Last Updated: 2/3/2025 | 15 min. read

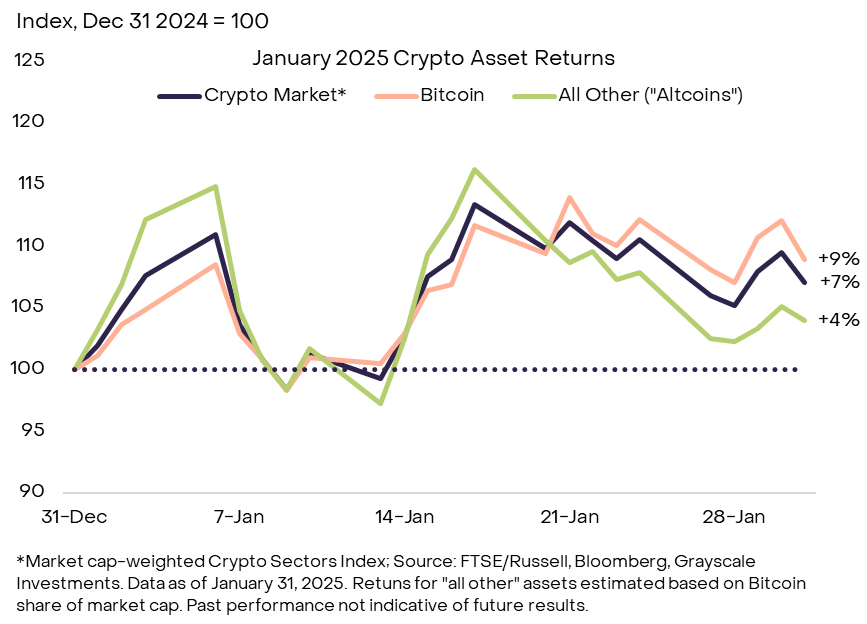

Overall crypto market valuations gained 7% in January 2025, based on our Grayscale Crypto Sectors Index — a market cap-weighted measure of the universe of investible digital assets developed in partnership with FTSE/Russell. Bitcoin’s price increased 9% month over month, reaching an intramonth high price of about $109k and ending January with a [1]. Crypto assets with a lower market cap than Bitcoin’s — often referred to as “altcoins” — collectively increased by about 4% (Exhibit 1).

Exhibit 1: Bitcoin outperformed broader crypto market in January

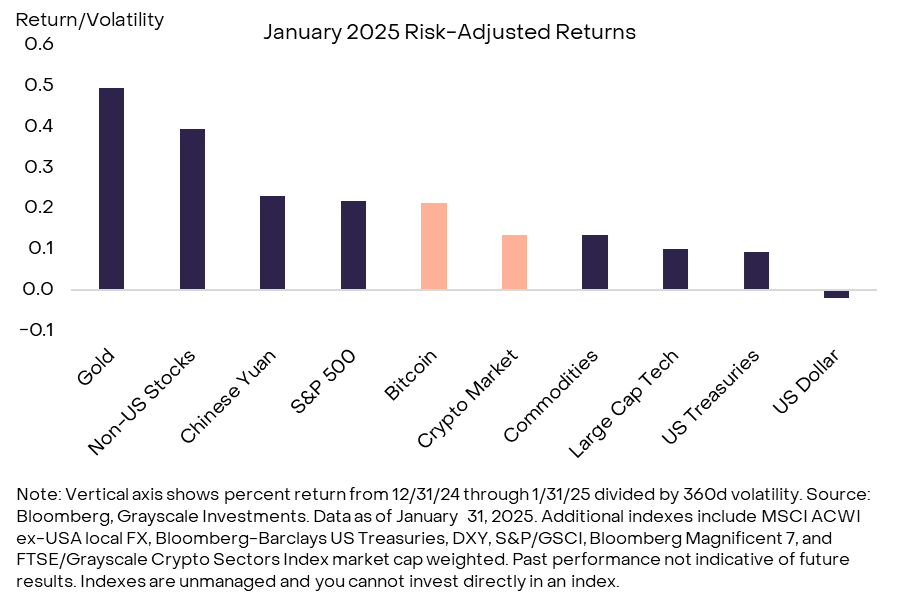

Most traditional asset classes also generally experienced gains during January (Exhibit 2). The increase in Bitcoin’s price was in the middle of the range on a risk-adjusted basis (i.e., accounting for each asset’s volatility). The U.S. Dollar declined in value and several non-US equity markets outperformed, possibly due to signals from the Trump administration that any tariff increases may be gradual—although these expectations ultimately proved incorrect.[2] In contrast, certain large-cap tech stocks were held back by higher earnings uncertainty, following the announcement of new technological breakthroughs in AI development by Chinese startup DeepSeek. Gold also performed well over the last month, g and leading most other major assets on a risk-adjusted basis.[3]

Exhibit 2: Most asset classes appreciated last month

Immediately after President Trump’s inauguration on January 20, the new administration began shifting U.S. policy on blockchain technology and digital assets. The first specific policy change was to rescind Securities and Exchange Commission (SEC) Staff Accounting Bulletin (SAB) 121, which required financial institutions to treat crypto assets held in custody as if held on balance sheet, thereby preventing their involvement in this business. On January 23, the SEC under Acting Chairmen Uyeda issued SAB 122, which rescinded the previous order. The change should allow existing securities custodians to also safeguard crypto assets in the U.S.

On the same day, the White House released an executive order (EO) on crypto policy, titled Strengthening American Leadership in Digital Financial Technology. Grayscale Research believes that the most important feature of the EO was the statement of support for the industry’s foundational principles, including the right to access open networks, develop and deploy software, participate in mining and staking/validating, transact on a peer-to-peer basis, and self-custody digital assets. It also underscored the need to protect access to traditional banking services for individuals and firms. The EO further laid out timelines for changes to federal government regulations and established The President’s Working Group on Digital Asset Markets, which will include the Secretary of the Treasury and other regulators.

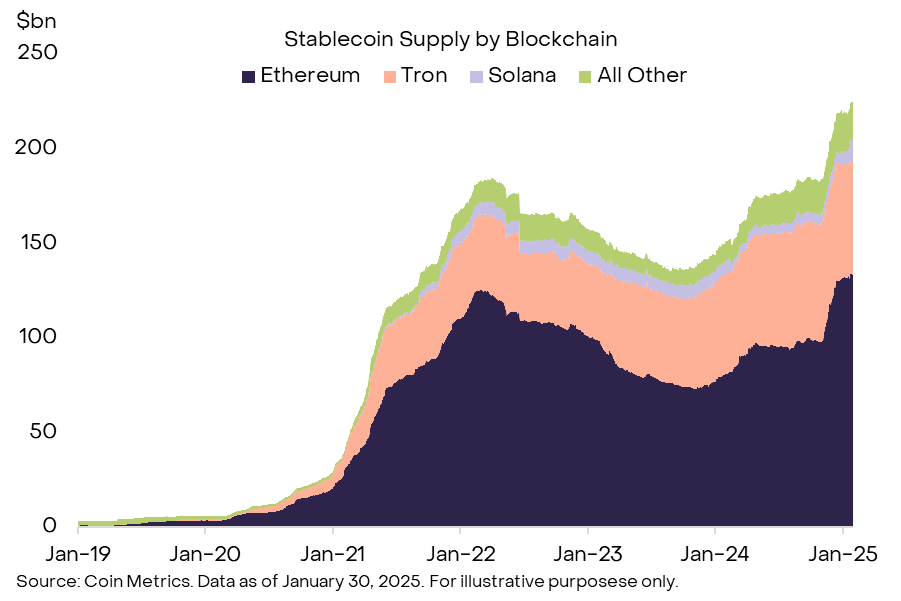

The president’s EO also stated that it would be administration policy to “promote the development and growth of lawful and legitimate dollar-backed stablecoins.” Stablecoins provide a way to transact in fiat currencies like the U.S. Dollar using blockchain infrastructure. Today the total outstanding value of stablecoins is more than $200bn (Exhibit 3). Given the explicit callout in the EO, stablecoins may be an area where changes to regulatory guidance move most quickly. In the EU, stablecoins policies were included in the Markets in Crypto Assets (MiCA) regulation, which became fully effective at the end of last year. Stablecoin USDC has come into regulatory alignment with MiCA, while Tether (USDT) has not, and this may have contributed to recent market share gains for USDC. Tether said in January that it is working on strategy for European markets[4] and announced that USDT will be coming to the Bitcoin Lightning Network.[5]

Exhibit 3: Stablecoin market cap greater than $200bn

Lastly, the EO directed the Working Group to “evaluate the potential creation and maintenance of a national digital asset stockpile.” As a candidate, President .[6] Grayscale Research expects the White House to honor this commitment, but we are unsure if the federal government will raise taxes or borrow funds to purchase Bitcoin in the open market. Separately, multiple U.S. states are advancing initiatives to establish Bitcoin reserves, with bitcoinist.com reporting legislative processes underway in 14 states (e.g., Texas, Oklahoma).

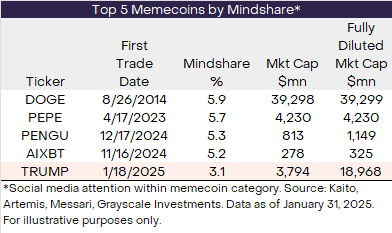

In addition to his executive order on crypto policy, President Trump and his family launched the memecoins $TRUMP and $MELANIA on the Solana blockchain. As of January 31, the fully diluted valuation of the toke.[7] Memecoins are a type of digital asset that do not claim to offer real-world utility, but which nonetheless can have economic value to the members of a certain community as a form of entertainment — like physical collectibles. Exhibit 4 shows the currently most popular memecoins by “mindshare” (social media attention). Dogecoin is the dominant memecoin by mindshare and the largest by market capitalization.

Exhibit 4: Trump coin the fifth most prominent memecoin by mindshare

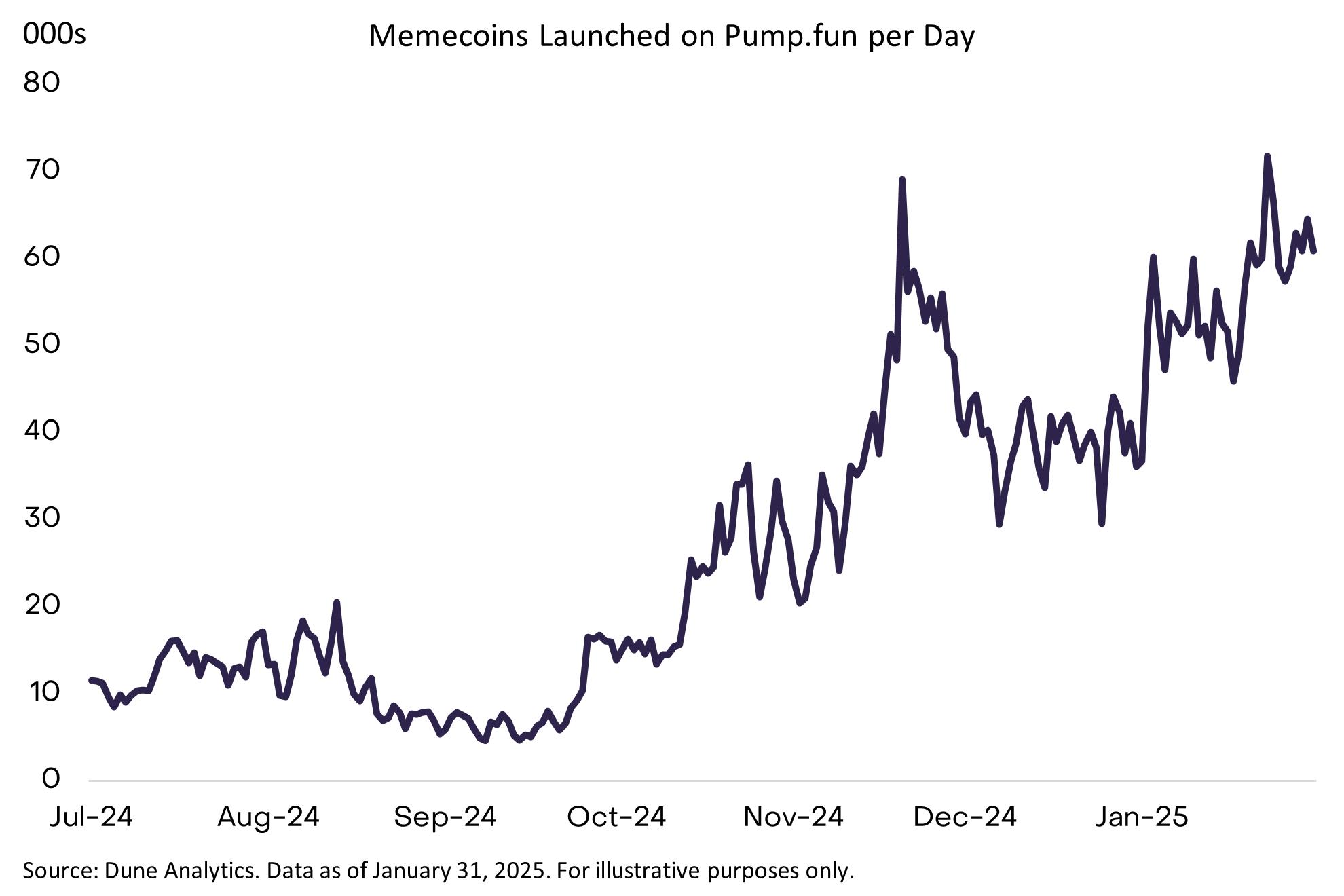

Over the last year, the Solana blockchain saw a surge of memecoin issuance activity. The activity has been driven primarily by pump.fun, an innovative platform where users can create and deploy their own memecoins. Over the last year, ~7mn new memecoins have been created on Solana, with new tokens on pump.fun issued at a rate of roughly 60k per day (Exhibit 5). Memecoin trading generates transaction fees and therefore accrues value to Solana token holders. Pump.fun itself (and nearly $150M in January 2025 alone).[8] The Solana blockchain — which hosts applications and activity beyond memecoins — Solana’s fee revenue was therefore comparable to fee revenue for Ethereum over the last year, while Solana’s (fully diluted)[9] market cap is only 35% of Ethereum’s.[10] In a January Ethereum has trailed Solana in memecoin activity over the last year, possibly in part due to higher transaction fees.

Exhibit 5: Solana platform pump.fun launching ~60k memecoins on average every day

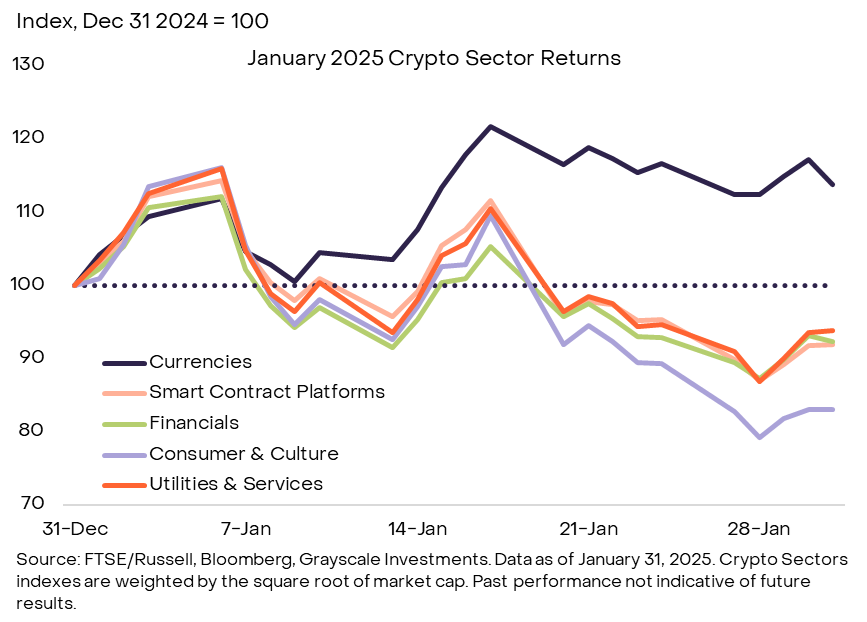

From a Crypto Sectors perspective, the best-performing market segment was the Currencies Crypto Sector and the worst-performing was Consumer & Culture Crypto Sector (Exhibit 6). Our Crypto Sectors indexes are weighted by the square root of each asset’s market cap to reduce the weight of the largest tokens and better represent the broader market. The strong performance for the Currencies Crypto Sector reflected the gain in Bitcoin.[11] The XRP Ledger (XRPL) is a blockchain designed for fast and efficient digital payments. XRP is the native asset that powers XRPL and facilitates low-cost cross-border transactions. We attribute the price performance of XRP to a few factors, including a perceived change in regulatory risk associated with the change in U.S. administration. Additionally, Ripple, the company behind XRPL’s development,D. Performance so far has been strong, as RLUSD has grown to over $500mn in market cap[12] and became the fourth most traded stablecoin on centralized exchanges this past month.[13]

Exhibit 6: Currencies Crypto Sector outperformed in January

Just like in traditional markets, developments in AI technology were a dominant theme in the crypto asset class in January. Most importantly, on January 20, China-based startup DeepSeek launched its new open-source AI model, called R1, which

At the same time, the DeepSeek news highlighted risks associated with centralized AI development, like data security, biases, and censorship — risks that can potentially be addressed by blockchain-based AI platforms like Bittensor. Bittensor is a decentralized network that aims to create an "Internet of AI" with interconnected ecosystems called "subnets," each focusing on a different specific use case. Bittensor is slated for a potentially major network upgrade in mid-February called dynamic TAO (“dTAO”), which would enable investment in individual subnets; we believe this could inject a wave of new liquidity into the Bittensor ecosystem.[16] Access to DeepSeek’s highly performant, open-source model may also reduce costs and lower the barriers to entry for many open-source decentralized AI projects, particularly at the application layer, like with AI agents. We are already seeing this take place. For example, decentralized AI agent launchpad ai16z (rebranded ELIZAOS) is allowing for agents building with its ELIZA framework to access DeepSeek’s model.

The digital assets industry is rapidly evolving — as demonstrated by the flurry of news in January 2025. While there have been many distinct developments, collectively they point to improved regulatory clarity, growing institutional adoption, and ongoing technological advancements. New tariffs announced by the Trump administration at the end of January could weigh on all markets over the short-term, and crypto investors will need to monitor these developments closely. Beyond tariffs, Grayscale Research expects crypto markets to focus on continued changes to U.S. federal government regulatory guidance on stablecoins and other topics, as well as other macro issues, including the outlook for US tax policy and the prospect for Fed rate cuts.

Some links are for articles which may sit behind a paywall and may require a subscription to access them in full.

Index Definitions: The FTSE Grayscale Consumer and Culture Crypto Sector Index includes digital asset networks, protocols, and applications that seek to deliver and support consumption-centric activities across a variety of goods and services. The FTSE Grayscale Smart Contract Platform Crypto Sector Index includes digital assets that are general purpose networks that provide programmable functionalities. The FTSE Grayscale Financials Crypto Sector Index includes digital asset networks, protocols, and applications that seek to deliver financial transactions and services. The FTSE Grayscale Currencies Crypto Sector Index includes digital assets that serve three fundamental roles – medium of exchange, store of value, and unit of account. FTSE Grayscale Utilities and Services Crypto Sector Index includes digital asset networks, protocols, and applications that seek to deliver practical and enterprise-level applications and functionalities. The FTSE/Grayscale Crypto Sectors family of indexes measure the price return of digital assets listed on major global exchanges. The Bloomberg Magnificent 7 Total Return Index (BM7T) is an equal-dollar weighted index that tracks seven of the most widely-traded companies in the United States. The S&P 500 Industrials comprises those companies included in the S&P 500 that are classified as members of the GICS industrials sector. The Bloomberg-Barclays 25y+ Treasury index measures the total return of nominal US Treasury bonds with a remaining maturity greater than 25 years. The U.S. Dollar Index (DXY) tracks the strength of the dollar against a basket of major currencies. The Russell 2000 Index is composed of the smallest 2000 companies in the Russell 3000 Index, representing approximately 8% of the Russell 3000 total market capitalization. The S&P Goldman Sachs Commodity Index (S&P/GSCI) is a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. The Nasdaq 100 Index is a stock index of the 100 largest companies by modified market capitalization trading on Nasdaq exchanges. The MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 Developed Markets countries (excluding the US) and 24 Emerging Markets countries.

[1] Source: Artemis. Data as of January 31, 2025.

[2] Source: Bloomberg.

[3] Source: Bloomberg. Data as of January 31, 2025.

[4] Source: Crypto Slate.

[5] Source: Coin Telegraph.

[6] Source: Transcript vs Roll Call.

[7] Source: Artemis. Data as of January 25, 2024.

[8] Source: Dune Analytics. Data as of January 25, 2024.

[9] Source: Token Terminal. Data as of January 31, 2025.

[10] Source: Artemis. Data as of January 31, 2025.

[11] Source: Artemis. Data as of January 25, 2025.

[12] Cryptorank

[13] CCData Stablecoins & CBDCs Report, January 2025.

[14] “How a top Chinese AI model overcame US sanctions.” MIT Technology Review. Jan 24, 2025

[15] “China's DeepSeek AI shakes industry and dents America's swagger.” BBC. Jan 28, 2025.

[16] X.com