Last Updated: 7/8/2025 | 24 min. read

Launched in 2023, Sui was founded by key members involved in Facebook’s Diem blockchain project. Their mission at Facebook was to create a crypto platform capable of supporting billions of users; in other words, they built with a global scale in mind from day one. After leaving to start Sui, the team continued to build on the foundations of what they had previously developed.

Sui is a next-generation blockchain that prioritizes two things: usability and scalability. It aims to deliver an unparalleled user experience that exceeds even the best Web 2.0 tech companies while enabling on-chain ownership and global, instant transfer of value. As a result, we believe the next consumer “killer application” in crypto could come from the Sui ecosystem.

SUI, the native token of the Sui network, can be found in the Grayscale Smart Contract Platforms Crypto Sector. The Sui network competes for fee revenue and market share primarily with high-throughput and low-cost blockchains including Solana, Ethereum Layer 2s, The Open Network (TON), and others. In this crowded sector, not every project will succeed. As a result, networks need differentiated features to separate themselves.

Grayscale Research believes Sui has potentially a differentiated mix of features, including:

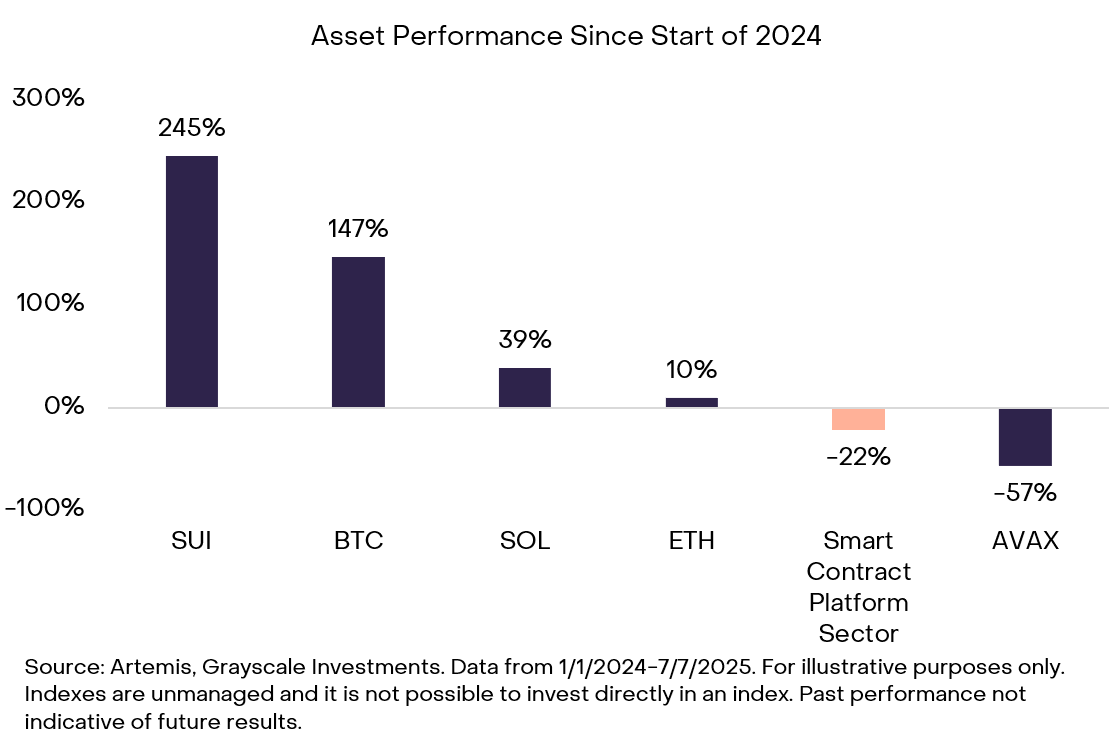

Since the start of 2024, SUI has been one of the best-performing assets in crypto, outperforming Bitcoin (BTC), as well as its broader sector and direct competitors: Solana (SOL), Ethereum (ETH), and Avalanche (AVAX) (Exhibit 1).

Exhibit 1: SUI has been one of the best-performing assets in crypto in the past year plus

In the sections to follow, we’ll explore what makes Sui unique, potential key ingredients necessary to grow its ecosystem and network effects, progress and adoption, value accrual and fees, token supply, and key risks.

Why Sui Stands Out

Every blockchain aspires to achieve usability and scalability (within certain constraints). Sui is unique because of its technology, the supporting team, and a vertically integrated strategy.

1. Tech: Blockchain design and programming language

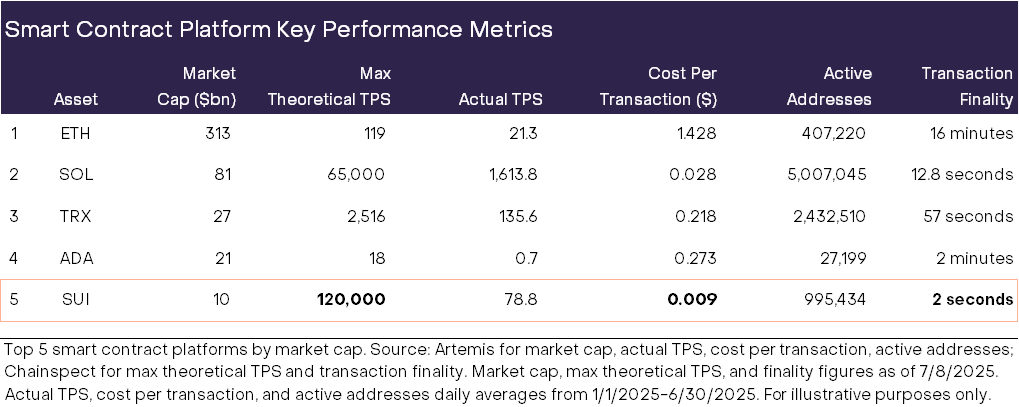

As a result of these features, Sui offers the highest theoretical blockchain throughput[6], lowest cost, and fastest time to finality of any of the five largest smart contract platforms by market cap (Exhibit 2).[7] As of July 2025, Sui trails Solana in actual transactions per second (TPS) as a function of the current state of adoption rather than theoretical capacity at maturity. As a result, we believe this number for Sui could improve with further ecosystem adoption.

Exhibit 2: Key blockchain metrics for top 5 smart contract platforms by market cap

Programming language: Sui’s programming language, Move, was originally developed by members of the Mysten Labs team while at Facebook. The Move language was adapted from Rust, one of the more popular programming languages in the world. As a higher-level programming language, Move offers strong safeguards for smart contract development that significantly reduce the likelihood of common programming errors and vulnerabilities.[8] In contrast, Solidity (the programming language of Ethereum) lacks these built-in protections, placing a greater burden on developers to manually enforce security best practices when writing smart contracts.

2. Team: Top-tier entrepreneurs with deep experience

Mysten Labs brings together award-winning technologists with expertise across product, computer science, and cryptography, including the following co-founders:

The Mysten Labs team has over 100 members who collectively hold more than 75 PhD degrees.[10] In our opinion, what sets Mysten apart, beyond their tech credentials, is their ability to translate technical expertise directly into products. Competing network foundations, by contrast, often take a more academic approach.

3. Strategy: A vertically integrated approach

Mysten is involved not only at the blockchain infrastructure layer but also at Sui’s application layer, building out products, tooling, and consumer apps throughout the network. This holistic approach includes:

Walrus

Walrus is a novel decentralized storage solution designed for performance and cost-efficiency. Unlike centralized providers such as AWS, decentralized storage eliminates single points of failure and enables trustless data integrity. Among decentralized storage solutions, Walrus stands out as a potentially attractive option. Its proprietary erasure coding technology dramatically reduces storage overhead, enabling up to 80% cost savings compared to legacy solutions like Filecoin and Arweave.[11] Walrus is trusted by leading crypto media platforms like Decrypt and the Unchained Podcast to store their content and by the Plume Network for real-world asset (RWA) data. Purpose-built for scalability, Walrus is designed to handle high-throughput, data-intensive applications ranging from RWA datasets to large language models.

In many ways, Walrus does for decentralized storage what Sui does for blockchain execution: it removes friction, reduces cost, and opens new categories of real-world utility. As more applications on Sui require storage for AI models, video content, or off-chain proofs, Walrus is poised to potentially become a core piece of the network’s growth as its data layer.

DeepBook

DeepBook is an on-chain central limit order book (CLOB) on Sui designed for institutional-grade trading. Today, most decentralized finance (DeFi) runs on automated market making pools (AMMs). In comparison to AMMs, DeepBook enables precise order control, reduced slippage, and tighter spreads, features preferred by professional traders and market makers.[12] As a shared liquidity layer for the Sui ecosystem, DeepBook allows many DeFi applications to access a unified order book, enhancing capital efficiency and reducing liquidity fragmentation.

DeepBook currently serves the first and second largest decentralized exchanges on Sui, as well as other applications that range from lending to derivatives apps.[13] As institutional adoption on Sui continues to grow, we believe that DeepBook volume and users may grow in tandem. We believe DeepBook is emerging as a critical liquidity layer and a foundational component of Sui’s on-chain financial infrastructure and has the potential to become a key catalyst for the growth of DeFi on Sui.

OTHER

Together, Sui’s ecosystem — with Sui's blockchain itself, zkLogins, DeepBook, Walrus, SuiNS, and Ika — represents the first fully vertically integrated application suite in crypto.

The Sui project is less decentralized than some other blockchains, but for its particular goals (e.g., mainstream consumer apps), this may be an advantage. With the Sui network still in its early stages (just two years old), Mysten’s team is actively shipping products across diverse use cases, reducing friction for both consumers and developers. This proactive approach could accelerate adoption and ultimately lead to a more robust ecosystem.

The Ingredients for Growth

Sui remains earlier in its lifecycle compared to more established networks like Ethereum or Solana, both in terms of developer traction and ecosystem maturity.[14] Yet, given its high scalability and user-centric design, the SUI token stands out as a compelling growth investment at its current ~$10 billion market cap (representing ~12% of SOL and ~3% of ETH).[15]

For users, Sui offers low-friction onboarding into crypto with its zkLogin tech. In an age where onboarding into crypto often requires confusing seed phrases, zkLogin allows users to access a crypto wallet using familiar Web 2.0 credentials like a Gmail account. This removes common points of friction while preserving user privacy, ensuring that the identity provider doesn’t know the user is signing into a crypto wallet. This feature is unique to Sui.

For application builders, Sui offers sponsored transactions, which can be thought of as a “customer acquisition cost.” Sponsored transactions allow for application builders to provide “gasless” transactions (i.e., transactions with no associated fee). Paired together, zkLogin and sponsored transactions enable a fully Web 2.0 experience: no need for a user to ever open a wallet or even own crypto while still recording user interactions on-chain.

We believe these elements — frictionless user onboarding, gasless app experiences, and an intuitive experience all within a secure development environment — can serve as a strong foundation to onboard users and developers and grow network effects.

Despite being early in development, Sui has demonstrated strong network growth in the first half of this year. Monthly active users (MAUs) surged earlier this year from around 10 million to over 40 million (good for second place among smart contract platforms) before trailing off slightly in the past few months. Beyond Mysten Labs products, Sui has seen notable adoption of third-party apps including Recrd (video platform for creators to earn revenue, 490,000 daily addresses) and Fan TV (video sharing, onboarded 5 million wallets into crypto).[16]

Fees and Value Accrual

Key to competition over the long term in the Smart Contract Platforms sector is value accrual and the ability of a blockchain to generate network fee revenue. Sui generates network revenue from transaction fees, which accrues value to stakers in the form of rewards rather than token holders in the form of token burns.

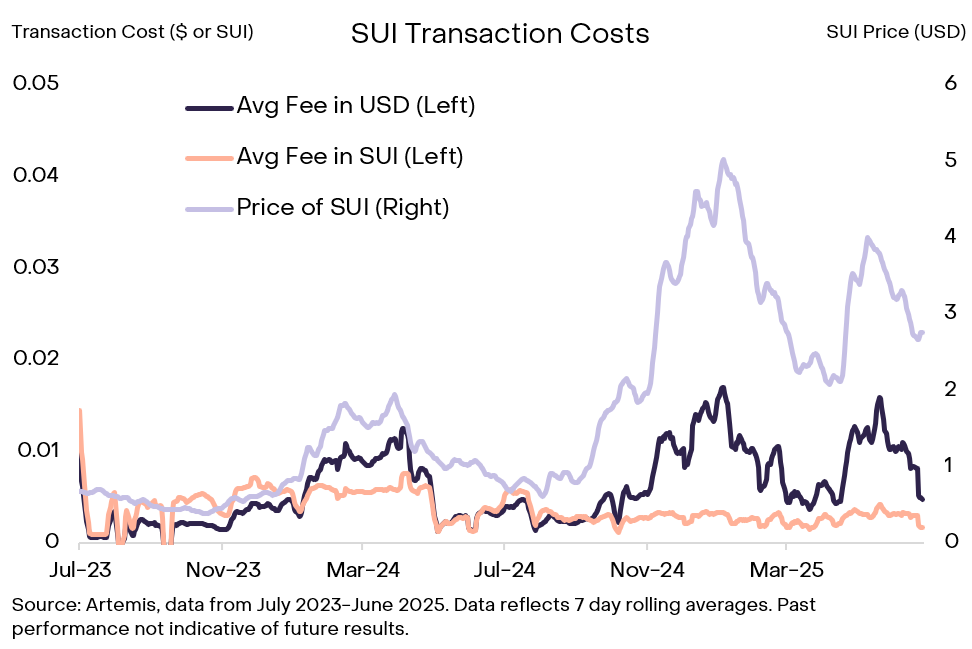

Transaction fees on Sui are split into computation and storage components, with rates largely anchored to a reference price determined by validators every 24 hours. As a result, transaction costs remain relatively stable throughout the day, enabling smoother and more predictable pricing. This pricing stability makes Sui less vulnerable to gas price spikes during periods of high network activity, unlike networks such as Solana and Ethereum, which experience greater intraday variability in fees.

Exhibit 3: Sui transaction costs are low and relatively stable

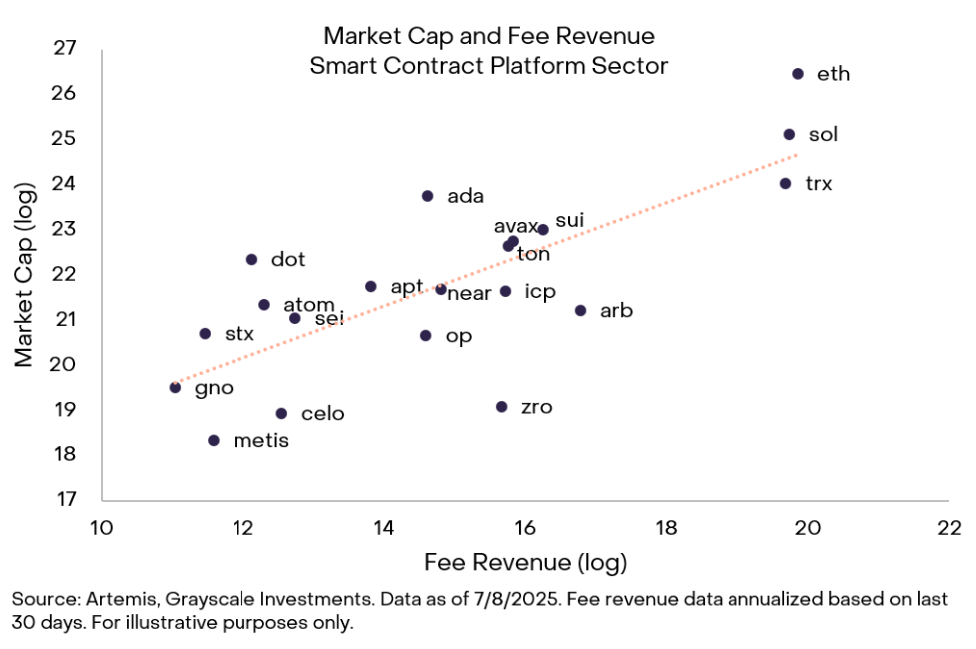

In terms of overall ability to generate revenue, however, Sui is earlier than its larger competitors. While Ethereum and Solana are on track to produce 2025 annualized network fee revenue of over $500 million, Sui is on track for just $15 million.[17] This indicates that Sui as a network is at an earlier stage in monetizing its userbase, in part because of Sui’s low average transaction cost (~3x lower than Solana and ~150x lower than Ethereum).[18] This low cost to transact on its network means that Sui will need to scale network activity significantly more to reach the same amount of revenue as its largest competitors. Compared to its fee revenue, the SUI token looks roughly fairly valued (based on circulating market cap) (Exhibit 4).

Exhibit 4: Market Cap and Fee Revenue in the Smart Contract Platforms Crypto Sector

Token Supply Still Expanding

Sui is a relatively early-stage project and only has 33% of its total supply in circulation. Over 50% of its supply will not be unlocked until after 2030.[19] All else equal, token supply inflation could be a headwind to valuation, but this can be mitigated by growth in network adoption.

The SUI token was launched in May 2023 with a capped supply of 10 billion tokens. Initial token distribution involved the following:[20]

Over the next year, SUI has a 17.4% inflation rate and will emit around $1.7 billion worth of SUI tokens (at current SUI price) into the market.[21]

Considering the Risks

While some Layer 1s have taken a “purist” approach to decentralization, Sui has taken a progressive approach. Sui has relatively less validators and a more cost prohibitive validator staking requirement,[22] making it relatively less decentralized and censorship resistant than other more mature networks like Ethereum. Instead, Sui prioritizes hardware performance and scalability.

Another factor is the strong presence of Mysten Labs. We think this is an advantage over the short term — because Mysten is able to prioritize development and ship applications — but it could limit the blockchain’s addressable market if the ecosystem does not further decentralize over the longer term. Mysten’s approach of building on Sui at the infrastructure and application layer could in the short term cannibalize developers attempting to build similar products within the same verticals as their products.

Sui also faces intense competition in the Smart Contract Platforms sector. Incumbents like Ethereum and Solana have higher levels of market share and on-chain assets. Other networks like Monad present alternative high-throughput options. Another potential competitor, TON, is able to leverage Telegram’s massive userbase for distribution. Still, we think Sui’s tech and Mysten Labs’ approach could offer meaningful differentiation in select use cases like gaming, trading, and payments that require low latency.

Conclusion

Sui is a next-generation blockchain engineered for scalability and usability. Its architecture is purpose-built to support consumer-grade applications with low fees, near-instant finality, and intuitive onboarding — key ingredients for bringing mass users on-chain. In contrast with competitor networks that are focused on speculative use cases or unresolved throughput challenges, Sui was built for scale and Mysten is laser focused on enabling the next “killer application.”[23]

With a current market cap of $10 billion and a large portion of token supply yet to be released, the project is still early in its lifecycle, but that also means its upside potential remains largely untapped. In our view, SUI is a high-conviction growth investment that offers diversified exposure to the thesis that scaled consumer applications can be brought on-chain. Backed by strong tech, a top-tier team in Mysten, and a vertically integrated strategy, Sui is well positioned to execute on this vision.

Interested in Investing?

We offer Grayscale® Sui Trust, which gives investors exposure to SUI in the form of a familiar investment vehicle. If you are an eligible accredited investor* interested in investing, or want to learn more about Grayscale Sui Trust, please reach out to a Grayscale portfolio consultant at 866-775-0313 or info@grayscale.com.

Glossary:

Central Limit Order Book (CLOB): A trading system where buyers and sellers place orders that are matched based on price and time priority, forming a transparent market with an order book showing all bids and asks.

Smart Contract Platform: A blockchain that enables developers to deploy self-executing code (smart contracts), which automatically enforce rules and transactions without intermediaries.

Throughput: The total volume of transactions a system can process over a given time, often used to measure a blockchain’s performance capacity.

TPS (Transactions Per Second): A metric indicating how many individual transactions a blockchain can handle every second, reflecting its scalability.

Validators: Network participants responsible for verifying and adding new transactions to the blockchain, often earning rewards for maintaining network integrity.

AMMs (Automated Market Makers): Protocols that use algorithms and liquidity pools instead of order books to enable decentralized trading of assets directly on-chain.

Gas Fees/Prices: Charges paid by users to compensate for the computational resources required to execute transactions or smart contracts on a blockchain.

Token Burns: A process by which tokens are permanently removed from circulation, often to reduce supply and potentially increase the value of remaining tokens.

Staking: The act of locking up tokens to support network operations such as validating transactions, often in exchange for rewards or yield.

* An accredited investor, as defined in Rule 501(a) of Regulation D under the Securities Act of 1933, as amended, is an individual with income over $200,000 ($300,000 with spouse) in each of the past two years, an individual with net worth over $1 million, excluding primary residence, an individual holding certain financial licenses (e.g., Series 7, 65, or 82), or an entity with over $5 million in assets or all equity owners who are accredited.

[1] Source: Artemis, data as of 7/8/2025.

[2] Source: Artemis, data as of 7/8/2025.

[3] Sui’s architecture separates simple object transfers—such as sending tokens—from complex transactions involving smart contract execution. This design enables faster and more scalable processing by allowing simple transfers to bypass the full consensus mechanism.

[4] Chainspect estimates finality at 2 seconds as of 7/7/2025.

[5] Crypto Slate. Sui aims to become the “Internet Coordination Layer,” says Mysten Labs Co-Founder.

[6] Theoretical throughput refers to the amount of transactions per second that a particular blockchain can process at its maximum capacity.

[7] Top by market cap referring to Layer 1s with $10bn in market cap or over

[8] High-level language features include type safety, memory safety, and support for formal verification.

[9] Outliers: Kostas Chalkias, Mysten Labs: The Cryptographers of Greece and the Blockchain of the Future

[10] According to discussions with the team

[11] Hacker Noon: Can Decentralized Storage Finally Go Mainstream? Walrus.xyz on Sui Might Hold the Answer

[12] Backpack Exchange. What is DeepBook? A Decentralized Order Book for the Sui Ecosystem

[13] DeFi Llama, data as of 7/7/2025. Cetus and Bluefin, largest by 30d DEX volume.

[14] By number of developers (Electric Capital) and number of dapps (Dapp Radar). Data as of 7/7/2025.

[15] Artemis, data as of 7/8/2025.

[16] Source: FanTV Creators Reach Millions on Sui, Recrd numbers based on Artemis daily transacting users.

[17] Source: Artemis. Based on fee revenue from the first half of 2025.

[18] Artemis, data as of 7/7/2025. Data based on averages for first half of 2025.

[19]Tokenomist, data as of 7/7/2025.

[20] Figment, Sui Tokenomics.

[21] Tokenomist, as of 7/7/2025.

[22] Around 117 validators as of 7/7/2025 (Suivision.xyz) and a 30 million SUI validator staking requirement

[23] The Block. Sui creator says crypto’s 'ChatGPT moment' coming as protocol celebrates mainnet's first year.