Last Updated: 7/23/2024 | 19 min. read

Following the SEC’s approval of spot Ethereum exchange-traded products, some investors may be looking to learn more about the second-largest crypto asset.[1] Grayscale Research expects that new products could introduce more investors to the concept of smart contracts and decentralized applications — and therefore to the potential for public blockchains to transform digital commerce. Below we have compiled 10 common questions about Ethereum that investors might have, whether they are looking to learn the basics or deepen their understanding of the network and its ecosystem. (For additional background, see our report on The State of Ethereum and materials related to the Smart Contract Platforms Crypto Sector.)

Q: What are the main differences between Bitcoin and Ethereum? How does Ethereum differ from other assets in the Smart Contract Platforms Crypto Sector?

A: Bitcoin’s primary use case today is as a store of value, while Ethereum’s primary use case is as a platform for decentralized applications.

In 2009, Bitcoin became the first public blockchain and the first investible blockchain token. Today, Bitcoin can be considered a asset and digital alternative to gold (see our report Bitcoin’s Purpose: Sizing the Addressable Markets). In 2015, Ethereum applied the concept of a public blockchain to smart contracts — self-executing computer code — creating a whole new category within the crypto asset class with entirely different use cases from Bitcoin.

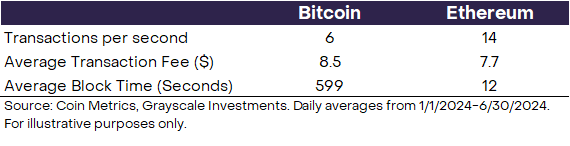

Ethereum can be likened to a decentralized version of Apple’s App Store, as it provides the foundational platform for applications to be built upon. These decentralized applications (dApps) can range from financial applications to gaming to identity tools. In comparison to Bitcoin, Ethereum currently allows for greater transaction throughput, lower average block times, and around the same level of transaction fees for users (Exhibit 1).

Exhibit 1: Bitcoin and Ethereum Comparison

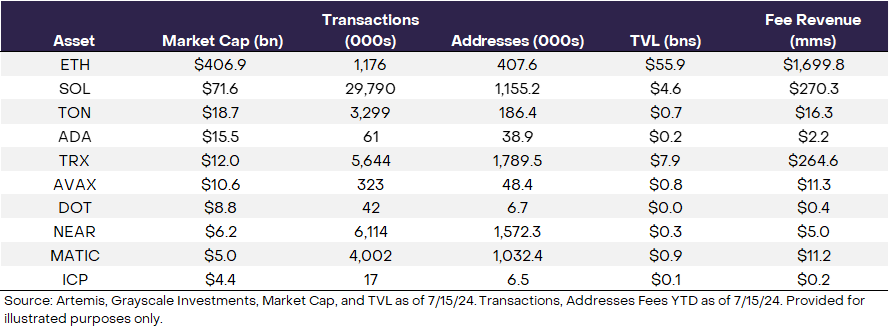

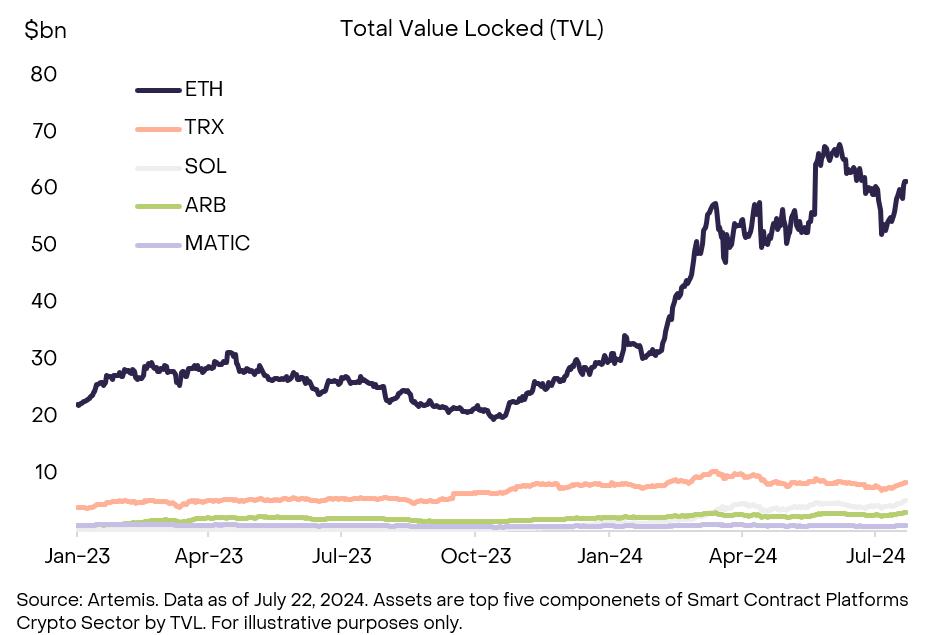

Because Ethereum and Bitcoin have entirely different primary use cases, they belong to different market segments in the Grayscale Crypto Sectors framework. Bitcoin is a part of the Currencies Crypto Sector, while Ethereum resides in the Smart Contract Platforms Crypto Sector, alongside Solana, Toncoin, Cardano, Tron, and Avalanche, among many others. Ethereum leads other assets in its sector in fundamental metrics, such as market cap, total value locked (TVL), and fee revenue (Exhibit 2).

Exhibit 2: Fundamentals for top 10 Smart Contract Platforms by Market Cap

Q: How much does the supply of Ether (ETH) [2] increase and what determines the issuance rate?

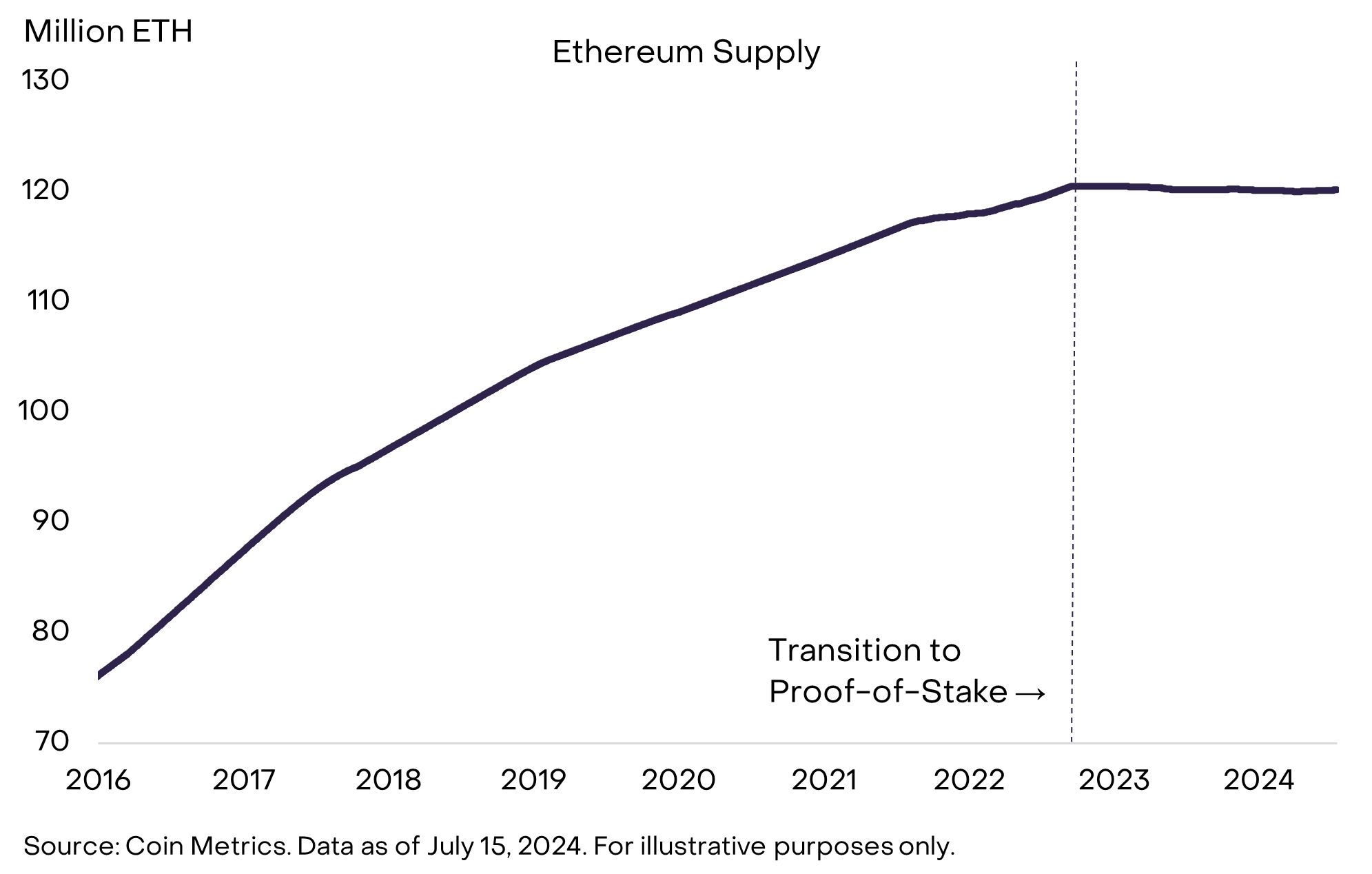

A: Since the transition to Proof of Stake (PoS) in 2022, the supply of ETH has been approximately unchanged. The issuance rate is determined by block rewards and transaction fees.

In 2022, Ethereum underwent a major upgrade dubbed “The Merge,” which included a shift from a Proof of Work (PoW) to a Proof of Stake (PoS) consensus mechanism. Before the Merge, Ethereum had an average annual inflation rate of about 3%.[3] Since the Merge and shift to PoS, Ethereum supply has been about unchanged (Exhibit 3). Like Bitcoin, limited ETH supply growth underpins its value as a scarce digital asset.

Exhibit 3: ETH supply has been about unchanged since September 2022

ETH issuance is influenced by block rewards and transaction fees. Block rewards are newly minted ETH distributed to validators, contributing to inflation. Transaction fees, or gas fees, include a base fee that is burned (deflationary) and a priority fee that is given as a reward to validators (neutral impact on inflation).

Q: What is “gas” on the Ethereum network? What is Ethereum network fee revenue and how does it accrue value to token holders?

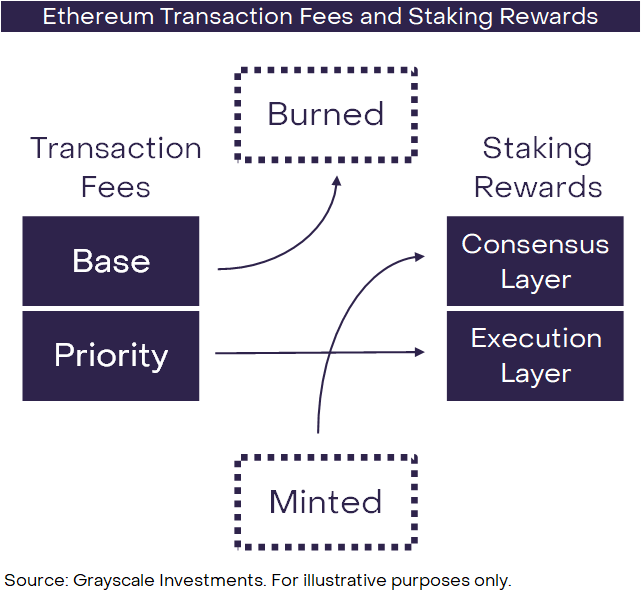

A: Transaction fees on Ethereum are referred to as “gas,” which can be considered the network’s revenue. Revenue accrues to token holders through mechanisms that resemble equity dividends and buybacks.

Ethereum network fee revenue is generated by gas, or fees paid in ETH to perform transactions and use applications on the Ethereum network. Gas is necessary to help regulate network usage: without some type of transaction cost, the network could be overwhelmed by spam transactions.

Gas fees consist of two parts: base fees and tips. Similar to a stock buyback, base fees are "burned," removing ETH supply from circulation. In this way, rising transaction volumes can help benefit all token holders. Similar to an equity dividend, tips are distributed as rewards to validators. However, the difference in this case is that validators help secure the network by processing transactions and maintaining the blockchain (Exhibit 4).

Exhibit 4: Ethereum Supply Dynamics via Burn and Staking

Gas fees are crucial for the functioning of the Ethereum network as they provide an economic incentive for validators to participate in the network's security. By tying the network's usage directly to the value of ETH, network fee revenue plays a critical role in Ethereum's value accrual mechanism, benefiting token holders, validators, and the overall network ecosystem.

Q: What makes Ethereum attractive to developers building on the network? What are the largest applications on Ethereum?

A: Ethereum is attractive to developers because of network effects and network security. Most of the largest decentralized applications (dApps) today have financial use cases.

Ethereum is attractive to developers building on the network for many reasons. For one, Ethereum benefits from greater network effects in comparison to other chains in the Grayscale Smart Contract Platforms Crypto Sector. Ethereum is a category leader in terms of number of applications (~4,700 decentralized applications in total) and has the largest developer community (~580 weekly developers), showcasing a robust environment for application interoperability and innovation.[4] Ethereum also dominates its competitors with $54 billion in TVL, a key indicator of ecosystem liquidity (Exhibit 5).[5] These advantages position Ethereum particularly well towards retaining and attracting new developers.

Exhibit 5: Ethereum leads competitors in TVL, a key indicator of liquidity

Ethereum is also a sector leader in terms of network security, which we believe helps garner confidence with users and developers alike. The theoretical cost of attacking the Ethereum network is prohibitively high. For instance, gaining control of 51% of the network to execute a majority attack would require an enormous amount of computational power and financial resources, making such an attack economically unfeasible.[6] The extensive network of decentralized nodes further helps enhance network security by ensuring redundancy and eliminating single points of failure.

Decentralized applications on Ethereum range in use cases from financial/tokenization to gaming and NFTs. Two of the largest applications built on Ethereum based on metrics like users, fees, and TVL include Lido and Uniswap. Lido, a liquid staking solution, enables users to stake their ETH while retaining liquidity through the issuance of derivative tokens (stETH). Uniswap is a decentralized exchange, which enables peer-to-peer trading of various crypto assets without an intermediary. Both use Ethereum as a settlement layer, designed to execute secure and decentralized transactions.

Q: What does it mean that Ethereum is a modular blockchain design?

A: Ethereum’s modular design means that different types of blockchain infrastructure (multiple software “layers”) work together to deliver the end user experience.

Blockchains can be considered a type of digital infrastructure. And just like infrastructure in the physical world, they can experience congestion. In May 2022, for example, increased congestion on the Ethereum network led to average daily gas fees reaching $196 for a single transaction.[7] When network congestion increases, gas fees rise, which can crowd out many types of network activity. As a result, Ethereum has pursued a modular (or layered) design philosophy, in which different types of blockchain infrastructure work together to deliver the end user experience.

Ethereum's modular design divides the network into specialized parts, such as execution (processing transactions), data availability (storing transaction data), and consensus (ensuring all transactions are valid). This approach allows for targeted innovations and updates without disrupting the entire network, enabling Ethereum to address its scalability challenges while still maintaining its network security.

This design contrasts with Solana’s monolithic approach, where each of these functions — execution, data availability, and consensus — are handled within a single layer, optimizing for speed, efficiency, and consistency.

Q: What are Ethereum Layer 2s, and how do they connect to the Ethereum mainnet?

A: Ethereum Layer 2s are scaling solutions built on top of Ethereum that execute transactions at lower cost.

Because Ethereum operates a modular design, it can separate transaction execution from transaction settlement. As a result, Ethereum Layer 2s process transactions, batch them together, and then send a compressed version back to the main network — the Ethereum mainnet or Layer 1— for settlement. Through this batching process, Layer 2s can offer users significantly greater throughput and lower costs in comparison to transactions executed on the main chain, while still relying on Ethereum’s network security.

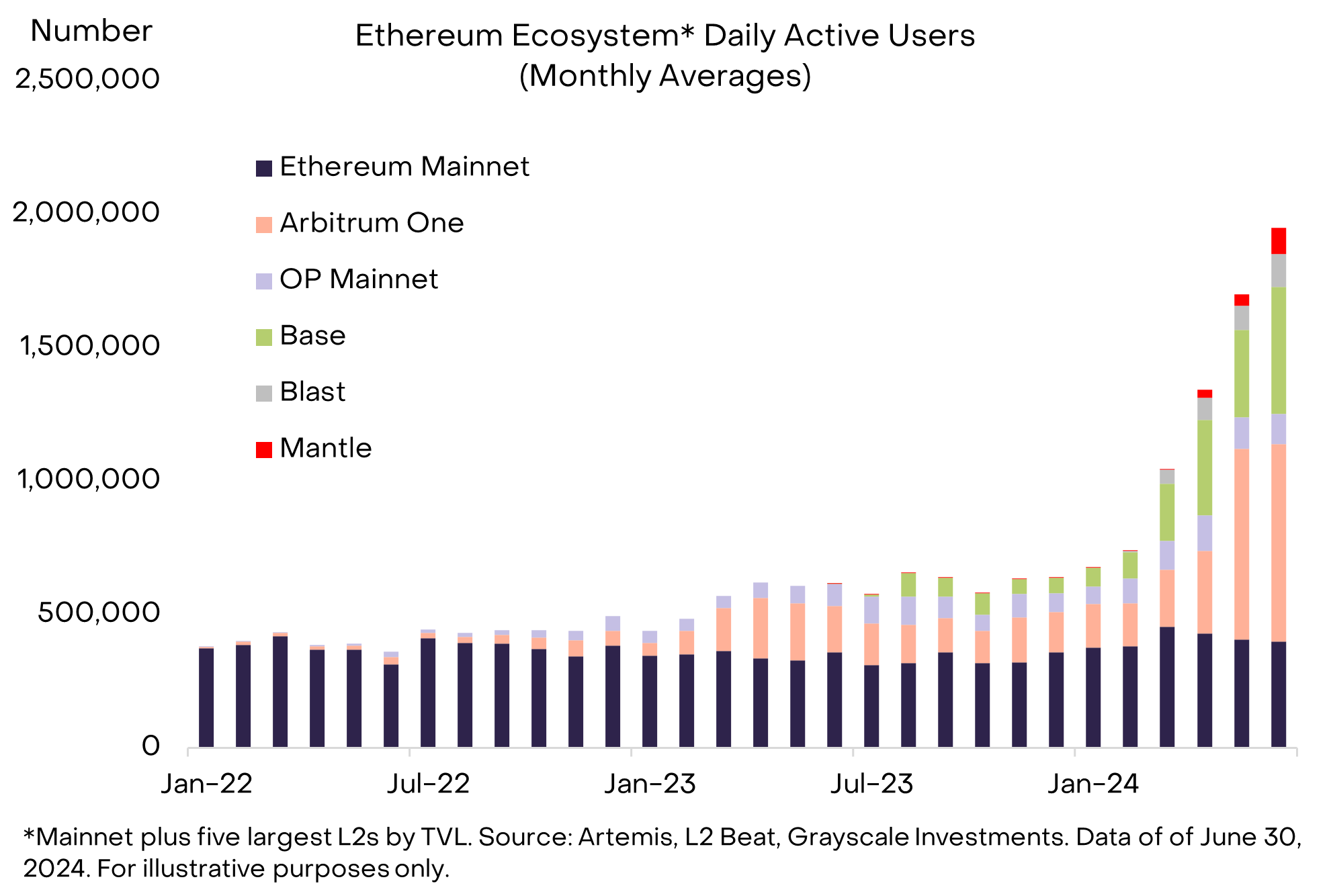

Today, there are a wide variety of Layer 2 scaling solutions including Optimistic Rollups, such as Optimism and Arbitrum, and ZK Rollups, such as Starknet and ZkSync. From the standpoint of blockchain activity, Layer 2 networks have allowed the Ethereum ecosystem to expand significantly; Layer 2s now account for about two-thirds of total activity in the Ethereum ecosystem (Exhibit 6).

Exhibit 6: Significant growth in Ethereum Layer 2 activity

Layer 2 adoption can, in part, be attributed to Ethereum’s recent Dencun upgrade (for details, see our report Ethereum’s Coming of Age: “Dencun” and ETH 2.0). With this upgrade in March 2024, Ethereum significantly reduced data costs for Layer 2s by providing a designated storage space for them on the mainnet. This allowed Layer 2s to lower their transaction fees, making Ethereum Layer 2s, in some cases, as affordable and accessible as Solana.

Q: How does Ethereum achieve consensus, and how do you measure network security?

A: Ethereum achieves consensus through a Proof of Stake algorithm. Network security can be measured in different ways, including the value of ETH staked and number of validators.

Originally, Ethereum achieved consensus through Proof of Work, similar to Bitcoin. However, in 2022, Ethereum transitioned to a PoS network with “The Merge” upgrade. This upgrade was designed to increase the efficiency and scalability of the network while reducing energy consumption by 99%.[8]

The PoS consensus used by Ethereum differs from PoW by selecting who has the right to confirm the next block based on the value of their staked tokens, rather than through competition among miners. In the PoS consensus mechanism, validators must stake in increments of 32 ETH to become eligible to confirm blocks for rewards.[9]

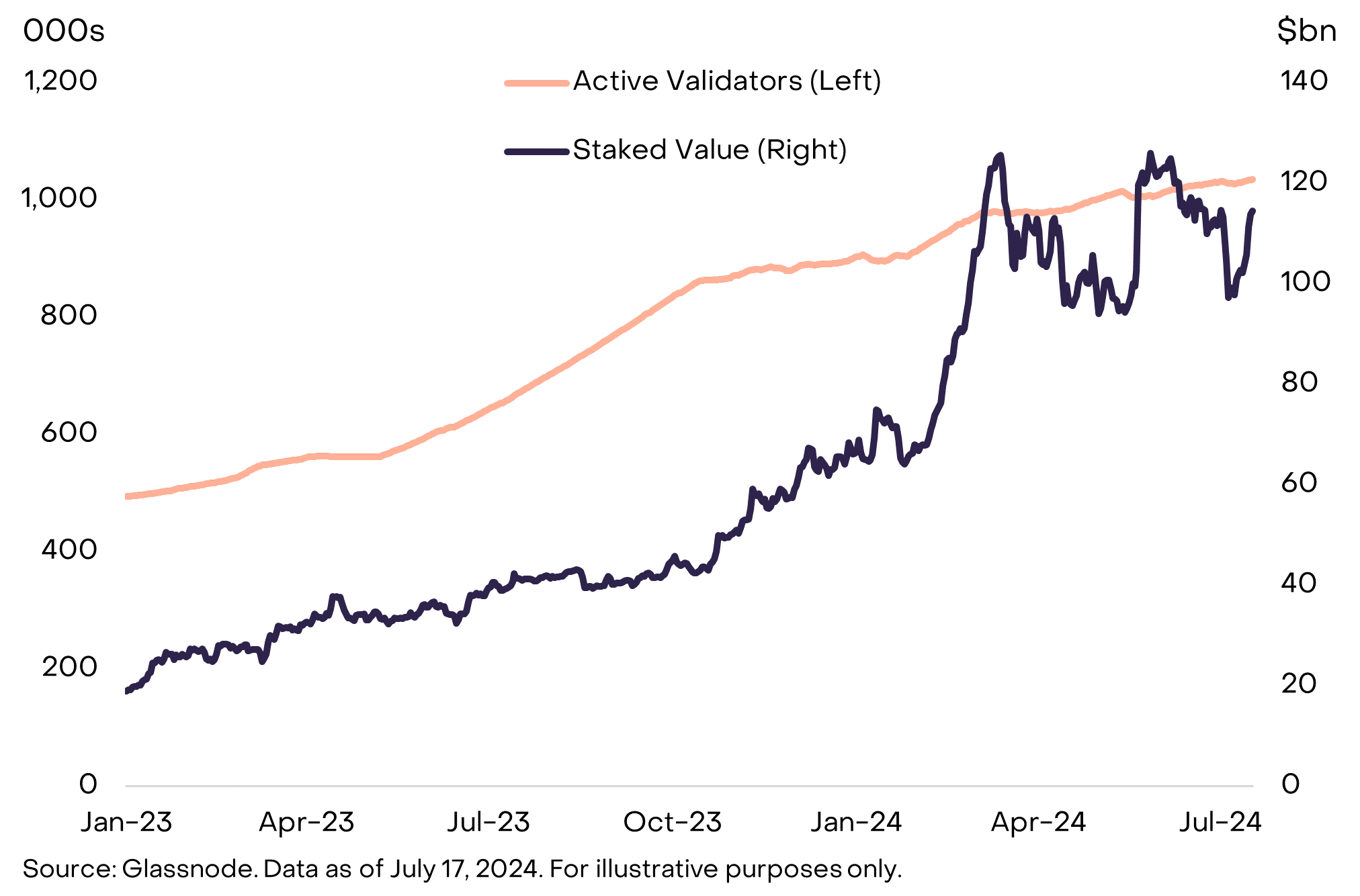

Ethereum network security can be measured by the total amount of ETH staked on the network, currently valued at around $112bn (Exhibit 7). This represents the overall ecosystem’s economic commitment to network security (also referred to as Ethereum’s security budget). Another measure is the number of validators, currently standing at ~1 million, which reflects the decentralization of the Ethereum network.[10]

Exhibit 7: Network security measured by validators and staked value

Q: What is the ownership distribution of ETH holders?

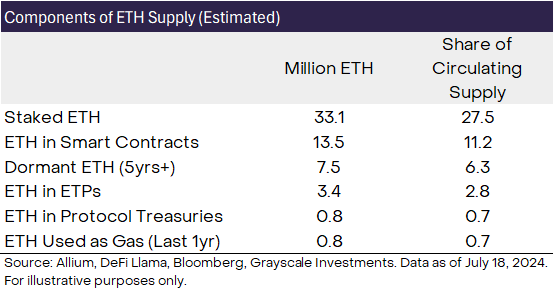

A: As of mid-July 2024, ETH ownership can be categorized into distinct categories as follows: staked ETH (27%), ETH in smart contracts (11%), dormant ETH (6%), ETH held in ETPs (~3%), ETH in treasuries (0.7%), and ETH used as gas annually (0.7%). See exhibit 8 for more details.

Grayscale Research believes that around 17% of ETH supply can be categorized as idle or relatively illiquid (for more details, see our report The State of Ethereum). According to data analytics platform Allium, this includes about 6% of ETH supply that has not been moved for over five years, as well as about 11% of ETH supply that is “locked” in various smart contracts (e.g., bridges, wrapped ETH, and various other applications). Moreover, 27% of ETH supply is staked.

In addition to these categories, the ETH used as gas for network transactions is $2.7bn on an annual basis.[11] This represents an additional 0.7% of supply at current ETH prices. There are also a number of protocols that hold a substantial portion of ETH on their treasuries, including the Ethereum foundation ($1bn worth of ETH), Mantle (~$750mm in ETH), and Golem (~$519mm in ETH).[12] In total, ETH in protocol treasuries accounts for about 0.7% of supply. Finally, 3.4mm ETH, or about 3% of the total supply, is already held in ETH ETPs.

Altogether, these groups account for nearly 50% of ETH supply (Exhibit 8), although the categories are partly overlapping (e.g., ETH in protocol treasuries may be staked).

Exhibit 8: Staked ETH constitutes a large amount of the total ETH supply

Q: What could inflows into US Ethereum ETPs look like?

A: Grayscale Research estimates that inflows into US Ethereum ETPs could be equivalent to around 25%-30% of the assets in Bitcoin ETPs, or $3.5 billion to $4 billion over the first four months.

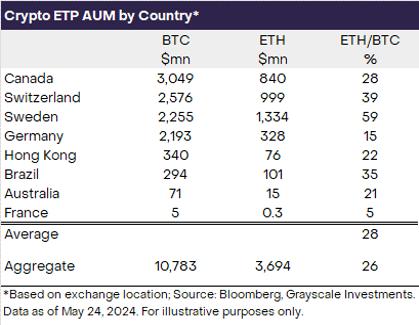

Outside the United States, where both Bitcoin and Ethereum exchange-traded products (ETPs) are already available, assets in Ethereum ETPs amount to about 25%-30% of assets in Bitcoin ETPs (Exhibit 9). On this basis, Grayscale Research’s working assumption is that net inflows into U.S.-listed spot Ethereum ETPs will be 25%-30% of those observed for the spot Bitcoin ETPs to date, or about $3.5 billion to $4 billion over the first four months or so (25%-30% of the $13.7bn net inflows into spot Bitcoin ETPs since January).

Exhibit 9: Outside the U.S., Ethereum ETP AUM totals 25%-30% of Bitcoin ETP AUM

Ethereum’s market capitalization is about one-third (33%) that of Bitcoin’s market capitalization, so our assumptions imply that Ethereum net inflows could be slightly smaller as a share of market cap. Although we believe this is a reasonable working assumption, the estimates are uncertain, and there are risks of both higher and lower net inflows into U.S.-listed spot Ethereum ETPs. In the U.S. market, ETH futures-based ETPs have only about 5% of the assets of BTC futures-based ETPs, although we do not think this is representative of the likely relative demand of spot ETH ETPs.

Q: What are the opportunities and challenges for the Ethereum network going forward?

A: Ethereum benefits from strong network effects and liquidity advantage. At the same time, it faces certain challenges, including Layer 2 centralization and increasing competition from other smart contract platforms.

Ethereum benefits from several fundamental positives. Most importantly, Ethereum’s network effects and liquidity advantage position it favorably towards retaining and attracting new developers, applications, and users. Ethereum also generates the most network fee revenue (over $2 billion in 2023) of its peer set, indicating its maturity, ability to monetize its user base, and its advantage towards attracting validators and stakers for network security. In total, Ethereum has the largest network security budget at 33mm ETH (currently worth around $112 billion).This is particularly important for use cases that require high levels of security such as stablecoins and tokenized financial assets.

Ethereum ETPs could increase the willingness of institutions to hold ETH as an asset and to adopt technology on the Ethereum blockchain. We have already seen strides in this direction, as the list of Wall Street firms building tokenized funds now includes Goldman Sachs and Blackrock, with Blackrock developing its BUIDL fund on Ethereum.[14] Beyond traditional finance, a spot Ethereum ETP approval could have implications on broader retail awareness of Ethereum, flows into ETH the asset, and adoption of the Ethereum network.

At the same time, Ethereum faces several challenges. For example, most Layer 2s are centralized today. To fully achieve its potential as a truly permissionless, decentralized ecosystem, Ethereum Layer 2s will need to progressively decentralize over time. Additionally, as network activity has transitioned to Layer 2s, network fee revenue on the Ethereum mainnet has recently declined. This underscores the importance that Ethereum continues to grow its fee revenue. This could occur either through i) modest growth in Layer 1 activity, paying higher transaction costs, or ii) significant growth in Layer 2 activity, paying lower transaction costs (see our report The State of Ethereum).

Ethereum faces increasing competition in the Smart Contract Platforms Crypto Sector. To maintain its dominance in a competitive market segment, Ethereum will need to leverage its strengths and bring in additional users as well as grow fee revenue.

[1] CoinMarketCap as of July 22, 2024

[2] "ETH” refers to the native token on the Ethereum blockchain

[3] Coin Metrics

[4] Dapp Radar and Artemis

[5] Defi Llama

[6] Breaking BFT: Quantifying the Cost to Attack Bitcoin and Ethereum

[7] Bitinfocharts

[8] Forbes

[9] Ethereum.org as of July 9th, 2024

[10] Beaconcha.in

[11] This reflects the dollar amount of Ethereum used as gas in transactions. This value is denominated in ETH in Exhibit 8

[12] Defi Llama, as of 7/18/2024

[13] Artemis, as of July 22, 2024

[14] Coindesk

Important Information

Investments in digital assets are speculative investments that involve high degrees of risk, including a partial or total loss of invested funds. Investments in digital assets are not suitable for any investor that cannot afford loss of the entire investment. “ETH” refers to the native token on the Ethereum blockchain.

All content is original and has been researched and produced by Grayscale Investments, LLC (“Grayscale”) unless otherwise stated herein. No part of this content may be reproduced in any form, or referred to in any other publication, without the express consent of Grayscale. This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any investment in particular. This material is strictly for illustrative, educational, or informational purposes and is subject to change. This content does not constitute an offer to sell or the solicitation of an offer to sell or buy any security in any jurisdiction where such an offer or solicitation would be illegal. There is not enough information contained in this content to make an investment decision and any information contained herein should not be used as a basis for this purpose. This content does not constitute a recommendation or take into account the particular investment objectives, financial situations, or needs of investors. Investors are not to construe this content as legal, tax or investment advice, and should consult their own advisors concerning an investment in digital assets. The price and value of assets referred to in this content and the income from them may fluctuate. Past performance is not indicative of the future performance of any assets referred to herein. Fluctuations in exchange rates could have adverse effects on the value or price of, or income derived from, certain investments. Certain of the statements contained herein may be statements of future expectations and other forward-looking statements that are based on Grayscale’s views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements. In addition to statements that are forward-looking by reason of context, the words “may, will, should, could, can, expects, plans, intends, anticipates, believes, estimates, predicts, potential, projected, or continue” and similar expressions identify forward-looking statements. Grayscale assumes no obligation to update any forward-looking statements contained herein and you should not place undue reliance on such statements, which speak only as of the date hereof. Although Grayscale has taken reasonable care to ensure that the information contained herein is accurate, no representation or warranty (including liability towards third parties), expressed or implied, is made by Grayscale as to its accuracy, reliability, or completeness. You should not make any investment decisions based on these estimates and forward-looking statements. There is no guarantee that the market conditions during the past period will be present in the future. Rather, it is most likely that the future market conditions will differ significantly from those of this past period, which could have a materially adverse impact on future returns. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. We selected the timeframe for our analysis because we believe it broadly constitutes the most complete historical dataset for the digital assets that we have chosen to analyze.