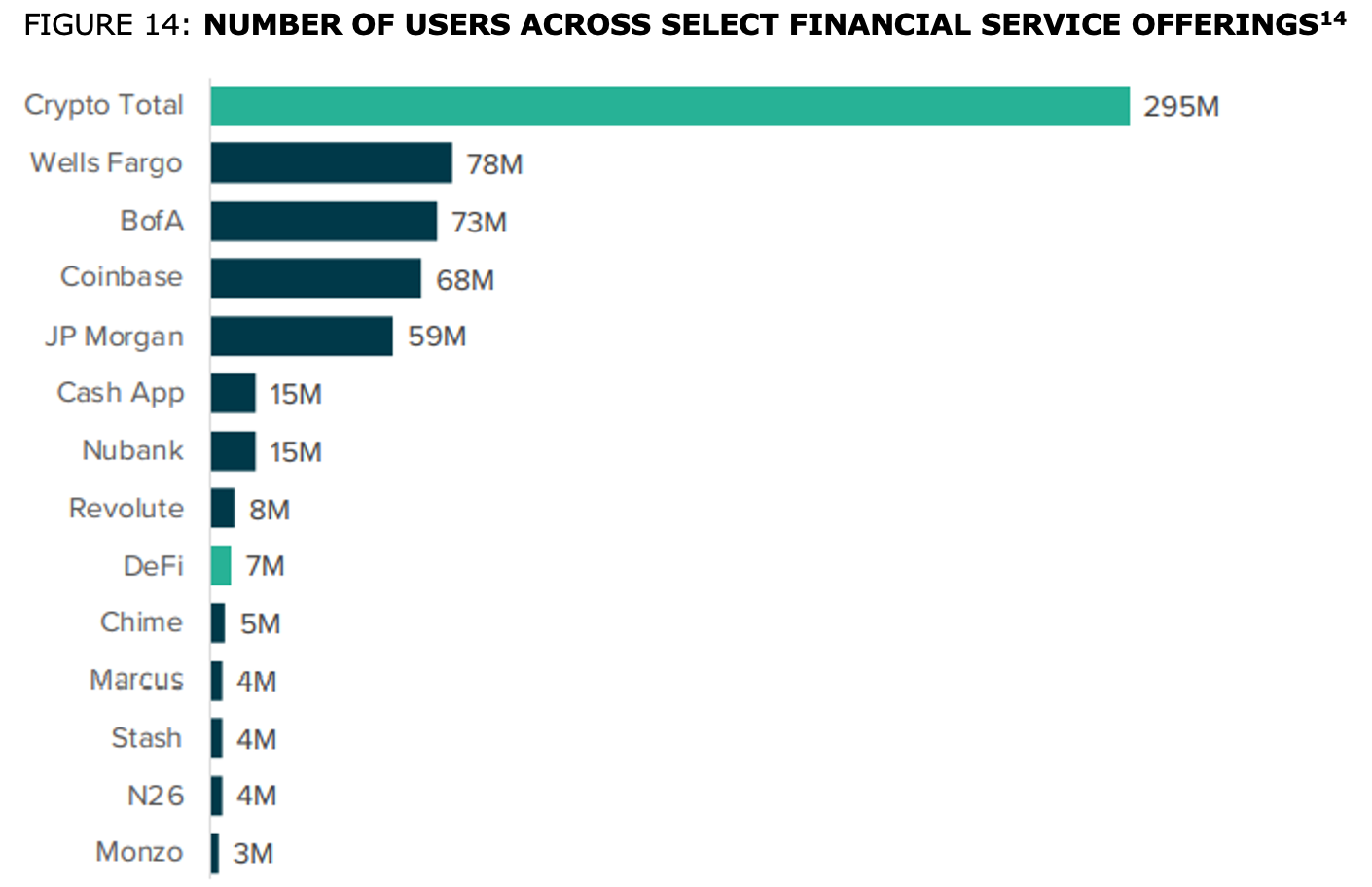

Global crypto users have been climbing the charts against competing financial providers for nearly the past decade. DeFi users have started to climb the ranks as well over the past two years. DeFi users have reached the scale of leading fintech players and may soon approach mainstream banks if the rate of growth continues.

FIGURE 14: NUMBER OF USERS ACROSS SELECT FINANCIAL SERVICE OFFERINGS[14]

[14] Grayscale, Credit Suisse, Crypto.com, CoinTelegraph, Coinbase

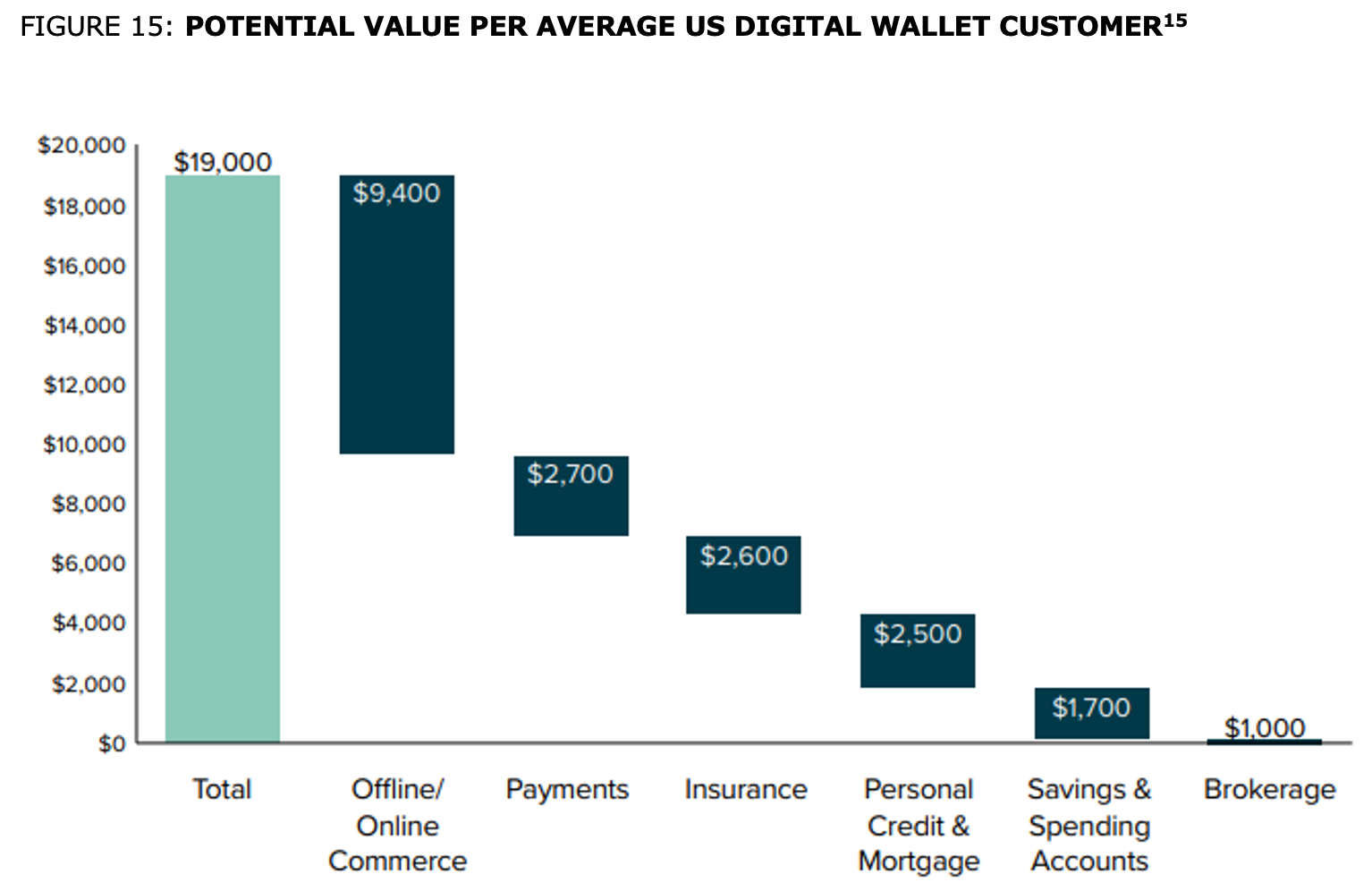

The prize for capturing consumer digital wallet market share may potentially be enormous. At maturity, the potential value per average digital wallet customer across commercial and financial products in the U.S. is estimated to be $19,000. This underscores the fundamental value that DeFi dApps have been accruing from their rapid user growth over recent years and the opportunity that may lie ahead.

FIGURE 15: POTENTIAL VALUE PER AVERAGE US DIGITAL WALLET CUSTOMER[15]

[15] Grayscale, ARK Invest

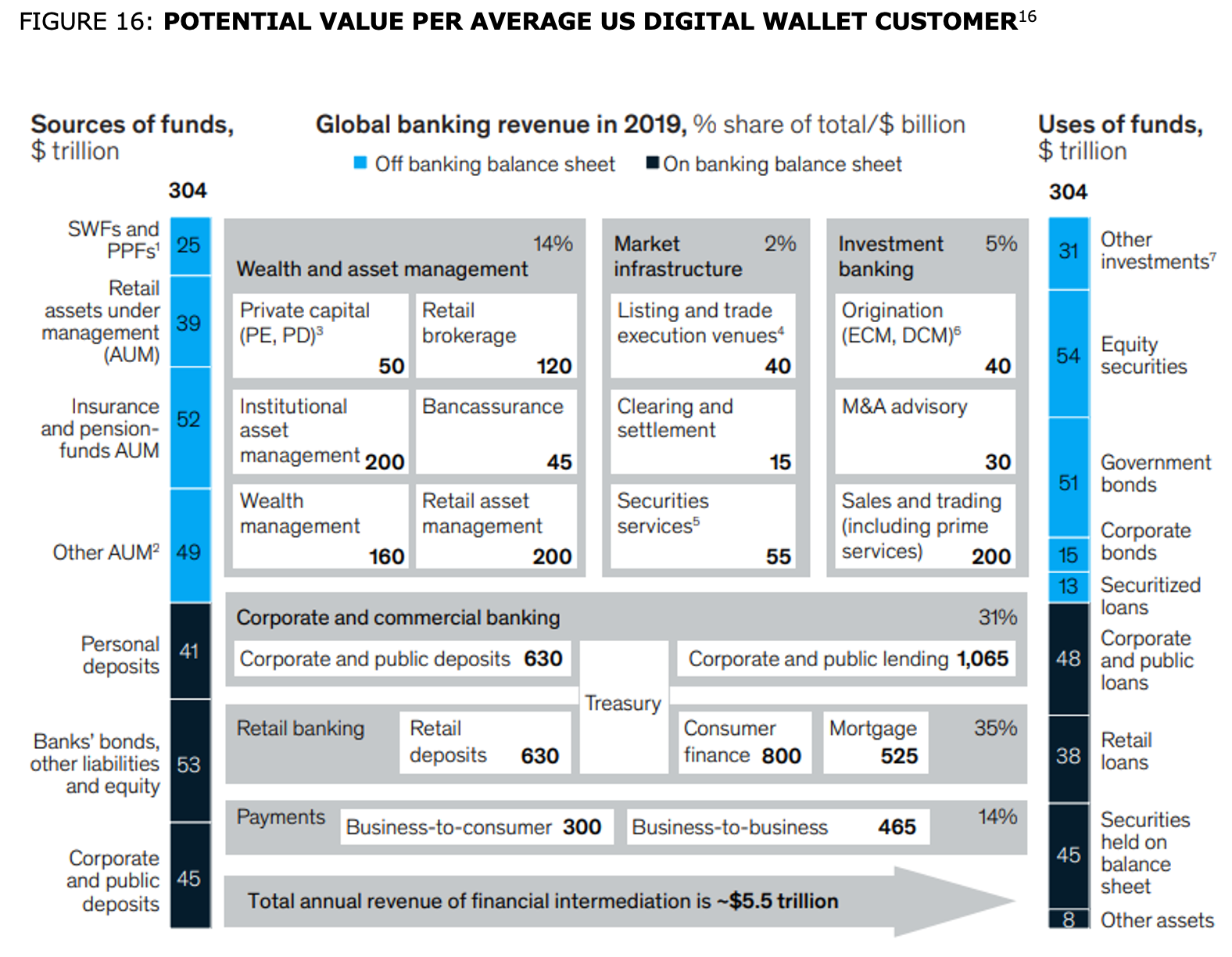

Global financial intermediation generates an estimated $5.5 trillion in revenue across industry segments by servicing ~$300 trillion in assets. DeFi has an opportunity to capture a greater share of this financial industry revenue pie, both as more value moves into the crypto economy and as a greater share of traditional financial assets become digitized and serviced by DeFi applications.

FIGURE 16: POTENTIAL VALUE PER AVERAGE US DIGITAL WALLET CUSTOMER[16]

[16] Grayscale, McKinsey

¹Sovereign-wealth funds and public-pension funds. ²Endowments and foundations, corporate investments. ³Private equity, private debt. ⁴Includes exchanges, inter-dealer brokers, and alternative venues but excludes dark pools. ⁵Custody, fund administration, corporate trust, security lending, net interest income, collateral management, and ancillary services provided by custodians. ⁶Equity capital markets, debt capital markets. ⁷Real estate, commodities, private capital investments, derivatives.

Source: SWF Institute; McKinsey Capital Markets and Investment Banking Pools; McKinsey Global Institute McKinsey Panorama Global Banking Pools; McKinsey Performance Lens Global Growth Cube

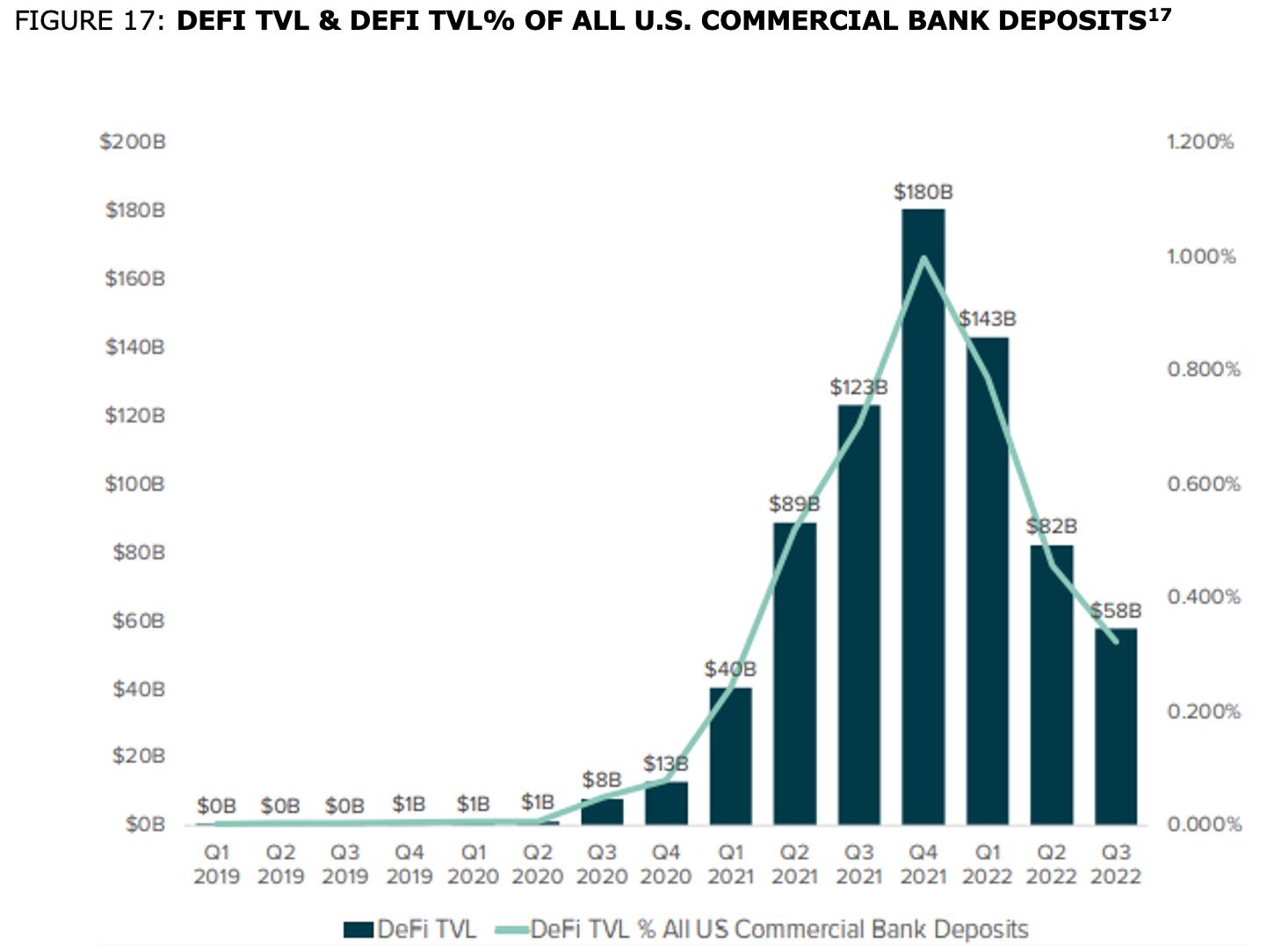

The Total Value Locked (TVL) serviced by DeFi applications has grown more than ~1800x over the last year to $40 billion dollars as of Q3 2022. In relative terms, DeFi TVL has reached 0.2% of total U.S. commercial bank deposits in this short time frame. TVL is a useful metric for DeFi protocols since it measures the asset that can generate fee revenues and profits for the network and token holders.

FIGURE 17: DEFI TVL & DEFI TVL% OF ALL U.S. COMMERCIAL BANK DEPOSITS[17]

[17] DeFi Llama, Federal Reserve

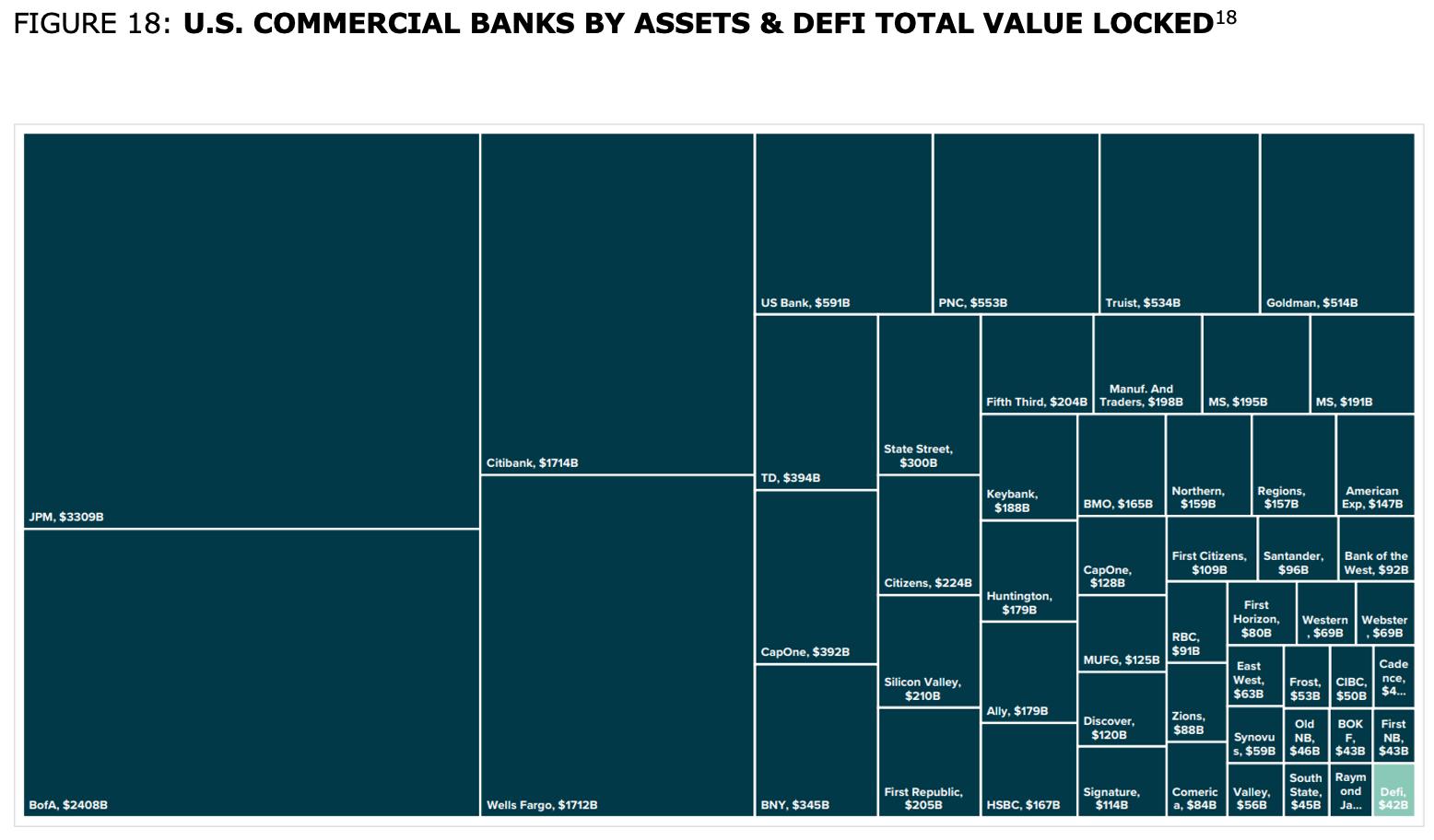

Many of the largest U.S. banks have ignored the growth of crypto for years. Today, these same banks are being forced to compete with crypto DeFi ecosystems that would rank as the 18th largest U.S. bank by total assets.

FIGURE 18: U.S. COMMERCIAL BANKS BY ASSETS & DEFI TOTAL VALUE LOCKED[18]

[18] Grayscale, DeFi Lama, Federal Reserve

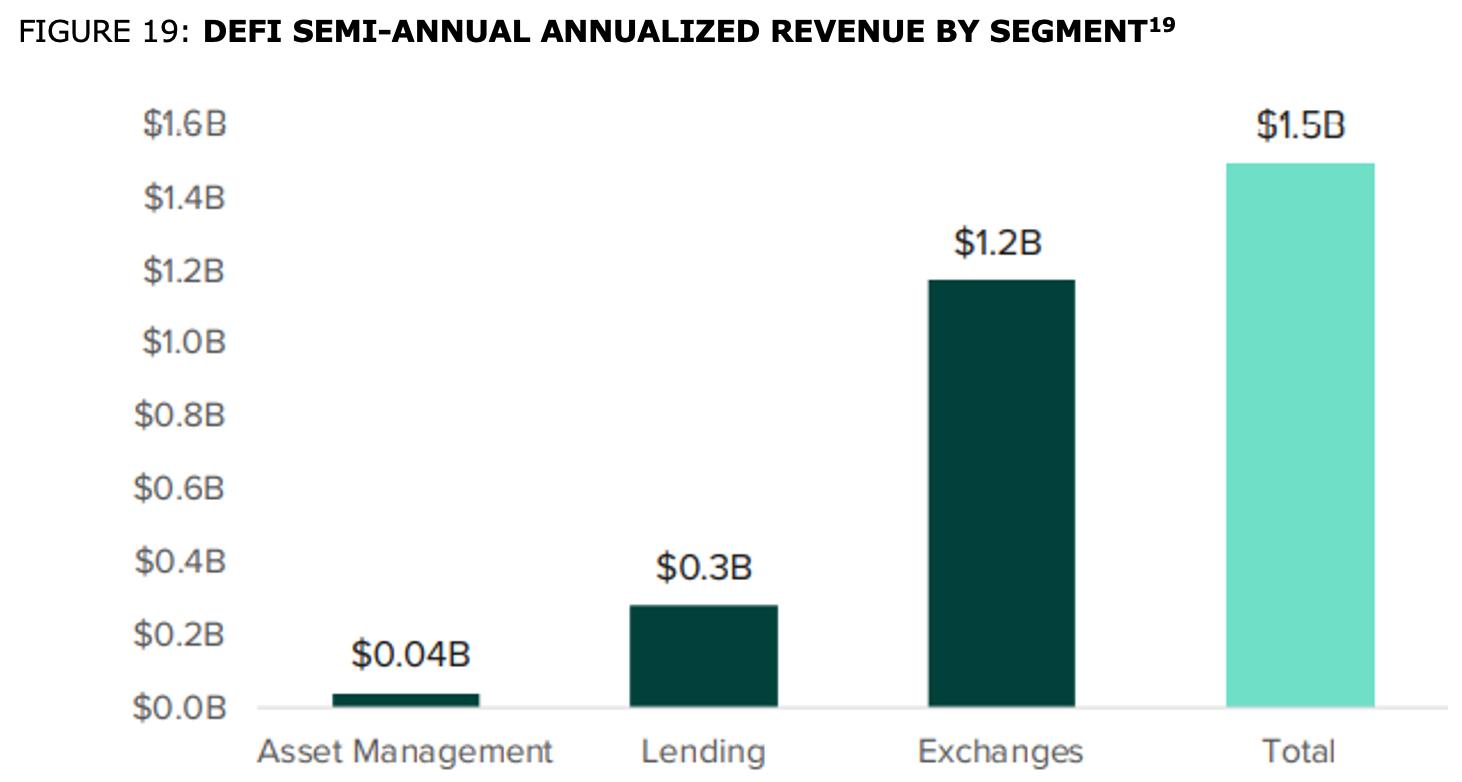

Many DeFi protocols are already generating substantial network fee revenue from the financial services they provide users. During the prior six months ending 12/1/22, leading DeFi protocols generated $750M in revenue across sectors, putting DeFi on pace to generate nearly $1.5 billion of annualized revenue. Each DeFi asset has unique revenue drivers, but across sectors these may generally be a function of:

FIGURE 19: DEFI SEMI-ANNUAL ANNUALIZED REVENUE BY SEGMENT[19]

[19] Grayscale, Token Terminal (12/1/22): Assets Per Sector: Asset Mgmt. (LDO, YFI, CTX, INDEX), Exchange (UNI, DYDX, CRV, 1INCH, CAKE, SUSHI, SNX, BAL, PERP, DODO, JOE, MIR, ZRX, BNT, PNG, LRC, QUICK, KNC), Insurance (NXM), Lending (AAVE, COMP, CFG, LQTY, CREAM, ROOK), Stablecoin (MKR, FLX)

DeFi protocol revenue is a key input to many networks and may be one good way to look at token value given:

DeFi tokens do not have a universal economic representation, but many of the software protocols are able to deliver value to token holders via structures that incorporate:

As a result, many leading DeFi protocols have shown the ability to translate the utility they provide users into economic value for token holders.

The DeFi ecosystem presents significant opportunity but also comes with a range of meaningful risks, which include:

Regulatory: Crypto and DeFi may be forming an emerging market economy in the cloud, but these global organizations must still engage in international relations or risk the potential for foreign sanctions. DeFi’s regulatory environment is still highly uncertain, and it remains to be seen how U.S. or other regulators will enact policy affecting the ecosystem. Should certain DeFi tokens be deemed securities, it would likely hamper their liquidity and harm pricing. Should certain stablecoins become more heavily regulated, they could be forced off DeFi platforms, which would harm DeFi services that rely on these fiat-backed assets as collateral. It’s unclear how DeFi’s open user access and data reporting model will be impacted by regulations. The incorporation of futures regulations into DeFi derivatives exchanges is still playing out. The stance regulators will take towards developers and participants on DeFi platforms is still evolving.

Hacks/Bugs: DeFi protocols have been hacked or experienced bugs that have resulted in the loss of user funds or smart contracts not executing as they were intended due to coding errors. DeFi protocols are also subject to exploit risks from poorly designed system financial parameters or governance controls that may result in lost user funds.

Tech Maturity: Crypto networks and DeFi technology are still nascent and continue to mature. There are many areas where the technology may still need to improve before DeFi can service a more sizable global financial market. Some of these areas include underlying network scalability, DeFi dApp capital efficiency, and UX/UI, among other areas.

Crypto Volatility: Crypto assets comprise a material portion of the Total Value Locked within many DeFi protocols. Crypto assets have been subject to high volatility. Negative fluctuations in the value of a DeFi protocols’ crypto holdings may materially harm the dApps usage, fees revenue, governance utility, and, ultimately, token value.

Financial Models: Many DeFi projects implement the use of governance tokens affiliated with the protocol. However, it’s yet to be fully seen how many of these digital assets will accrue long run sustainable value tied to the fundamental growth of the dApp.

Grayscale Investments, LLC (“Grayscale”) is the parent holding company of Grayscale Advisors, LLC (“GSA”), an SEC-registered investment adviser, as well Grayscale Securities, LLC (“GSS”), an SEC-registered broker/dealer and member of FINRA. Grayscale is not registered as an investment adviser under the Investment Advisers Act of 1940 and none of the investment products sponsored or managed by Grayscale (“Products”) are registered under the Investment Company Act of 1940.

Investments managed by GSA are registered under the Investment Company Act of 1940 and subject to the rules and regulations of the Securities Act of 1933 and Investment Advisers Act of 1940.

Carefully consider each Product’s investment objectives, risk factors, fees and expenses before investing. This and other information can be found in each Product’s private placement memorandum, which may be obtained from Grayscale and, for each Product that is an SEC reporting company, the SEC’s website, or for each Product that reports under the OTC Markets Alternative Reporting Standards, the OTC Markets website. Reports prepared in accordance with the OTC Markets Alternative Reporting Standards are not prepared in accordance with SEC requirements and may not contain all information that is useful for an informed investment decision. Read these documents carefully before investing.

Investments in the Products are speculative investments that involve high degrees of risk, including a partial or total loss of invested funds. Grayscale Products are not suitable for any investor that cannot afford loss of the entire investment. The shares of each Product are intended to reflect the price of the digital asset(s) held by such Product (based on digital asset(s) per share), less such Product’s expenses and other liabilities. Because each Product does not currently operate a redemption program, there can be no assurance that the value of such Product’s shares will reflect the value of the assets held by such Product, less such Product’s expenses and other liabilities, and the shares of such Product, if traded on any secondary market, may trade at a substantial premium over, or a substantial discount to, the value of the assets held by such Product, less such Product’s expenses and other liabilities, and such Product may be unable to meet its investment objective.

This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This material is strictly for illustrative, educational, or informational purposes and is subject to change.

The shares of each Product are not registered under the Securities Act of 1933 (the “Securities Act”), the Securities Exchange Act of 1934 (except for Products that are SEC reporting companies), the Investment Company Act of 1940, or any state securities laws. The Products are offered in private placements pursuant to the exemption from registration provided by Rule 506(c) under Regulation D of the Securities Act and are only available to accredited investors. As a result, the shares of each Product are restricted and subject to significant limitations on resales and transfers. Potential investors in any Product should carefully consider the long-term nature of an investment in that Product prior to making an investment decision. The shares of certain Products are also publicly quoted on OTC Markets and shares that have become unrestricted in accordance with the rules and regulations of the SEC may be bought and sold throughout the day through any brokerage account.

The Products are distributed by Grayscale Securities, LLC (Member FINRA/SIPC).*