Last Updated: 4/1/2024 | 11 min. read

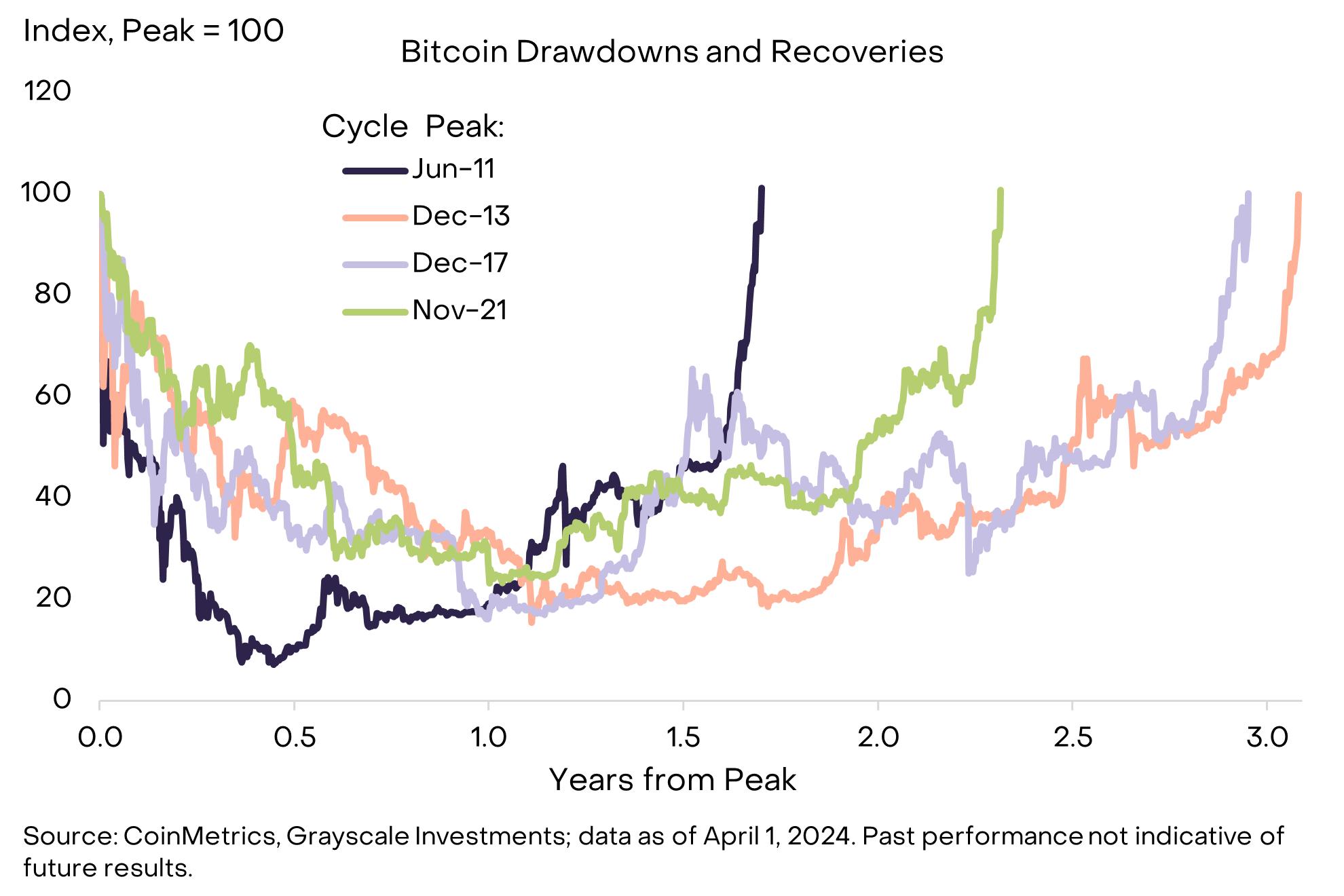

Once again Bitcoin has roared back after a deep drawdown. Bitcoin’s price peaked at $69,000 in November 2021 during the last crypto cycle. It then declined roughly 75% over the following year, reaching a low of about $16,000 in November 2022, before starting to recover.[1] In total, it took just over two years for Bitcoin’s price to return to its previous peak (Exhibit 1). By comparison, the recovery from the prior two drawdowns took approximately three years, while the recovery from the first major drawdown took about one and a half years. In Grayscale Research’s view, we are now in the “middle innings” of another Bitcoin bull market, which could see prices continue to climb (for more details see Anatomy of a Bitcoin Bull Market).

Exhibit 1: Faster Bitcoin recovery compared to prior two cycles

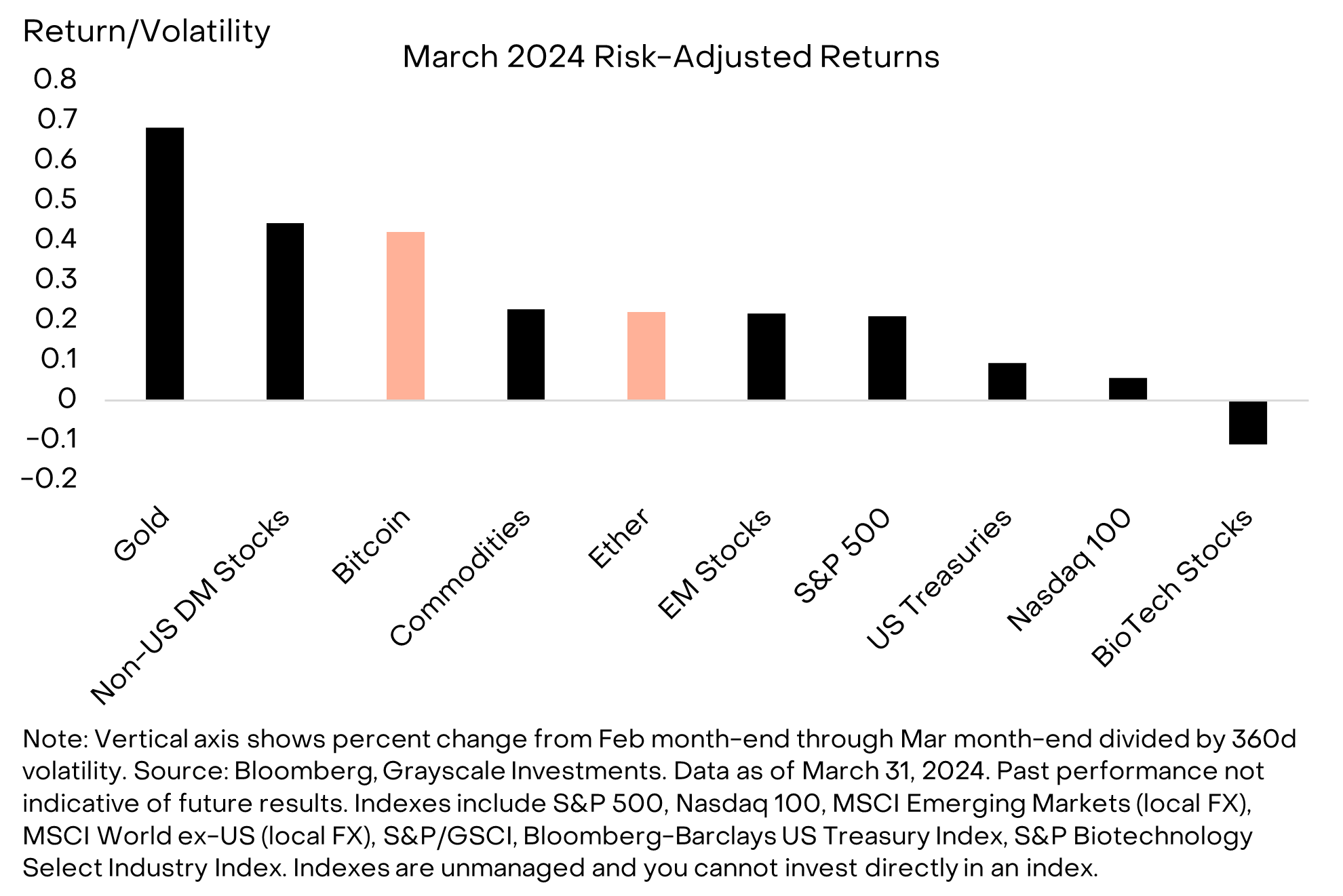

Many traditional assets also delivered positive returns in March 2024. On a risk-adjusted basis (i.e. accounting for each asset’s volatility), Bitcoin’s performance was at the higher end of the range and Ether’s returns were closer to the middle of the pack (Exhibit 2). The best performing segments of traditional asset markets last month included physical gold, non-US developed market stocks, and energy-related equities. Certain equity market segments tied to emergent technologies, like biotechnology, underperformed the broader market.

Exhibit 2: Bitcoin among best performing assets in March 2024

One reason for the strong performance across markets last month may have been signals from major central banks that interest rates are heading lower. According to surveys conducted by Bloomberg, all G10 central banks except the Bank of Japan are expected to reduce policy rates over the coming year.[2] A variety of developments over the last month reinforced this outlook. For example, at its March 19-20 meeting, Fed officials indicated that they still planned to cut rates three times this year, despite forecasting stronger GDP growth and higher inflation. Similarly, at the Bank of England, no official supported raising rates for the first time since September 2021, and on March 21 the Swiss National Bank unexpectedly cut its policy rate.[3]

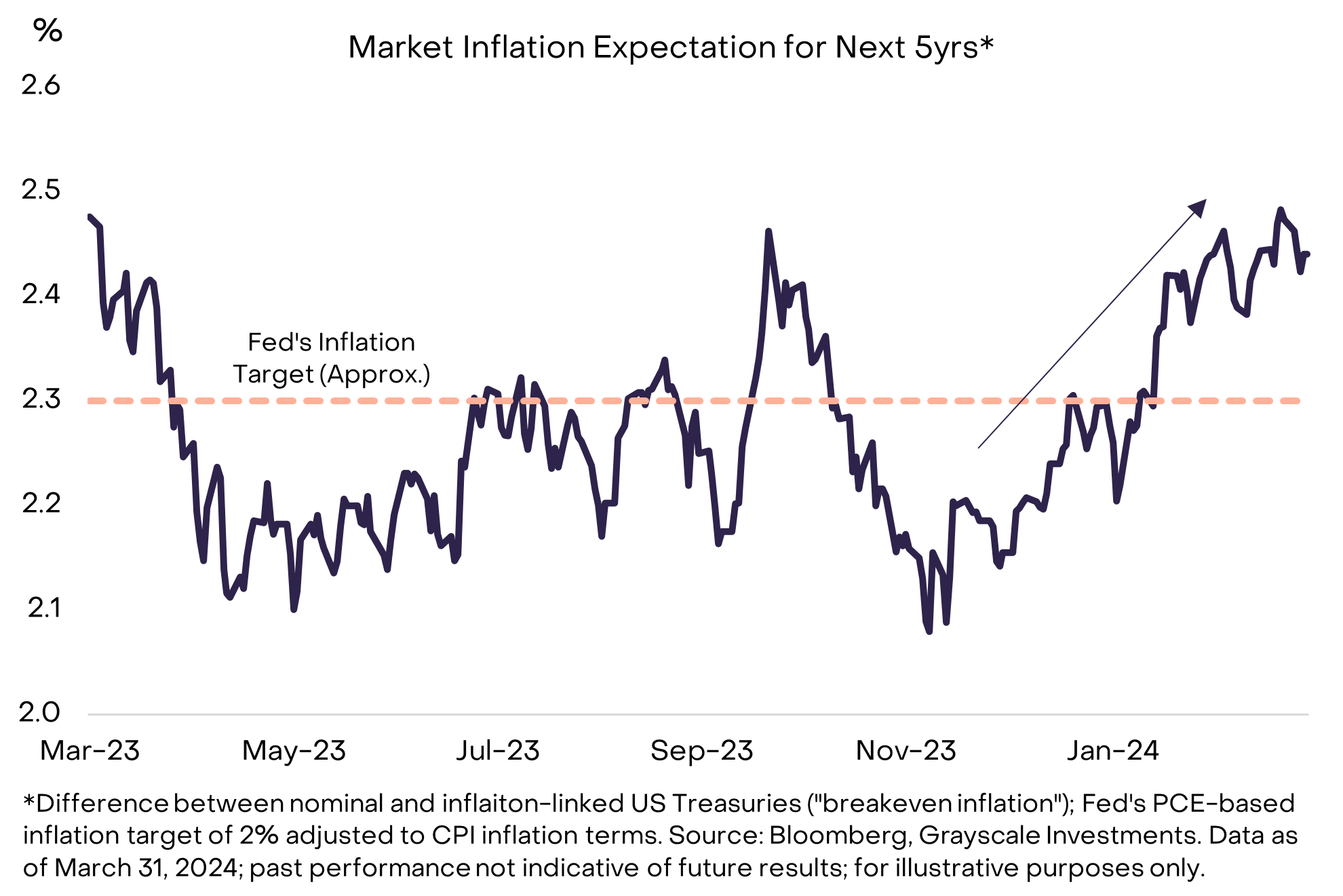

The eagerness of major central banks to reduce interest rates despite strong economic growth has likely contributed to an increase in market inflation expectations. For example, the difference between nominal and inflation-linked US Treasury notes—so called “breakeven inflation”—has increased across maturities this year (Exhibit 3). The risk of higher inflation may in turn be stimulating demand for alternative stores of value, like physical gold and Bitcoin.

Exhibit 3: Increase in market inflation expectations

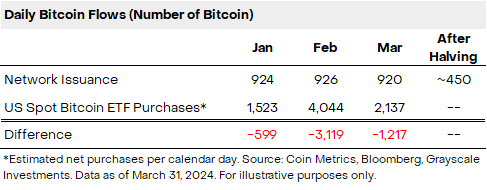

Despite reaching a new all-time high, Bitcoin also experienced a mid-month drawdown of about 13% as traders reduced leverage and inflows into US-listed spot Bitcoin ETFs slowed.[4] For the month as a whole, net inflows into the US-listed spot Bitcoin ETFs totaled $4.6bn, down from $6bn in February.[5] Although down from the prior month, the spot Bitcoin ETF net inflows remain well in excess of network issuance. In Bitcoin terms, we estimate that these US ETFs purchased about 2,100 coins per calendar day in March, compared to network issuance of about 900 coins per day (Exhibit 4).[6] After the halving event in April, network issuance will fall to about 450 coins per day.

Exhibit 4: ETF inflows continue to outpace network issuance

Meanwhile, on March 13, the Ethereum network underwent a major upgrade that was designed to lower costs for Layer 2 (L2) chains and facilitate Ethereum’s transition to a modular architecture (for more details see Ethereum’s Coming of Age: “Dencun” and ETH 2.0). The impact of the upgrade can already be observed on chain: transaction costs on L2s like Arbitrum and Optimism have fallen from $0.21 and $0.23 in February, respectively, to less than $0.01 after the upgrade, making it cheaper for end users to transact in the Ethereum ecosystem.[7]

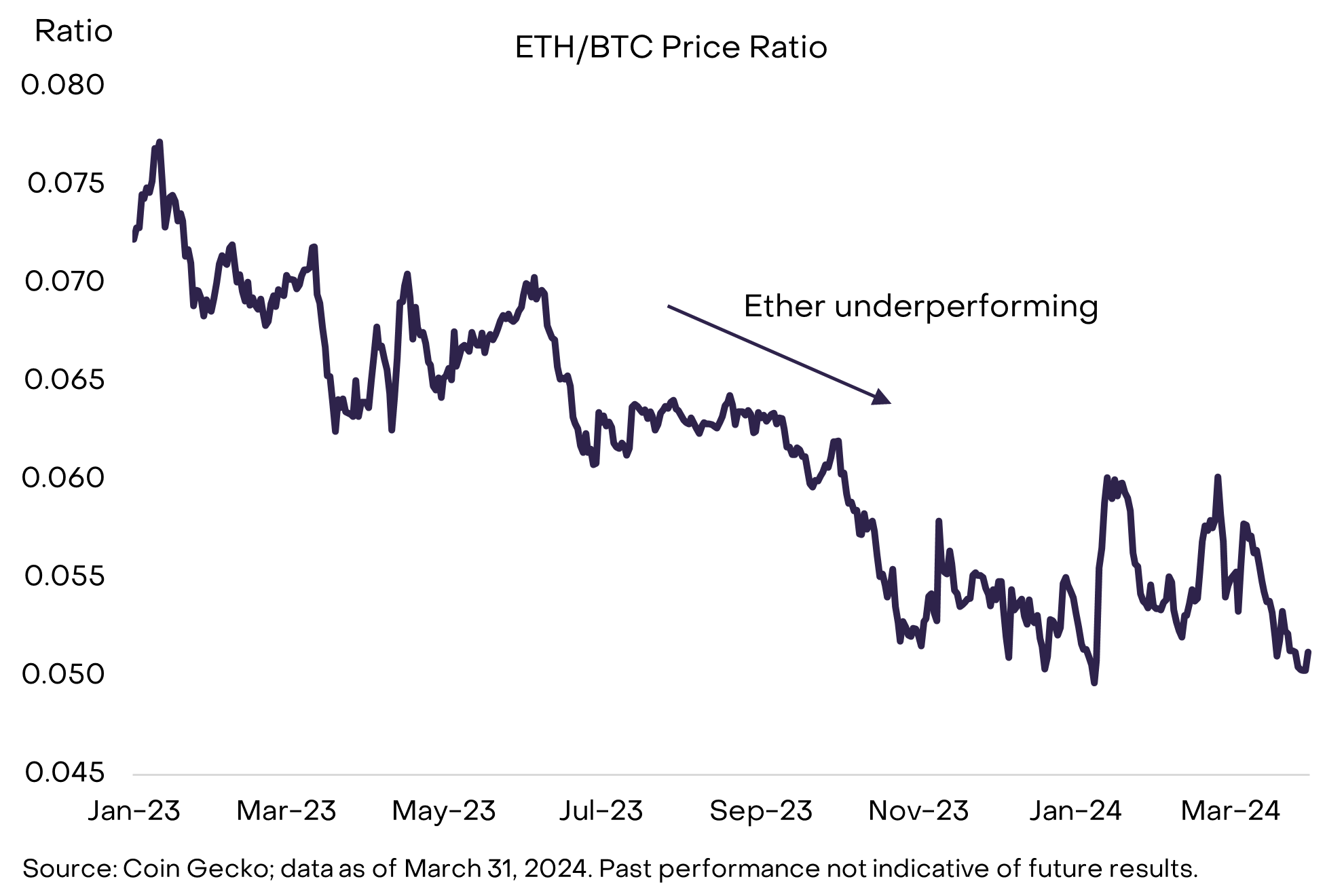

While it’s possible the upgrade was priced in beforehand, Ether (ETH) underperformed Bitcoin (BTC) during the month, and the ETH/BTC price ratio fell to the lowest level since early January (Exhibit 5). ETH’s valuation may have been held back by a decline in market expectations for spot ETF approval in the US market. According to the decentralized prediction platform Polymarket, consensus expectations for SEC approval of a spot ETH ETF by the end of May have declined to 21% from about 80% in January. We expect the prospect for spot ETH ETF approval or denial among the current wave of applications to be an important driver of the token’s valuation over the next two months.

Exhibit 5: Ether underperformed Bitcoin despite major network upgrade

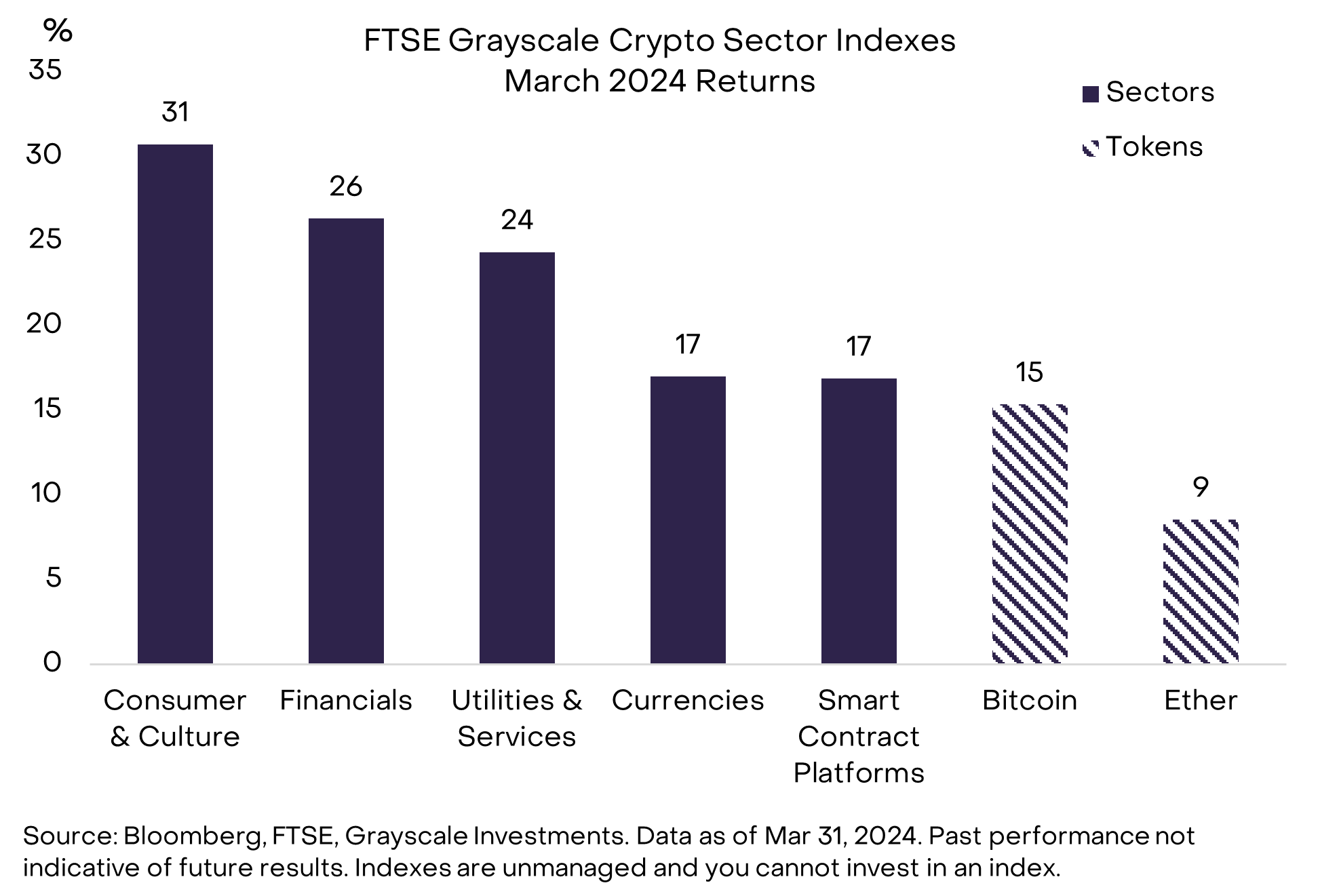

Grayscale has developed the Grayscale Crypto Sectors, a comprehensive framework that divides the crypto asset class into five distinct sectors and can be used by investors to track activity going on in crypto beyond just Bitcoin and Ethereum. From a Crypto Sectors perspective, the best performing market segment during March was Consumer & Culture, reflecting high returns for “memecoins” (Exhibit 6).[8] Memecoins are a reflection of internet culture, and in the crypto space, Memecoin-related tokens are primarily traded for entertainment value; these projects historically have not generated revenue nor do they have tangible use cases (e.g., payments), and should therefore be considered very high risk investments. That said, developers behind the Shiba Inu token—the second largest memecoin in the Consumer & Culture Crypto Sector by market cap—have attempted to expand the project’s scope by launching an Ethereum L2, which hosts decentralized finance (DeFi) activity.[9]

Exhibit 6: Consumer & Culture Crypto Sector up more than 30%

A variety of tokens in the Financials Crypto Sector also delivered solid returns during the month, the best performing of which were Binance Coin (BNB), the MakerDao governance token (MKR), THORchain (RUNE), 0x (ZRX), and Ribbon Finance (RBN). In recent months, Binance has seen its share of spot market trading volume begin to recover (currently 46%), although it remains below the peak reached in February 2023.[10] THORchain is a decentralized exchange that allows for native cross-chain swaps—swapping tokens across blockchains, for example from Bitcoin to Ethereum, and may be benefiting from growth in the broader Bitcoin ecosystem.

Like all other asset markets, crypto valuations are affected by both fundamental and technical factors. From a technical standpoint, net inflows/outflows from US-listed spot Bitcoin ETFs are likely to remain an important driver of Bitcoin’s price over the short-term. These products now hold approximately 4% of the outstanding supply of Bitcoin, so any marginal changes in demand can create meaningful Bitcoin flows.[11]

However, we believe demand for Bitcoin ultimately derives in part from investor interest in its properties as a “store of value” asset. Bitcoin is an alternative money system with a unique and highly predictable monetary policy. Whereas the supply of US Dollars is determined by the personnel at the US Treasury and Federal Reserve, the supply of Bitcoin is determined by preexisting code: daily issuance falls by half every four years until a cap of 21 million coins.

In Grayscale Research’s view, investors seek out assets with this type of verifiable scarcity when they are uncertain about the medium-term outlook for fiat currencies. Currently, this uncertainty seems to be rising: the Federal Reserve is preparing to reduce interest rates even as inflation remains above its target, and the November election in the United States may spur macro policy changes that could weigh on the value of the Dollar over time. Next month’s Bitcoin halving event should remind investors about Bitcoin’s fundamental properties as a scarce digital asset and alternative to fiat currencies with uncertain future supply.

[1] Source: CoinMetrics.

[2] Monthly Bloomberg surveys of economists/forecasters; data from Bloomberg Terminal as of March 31, 2024.

[3] Source: “Bank of England Inches Closer to Rate Cuts as Hawks Retreat”, Bloomberg, March 21, 2024; “SNB First to Loosen as Swiss Franc Strength Tops Concerns”, Bloomberg, March 21, 2024.

[4] Source: Bloomberg; based on New York closing prices from March 13 to March 19.

[5] Source: Bloomberg, as of March 28, 2024.

[6] Source: Grayscale Research calculations based on Bloomberg data, as of March 31, 2024.

[7] L2Fees

[8] The FTSE Grayscale Crypto Sectors family of indexes underwent its regular quarterly rebalancing on Sunday, March 17.

[9] Source: CoinDesk

[10] Source: The Block.

[11] Source: Bloomberg, data as of March 28, 2024.