Last Updated: 1/18/2024 | 11 min. read

This past November, OpenAI’s six-person Board announced company CEO Sam Altman was being replaced, which sent shock waves through the tech and business communities. Though this decision was later reversed and Altman was reinstalled as CEO, the conversation about Artificial Intelligence (AI) governance persists – and is even a large topic of conversation at this year’s World Economic Forum Annual Meeting in Davos, Switzerland.

The OpenAI incident underscores the potential dangers of centralized control over pivotal technologies. For Grayscale Research, this begs a critical question: how do we ensure that AI development is accessible, competitive, and transparent? Aren’t these concerns the core tenants of blockchain technology? Grayscale Research believes so, and others in the industry are starting to discuss similar themes. According to Sheila Warren at CCI[2], crypto will play a “pivotal role in putting checks and balances on AI.” Likewise, venture capitalist Fred Wilson[3] believes that AI and crypto are “two sides of the same coin” and “web3 will help us trust AI.”

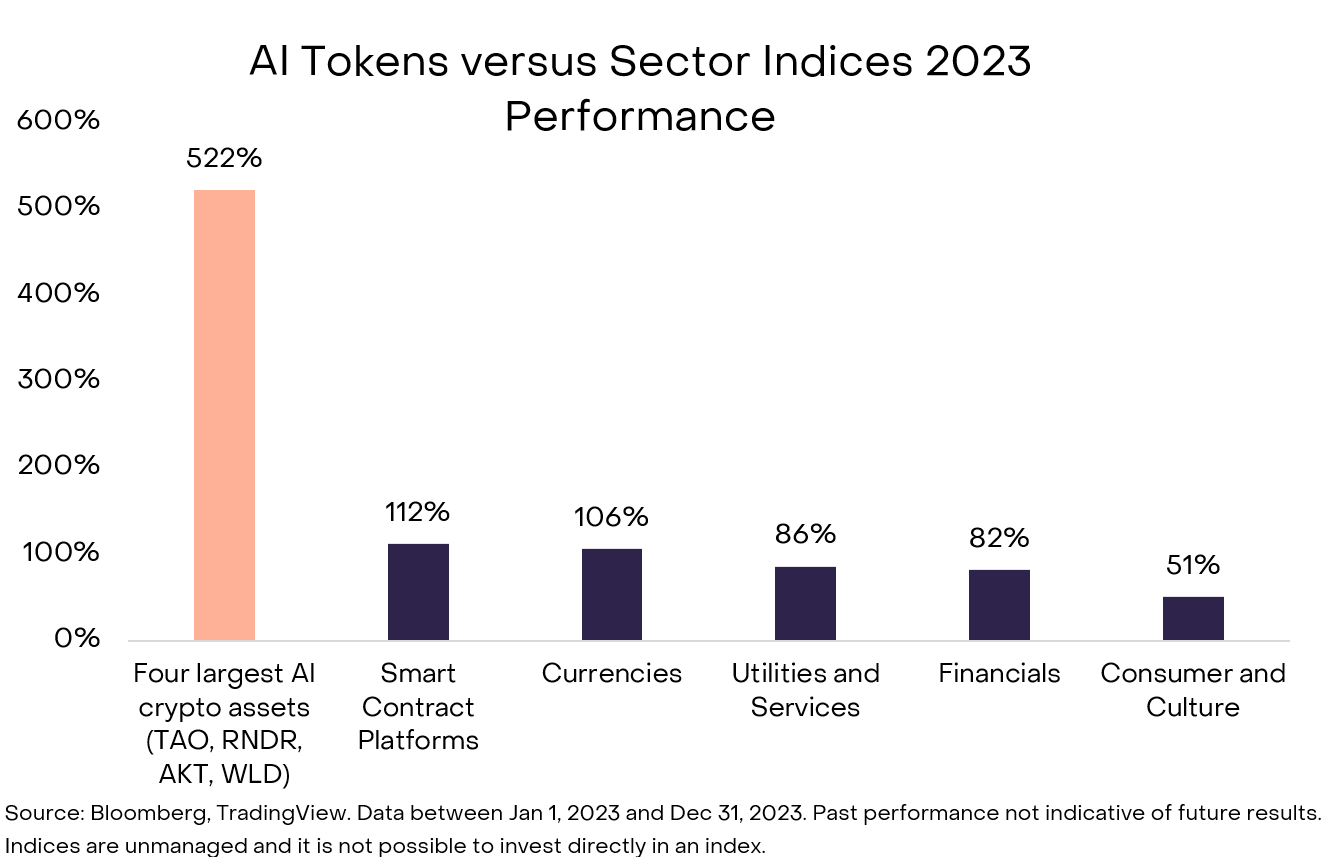

Despite the fact that many of these use cases are in their infancy, the market seems optimistic about the significance of this intersection. According to Coingecko web traffic, Artificial Intelligence was the most popular “crypto narrative[4]” in 2023. Further, the FTSE Russell Grayscale Crypto Sectors indices reflected the outperformance of select AI-related crypto assets compared to the Utilities and Services Sector and the crypto ecosystem at large (Figure 1).

In this report we attempt to explain where progress has been made across the following areas in the overlap of AI and crypto: Verifying content authenticity, reducing model bias, and improving access and competition within AI development.

Figure 1: Large AI tokens outperformed each Crypto Sector in 2023

Verifying Content Authenticity

One major societal issue exacerbated by AI is the proliferation of bots and misinformation. This is particularly relevant in the coming months as top AI experts fear a flood of deepfakes attempting to influence the 2024 US presidential election.[5] Public blockchains—and inherent characteristics of a transparent and tamper-proof ledger—presents the potential to push back against this broader threat.

One major initiative working on this problem is a crypto protocol called Worldcoin. Co-founded by Sam Altman, Worldcoin aims to register every human on the planet via a biometric scan in order to verifiably distinguish humans from bots, all incentivised by a dedicated blockchain token. The Worldcoin team has been aggressive in tackling its ambitious pursuit. Since launching around six months ago, Worldcoin has signed up 2.9mm people around the world.[6] Additionally, in December Worldcoin announced that it is looking to expand with $50mm in additional private funding.[7]

Another initiative tackling this problem is the Digital Content Provenance Record (DCPR) standard, pioneered by the teams at Arweave and Bundlr. The DCPR standard uses the Arweave blockchain to timestamp and verify digital content, providing dependable metadata to help users assess the trustworthiness of digital information.[8]

Reducing Bias in AI Models

As AI models become increasingly integrated into our daily lives, there’s a growing concern about overdependence on these systems and the inherent biases they may exhibit. Consider the scenario where an AI-powered chatbot could sway consumers’ choices by pushing them towards particular products or favoring specific political beliefs. Similarly, this technology could display bias in employment screenings by making decisions influenced by candidates' demographic features. The resulting breakdown in trust carries knock-on effects. According to one study, “AI detectors” may themselves be biased against natural writing by non-native English speakers.

Bittensor, a novel decentralized network, attempts to address AI bias by incentivizing diverse pre-trained models to vie for the best responses, as validators reward top performers and eliminate underperforming and biased ones. By fostering an open and collaborative environment for AI innovation across a diverse range of models and datasets, Bittensor could have the potential to propel AI development while attempting to mitigate the negative impact of bias.[9]

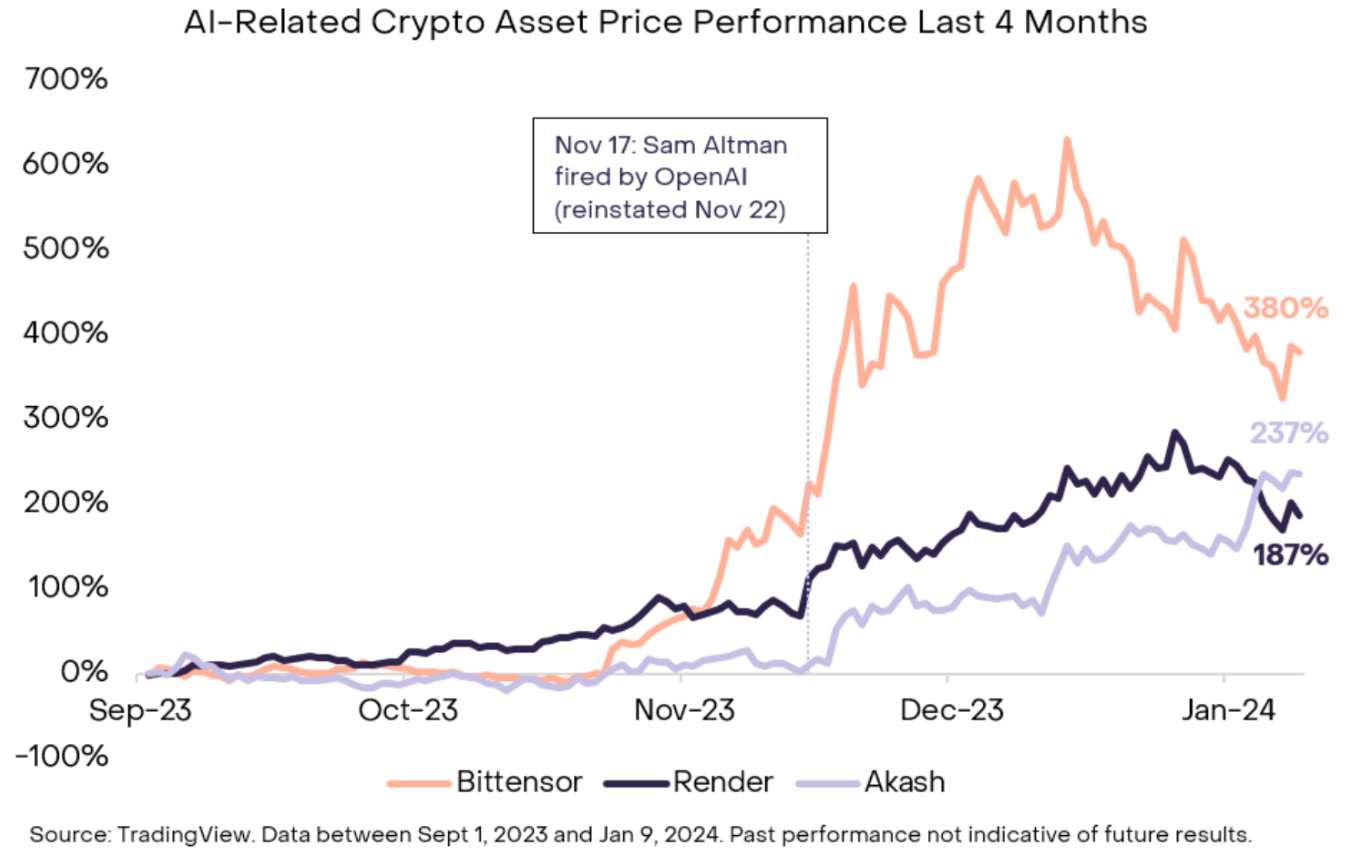

While development on Bittensor is still nascent, the decentralized network has shown initial progress with 32 subnetworks specialized for specific use cases including chat-bots, image-generation, price prediction, and language translation.[10] Notably, in the immediate period after the OpenAI leadership conflict, Bittensor and the other two largest AI-related crypto assets by market cap significantly increased in price (Figure 2). We believe this could indicate that the market views these assets as a potential counter to the centralization risk posed by major incumbent AI companies.

Figure 2: AI-related crypto assets have performed well since major developments at OpenAI

Improving Access to AI Development, Increasing Competition

In addition to risks of model bias, another concern around AI is that development is particularly concentrated. As AI model sizes grow, associated high capital costs for compute and storage threaten to price out competition, leaving AI development largely in the hands of the few tech giants that can afford it.[11] Over the past year, increasing demand for AI and compute resources has led to large compute providers limiting GPU (a specialized processor needed for AI development) availability[12] despite excess capacity.[13]

Decentralized compute marketplaces like Akash and Render are designed to address the inefficiency of underused GPU resources by connecting GPU owners with AI developers seeking compute power. This system allows individuals and organizations around the world to monetize their otherwise idle compute. At the same time, it provides AI developers with flexible access to computing resources. Because the blockchain cuts out intermediaries with a profit motive and overhead costs, these networks can offer services at sometimes a fraction of the rate ( around1/5 of the cost via Akash[14]) offered by centralized incumbents.

For instance, this past fall a Columbia student trying to work on AI development had difficulty gaining access to compute through Amazon Web Services; instead he rented GPUs through Akash for as little as $1.10 per hour.[15]

Recently, several of these decentralized marketplaces have gained preliminary traction. For example, since the launch of GPU deployments in September, Akash has grown to over 70 active GPU leases[16]. Notably, one of these organizations offering its idle GPU compute on Akash is Foundry[17], one of the largest crypto mining companies. Additionally, Render, a GPU marketplace for 3D image rendering, experienced a substantial uptick in usage in 2023.[18]

Figure 3: Increasing utilization of GPUs for decentralized marketplace Akash[19]

Conclusion

Today, the majority of the progress in this intersection has occurred within the context of crypto protocols helping democratize and accelerate AI development via decentralized GPU marketplaces. Other opportunities could lie in areas such as:

This synergy is still in its nascent stages, yet it shows promise of gathering momentum through 2024 and beyond, particularly if market participants continue to view these assets as a counterbalance against the future entrenchment of large centralized players like OpenAI. Whether or not AI and crypto are intrinsically linked, these two rapidly evolving technologies have the potential to mutually support each other’s growth, both in scope of use cases and relevance to the broader public.

[1] AI-adjacent refers to the fact that each of these tokens play a role in encouraging AI development or addressing AI-related problems.

[2] LinkedIn

[3] AVC.com

[4] Coingecko

[5] Fortune

[6] Worldcoin

[7] Reuters

[8] Github

[9] Bittensor and Plaintextcapital and Blockgeeks

[10] Messari

[11] CTECH

[12] Messari and The Information

[13] Tech HQ

[14] As of January 17th, 2024

[15] Semafor

[16] Akash.network

[17] Foundry

[18] Dune Analytics

[19] Graph from when is based on 7 day moving average. Date range is between when GPUs were launched on the platform until present

[20] Worldcoin

[21] Substack