Last Updated: 5/23/2023 | 8 min. read

Stacks is a scaling solution bringing smart contracts and other functionality to Bitcoin.

Summary

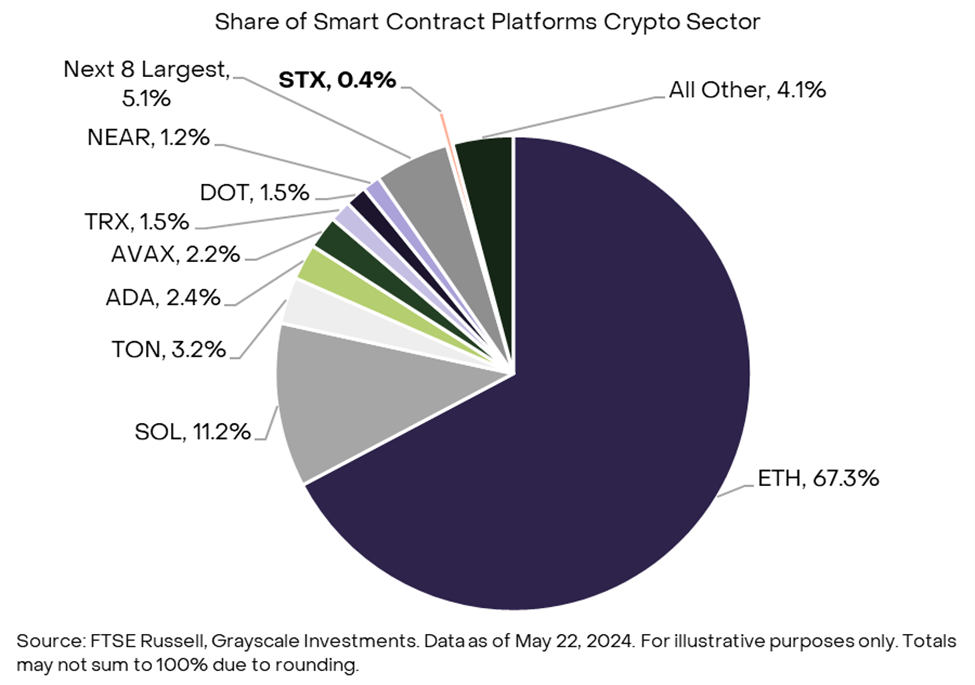

The launch of Ordinals in 2023 kicked off a new phase of development for Bitcoin, the oldest and largest[1] public blockchain. Although Bitcoin has been heralded as a “store of value” asset, it arguably has less functionality than other blockchains due to its relatively slow transaction speeds and a more limited programming language. Today, however, developers are expanding the range of potential Bitcoin applications through Layer 2 networks and other scaling solutions (for more detail see our report Bitcoin Renaissance: The Evolution of the World’s First Public Blockchain). Stacks is a leading Bitcoin scaling solution, and is a component of the Smart Contract Platforms Crypto Sector (Exhibit 1). Structured as a Layer 2, Stacks brings smart contacts and decentralized applications (dApps) to Bitcoin—while benefiting from Bitcoin’s security, scarce supply, and widespread user base.

Exhibit 1: STX represents <1% of the Smart Contract Platforms Crypto Sector by market capitalization

The Token

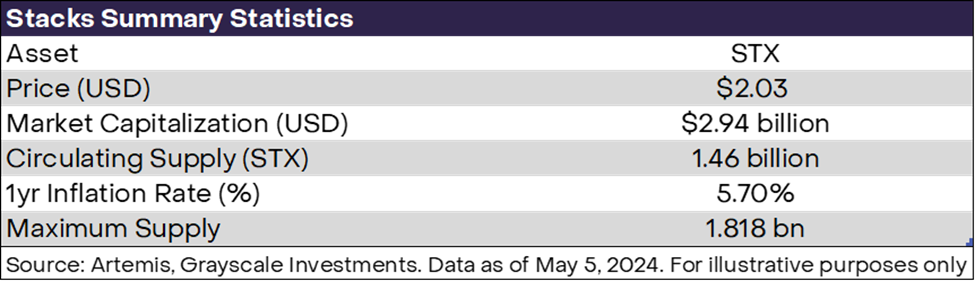

STX is the native token of the Stacks network and represents a piece of ownership in the ecosystem (Exhibit 2). The STX token is used for (i) paying for transaction fees, (ii) acting as a medium of exchange on the network, (iii) rewarding miners who commit Bitcoin to secure the network, and (iv) “stacking”—a component of the network’s novel consensus mechanism.

Exhibit 2: STX token basics

The Network and Technology

The Bitcoin blockchain processes approximately seven transactions per second, and does not natively offer smart contract functionality. However, the network is highly secure, and developers have long debated whether it would be possible to bring a richer array of functionality to Bitcoin. Although the Stacks project began as early as 2013[2], its vision now appears to be delivering results, thanks in part to the success of Ordinals.

The Stacks network is structured as a sidechain—one type of blockchain scaling technology—and secured through a novel “proof-of-transfer” consensus mechanism. Under this structure, miners commit Bitcoin and create Stacks blocks in exchange for the possibility of earnings STX rewards. In this way, the Stacks network partly shares the Bitcoin network’s security. Unlike the Bitcoin mainnet, Stacks offers smart contract functionality and dApps.

In addition to the growth in Bitcoin development, the Stacks protocol is nearing a critical upgrade called Nakamoto, designed to enhance its performance by reducing block times from 10-30 minutes to about five seconds. The upgrade will also introduce a new asset, sBTC, which will be pegged to Bitcoin and can serve as collateral in financial applications. With increased transaction activity on the main Bitcoin chain driving up costs, the Nakamoto upgrade positions Stacks as a more efficient and cost-effective alternative, making this a pivotal moment for the protocol.

Exhibit 3: Stacks features cheaper transactions and faster blocks compared to Bitcoin

Use Cases

Like most other smart contract blockchains, Stacks is a general purpose blockchain for decentralized applications (dApps), albeit at an early stage of development. Stacks currently features nearly 50 dApps[3] with functions primarily related to decentralized finance (DeFi). Over time, we expect that the network will host additional dApps like those found on other smart contract platform blockchains.

Factors to Consider

The Bitcoin ecosystem is changing. The launch of Ordinals, BRC-20 tokens, and Runes have demonstrated that more can be built on the Bitcoin network, and the introduction of spot Bitcoin ETFs in the US market has brought further attention to the first public blockchain. While Bitcoin has created a narrative as a “store of value” asset, a new wave of development seeks to find more uses for the token and its underlying network.

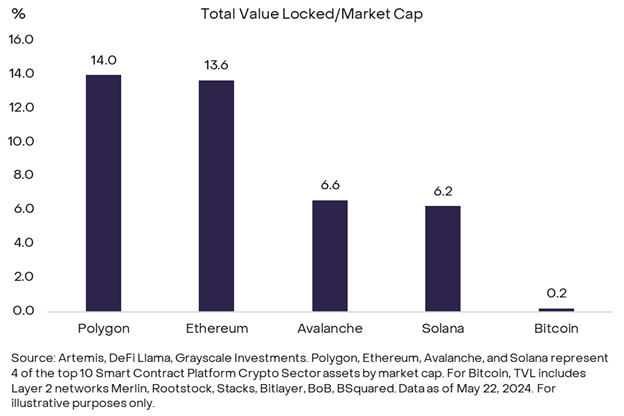

Among investable tokens, STX could benefit from the Bitcoin renaissance. Among Bitcoin scaling solutions, Stacks is the oldest project and has the second highest number of active developers, after the Lightning Network.[4] Stacks offers users the security of Bitcoin, but with faster transactions, lower fees, and more functionality. Bitcoin is still in its infancy as a smart contract platform relative to Ethereum or Solana. If you compare Bitcoin’s total value locked (TVL) relative to market cap ratio to existing smart contract platforms, the difference is stark (Exhibit 4). Given Bitcoin’s popularity, the potential for growth in TVL and demand for related dApps could be significant.

In addition, after the Nakamoto upgrade the Stacks protocol will offer unique features, including: (i) Bitcoin collateralized stablecoins, (ii) Bitcoin-based lending (and therefore Bitcoin native reward), and (iii) Bitcoin-based decentralized autonomous organizations. Similar to how basic financial primitives enabled the growth of Ethereum’s DeFi ecosystem in 2017, Bitcoin’s ecosystem may now similarly flourish given its current place in the spotlight.

Exhibit 4: Bitcoin’s existing opportunity set remains large

Investment risks

Stacks faces several possible risks specific to the network, which include, but are not limited to:

[1] By market capitalization as of May 14, 2024

[2] As founder Muneeb Ali’s PhD thesis, then called Blockstack.

[3] Source: DappRadar.

[4] Source: Electric Capital’s Developer Report, as of May 21, 2024

[5] Source: Artemis.xyz