Last Updated: 11/3/2023 | 5 min. read

Examples provided for illustrative purposes. Allocations are subject to change.

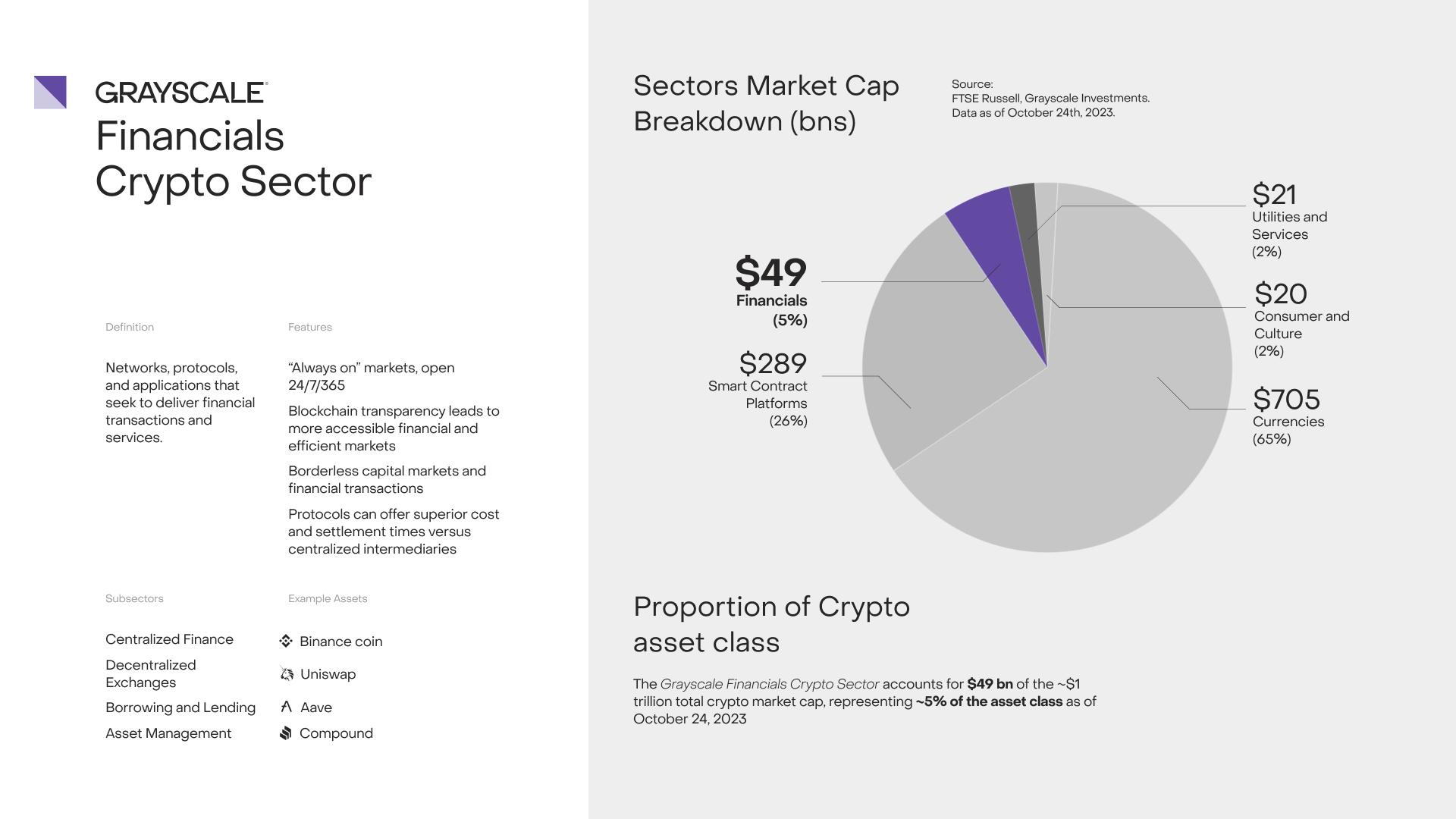

Applications in the Grayscale Financials Crypto Sector enable users to borrow, lend, and trade assets peer-to-peer rather than through intermediaries. As a result, the applications in this sector can offer sometimes more direct, efficient, and cheaper transactions than the traditional financial services. The Grayscale Financials Crypto Sector provides the economic backbone of the crypto economy as it facilitates ecosystem liquidity, leverage, and efficient capital allocation through trading, lending, and borrowing.

Notably, there are several areas where blockchain-based finance is believed to have legitimate advantages over traditional forms of finance. First, blockchain-based financial markets are “always on”, globally open 24/7 and 365 days a year—a stark contrast from the Monday to Friday workday hours of traditional finance. Moreover, these protocols offer significant advantages around the availability of real time data. Public company financials are typically available quarterly, whereas the transparency of blockchains allows for greater efficiency since investors can consistently update their investment views with new information.

In traditional finance, there is often an intermediary charging fees for financial transactions. In contrast, blockchain-based finance allows for direct financial transactions between individuals rather than through intermediaries. As a result, users can trade, lend, and borrow at less expensive rates than before as their counterparty is an individual. In other words, blockchains streamline financial interactions, facilitating more efficient and less costly transactions. In the future, this could open up the marketplace for traditional financial services to a much larger audience of users at any point in time.

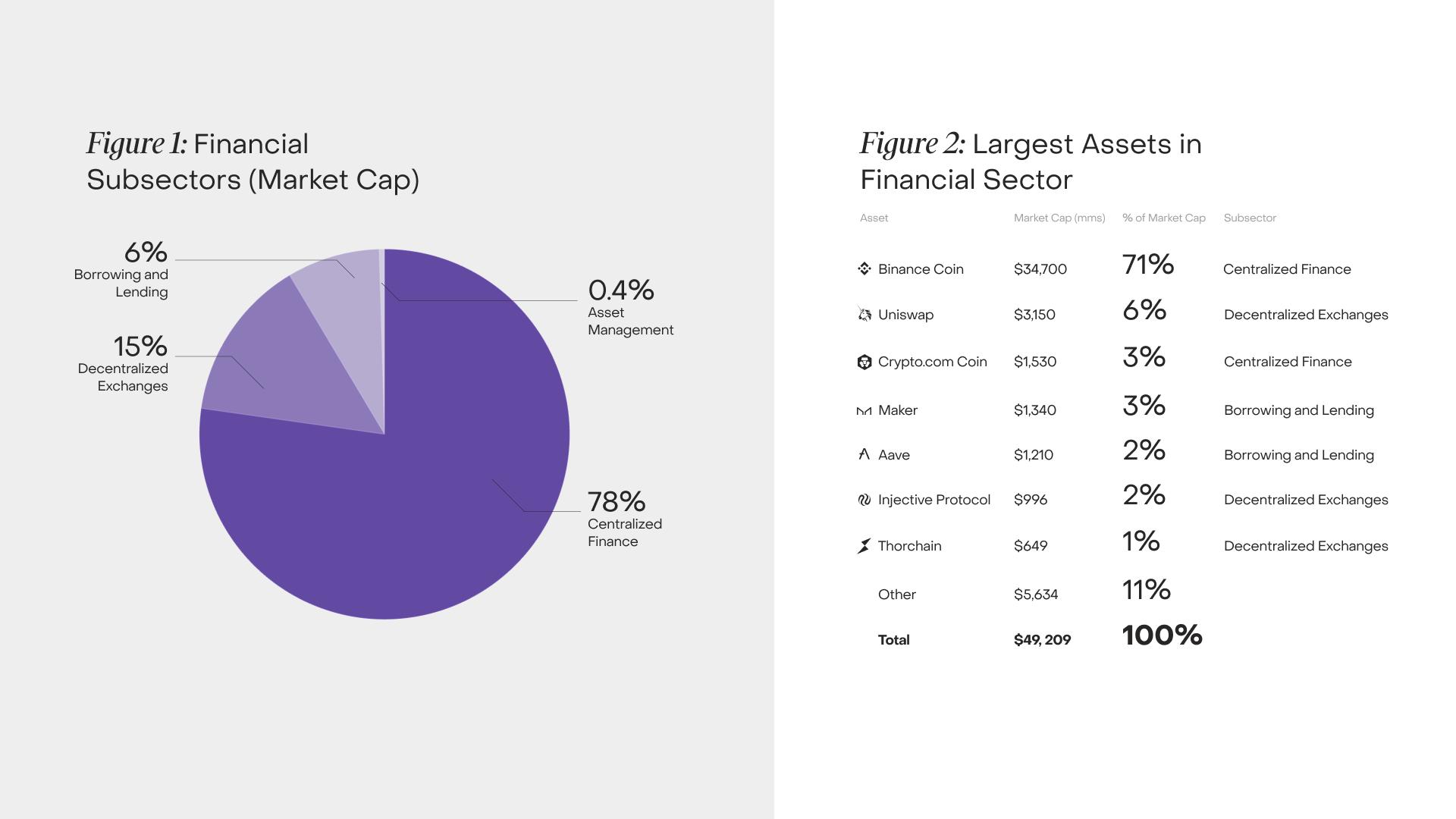

Figure 1 and 2 Source: FTSE Russell, Grayscale Investment. Data as of October 24th, 2023. Allocations are subject to change.

The Grayscale Financials Crypto Sector can be broken down into four subsectors (Figure 1). Currently the largest subsector is Centralized Finance (78%) while smaller subsectors include Decentralized Exchanges (15%) as well as Borrowing and Lending (6%), and Asset Management (0.4%).

The fact that Centralized Finance platforms (led by Binance Coin at 71% of the total sector market cap as of October 24th, 2023) currently represent the largest subsector in Financials reflects the nascency of the crypto asset class. These kinds of platforms often serve a critical role in onboarding mainstream users into the crypto industry.

However, as the industry matures and use cases increase, we believe individuals and institutions may become more comfortable with more sophisticated—but often more efficient—decentralized finance (“DeFi”) protocols such as Uniswap, Aave, or Maker. Ultimately, to live up to its decentralized promise, these trading, lending, and borrowing protocols must capture the millions of users who only use centralized intermediaries today.

Examples provided for illustrative purposes only.

[1] Defi Llama, Amberdata

[2] Dapp Radar. Uniswap settles transactions on eight total networks including Ethereum, BNB Chain, Polygon, Celo, Arbitrum, Optimism, Avalanche, and Base (each in the Grayscale Smart Contract Platforms Sector)

[3] Aave Docs

[4] Dapp Radar