Last Updated: 1/6/2025 | 14 min. read

Crypto markets took a breather in December 2024 alongside a pullback in major equity indexes and an increase in bond yields. Grayscale Research believes many of the market shifts were attributable to more hawkish signals from the Federal Reserve at its mid-December meeting. Despite the setback over the last month, Bitcoin ended 2024 with a gain of 121%.[3]

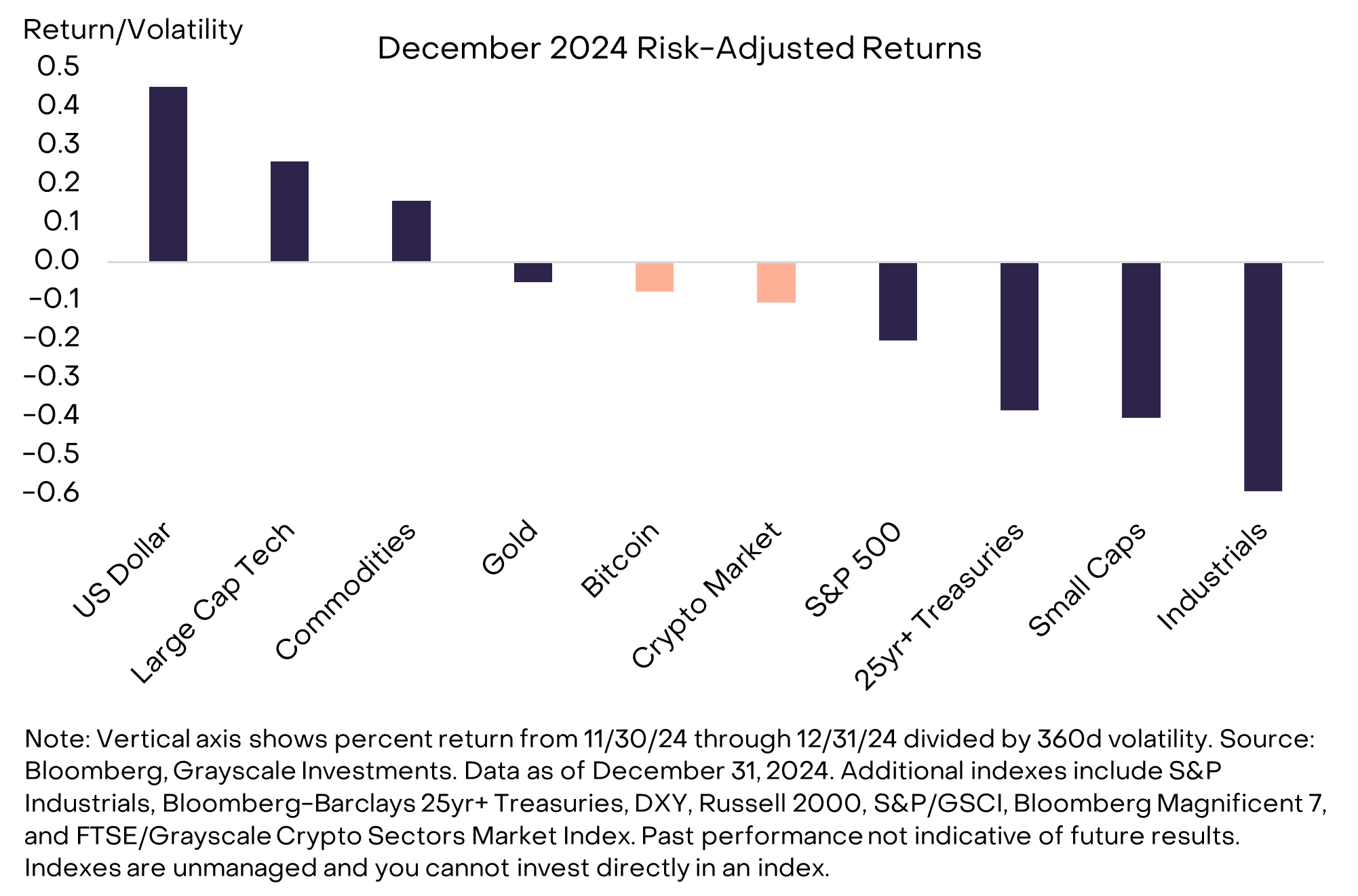

Traditional markets had mixed results to close the year (Exhibit 1). The U.S. Dollar increased in December, and interest rates increased across the yield curve. Guidance from the Federal Reserve that it would slow the pace of rate cuts in 2025 likely contributed to the moves in both currency and bond markets. Broad equity indexes declined, led by cyclical market segments. Large-cap tech stocks — represented by the Bloomberg Magnificent 7 Index — were an exception, posting gains in December and strong returns for the year as a whole. Bitcoin declined moderately, and returns were in the middle of the pack on a risk-adjusted basis (i.e., accounting for each asset’s volatility). The FTSE/Grayscale Crypto Sectors Market Index (CSMI) declined by 6% in December, giving back about 15% of its gain from November 2024.

Exhibit 1: Crypto returns were in middle of the pack on risk-adjusted basis

Temporary drawdowns are a common feature of crypto bull markets. For example, during the most recent appreciation phase of the crypto market cycle — which ran from December 2018 through November 2021 — Bitcoin’s price increased about 21x. However, during this period, Bitcoin’s price declined by at least 10% a total of 11 times, including two large drawdowns of about 50%. In the prior appreciation phase of the crypto market cycle — which ran from January 2015 through December 2017 — Bitcoin’s price declined by at least 20% a total of 11 times.[4] We continue to believe that we are at an intermediate stage of the current Bitcoin bull market and see potential for further gains in 2025 and beyond, as long as the market remains supported by fundamentals (Exhibit 2).

Exhibit 2: Bitcoin’s price tracking prior two bull markets

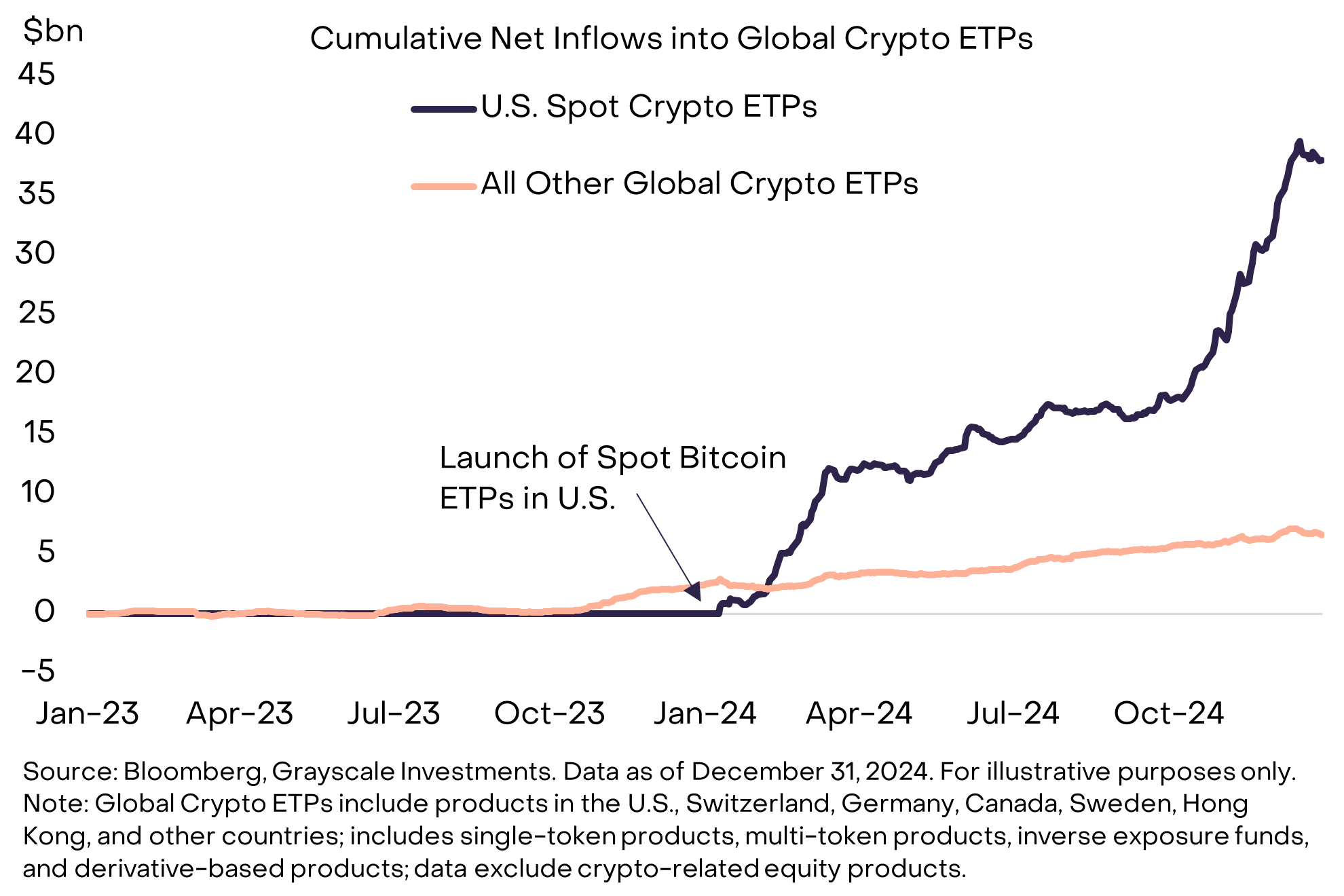

The U.S.-listed spot Bitcoin exchange-traded products (ETPs) were again an important source of new demand in December, with net inflows totaling $4.7bn during the month. Including the spot Ether ETPs, which launched in July, cumulative net inflows into U.S.-listed spot crypto ETPs have now totaled $38bn.[5] Although crypto ETPs in other jurisdictions have also seen increased investor demand, cumulative inflows have been lower and more consistent month-to-month (Exhibit 3).

Exhibit 3: Surge in demand for U.S.-listed spot crypto ETPs

An important additional source of demand for Bitcoin in the U.S. market has been MicroStrategy, a publicly listed company that holds Bitcoin on its balance sheet and primarily operates as a Bitcoin investment vehicle.[6] MicroStrategy was added to the Nasdaq 100 Index in December.[7] During Q4 2024, MicroStrategy purchased 194,180 Bitcoin, which had a year-end market value of $18.2bn.[8] Therefore, Bitcoin purchased by MicroStrategy in Q4 was comparable to net inflows into the spot Bitcoin ETPs in Q4.[9] MicroStrategy issues shares and debt instruments to finance its purchases of Bitcoin and has announced plans to continue acquiring Bitcoin over the next 3 years.[10] Given the quantitative importance of this source of Bitcoin demand, crypto investors should consider monitoring measures of MicroStrategy’s financial performance, including the difference between the firm’s market capitalization and the value of its Bitcoin holdings. In general, if the firm’s shares trade at a premium to the value of its Bitcoin, it may be incentivized to issue shares and buy more Bitcoin.

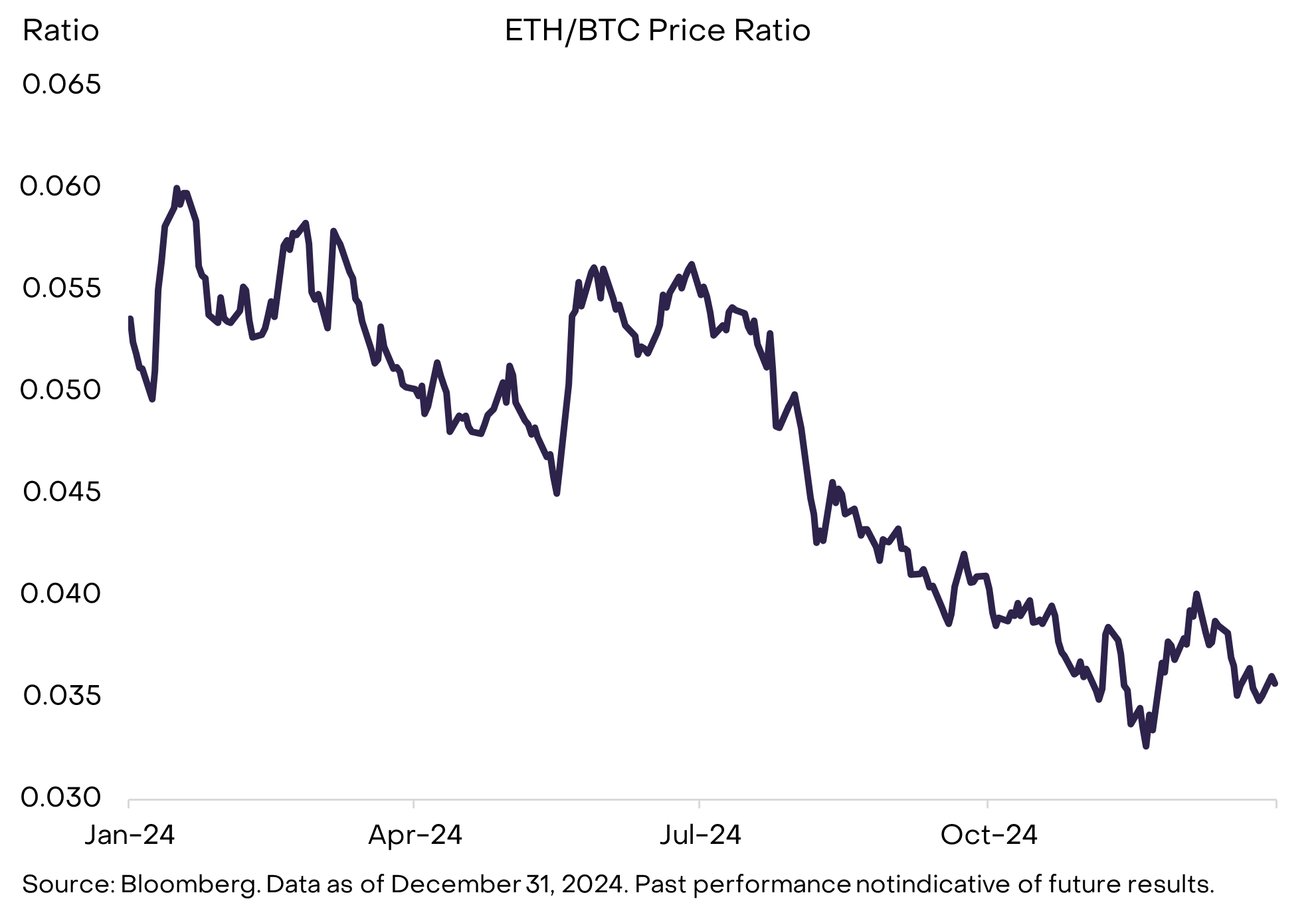

Ether (ETH) underperformed Bitcoin (BTC) in December, and the ETH/BTC price ratio has moved sideways for the last two months (Exhibit 4). Ethereum is the leading smart contract platform blockchain by market cap, but it faces increasing competition from other projects.[11] During 2024, the Ether token underperformed Solana, the second-largest asset by market cap[12], and investors increasingly focused on alternative Layer 1 networks like Sui and The Open Network (TON). In creating the infrastructure for application developers, the architects of smart contract blockchains face various design choices, which can affect technical features like block times, transaction throughput, and average transaction fees. Regardless of the specific design choices, all smart contract platforms compete for network fee revenue, which Grayscale Research believes is an important determinant of value accrual (for more details, see Grayscale Research Insights: Crypto Sectors in Q1 2025).

Exhibit 4: Ether underperformed Bitcoin in December and 2024 as a whole

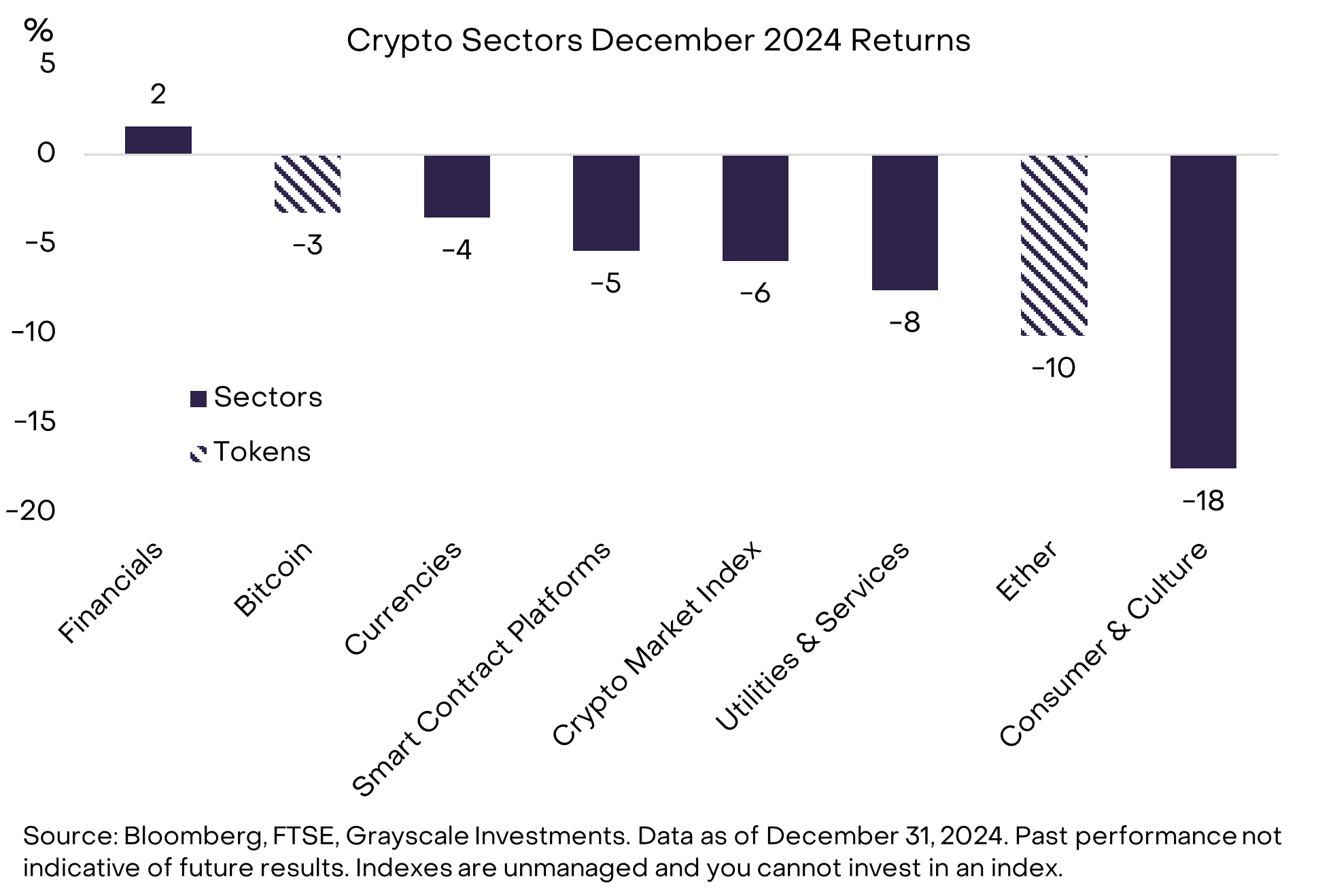

The Grayscale Crypto Sectors framework showed a broad-based pullback in digital asset valuations in December (Exhibit 5). The worst-performing market segment was the Consumer & Culture Crypto Sector, largely due to a decline in the price of Dogecoin, the largest memecoin by market capitalization.[13] One exception to the broad market decline was the Financials Crypto Sector, which was supported primarily by a gain in Binance Coin (BNB), a token associated with the Binance Exchange and the Binance Smart Chain smart contract platform. Grayscale Research believes that regulatory changes and new legislation under the new U.S. administration could be particularly supportive of blockchain-based financial applications. As a result, we have featured several assets related to decentralized finance (DeFi) in our latest Top 20 list.

Exhibit 5: Financials Crypto Sector outperformed

New innovations related to decentralized artificial intelligence technologies were a dominant crypto market theme in 2024 and may be again in the new year. Much of the attention remains focused on developments related to AI “agents” — a type of software that can act independently to pursue a complex set of objectives (for more details, see When You Give an AI a Wallet). These AI agents are revolutionizing how we interact with blockchain technology, as demonstrated by Luna on the Virtuals Protocol. Luna operates as a female anime-styled chatbot with the specific goal of reaching 100,000 followers on X, and notably can perform financial transactions by paying (“tipping”) users with Luna tokens through her own crypto wallet. This integration with blockchain technology is particularly significant as it enables AI agents like Luna to directly access and distribute financial resources, which goes beyond previous use cases from task-based agentic AI.

Since the emergence of AI agent tokens in late October 2024, the sector's leading projects by market cap have seen extraordinary gains, with Virtual surging 49,000% and Ai16z rising 8,700%[14]. Notably, ai16z, a project named after the investing firm a16z, built the No.1 trending AI agent framework on GitHub in December[15] and also announced a partnership with Stanford University.[16]

Ultimately, 2024 was a monumental year for digital asset markets: the new spot Bitcoin and Ether ETPs brought more investors into the crypto ecosystem, the Bitcoin network experienced its fourth halving event, researchers made breakthroughs in new blockchain applications technologies, and crypto featured prominently in the U.S. election. Although some of the specific themes will change, we expect no shortage of excitement for crypto investors in 2025.

In early January, the U.S. Senate will begin considering the candidates nominated by President-elect Trump for his cabinet and the leadership of various government agencies. For crypto markets, we believe the most important confirmations are likely to be for Treasury Secretary (Scott Bessent), Commerce Secretary (Howard Lutnick), Securities and Exchange Commission (SEC) Chair (Paul Atkins), and Commodity Futures Trading Commission (CFTC) Chair (candidate not yet announced at the time of writing). The new role of White House AI and Crypto Czar (David Sacks) does not require Senate confirmation. Although Grayscale Research expects the next Congress to take up crypto-related legislation, this may not occur until after legislators address taxes and certain other issues. Outside the U.S., the European Union's MiCA regulation, fully effective from December 30, 2024, enforces stricter rules on stablecoins, causing Tether’s unlicensed USDT to be delisted by exchanges in favor of compliant alternatives such as Circle's USDC starting in 2025.[17]

Beyond politics, crypto markets seem likely to be driven by their usual fundamentals: adoption of Bitcoin as an alternative money medium around the world, demand for next-generation decentralized web applications, and the macro market factors, like changes in central bank monetary policy that affect the valuations of all assets. Although the outlook is uncertain, in our view, many industry trends look favorable at the start of the new year.

Index Definitions:

The Bloomberg Magnificent 7 Total Return Index (BM7T) is an equal-dollar weighted index that tracks seven of the most widely-traded companies in the United States. The S&P 500 Industrials comprises those companies included in the S&P 500 that are classified as members of the GICS industrials sector. The Bloomberg-Barclays 25y+ Treasury index measures the total return of nominal US Treasury bonds with a remaining maturity greater than 25 years. The U.S. Dollar Index (DXY) tracks the strength of the dollar against a basket of major currencies. The Russell 2000 Index is composed of the smallest 2000 companies in the Russell 3000 Index, representing approximately 8% of the Russell 3000 total market capitalization. The S&P Goldman Sachs Commodity Index (S&P/GSCI) is a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. The FTSE/Grayscale Crypto Sectors family of indexes measure the price return of digital assets listed on major global exchanges. The Nasdaq 100 Index is a stock index of the 100 largest companies by modified market capitalization trading on Nasdaq exchanges.

[1] Source: Bloomberg, Grayscale Investments. Data as of December 31, 2024.

[2] Source: Artemis. Data as of December 31, 2024.

[3] Source: Coin Metrics. Data as of December 31, 2024.

[4] Source: Coin Metrics. Grayscale Investments. Data as of 12/31/2024. Past performance not indicative of future results.

[5] Source: Bloomberg, Grayscale Investments. Data as of December 31, 2024.

[6] Investopedia, data as of December 23, 2024. Michael Saylor “called MicroStrategy a bitcoin treasury operations company.”

[7] Markets.com

[8] Source: Bitcointreasuries.net, Bloomberg, Grayscale Investments. Data as of December 31, 2024.

[9] The spot Bitcoin ETPs had a net inflow of $16.5bn during Q4, valued at the time of the inflow. The increase in the ETPs’ Bitcoin holdings during Q4 valued at year-end prices was $18.6bn. Source: Bloomberg, Grayscale Investments. Data as of December 31, 2024.

[10] Microstrategy, as of January 3rd 2025.

[11] Artemis, FTSE, Grayscale. As of January 6, 2025.

[12] Artemis, FTSE, Grayscale. As of January 6, 2025.

[13] Artemis, FTSE, Grayscale. As of January 6, 2025.

[14] Dexscreener. As of 1/2/2025

[15] Chain Catcher

[16] Blockworks

[17] Ernst and Young, The Currency Analytics